(SUMMARY OF JOHN’S JULY 10, 2024, WEBINAR)

July 12, 2024

Hello everyone.

TOPIC

Back from Alaska

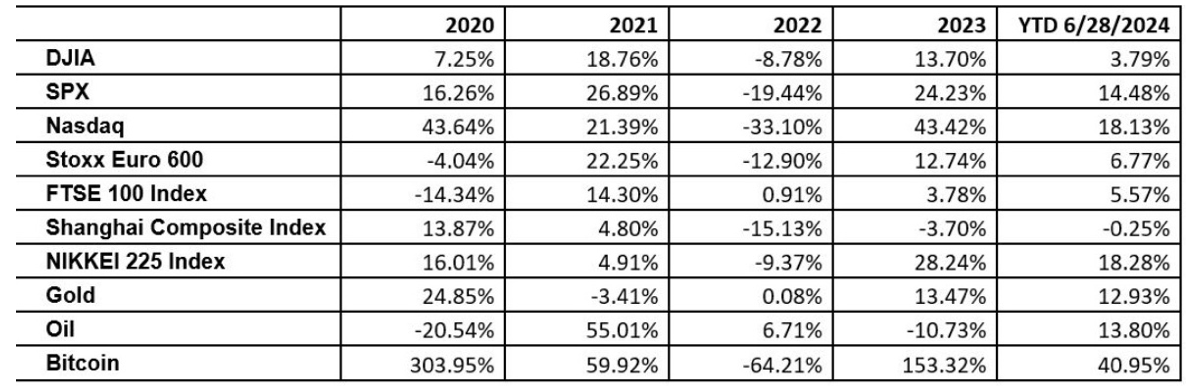

PERFORMANCE

July MTD +0.00%

Average Annualized Return: +51.53% for 16 years.

Trailing one Year Return: +34.63%

PORTFOLIO REVIEW

No Positions

THE METHOD TO MY MADNESS

The cool June Nonfarm Payroll Report was a game changer, and the three–year Unemployment rate high at 4.1% was even more important.

The first interest rate cut in five years in September is now a certainty, according to John. July 30-31 Fed meeting will tell all.

All interest rate sectors catch huge bids.

Technology stocks remain hot as bad news is good and good news is even better.

Gold and Silver catch bids on rate cut prospects.

Energy gets dumped on recession fears if the Fed acts too slowly.

Buy stocks and bonds on dips.

THE GLOBAL ECONOMY – FADING

Nonfarm Payroll Report comes in weak for June at 206,000.

The Headline Unemployment rate rose to a three-year high at 4.1%.

If the Fed doesn’t cut soon, we are going into recession.

Trade War between China and the E.U. heating up. China will investigate European brandy imports after the E.U. slapped tariffs on Chinese-trade electric vehicles.

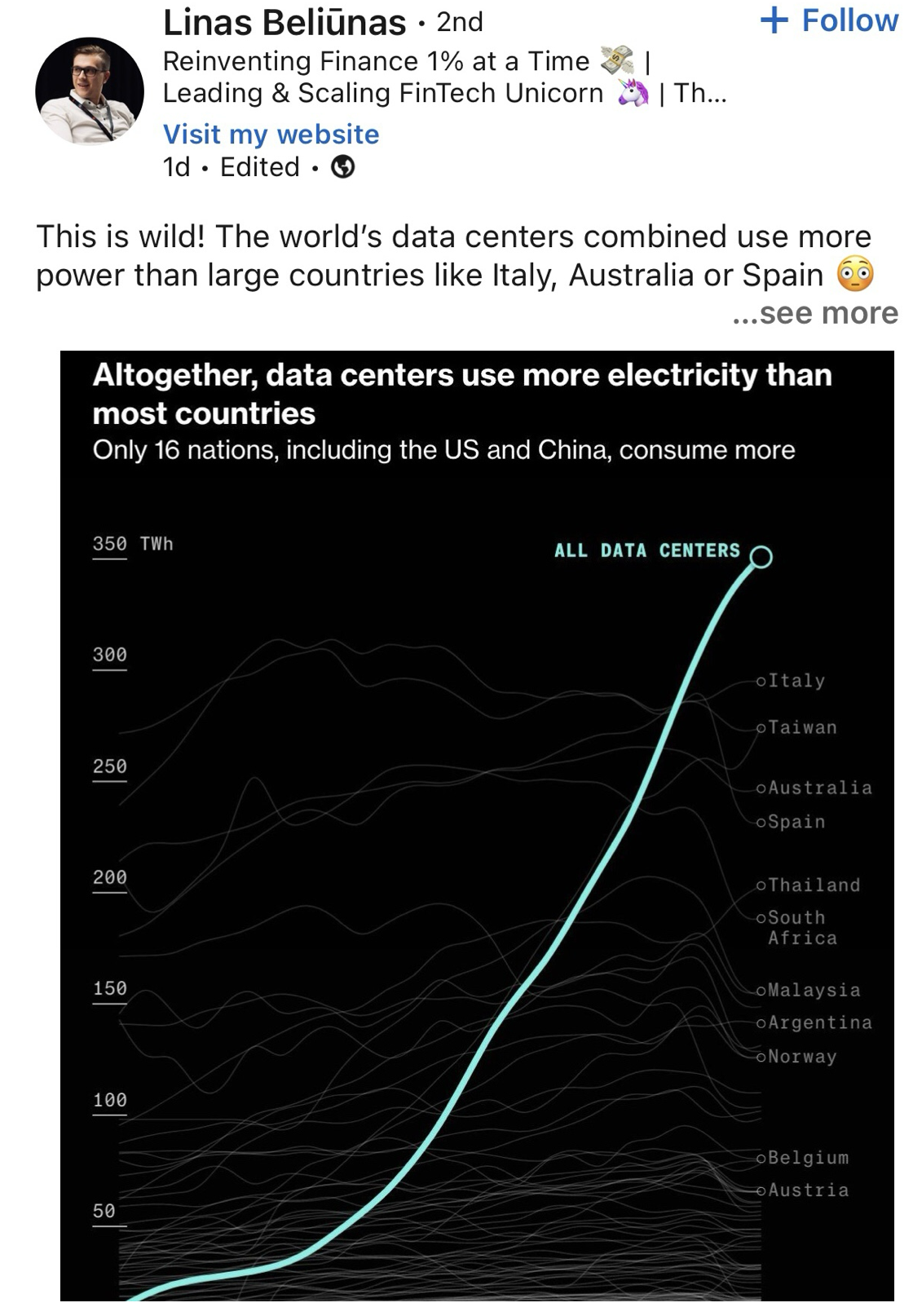

US Venture Capitalists flood into AI Investments. U.S. venture capital funding surged to $55.6 billion in the second quarter, marking the highest quarterly total in two years.

The core personal consumption expenditures price index increased just a seasonally adjusted 0.1% for the month and was up 2.6% from a year ago.

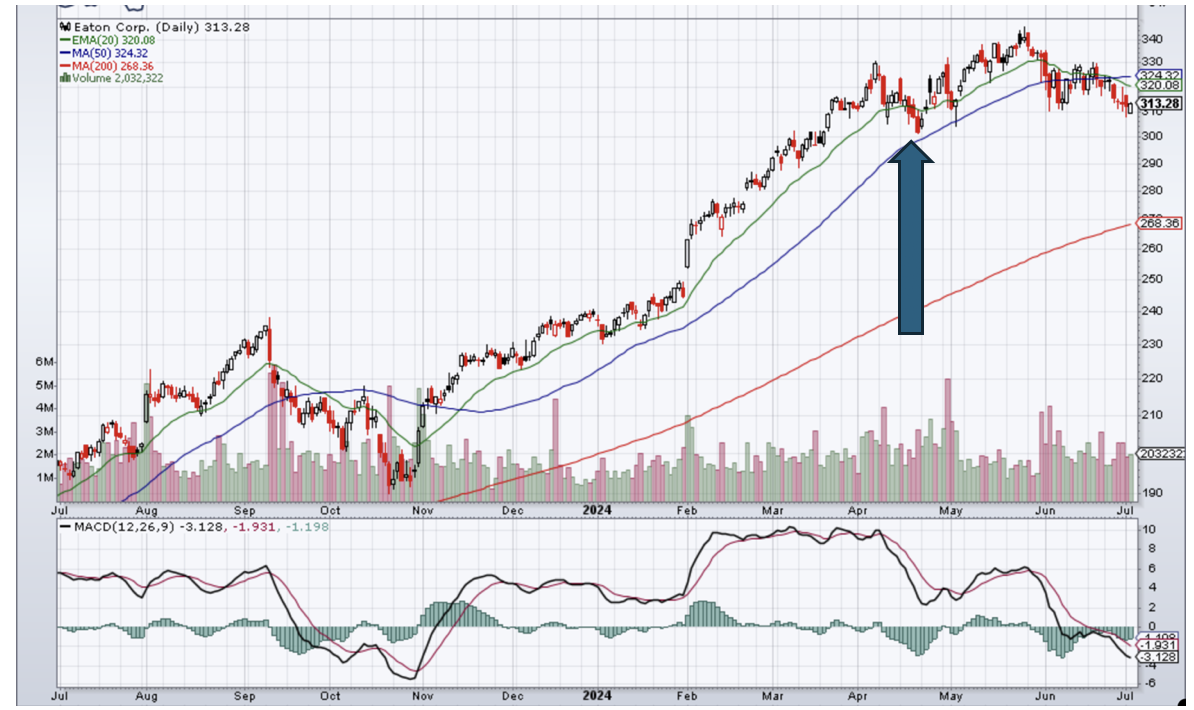

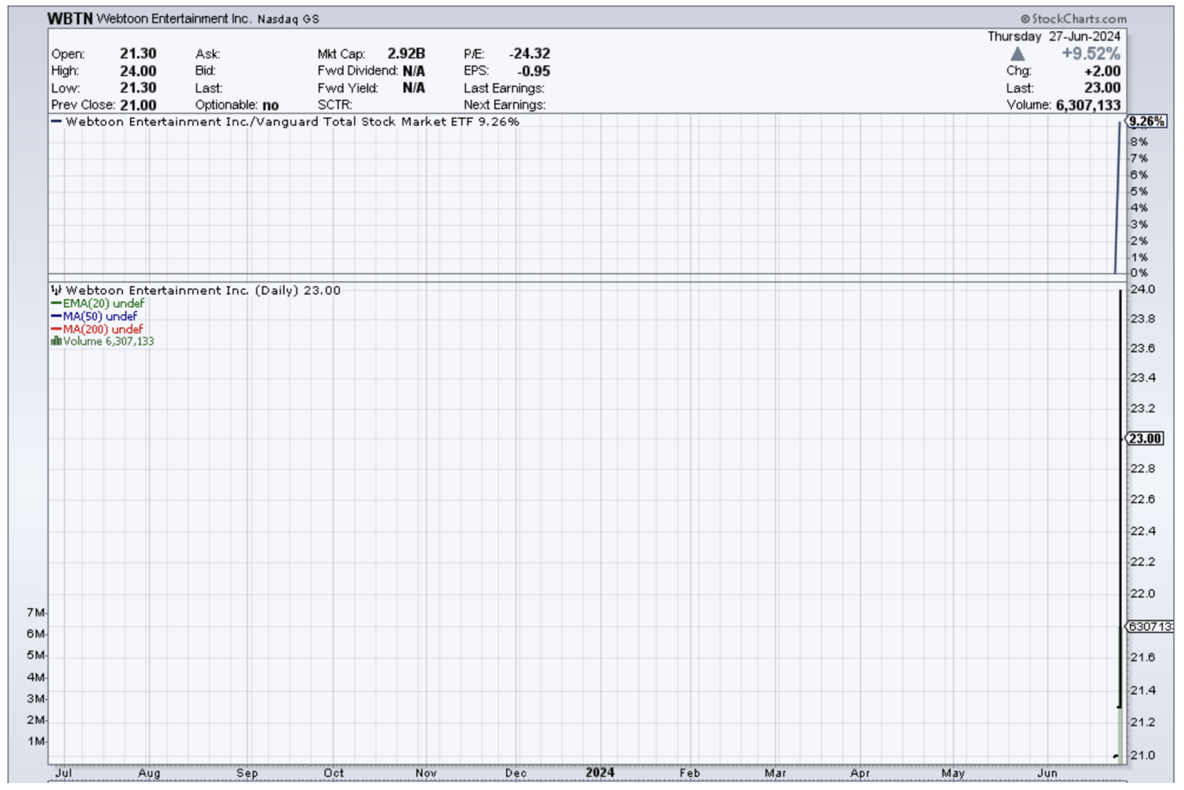

STOCKS – RATE CUTS

All interest rates plays rocketed as a September interest rate came back on the table.

Bank of America said U.S. large-cap equities – the largest companies in the American market – received their biggest inflow in 16 weeks at $16.6 billion.

Saks Fifth Avenue buys Nieman Marcus for $2.65 billion, as consolidation of retail continues.

Walgreens shares crushed 25% on poor outlook

Micron shares plummet on weak earnings.

Fisker, the next Tesla just went bankrupt. It’s the second EV maker to go under this year, following the ill-fated Lords Town Motors.

BONDS – SIGNS OF LIFE

Cool Nonfarm payroll report sends bonds soaring, confirming earlier rallies based on weak economic data.

Bonds see the biggest cash inflows since 2021, some $19 billion, as investors position for interest rate cuts.

Funds are pouring into Corporate Bonds at four-year highs.

Bonds are becoming respectable again after an extra-long winter.

U.S. Budget Deficit jumps from $1.6 to $1.9 trillion for fiscal 2024, the Congressional Budget Office said on Tuesday, citing increased spending for a 27% increase over its previous forecast.

Do you want a safe 8.48% yield?

BB bank loans will soar in value with even just one quarter-point rate cut. The top ticker symbols are (SLRN), (BRLN), (BKLN), and (FFRHX). Check them out.

Buy (TLT), (JNK), (NLY), and REITS on dips.

FOREIGN CURRENCIES – DOLLAR IS TOAST

Cool hot May Nonfarm Payroll Report gives dollar spikes currencies except yen.

The U.K.’s opposition Labour Party secured a massive parliamentary majority in the country’s general election, demolishing the Conservative Party.

The Bank of Japan debated in June the chance of a near-term interest rate hike.

Inflation has crushed Japanese purchasing power, but the debt levels are so high that institutions fear raising rates could bring on even more problems.

Buy all short dollar, long currency plays on dips.

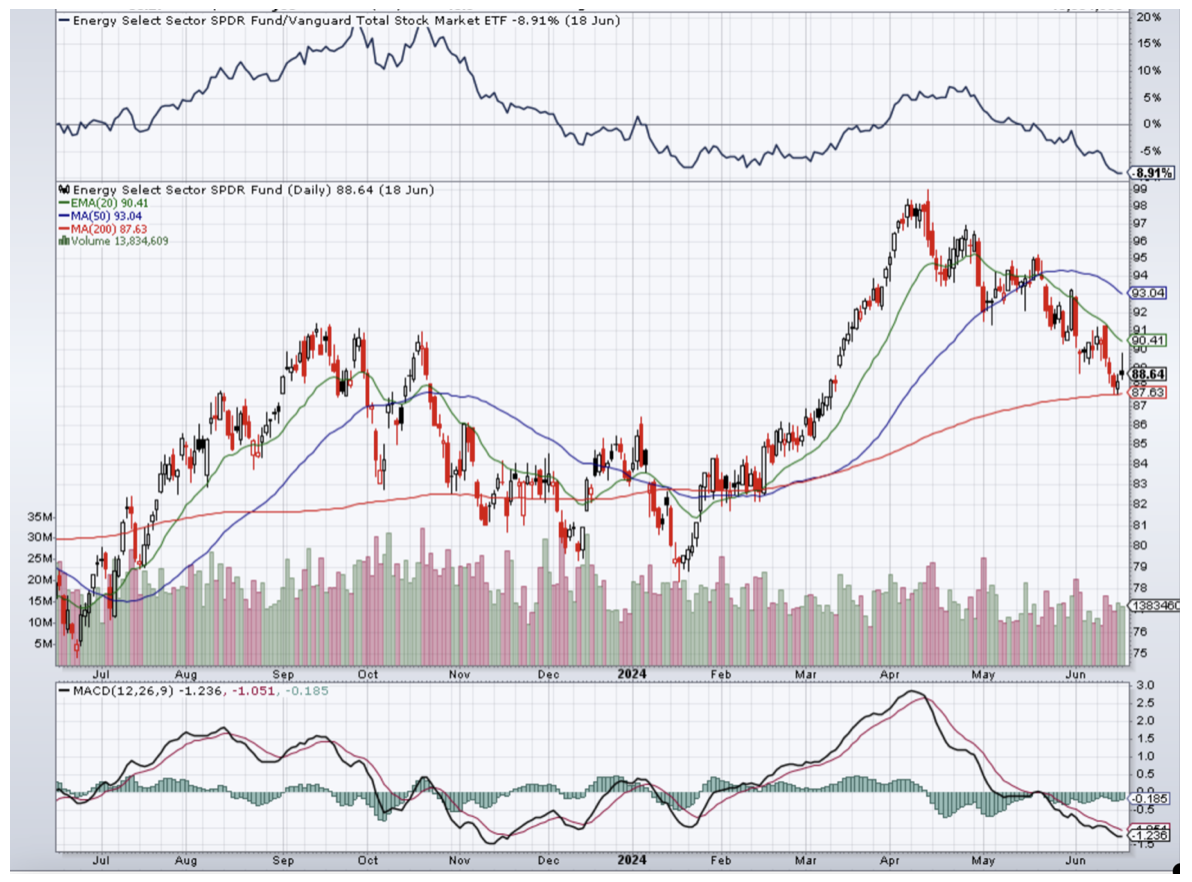

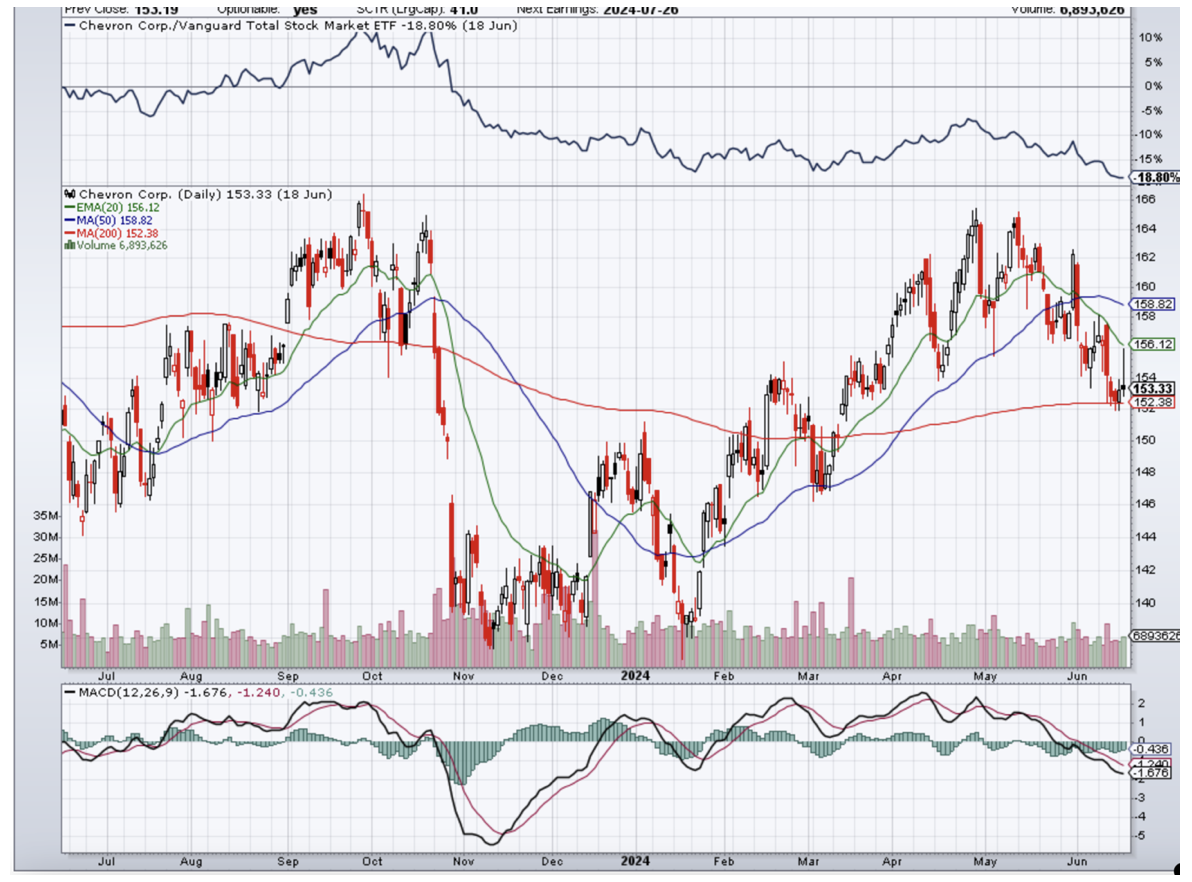

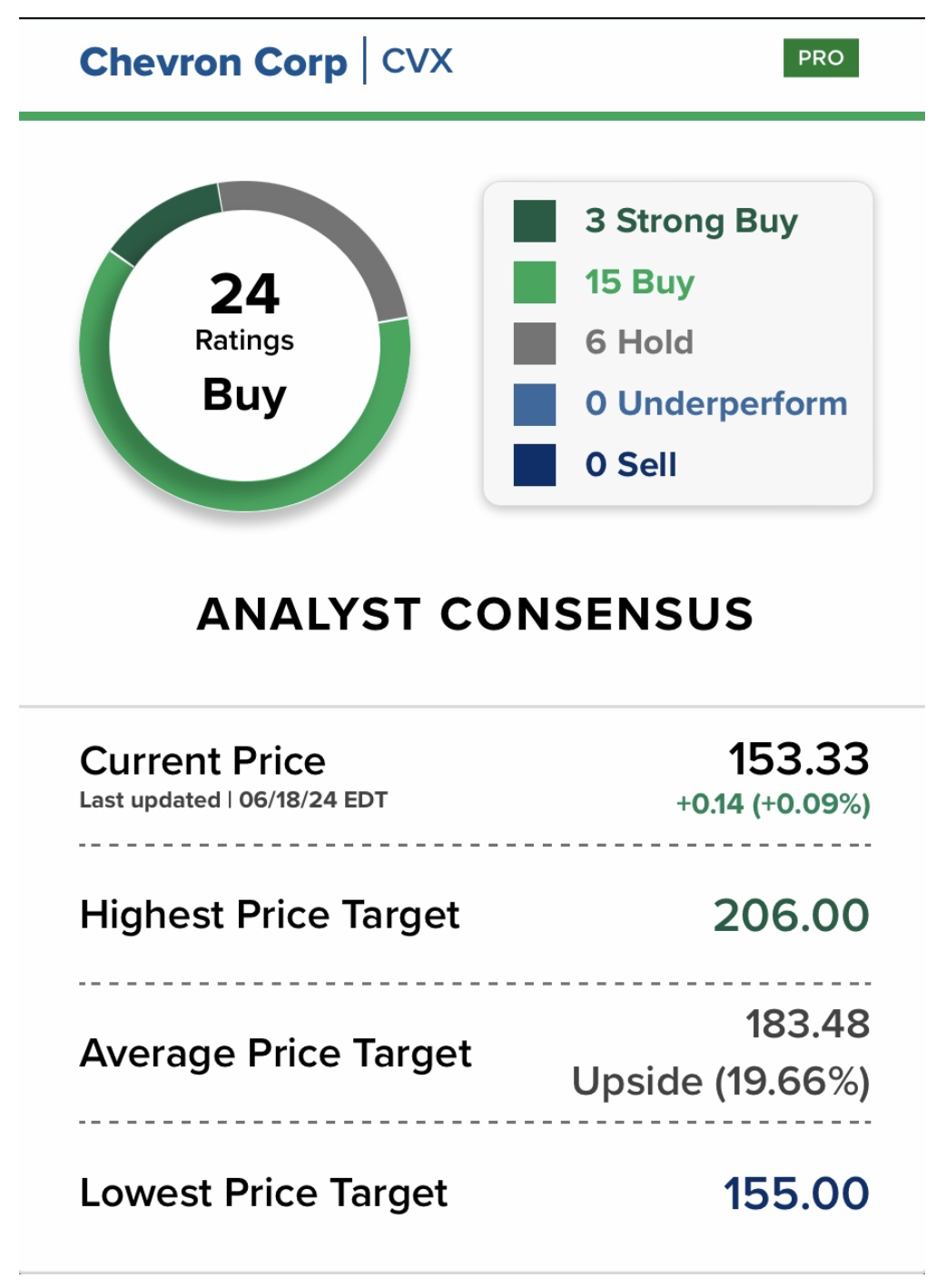

ENERGY & COMMODITIES – DOWNTREND

Energy has been the worst-performing asset class of 2024.

Energy stocks have been worse, underperforming crude.

Gasoline demand has been in long-term secular demand since 2019.

Replacement by EV’s and a shift out of cars into planes are big factors.

Hurricane seasons bringing a short-term pop in prices which John says you should sell.

Buffet buy Occidental for 9 straight days – betting that global economic recovery takes Texas tea back to $100. It’s the cheapest oil company out there. Buy (OXY) on dips.

A Trump presidential win will cause all energy plays to rocket as environmental regulations are rolled back and subsidies renewed, and federal lands opened to new drilling.

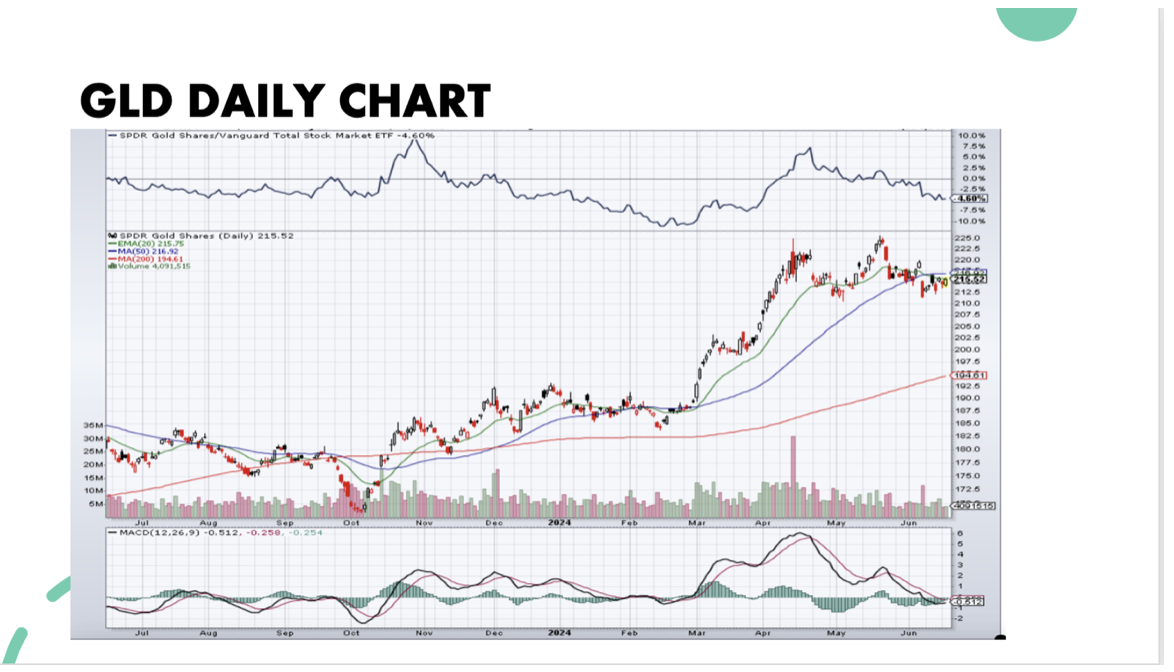

PRECIOUS METALS

The gold rush will continue throughout 2024, as much of Asia is still accumulating the yellow metal.

Asia lacks the stock markets we here in the U.S. enjoy.

A global monetary easing is at hand.

Cool May Nonfarm Payroll Report boosts the gold trade.

Buy precious metals on the dip because rates must fall eventually.

Miners are expanding their operations and ramping up production as prices for the precious metal climb to decade highs.

Buy (GLD), (SLV), and (WPM) on dips.

REAL ESTATE – FOREVER BID

Record prices but scarce sales volume.

U.S. housing is unaffordable but aggregate demand continues to push prices higher.

U.S. home sales fall, down 1.7% month-over-month in May on a seasonally adjusted basis and dropped 2.9% from a year earlier. Median home sale price rose to a record high of $439,716, up 1.6% month-over-month and 5.1% year-over-year.

The median price of an existing home sold in May was $419,300, up 5.8% year-over-year.

Rents are up 27% since 2020.

Bankrupt Forever 21 is asking some landlords for rent concessions as high as 50% as liquidity pressures commercial real estate.

Beachfront Property Prices are Washing out to Sea, with dramatic price drops visible on all three coasts.

Prices are further eroding thanks to the complete disappearance of the home insurance policies, forcing buyers to pay all cash.

TRADE SHEET

STOCKS – buy any dips.

BONDS – buy dips.

COMMODITIES – buy dips.

CURRENCIES – sell dollar rallies, buy currencies.

PRECIOUS METALS – buy dips.

ENERGY – buy dips.

VOLATILITY – buy $12

REAL ESTATE – buy dips

NEXT STRATEGY WEBINAR

12:00 EST Wednesday, July 24 from Zermatt, Switzerland

=========================================================================

UPDATE

Data has shown a slowing economy, and as a result rate cuts are well and truly back on the table.

If you look back at a Post I wrote on March 18, 2024, entitled, Slowing Economic Data May Shift the Fed into Reactionary Mode, this appears to be what is certain to happen.

Except, I anticipated rate cuts to happen toward the end of the year. Now, we could get one in September with others to follow before the year's end.

No rate cuts in the U.S. would see the country barrelling toward a deep recession.

A broader market rally should happen in the second half of the year.

Investors jumping out of tech into other sectors, such as Energy, and Healthcare, and REITS does not mean that tech is dead. It just means it’s resting. Please do not sell your big tech holdings. They are a long-term hold. (If you sell now, will you be able to enter at the same price you originally bought?) Timing the markets is a fool’s errand; sit with the market movements as it is the institutions that scoop up the retail investors’ holdings that sell out for short-term gains).

Cheers

Jacquie