(UNDERSTANDING BEHAVIOURAL FINANCE CAN HELP US MAKE BETTER FINANCIAL DECISIONS)

August 9, 2023

Hello everyone,

Today I want to explore elements of behavioural finance. Behavioural finance explains how decision-makers take financial decisions in real life, and why their decisions might not appear to be rational every time and, therefore, have unpredictable consequences. When we look at the subject of behavioural finance, we are analysing the influence of psychological biases. Among the common behavioural financial aspects are loss aversion, consensus bias, and familiarity tendencies.

Understanding human behaviour is at the core of most behaviour-based finance theories. Learning some common biases and beliefs can help better predict the decisions that individuals might make in the future. The elements of this theory may include:

Self-deception

Self-deception relates to the idea that human beings may be missing important information that is required to make an informed decision. People may think they know more than they actually do, which can lead to errors when making financial decisions. This idea can mask itself in our emotions and manifest itself as feelings of overconfidence or self-assurance.

Or we can also term this Overconfidence. Overconfidence is a cognitive bias that causes people to overestimate their knowledge, skills, or ability to predict future outcomes. In finance, overconfidence can lead to excessive trading, under-diversification, and inadequate risk management.

Mental accounting

Mental accounting is the human tendency to assign subjective value to money. People tend to separate money into different mental accounts that affect the way they spend it. For example, if someone receives a tax refund, they may likely see it as extra money, or a windfall. In reality, the money already belongs to them. Although the refund money is part of their regular income, they may spend it on discretionary items because they see it as disposable.

Heuristic simplification

A heuristic simplification accounts for human error when analysing data and information. Heuristics are mental shortcuts that reduce mental processing effort. They factor into whether people fully process information, which can have a significant impact on their financial decisions.

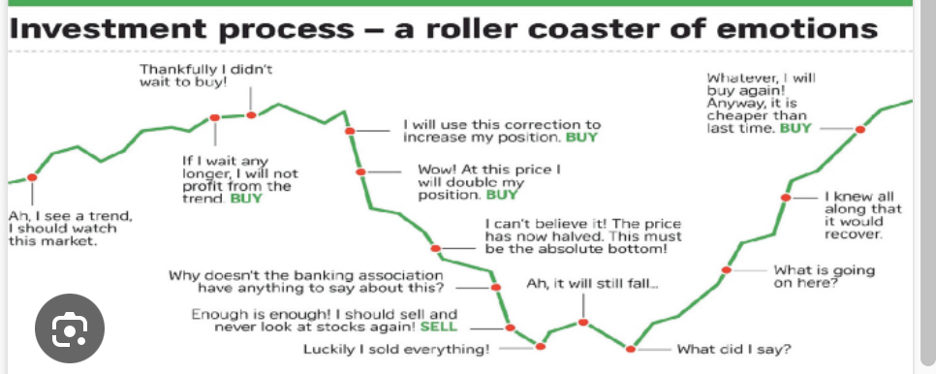

Emotion

Emotion in finance refers to how our emotions can influence the decisions we make. And doesn’t this ring true for all of us. We all understand how strongly emotions influence our financial decisions making. Emotions help shape the human mindset and are typically the primary reason people may struggle to make informed decisions. For example, when people experience positive emotions, such as excitement and optimism, they’re more likely to take risks when investing. Isn’t it true that when you have had a run of great profitable trades, you tend to place bigger positions?

When people are feeling low in their emotions and experience emotions such as sadness and anxiety, they become more risk-averse and are less likely to make major financial decisions. It can also be said that people with these emotions are often vulnerable and easily influenced by financial “vampires” or fraudulent financial schemes as they are often looking to escape a situation or person and will consider alternatives not normally considered when they are thinking rationally.

Social influence

The social environment can play a considerable role in human behaviour. Social influence bias explains why humans make investment decisions based on what other investors are doing. By preparing and planning financial decisions, you are less likely to let factors such as emotion, deception, or social influence affect your actions.

Other key concepts in behavioural finance that you need to be aware of.

Confirmation Bias

Confirmation Bias is the tendency to seek, interpret, and remember information that confirms one’s pre-existing beliefs while ignoring or discounting contradictory evidence. This bias can contribute to investment mistakes such as holding onto losing positions or overlooking red flags.

Loss aversion

Loss aversion is the tendency for individuals to prefer avoiding losses over acquiring equivalent gains. The bias can lead to risk-averse behaviour when facing potential gains and risk-seeking behaviour when facing potential losses. In other words, we might hear that a trader stops out of winning positions early and doubles up on losing positions.

Herding Behaviour

Herding behaviour is individuals’ tendency to follow a larger group’s actions or beliefs, even if It contradicts their own judgement or available information. In finance, herding can contribute to market bubbles and crashes.

Availability bias

Availability bias is the tendency to rely on readily available information or recent experiences when making decisions, often leading to a distorted perception of probabilities and risks.

By identifying the various biases that we may have, we will be better prepared to make more rational, thoughtful, and informed decisions in the future.

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

–Jason Zweig

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

“Overconfidence is a very serious problem. If you don’t think it affects you, that’s probably because you’re overconfident.”

– Carl Richards

Have a great week.

Cheers,

Jacquie