(THE “SELL AMERICA” THREAD HAS TAKEN HOLD)

April 28, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY, APRIL 28

10:30 a.m. Dallas Fed Index (April)

Earnings: Universal Health Services, Domino’s Pizza

TUESDAY, APRIL 29

8:30 a.m. Wholesale Inventories preliminary (March)

9:00 a.m. FHFA Home Price Index (February)

9:00 a.m. S&P/Case Shiller comp. 20 HPI (February)

9:30 a.m. Australia Inflation Rate

Previous: 2.4%

Forecast: 2.2%

10:00 a.m. Consumer Confidence (April)

10:00 a.m. JOLTS Job Openings (March)

Earnings: Visa, Seagate Technology Holdings, Starbucks, Mondelez International, PPG Industries, First Solar, Extra Space Storage, Caesars Entertainment, Booking Holdings, Sysco, Corning, Sherwin-Williams, Altria Group, Kraft Heinz, Coca-Cola, American Tower, Pfizer, Regeneron Pharmaceuticals, Royal Caribbean Group, General Motors, United Parcel Service, Honeywell International, Hilton Worldwide, PayPal

WEDNESDAY, APRIL 30

8:15 a.m. ADP Employment Survey (April)

8:30 a.m. ECI Civilian Workers (Q1)

8:30 a.m. GDP Chain Price (Q1)

8:30 a.m. GDP first preliminary (Q1)

8:30 a.m. Chicago PMI (April)

10:00 a.m. Core PCE Deflator (March)

10:00 a.m. PCE Deflator (March)

10:00 a.m. Personal Consumption Expenditure (March)

10:00 a.m. Personal Income (March)

10:00 a.m. Pending Home Sales (March)

11:00 p.m. Japan Rate Decision

Previous: 0.5%

Forecast: 0.5%

Earnings: Prudential Financial, MGM Resorts International, Allstate, eBay, Qualcomm, Public Storage, Microsoft, Meta Platforms, Invitation Homes, Albemarle, Aflac, Hess, yum! Brands, Norwegian Cruise Line Holdings, Caterpillar, GE Healthcare Technologies, Stanley Black & Decker, Humana, Generac Holdings, Western Digital, Martin Marietta Materials, Automatic Data Processing

THURSDAY, MAY 1

8:30 Continuing Jobless Claims (04/19)

8:30 a.m. Initial Claims (04/26)

9:45 a.m. S&P PMI Manufacturing final (April)

10:00 a.m. Construction Spending (March)

10:00 a.m. ISM Manufacturing (April)

Earnings: Apple, Motorola Solutions, Live Nation Entertainment, GoDaddy, Airbnb, Monolithic Power Systems, Amazon.com, Ingersoll Rand, DexCom, Kellanova, McDonalds, Howmet Aerospace, Hershey, Quanta Services, KKR & Co, Eli Lilly & Co, Estee Lauder Companies, Moderna, IDEXX Laboratories, CVS Health, Mastercard

FRIDAY, MAY 2

8:30 a.m. Hourly Earnings preliminary (April)

8:30 a.m. Average Workweek preliminary (April)

8:30 a.m. Manufacturing Payrolls (April)

8:30 a.m. Nonfarm Payrolls (April)

Previous: 228k

Forecast: 130k

8:30 a.m. Participation Rate (April)

8:30 a.m. Private Nonfarm Payrolls (April)

8:30 a.m. Unemployment Rate (April)

10:00 a.m. Durable Orders (March)

10:00 a.m. Factory Orders (March)

Earnings: T. Rowe Price Group, Chevron, Exxon Mobil, Apollo Global Management

Since April 2, investors have been trying to see through the noise of a tariffed landscape – which has seemingly toppled the U.S. from its perceived position of power.

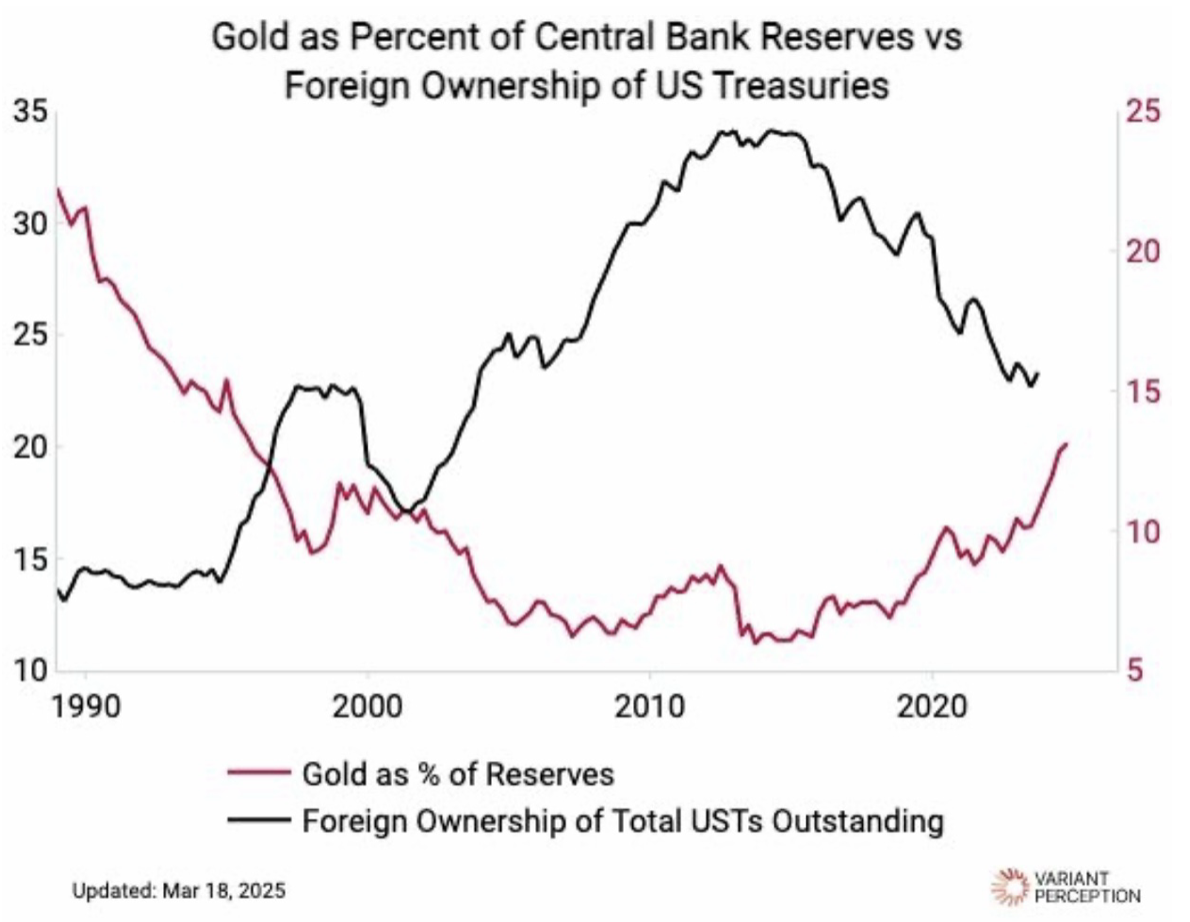

“Sell America” is now a theme in the macro landscape. U.S. equities have slumped, the U.S dollar has been pummelled, and bonds have sold off. This has forced investors into a rethink on the U.S. exceptionalism trade in the future.

Hiding away from the volatility is possible – diversify into a mix of short-term bonds, gold, utilities, and consumer staples. Think of stocks like Coca-Cola, Procter & Gamble, Walmart & Costco. Or you could also think about an ETF – Vanguard Consumer Staples ETF (VDC). This ETF holds Walmart & Costco. You could also look at the Swiss franc currency ETF – (FXF).

Last Friday, stocks closed out a winning week. The Dow Jones Industrial Average ended 2.5% higher on the week. The S&P 500 was up by 4.6%, while the Nasdaq Composite rose by 6.7%.

This week will be busy with more than 180 companies in the S&P 500 set to release results. Of those, 11 companies in the Dow Industrials are expected to report, as well as four of the Magnificent Seven companies – Amazon, Apple, Meta Platforms, and Microsoft.

The Mag 7 - not what they used to be –have been well and truly knocked off the top rung of the ladder – and investors would be wise to stop putting all their eggs in that one basket. While these companies are still expected to show strong earnings in 2025, mostly, the rest of the market, that is, the other 493 S&P 500 companies, are expected to post double-digit earnings growth next calendar year, catching up to the mega cap leadership.

On Wednesday, the Federal Reserve’s preferred inflation gauge – the personal consumption expenditure price index – is expected to show the annual rate of inflation eased to 2.2% in March from 2.5% in February.

Jobs data will be one to watch this week, as it could start to show signs that the labour market is slowing. Nonfarm payrolls on Friday are projected to show the U.S. added 150,000 jobs in April, down from 209,000 previously, according to FactSet data. The unemployment rate is expected to stay at 4.2%.

MARKET UPDATE

S&P500

The index is near recent highs in the up move from the April 7th low at 4835, breaking above resistance at 5475/85. This is a near-term positive sign and, along with positive technical data, argues for further gains. We can’t be sure yet whether this will be a pattern of limited ranging or a run back to the Feb high at 6147.

Resistance: $5640/50

Support: $5475/85 & $5350/60 & $5185/95

GOLD

Gold has fallen from the April 22 high at $3500. The market was extremely overbought, and this could be the top for at least a few weeks to a month or more. In the short term, there could be more retests towards the high before rolling over.

Resistance: $3367/77 & $3447

Support: $3305/15 & $3257/67 (recent lows) & $3218/28

BITCOIN

There has not really been much change in the big picture view over the last few months. We have seen a large bottoming taking place, with eventual gains above the Jan. peak at 109.40k expected.

The recent rally argues that the final low is likely in place. Bitcoin is now testing resistance at 95.9/96.4k, and this movement could trigger some consolidation for a week or two (not yet confirmed).

On March 17, I suggested several option trades in (IBIT) and (MSTR) that you could enter. A few of these are already in profit, and I expect the rest soon will be.

Further resistance: 98.9/99.4k

Support: 91.3/88.5k

QI CORNER

HISTORY CORNER

On April 28

SOMETHING TO THINK ABOUT

Cheers

Jacquie