(MY TIME IN LONDON)

July 19, 2023

Hello everyone,

Alex and I made it to the U.K. He is busy catching up with friends and cousins while I get to continue working. Not much downtime when you work for John.

London is packed with tourists – it’s exhausting just walking down the sidewalks because the tourists and the English don’t seem to have any concept of walking on the right or the left, so you spend the time walking diagonally and trying not to run into people.

As I write this on Sunday, July 16, we are an hour away from the start of the Wimbledon men’s final. Djokovic vs Alcaraz. Personally, I would love to see a new name on the Wimbledon Cup.

There seems to be a lot of strike action everywhere. And it's typically done in the high tourist season. Southwestern Railways are striking on certain days this coming week and the tube is shutting down from the 23rd to the 29th of July. It will be a nightmare. But I’m sure the English black cabs will do well.

We also have the actors under the Screen Actors Guild (SAG) going on strike as well. Start date for their strike was July 13.

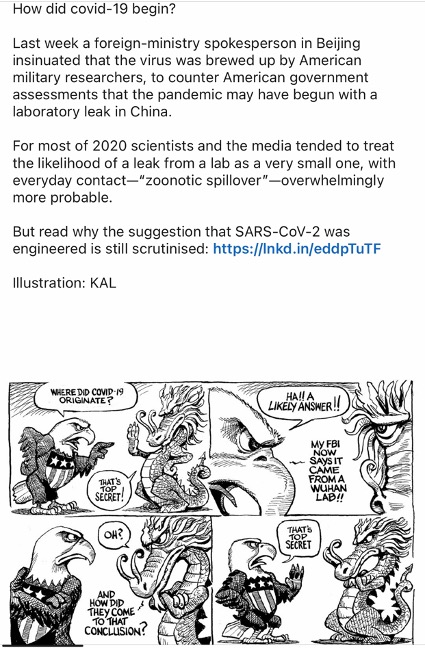

It seems AI is the reason for the strike by the actors. They are seeking some regulation and reassurance about its use in the world of film. I thought technology was supposed to improve things, not be totally disruptive. But it seems that is the effect of new and improved technology, and we must accept that some will fall by the wayside, while others will embrace future technology and adapt.

The Reserve Bank of Australia has a new Governor. We welcome Michele Bullock. Bullock – who has worked at the bank for four decades - will be the ninth governor of the central bank from September after the Labour government decided not to extend Philip Lowe’s tenure.

The Reserve Bank and the Treasury forecasts have inflation moderating in the coming months. Notably, they have a tick-up in unemployment.

In the future, the RBA will be cutting the number of meetings it holds annually to set interest rates, from 11 to eight.

Everything is expensive here in London. Prices have gone up so much since I lived here five years ago. Inflation is running at 8%. I see it moderating over the course of the next few years.

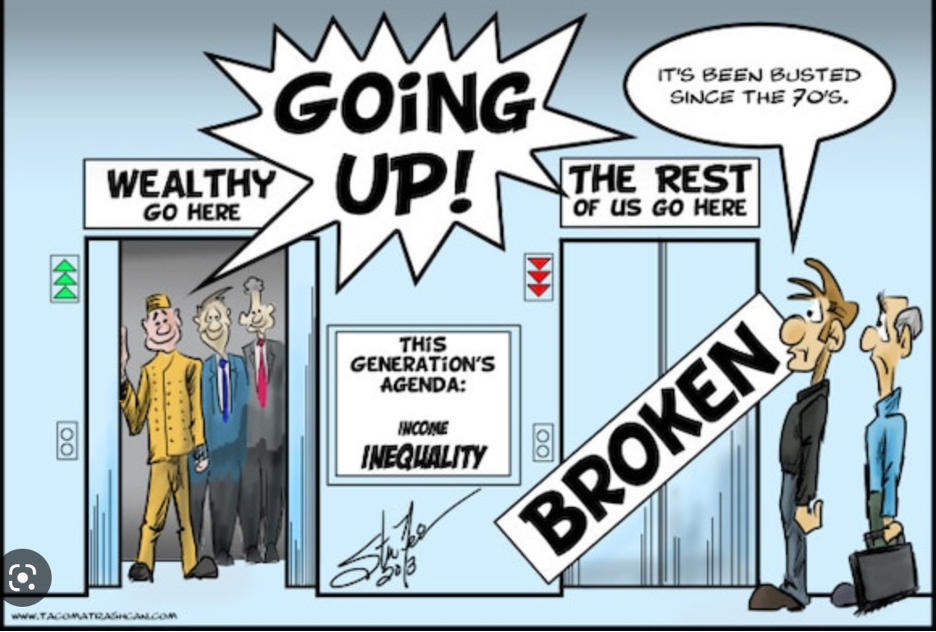

English people can’t afford to live in the city anymore. So, they are now traveling long distances to get to work in the city. Tube and train strikes – which happen on a regular occasion in the UK – further complicate matters for workers. This is why the trend to work from home has been embraced by city workers and those with a side hustle.

Have a wonderful week.

Take care.

Cheers,

Jacquie