(THE OPIOID CRISIS AND ITS EFFECT ON THE ECONOMY)

November 10, 2023

Hello everyone,

While the market is dancing along nicely to year-end, I’m going to focus on an issue that can affect anyone at any time in their life.

Drugs.

Am I worried about my son, Alex, ever taking drugs? No. He crosses the road when he sees a person walking toward him, who is smoking a cigarette because he can’t stand the smell of the smoke.

Alex’s first semester at college has been unremarkable. He has done the work, received good grades, and has joined the Chess Club. He sometimes even tells me he is bored. But I never think that is a bad thing. After all, boredom can stimulate and inspire us to get lost in new ventures and hobbies that might otherwise have never been explored.

I had an interesting conversation with him the other day. His major is tech, while his roommate’s major is business. Alex is quiet and conservative, while his roommate is a party boy and often stays out until 4 a.m. Furthermore, sometimes, he just never comes back to the room at all over the weekend. But that is not surprising behaviour for a young adult teenager. What is a bit concerning is his roommate’s pill-popping, which Alex tells me has an impact on the way he behaves.

Alex did not tell me what he was taking, only that they were illegal.

The opioid crisis is a scourge on our society. Is life so confronting that some people have to get a buzz from a pill to make it to the end of the day?

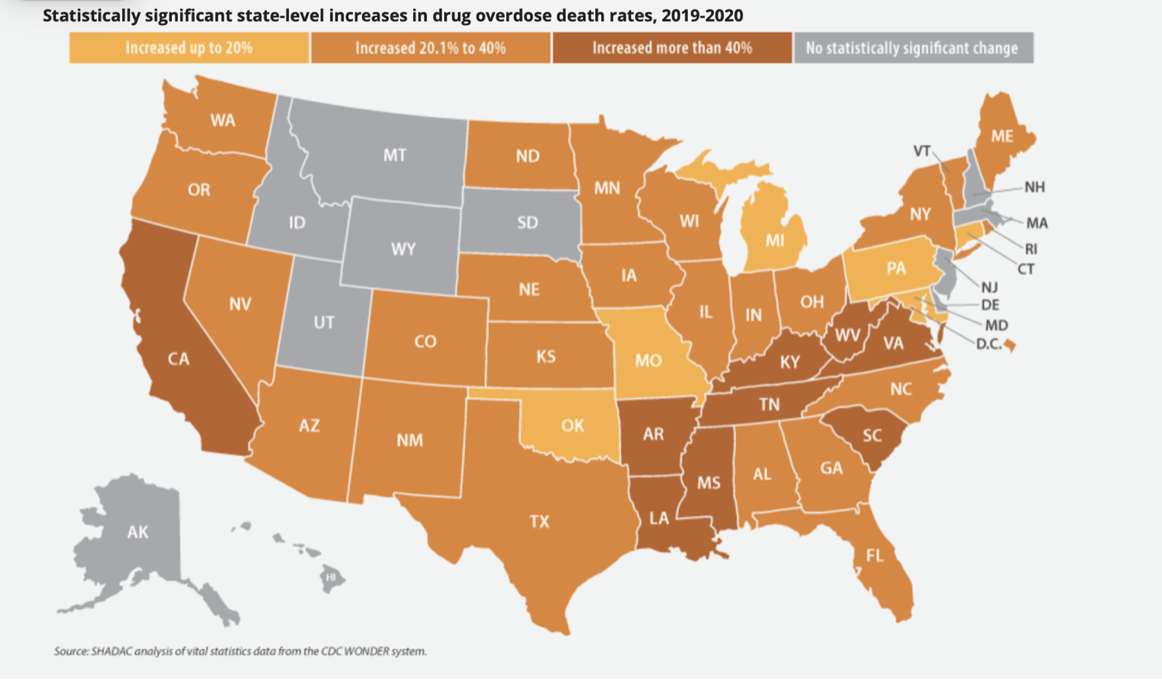

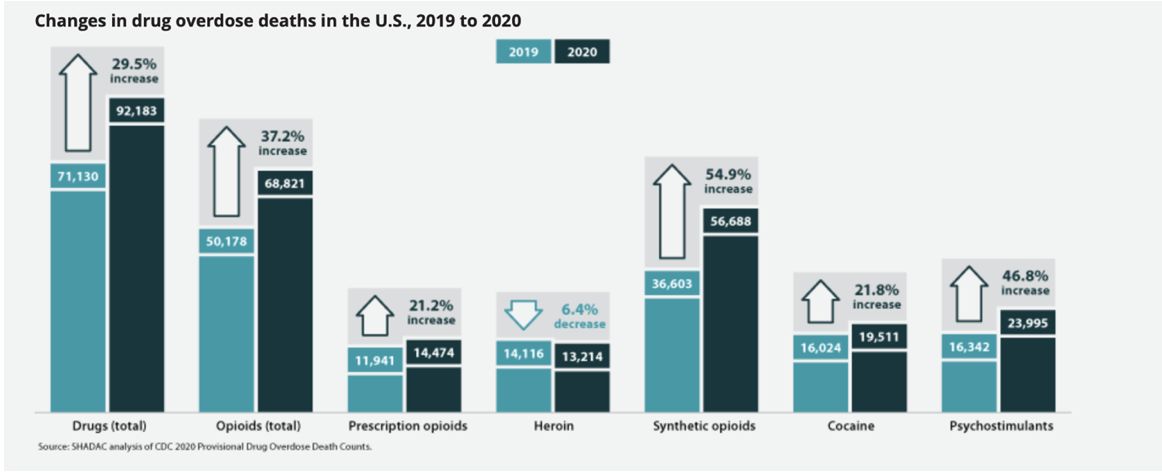

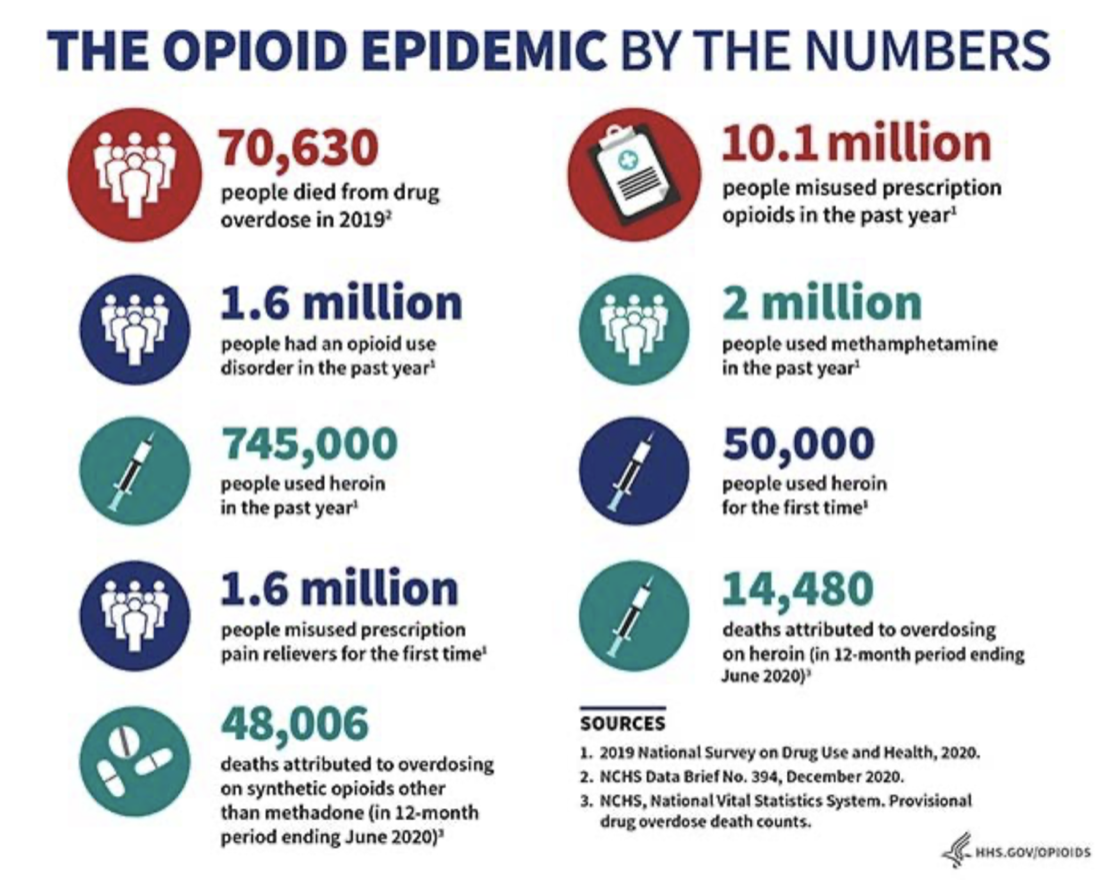

The statistics are alarming!

Worldwide, about 296 million people (or 5.8% of the global population aged 15-64 years) used drugs at least once in 2021. Among them, about 60 million people used opioids. About 39.5 million people lived with drug use disorders in 2021. Most people dependent on opioids use illicitly cultivated and manufactured heroin, but the proportion of those using prescription opioids is growing.

More than 100 people die every day from opioid overdoses.

Overall life expectancy in the U.S. has declined for three years in a row due in large part to the opioid epidemic, reversing a half-century trend.

Overdoses kill more Americans than car crashes or gun violence.

Addiction contributes to incarceration. In 2010, 85% of the U.S. population was incarcerated for substance-related reasons, with over half of all inmates diagnosed with substance use disorder.

In economic costs

Reduced labor force participation

Decreased employment

Productively loss.

Extra health costs.

Permanent injury & chronic health conditions.

Reported opioid overdose deaths:

2010 – 21,089

2017 – 47,600

2020 – 68, 630

2021 – 80, 411

Opioids have analgesic and sedative effects, and such medicines as morphine, codeine, and fentanyl are commonly used for the management of pain. Opioid medicines methadone and buprenorphine are used for maintenance treatment of opioid dependence. After intake, opioids can cause euphoria, which is one of the main reasons why they are taken for non-medical reasons. Opioids include heroin, morphine, codeine, fentanyl, methadone, tramadol, and other similar substances. Due to their pharmacological effects, they can cause difficulties with breathing, and opioid overdose can lead to death.

In the 1980s and 1990s, I worked in the Drug and Alcohol Unit and the Psychiatric Unit of the Toowoomba Hospital. I was the Administration Manager for those units. I learned a lot about the effects of drugs and alcohol on individuals, and the impact on families and the wider community. White-collar workers, blue-collar workers, male and female, young and old – all are at risk of being a statistic in the opioid epidemic. Those people who took drugs for non-medical reasons were in emotional pain, except the panacea turned into an additional crisis which exacerbated the person’s despair and feelings of hopelessness. A truly sad situation.

We can point to the pharmaceutical industry and its aggressive promotion of prescription drugs as one of the main elements contributing to the opioid epidemic in the U.S. Advertising of drugs is at saturation point on free-to-air T.V. in the U.S. Conversely, in Australia, promotion of drugs in television or print media is at a minimum. There are restrictions on the direct advertising of pharmaceuticals to patients, as well as regulatory and professional actions, which have resulted in different patterns of prescribing and outcomes in Australia.

Nonetheless, opioid prescribing has increased gradually in Australia over the last three decades. Each time a new opioid formulation becomes available, it is enthusiastically prescribed. That brings us to look at the relationship between the drug representative and the G.P. The payoffs for the G.P. when s/he promotes the drug are usually quite attractive. Surely, lack of remuneration would lessen the likelihood of G.P.’s being so eager to prescribe these drugs, knowing the tendency for some patients with non-medical conditions to abuse these drugs.

Take care.

Cheers,

Jacquie