(HEADING TOWARDS A CASHLESS SOCIETY IN AUSTRALIA)

(GEOPOLITICS AND GOLD)

(LONGEVITY SECRET OF THE NAKED MOLE RAT)

October 18, 2023

Hello everyone,

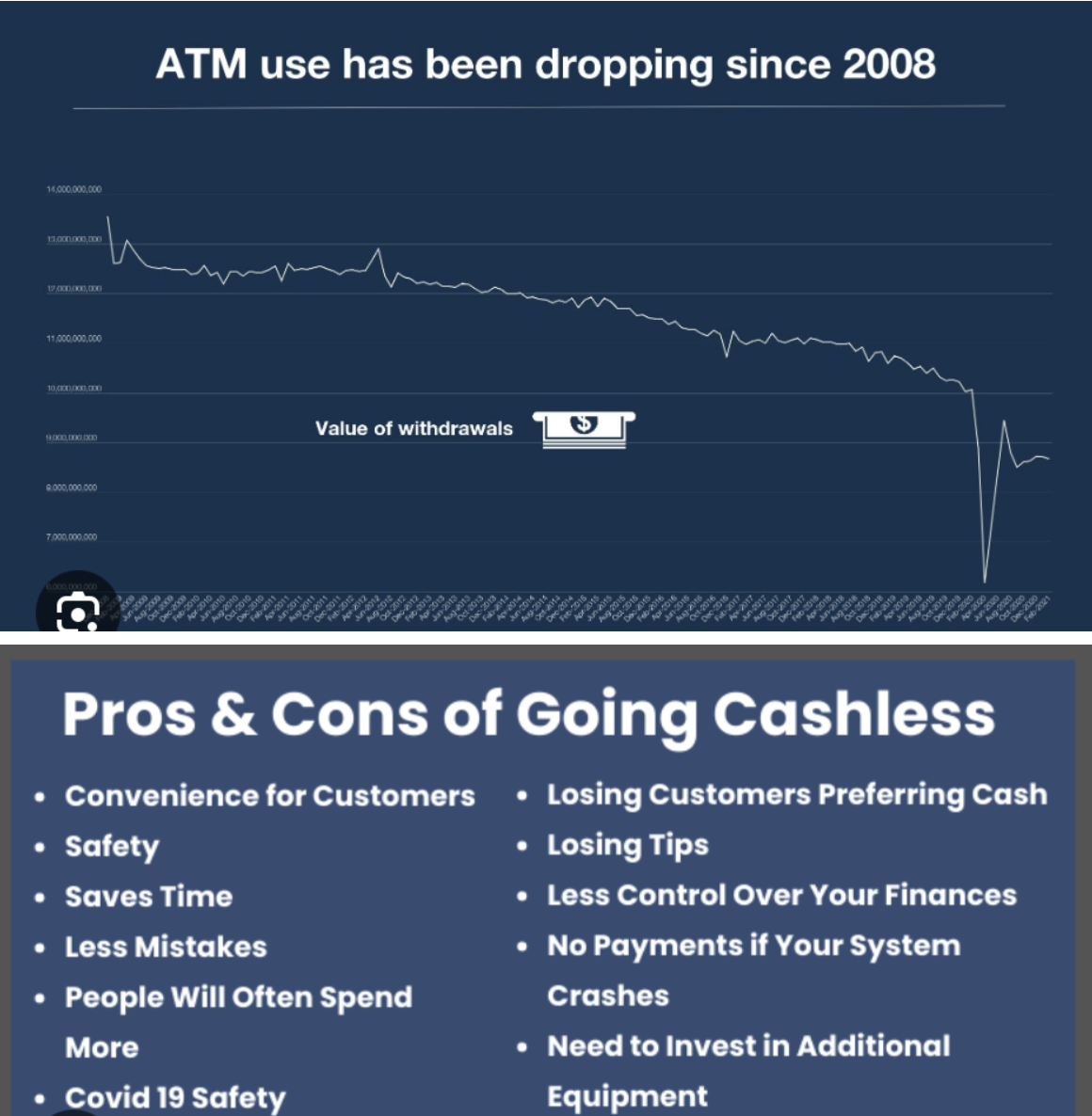

By the end of the decade, Australia could be a cashless society. In other words, instead of walking around with notes and change in our wallets, we will walk around with just our phones.

The transition to digital transactions is happening much quicker than experts first imagined as cash becomes a less popular form of payment.

Credit/debit cards and digital wallets such as Apple Pay and Google Pay are now the preferred method of payment by most customers.

It is a convenient way to transact in our day-to-day lives.

One of Australia’s major banks, the Commonwealth Bank, is predicting that the use of cash will be a thing of the past by 2026.

In 2007, 70% of consumer payments were cash and they were still 61% in 2010.

By 2022, cash payments were just 13%.

The Covid-19 pandemic popularised the use of mobile wallets when businesses avoided contact with customers by implementing strict no-cash policies. Today, around 40% of Australians are comfortable leaving home without their actual wallets or cards, using only their phone to pay.

Digital wallet payments rocketed from $746 million in 2018 to more than $ 93 billion four years later.

There are concerns over consumer privacy when using digital payments as everything we spend our money on can be seen. Using cash, on the other hand, prevents our bank or government from knowing where our money goes. Furthermore, fraud and identity theft are also an increasing threat due to our reliance on our cards/digital transactions.

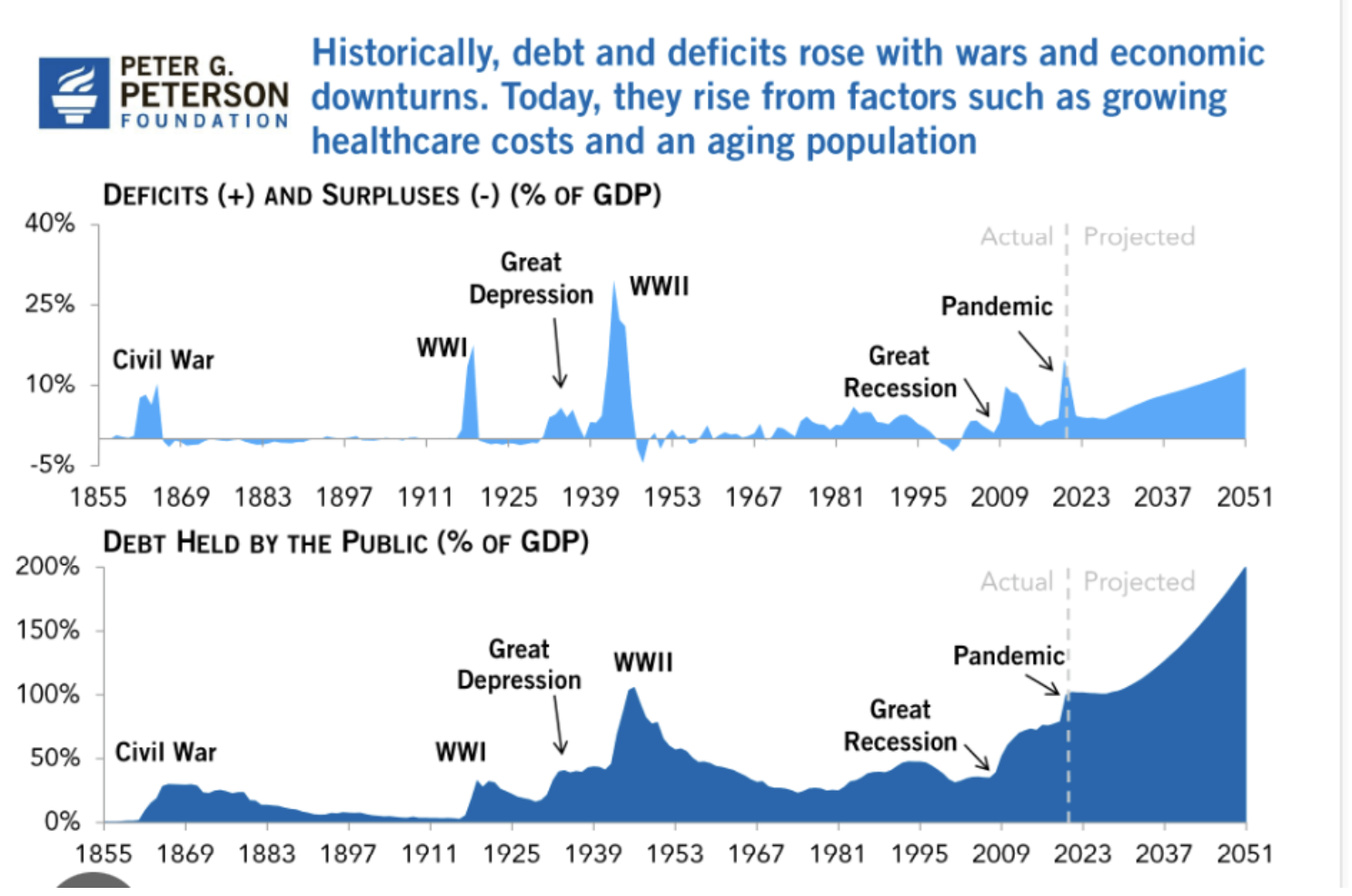

Interest rates and geopolitics are prompting us to buy more Gold.

The commodity will act as a hedge against looming geopolitical risks and an expected fall in bond yields. As I write this gold now sits around $1922. Buy in small parcels. (I have been urging everyone to purchase gold in small parcels for many weeks now, particularly when gold was falling towards $1800.) (WPM), (SIL), SLV), (GOLD), (GLD).

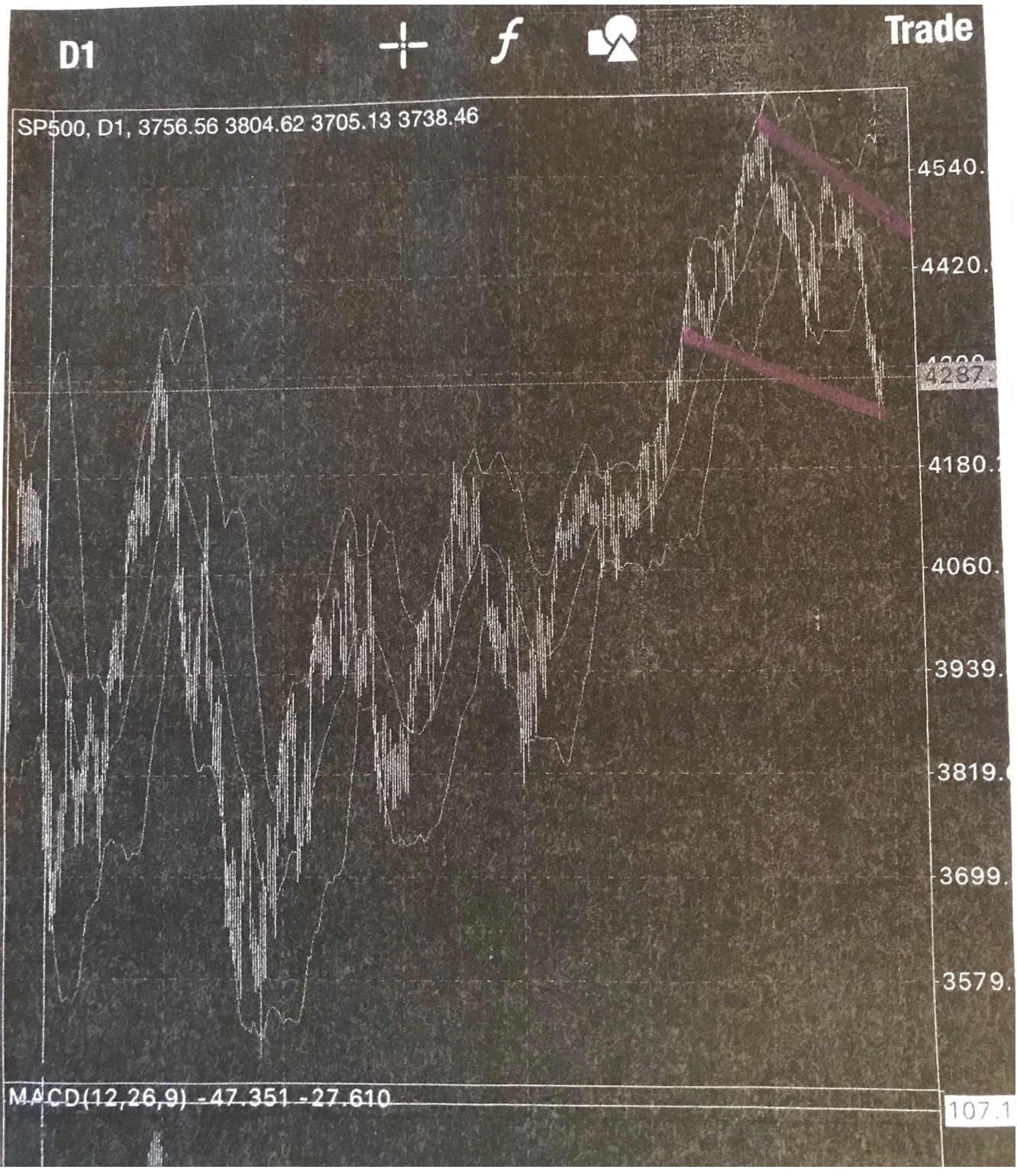

An option trade to consider (MCD)

Mcdonald's has shed some 17% of its market value over the past three months as it declined from nearly $300 to its current level of around $250. To any trader looking at the McDonald's chart, we could say the trends are bearish with negative momentum. But a contrarian view could see it as an opportunity to be a buyer of this blue chip at a cheap valuation and play for a bounce.

MCD is showing signs of exhaustion (the RSI is oversold) and now trades at just above 20 times forward earnings, which is about a 15% discount to its historical average relative. Furthermore, its push into digital penetration with mobile ordering and delivery is expected to deliver growth of nearly 10% this year after a flat 2022.

You could look at a vertical call spread in MCD with expiration and strikes at

Dec 2023 $250/$270 or even Dec 2023 $250/$260

MCD is a suggestion for a trade idea. By the time you receive this Post, the stock may have moved, and prices changed. Check your risk/reward before entering any trade.

We have a lot to learn about longevity from The Naked Mole Rat.

Compared to other rodents, naked mole rats have unprecedented longevity; their average lifespan lies somewhere between 10 to 30 years. By comparison, similarly sized rodents are lucky if they make it to four. Not only are naked mole rats long-lived, but they are also comparatively healthier than other rodents.

We need to look at the cellular level to explain the naked mole rat’s extraordinary longevity.

Structures called telomeres, found at the ends of chromosomes, protect our DNA from damage. They normally shortage with age, but in the naked mole rate their telomeres elongate slightly as they age. They also don’t face any issues with proteasome function, which is like the cellular garbage disposal system that gets rid of old and damaged proteins that are clogging up the space.

What’s behind their mysterious long-lived lives?

Hyaluronic Acid.

It’s the kind of glue that provides mechanical support to cells and is involved in a host of important cellular functions, including cell migration and proliferation. Hyaluronic acid comes in different masses, which define its function. The low mass version of the molecule (LMM-HA) is related to inflammation and cancer metastasis. The high mass version (HMM-HA), on the other hand, has anti-inflammatory properties and helps keep the body’s tissues in order. Scientists have discovered that naked mole rats have up to ten times more high-molecular-mass hyaluronic acid in their bodies than do their close relatives, mice, or even humans. Furthermore, the hyaluronic acid produced by the naked mole rats also seems to be very good at protecting cells against harmful agents. To discover whether other rodents could benefit from the effects of the mole rat’s hyaluronan, researchers genetically modified mice so that they carried the naked mole rate version of the gene that produces the acid, hyaluronan synthase 2 gene. After studying these mice for the duration of their lifespan and paying special attention to cancer incidence, the researchers found that the genetically modified mice were far less likely to develop cancer, and experienced fewer health issues generally.

Can we replicate this in humans in the future?

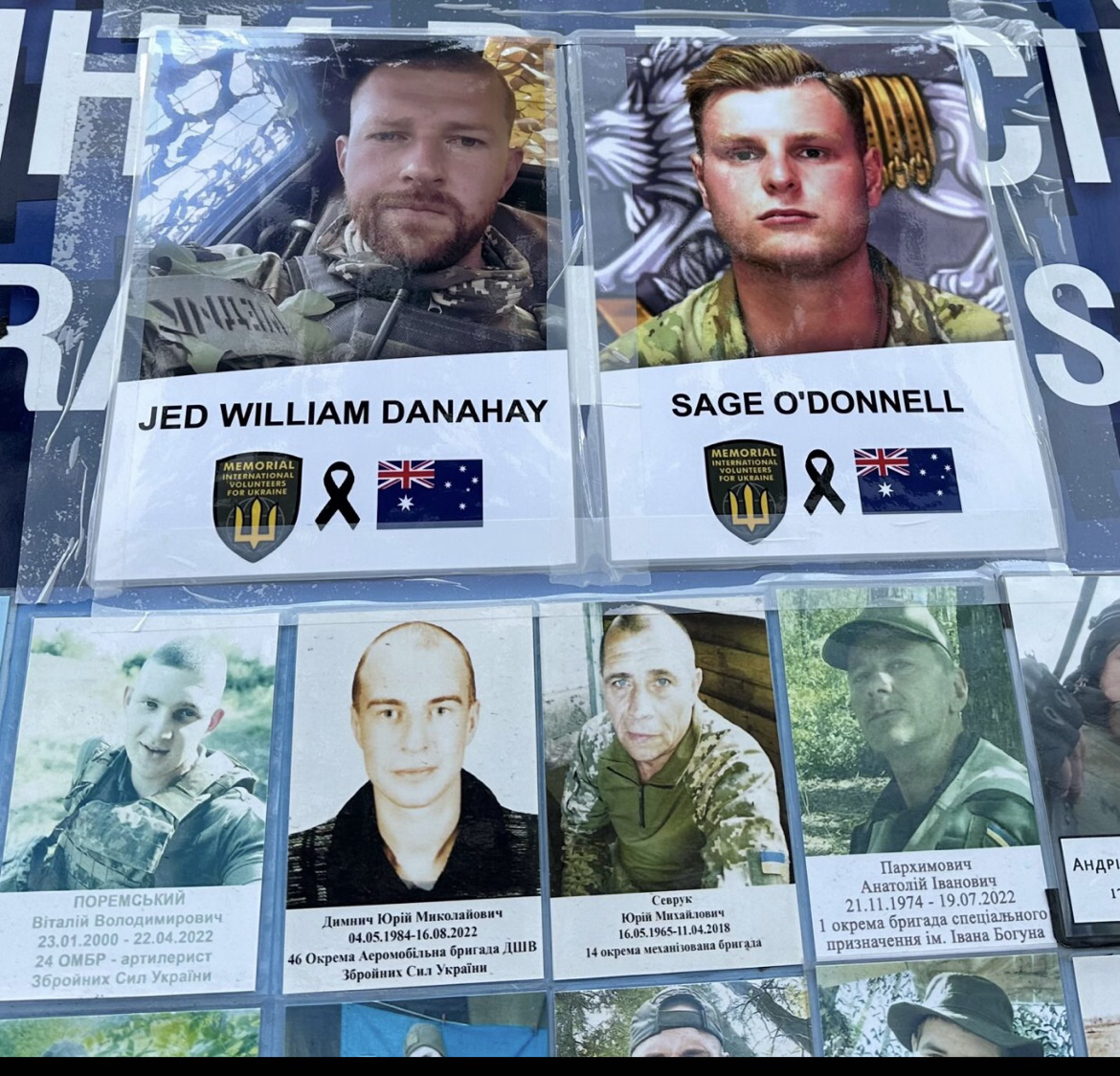

Honouring the Fallen

Many Australian citizens have dropped their lives in their home country to go and fight with Ukrainians in Ukraine. Many have made the ultimate sacrifice including those pictured below. We give thanks to those men and to all those people who have fought to support the Ukrainians. I have a Ukrainian friend in London, and she tells me that her cousins – some as young as 12 have gone to the front to fight. Incredible courage!

Cheers,

Jacquie