(MINIATURE AI WILL BE BIG IN THE FUTURE)

December 29, 2023

Hello everyone,

We are living in the era of Artificial Intelligence (AI), and it will change our lives in many ways.

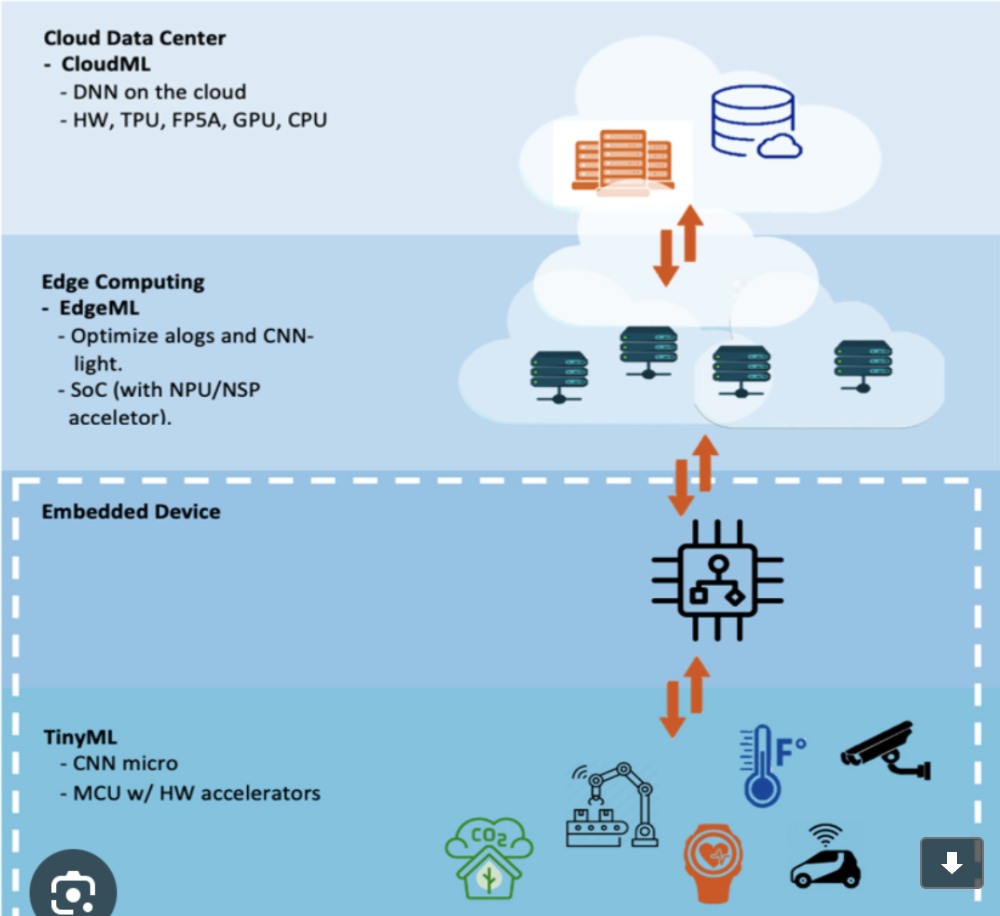

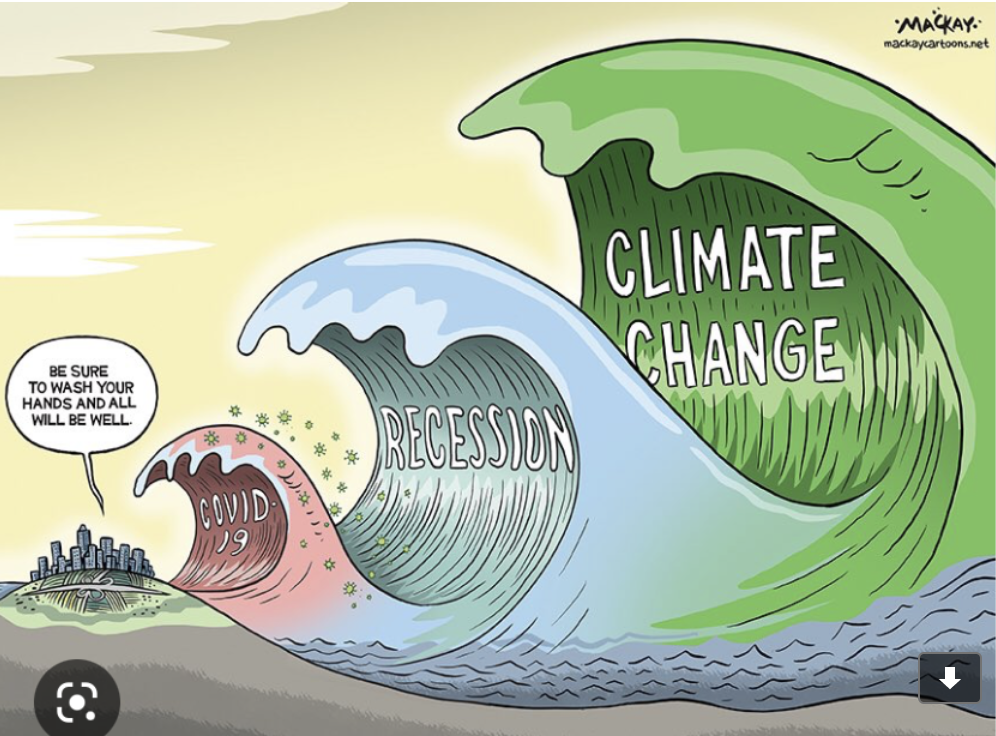

Within AI there is currently a large focus on Tiny AI or Minature AI which aims to improve the sustainability of artificial intelligence, thereby reducing its high carbon footprint. This emerging technology compresses the size of artificial intelligence algorithms - which use far less computing power - especially those that use large quantities of data and computational power. What this means is that this technology – Minature AI, can fit and run within microprocessors on consumer or the Internet of Things (IoT)-enabled devices. For instance, we can point to natural language processing (NLP) models like Google’s BERT. The larger version of BERT has 340 million data parameters and training it just once costs enough electricity to power a U.S. household for 50 days. In another example, we learn that a single training session of GPT-3, a popular language that produces human-like text, has the same carbon footprint as traveling 700,000 kilometers by car.

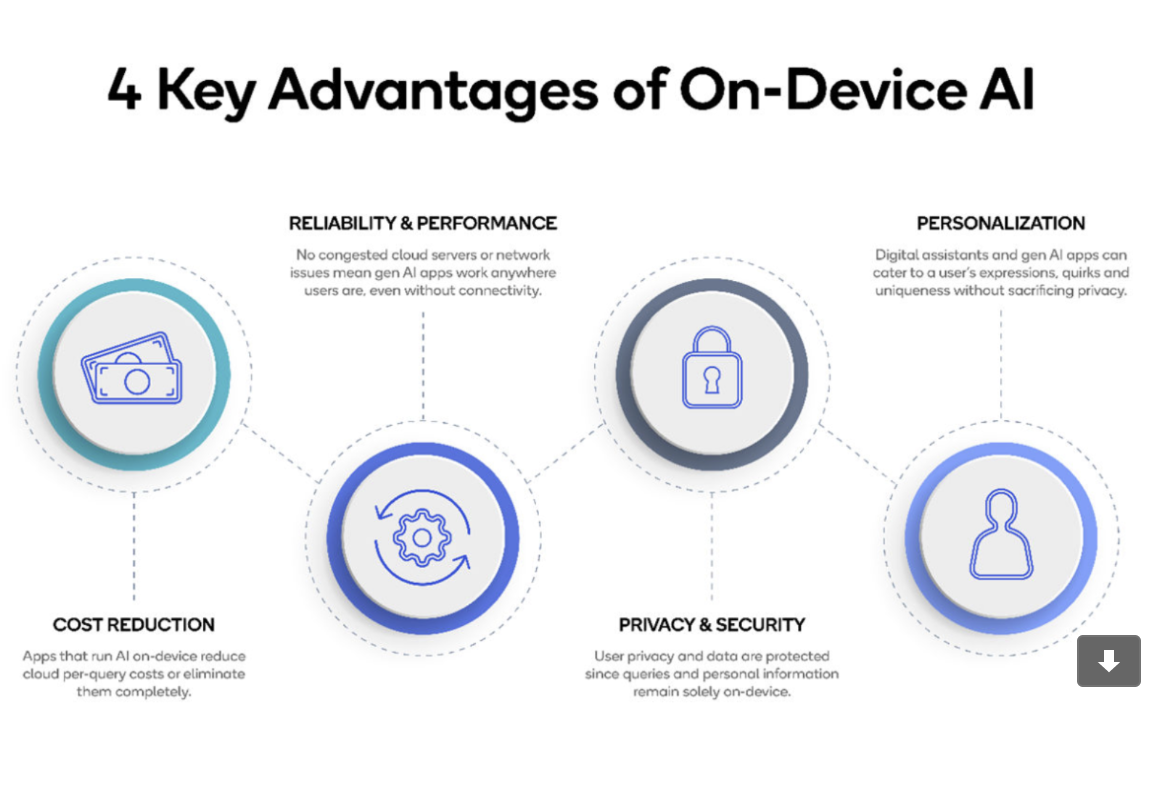

Tiny AI is a power saver and addresses the carbon footprint of artificial intelligence. It aims to reduce the amount of power needed by building algorithms into hardware at the periphery of a network, where they can perform data analytics at low power, avoiding the need to send data back to the cloud for processing. This improves latency as well as power consumption and enables Tiny AI to run on devices like our mobile phones, increasing their functionality but also improving our privacy as the data stays on the device.

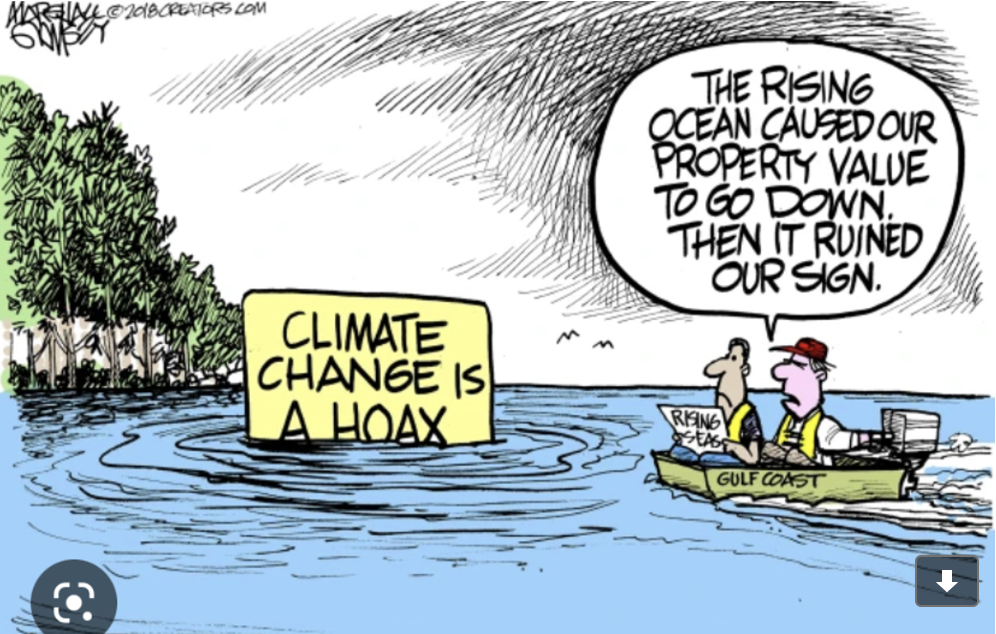

As AI keeps popping up in our everyday lives, it raises several privacy concerns. Do you ever get the feeling that you are being constantly monitored in some way, or that your privacy is being compromised? Smart home devices use AI to personalize the experience for each user. However, they store large amounts of data that is not particularly relevant for their applications, on the cloud – making it vulnerable to hacking. There is a demand now for on-device AI which enhances both privacy and safety for Smart Home Devices. The Tiny AI algorithms would run on consumer phone hardware, eliminating the need to analyze data on the cloud, thus reducing a significant amount of energy. Furthermore, it would also ensure ultra-low latency. Think about Google Assistant, the voice assistant on Google’s phone and smart home devices. After Google trimmed down its code so that it runs on-device rather than sending data to the cloud for processing, it processes requests a lot faster than it did before.

Tiny/miniature AI will impact all industries. This technology will facilitate the running of machine learning (ML) models to the smallest of chips and a diverse range of devices. This allows devices to be smart without connecting to the internet. Think for a moment about an autonomous car that doesn’t need to connect to the cloud or simply use a mobile phone to diagnose diseases in remote areas without the internet. Along with better algorithms, advances in embedded devices are advancing the trend. This allows for the development of devices that consume very little power and run for months or years. Now that’s a win-win for people and the environment.

Happy Wednesday.

Cheers,

Jacquie

Tiny Machine Learning: The Next AI Revolution