(APRIL IS HERE - WHEN THE TARIFF UNCERTAINTY MAY BECOME A KNOWN CERTAINTY)

March 31, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY, MARCH 31

9:45 a.m. Chicago PMI (March)

10:00 a.m. Dallas Fed Index (March)

7:30 p.m. Japan Unemployment Rate

Previous: 2.5%

Forecast: 2.5%

TUESDAY, APRIL 1

12:30 a.m. Australia Rate Decision

Previous: 4.1%

Forecast: 4.1%

9:45 a.m. S&P PMI Manufacturing final (March)

10:00 a.m. Construction Spending (February)

10:00 a.m. ISM Manufacturing (March)

10:00 a.m. JOLTS Job Openings (February)

WEDNESDAY, APRIL 2

8:15 a.m. ADP Employment Survey (March)

10:00 a.m. Durable Orders final (February)

10:00 a.m. Factory Orders (February)

10:00 a.m. New York Federal Reserve Bank

Deputy SOMA Manager Julie Remache speaks at a seminar in Monetary and Fiscal Policy at Vanderbilt University, Nashville.

8:30 p.m. Australia Trade Balance

Previous: A$5.6B

Forecast: A$5.6B

THURSDAY, APRIL 3

8:30 a.m. Continuing Jobless Claims (03/22)

8:30 a.m. Initial Claims (03/29)

8:30 a.m. Trade Balance (February)

9:45 a.m. PMI Composite final (March)

9:45 a.m. S&PPMI Services final (March)

10:00 a.m. ISM Services PMI (March)

FRIDAY, APRIL 4

8:30 a.m. Hourly Earnings preliminary (March)

8:30 a.m. Average Workweek preliminary (March)

8:30 a.m. Manufacturing Payrolls (March)

8;30 a.m. Nonfarm Payrolls (March)

Previous: 151k

Forecast: 128k

8:30 a.m. Participation Rate (March)

8:30 a.m. Private Nonfarm Payrolls (March)

8:30 a.m. Unemployment Rate (March)

9:00 a.m. New York Federal Reserve Bank

Director of Research Kartik Athreya speaks at the 2025 New York Fed Innovation Conference, New York.

April is tariff month, I think, unless President Trump changes his mind.

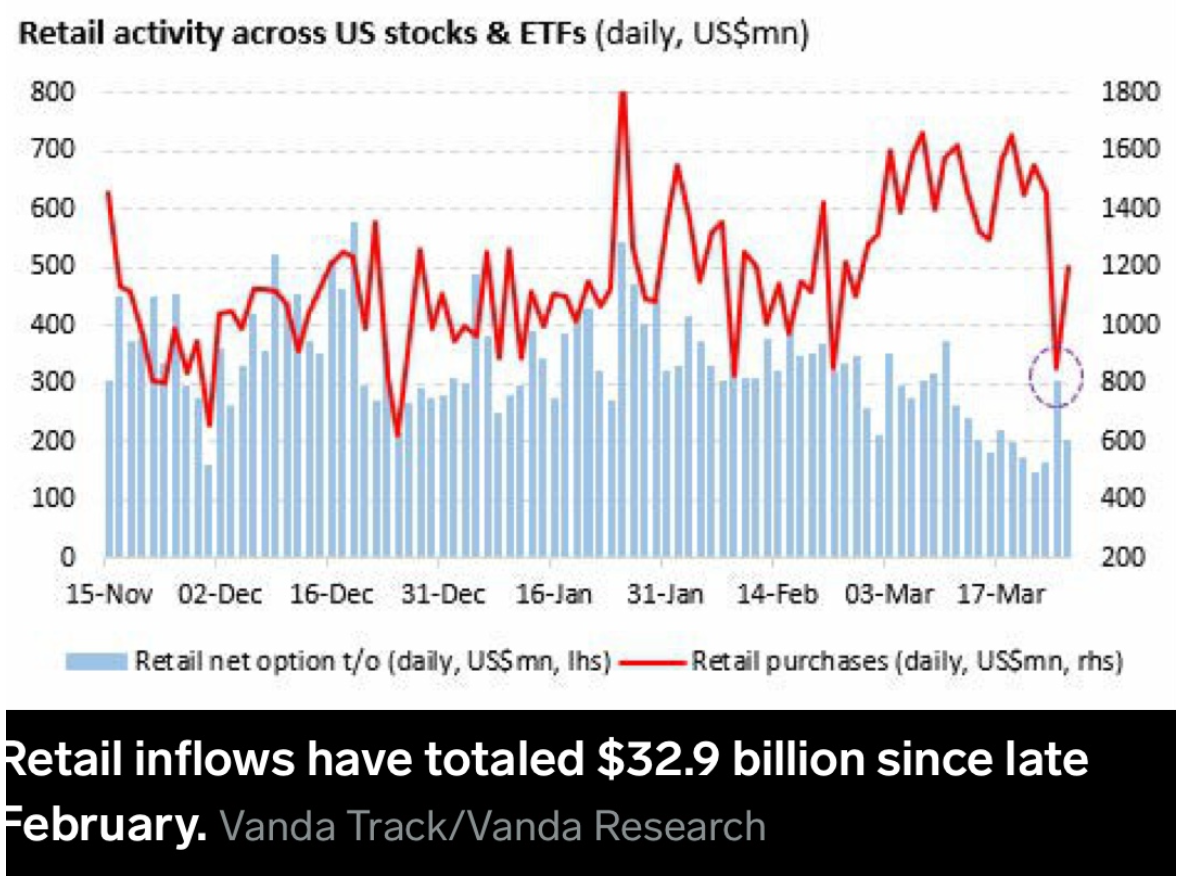

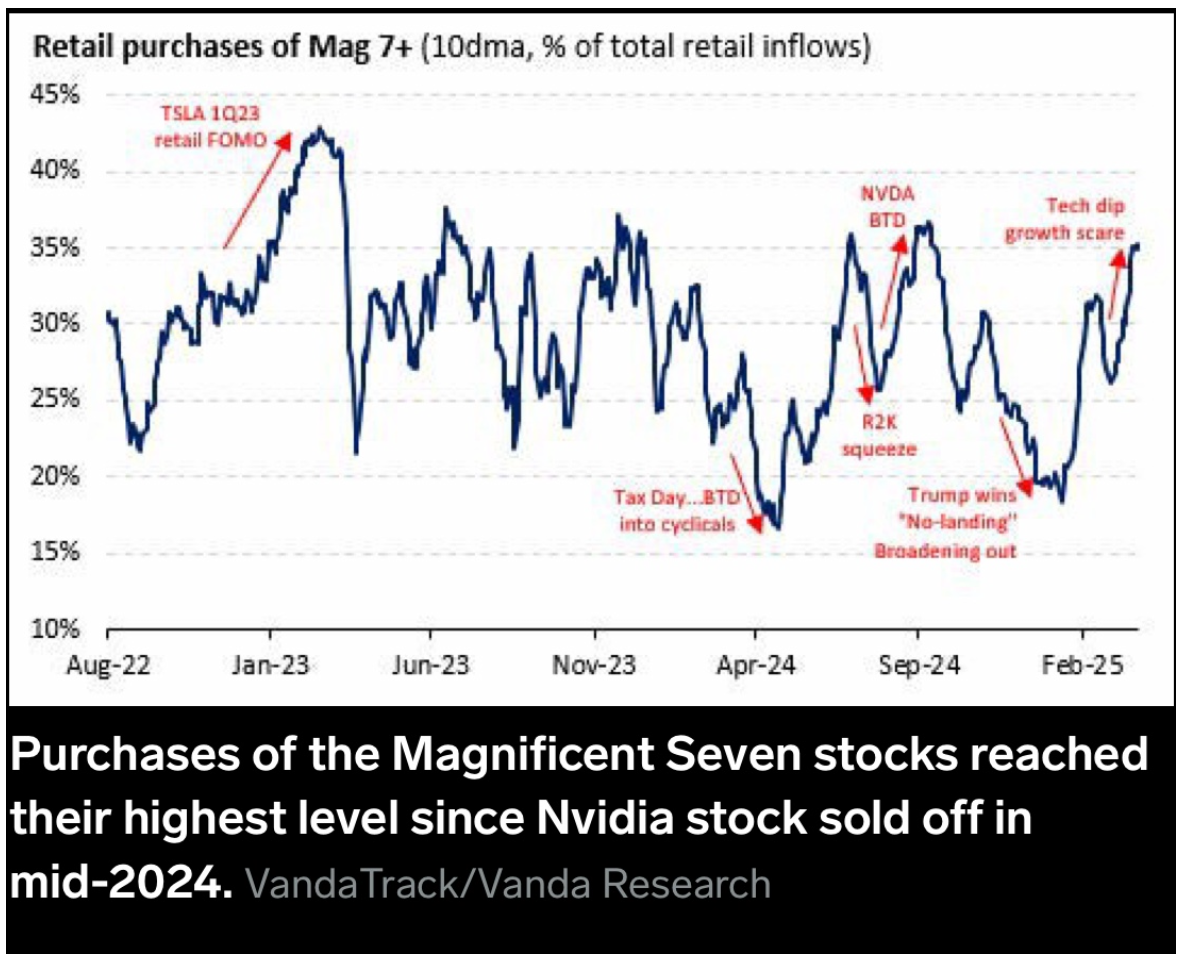

The stock market is on tenterhooks waiting for some known path forward. Investors are similarly agitated as policy changes from the White House have kept everyone off balance and confused about what is the best area to buy into and which sectors should be sold off.

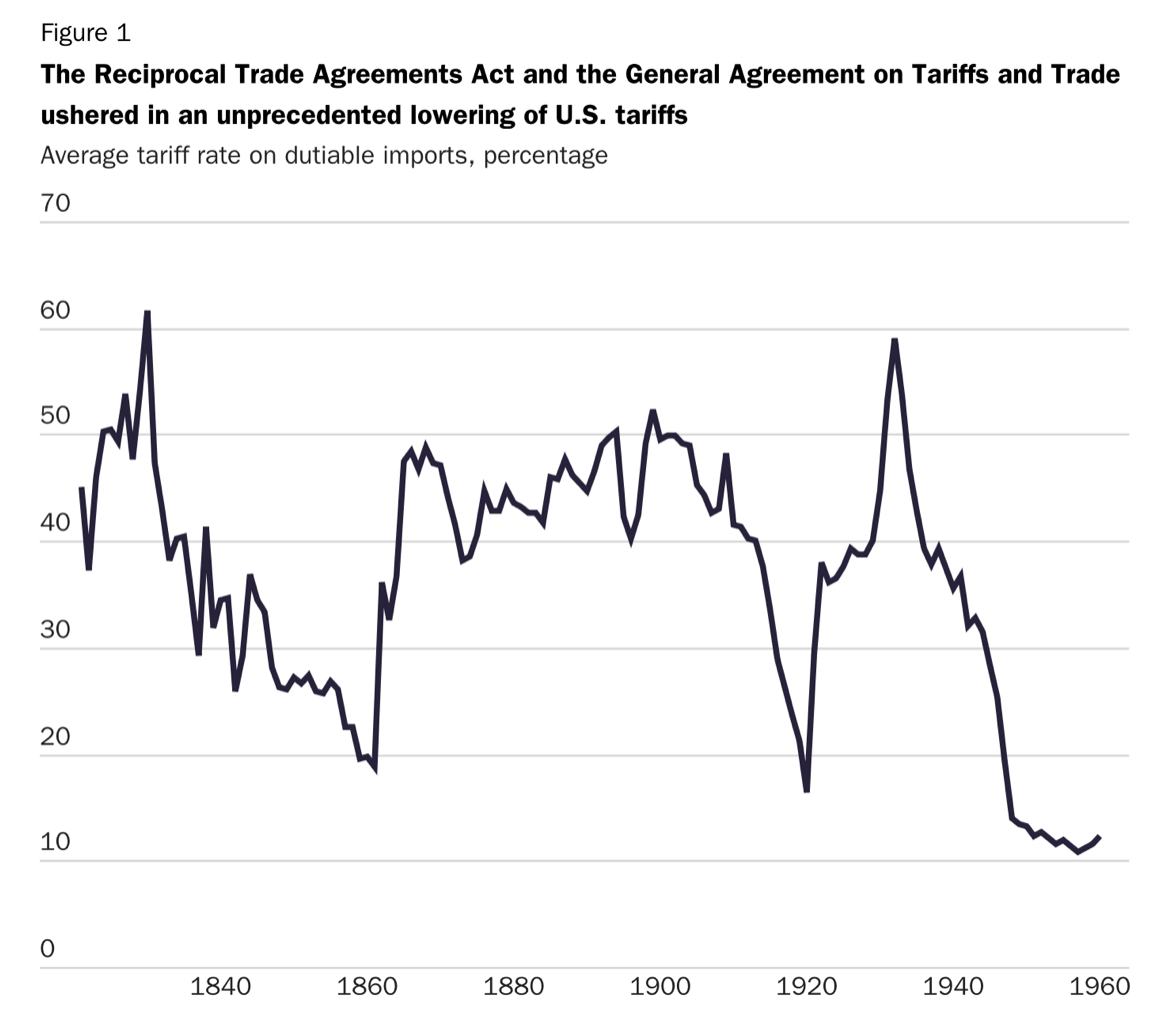

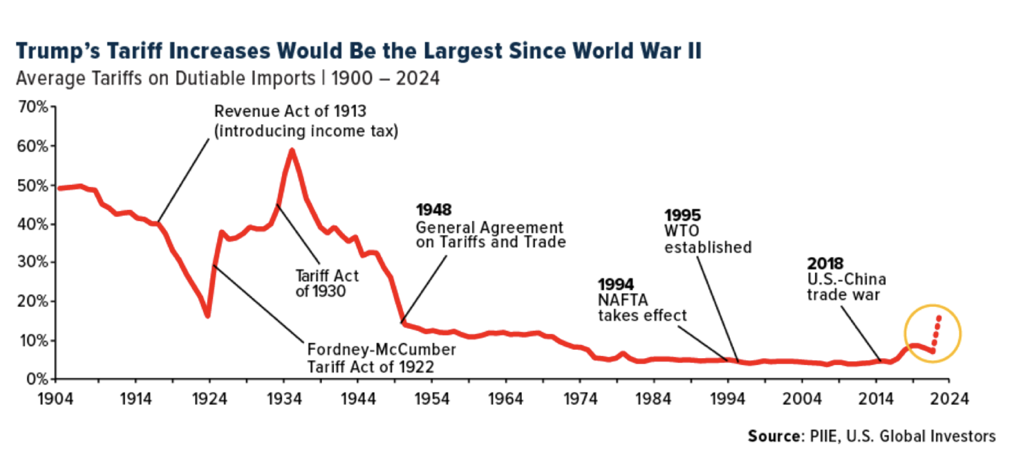

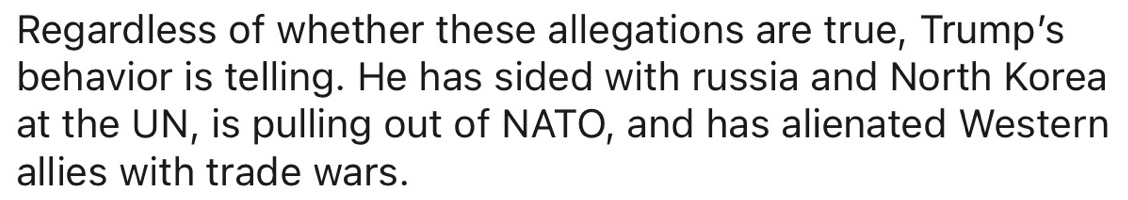

It may be that come April 2, the market will have enough certainty to get some sort of boost – a temporary relief rally. But that would be a sell into space as tariffs are a negative any way you look at them. They will be disruptive to the US and global supply chains, negative for US and global growth and, for the US and economies that retaliate, inflationary.

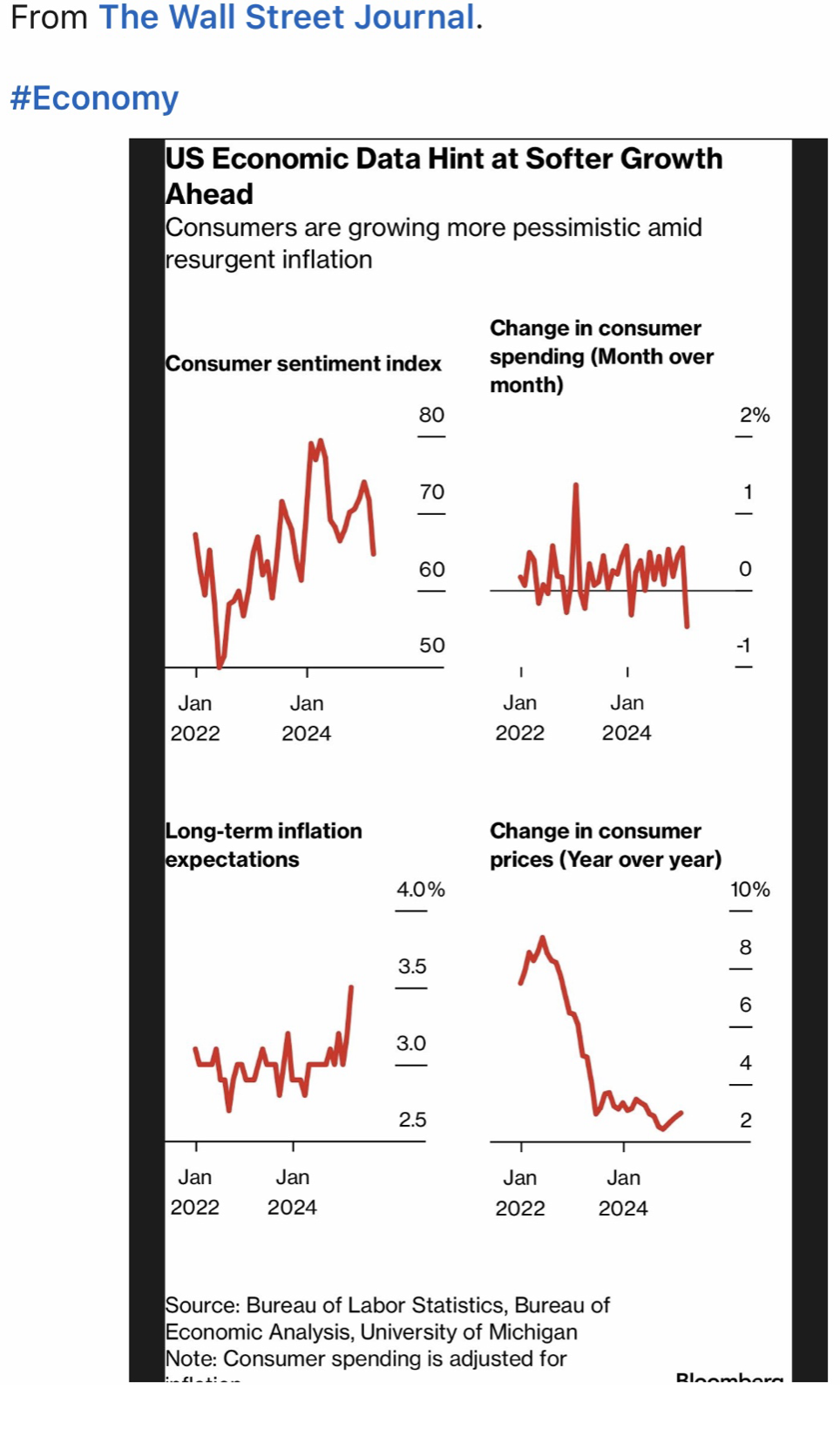

And tariffs are just one slice of the economic picture, which is looking increasingly challenging. Consumer sentiment is showing weakness, inflation is expected to surge, and unemployment numbers are rising. Recession signs are showing up everywhere.

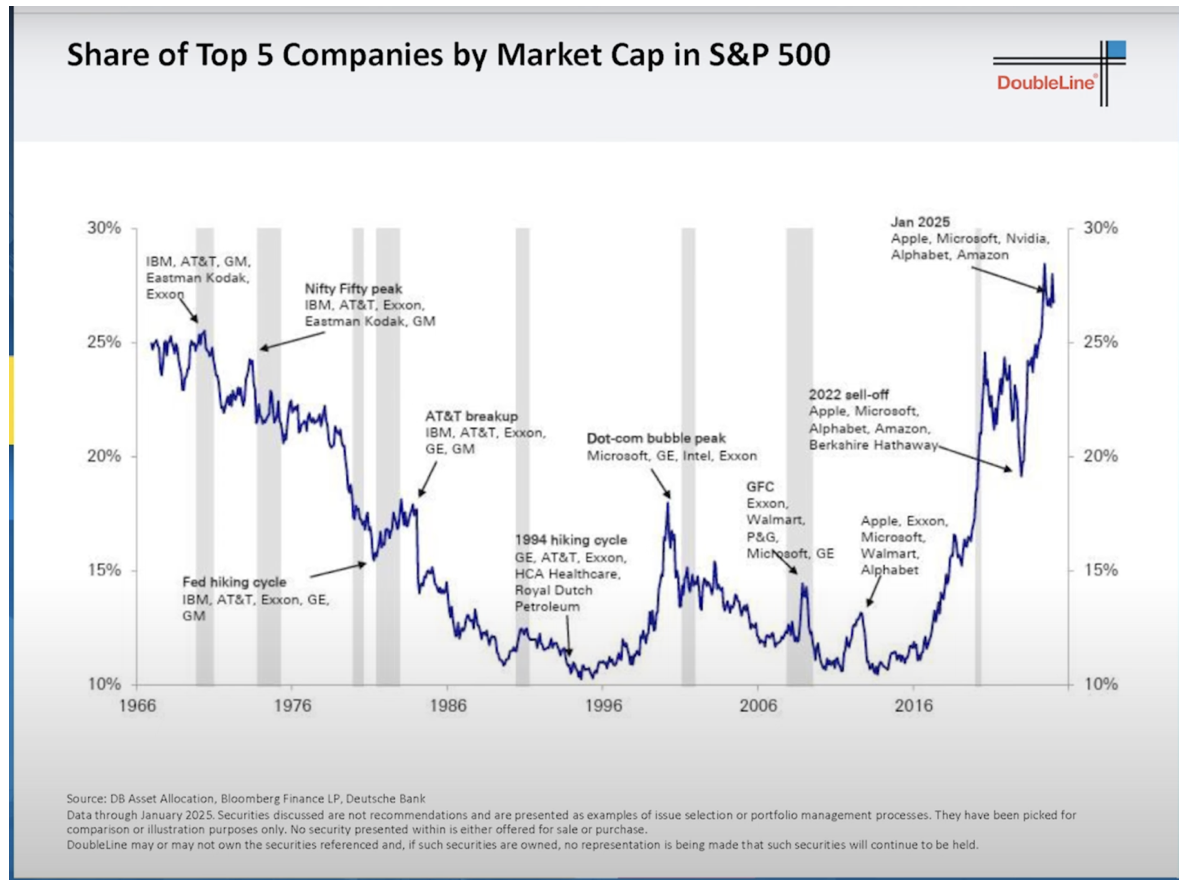

The U.S. share market fell 2 percent last Friday. It’s down more than 9 percent since Trump announced his plan for reciprocal tariffs in the middle of last month – with the tech-heavy Nasdaq market down 2.7 percent and the “Mag Seven” mega-tech stocks down 3.5 percent.

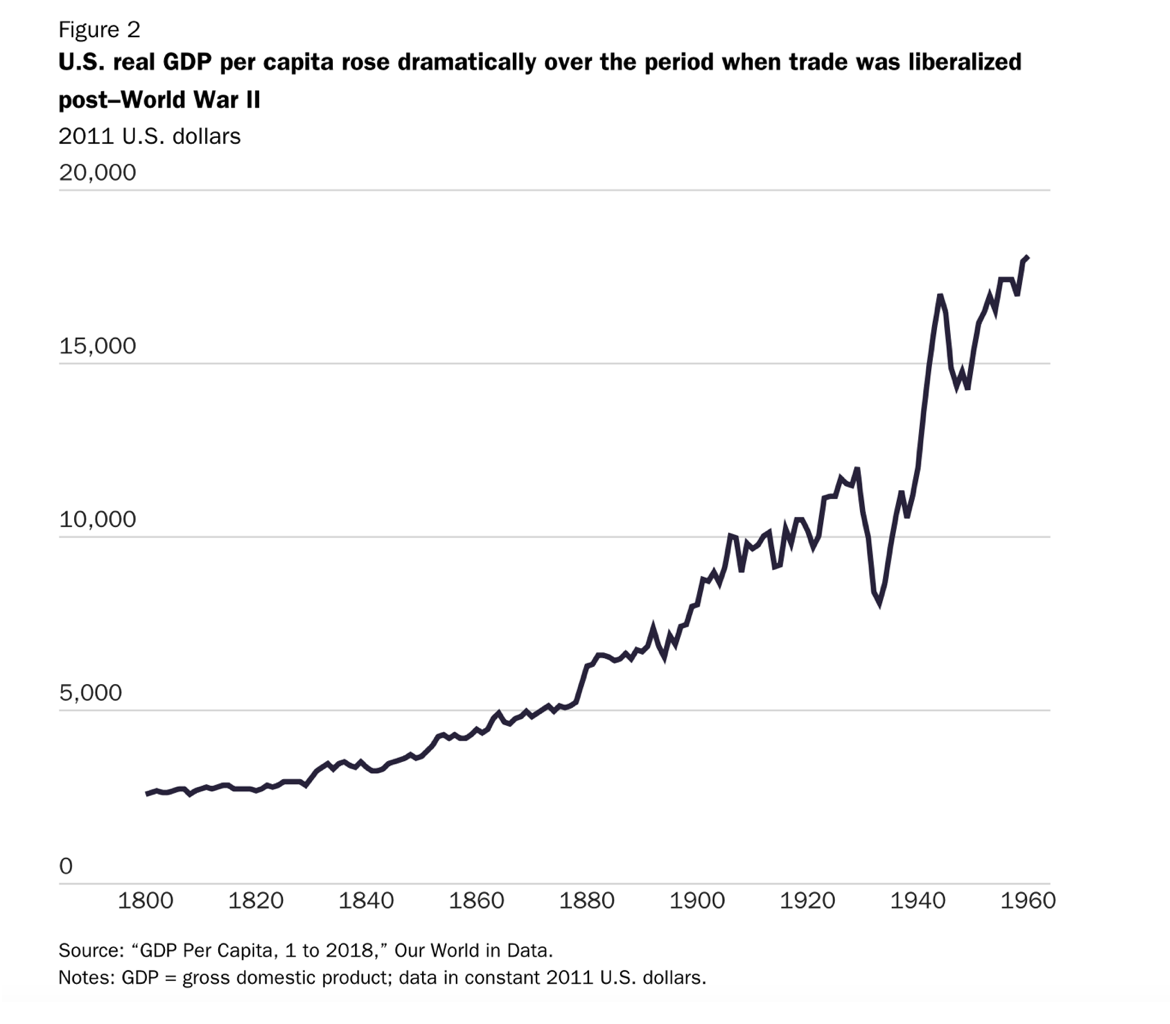

Most US business economists have been revising down their expectations of US economic growth this year from an original consensus of GDP growth of around 2 percent. Some investment banks’ forecasts are below 1 percent.

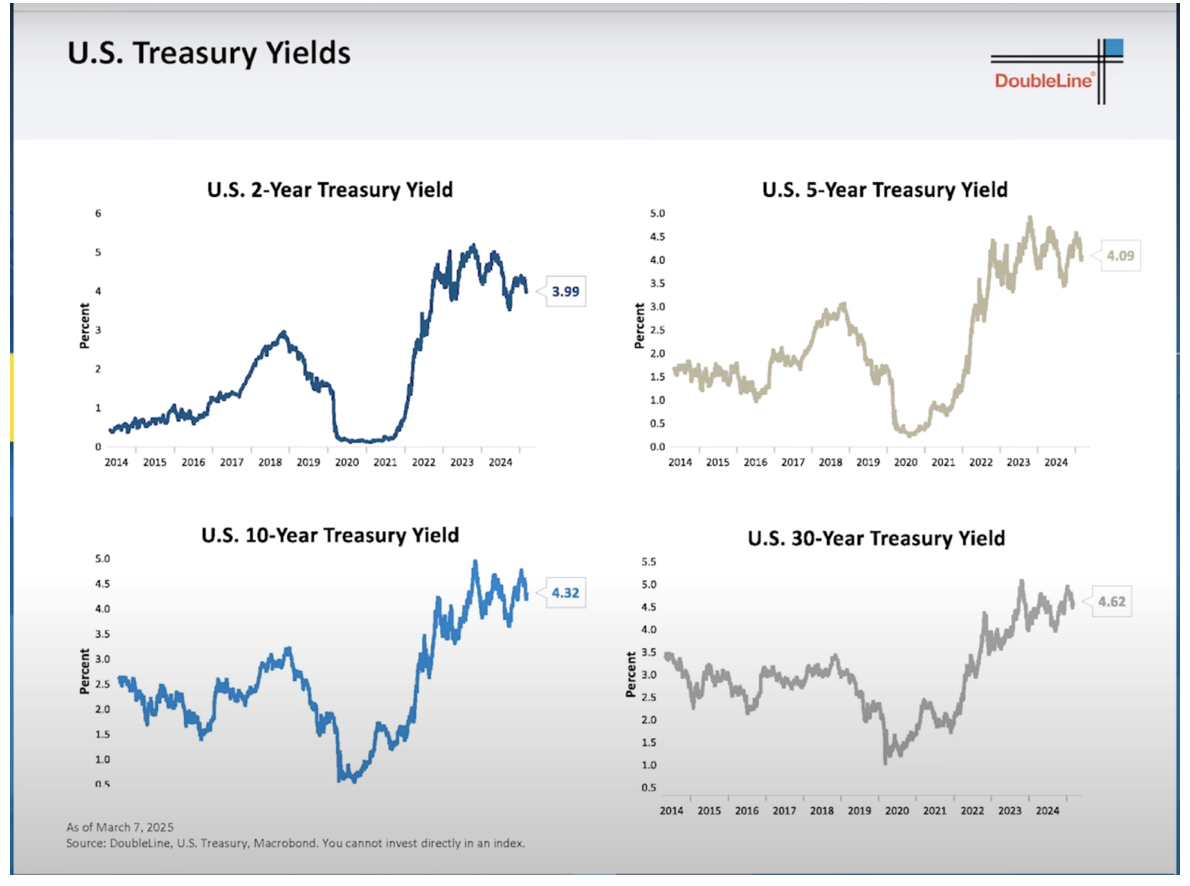

With inflation remaining stubbornly high – above the Fed’s 2 percent target even before the core of Trump’s tariffs plans is unveiled, the risk of stagflation – falling growth even while inflation remains high – is rising. Without a material fall in the inflation rate, the Fed will be forced to keep interest rates on hold.

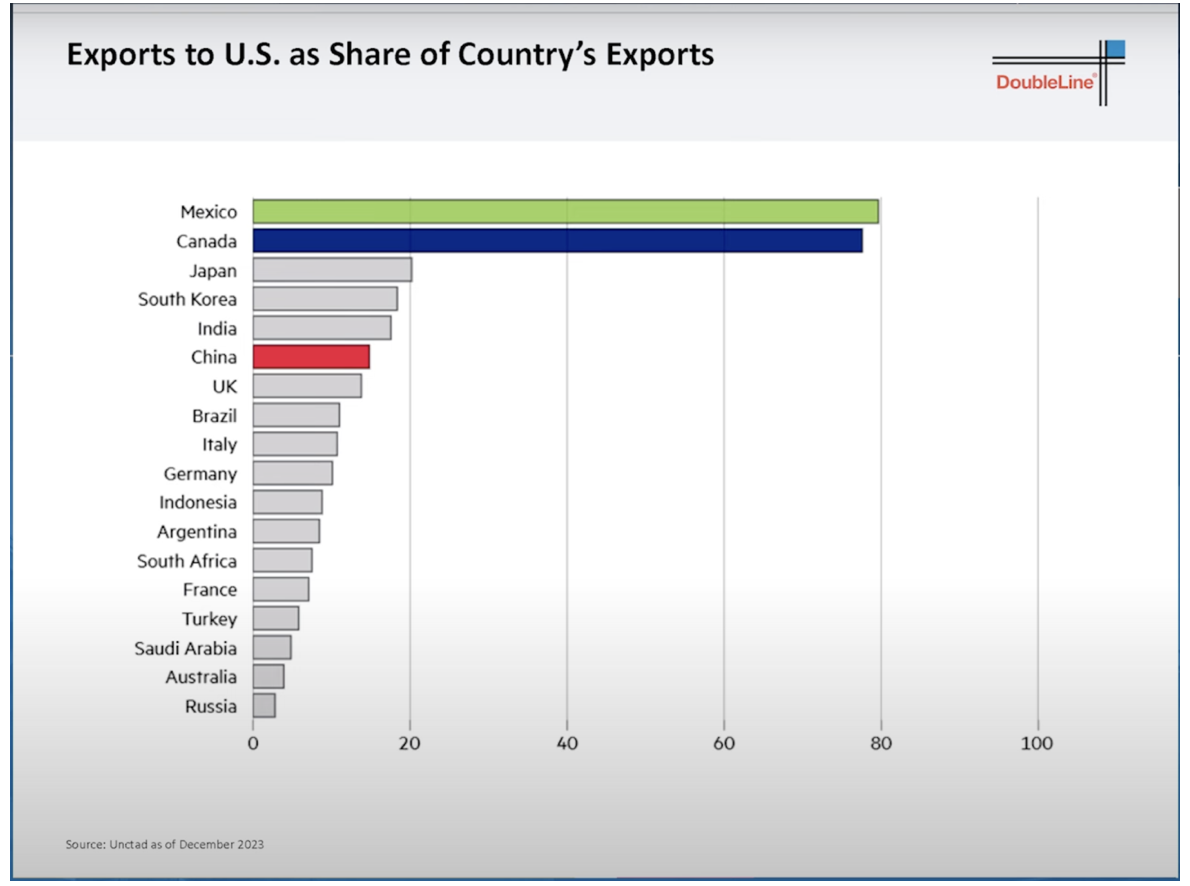

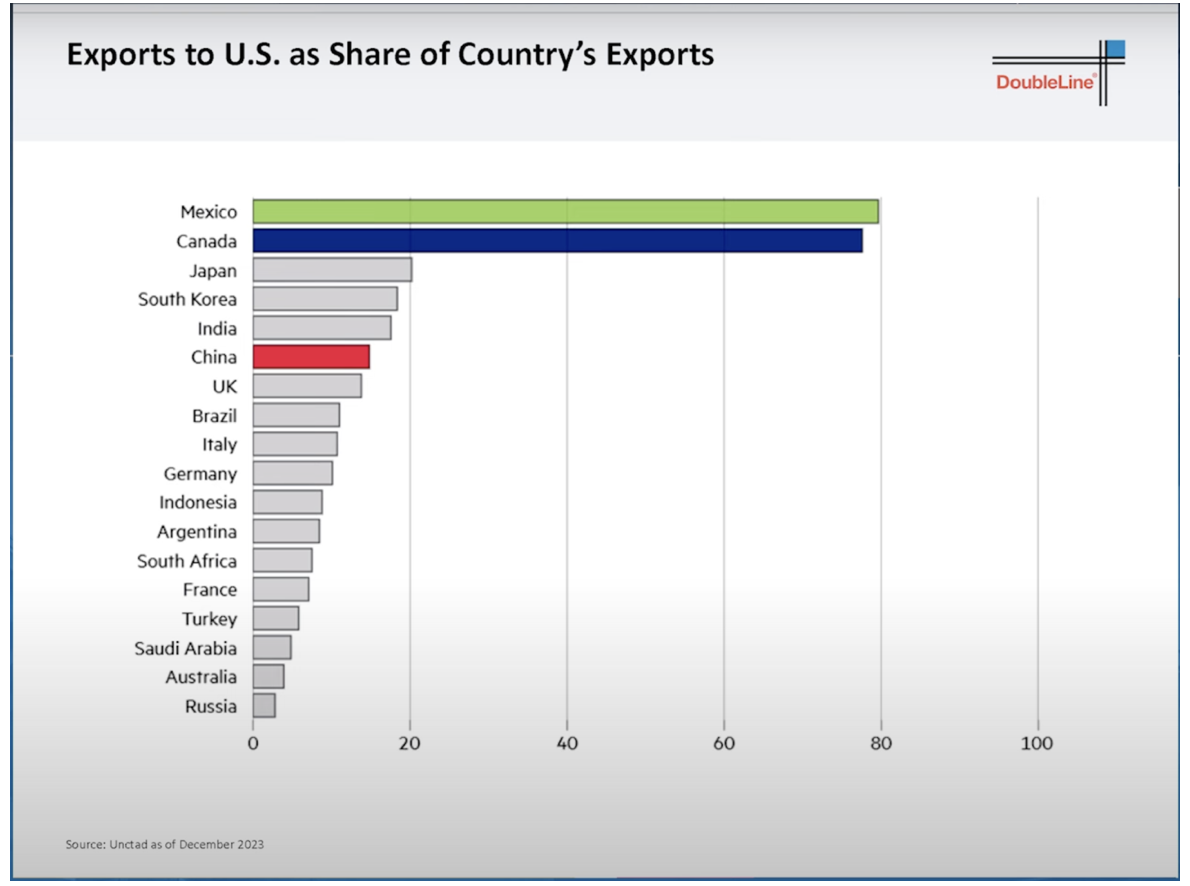

Trump’s tariffs policy is a game where no one wins. It is doubtful that anything Trump does will materially shrink America’s trade deficit unless it results in a substantial reduction in US living standards and an America that lives within its (diminishing) means. And it is something to think about that he might inadvertently actually achieve that.

MARKET UPDATE

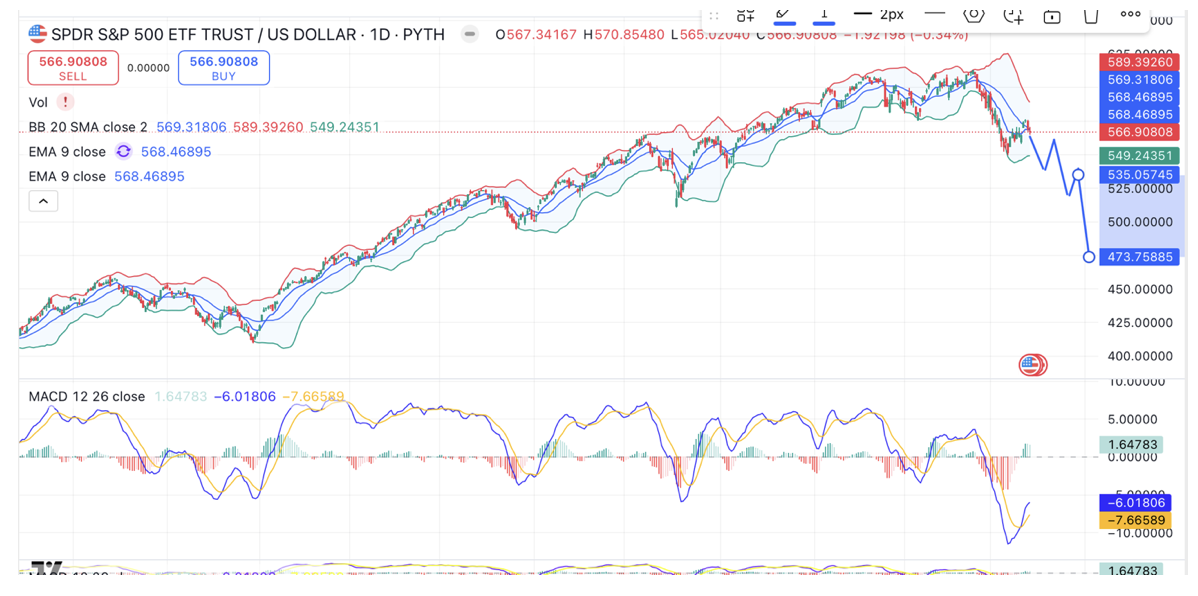

S&P500

The view of a major top since Feb. remains. There is scope for further consolidation/ranging before a strong resumption of the downtrend resumes.

Support: $5555/65/$5500

Resistance: $5675/85 and $5795

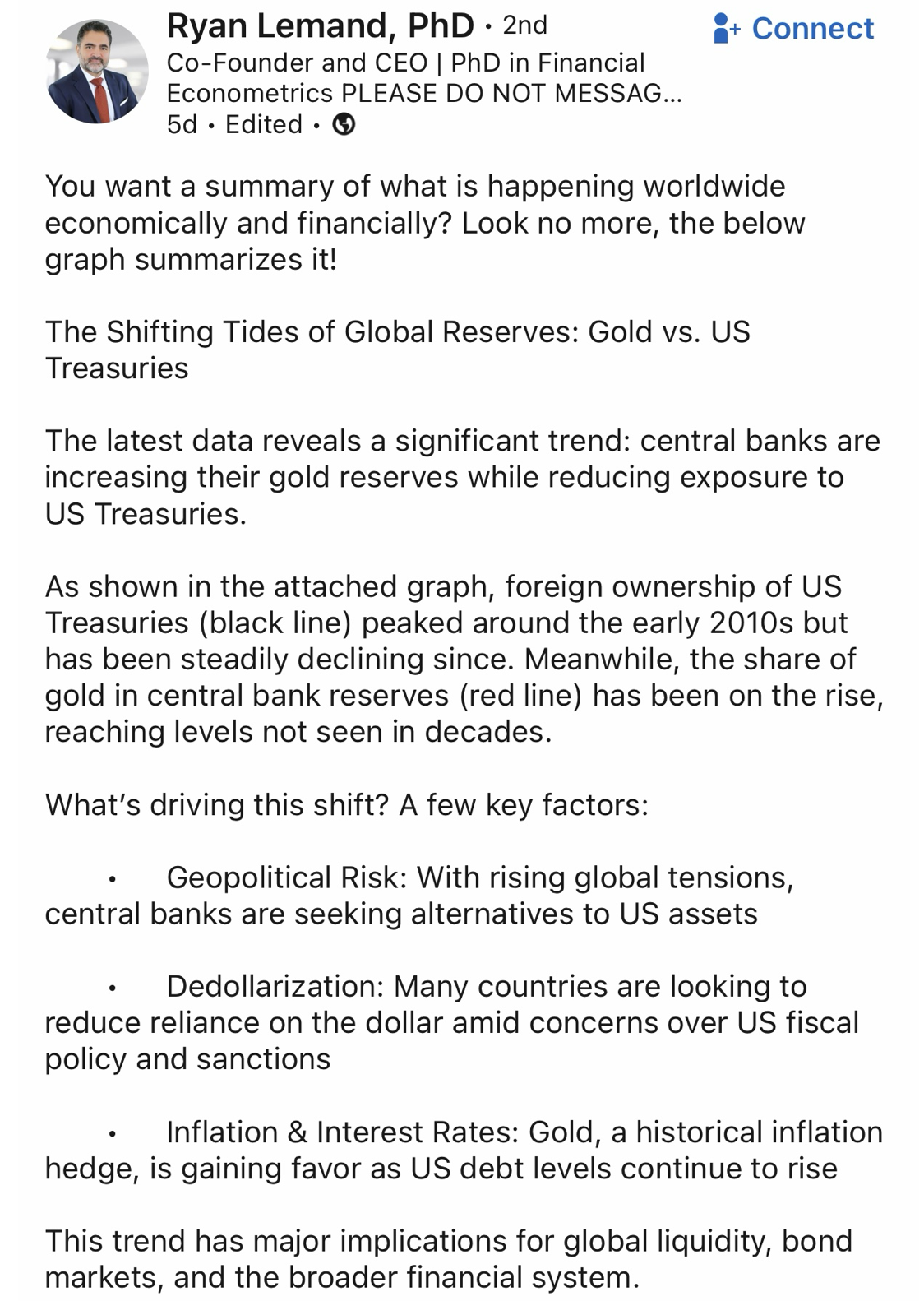

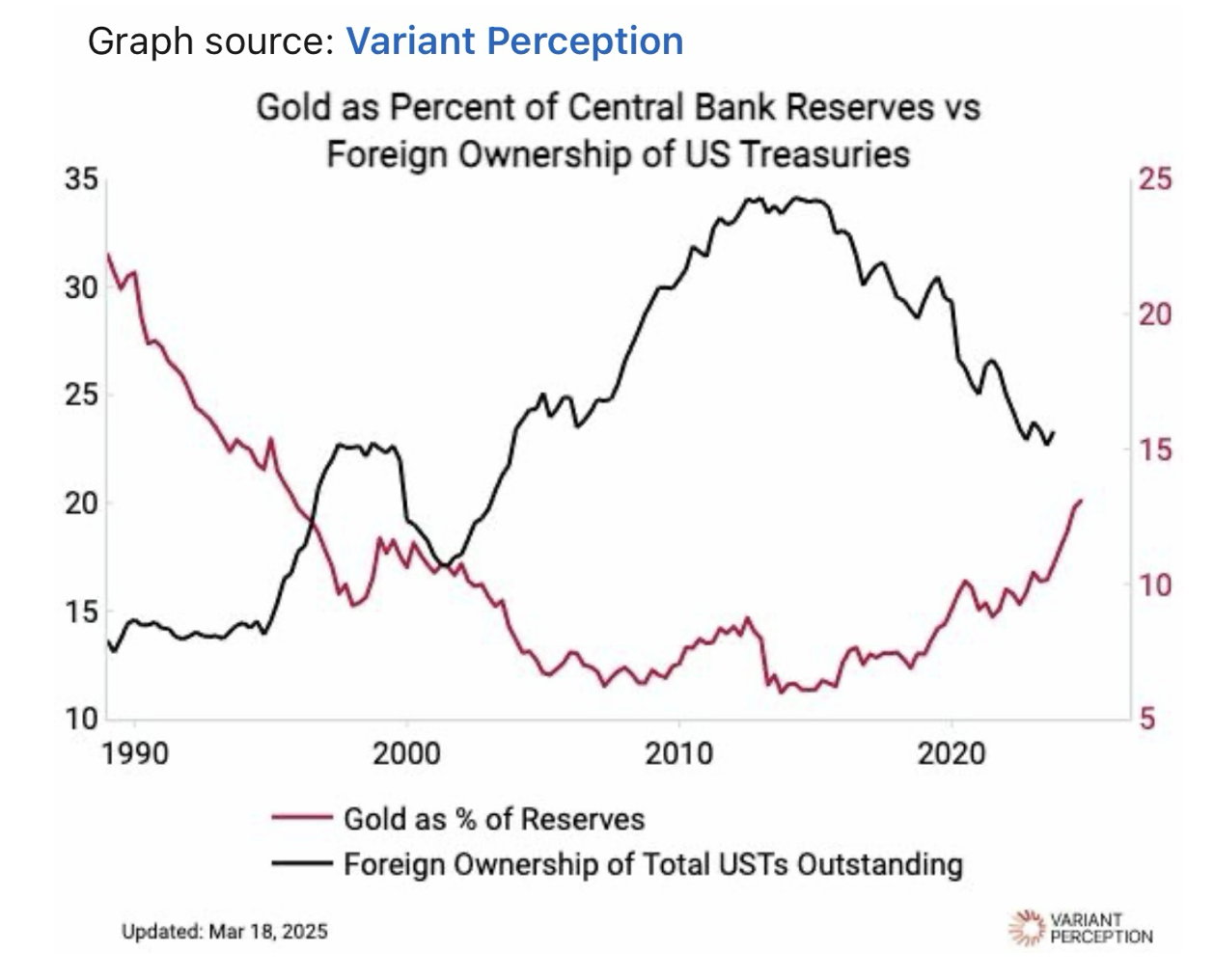

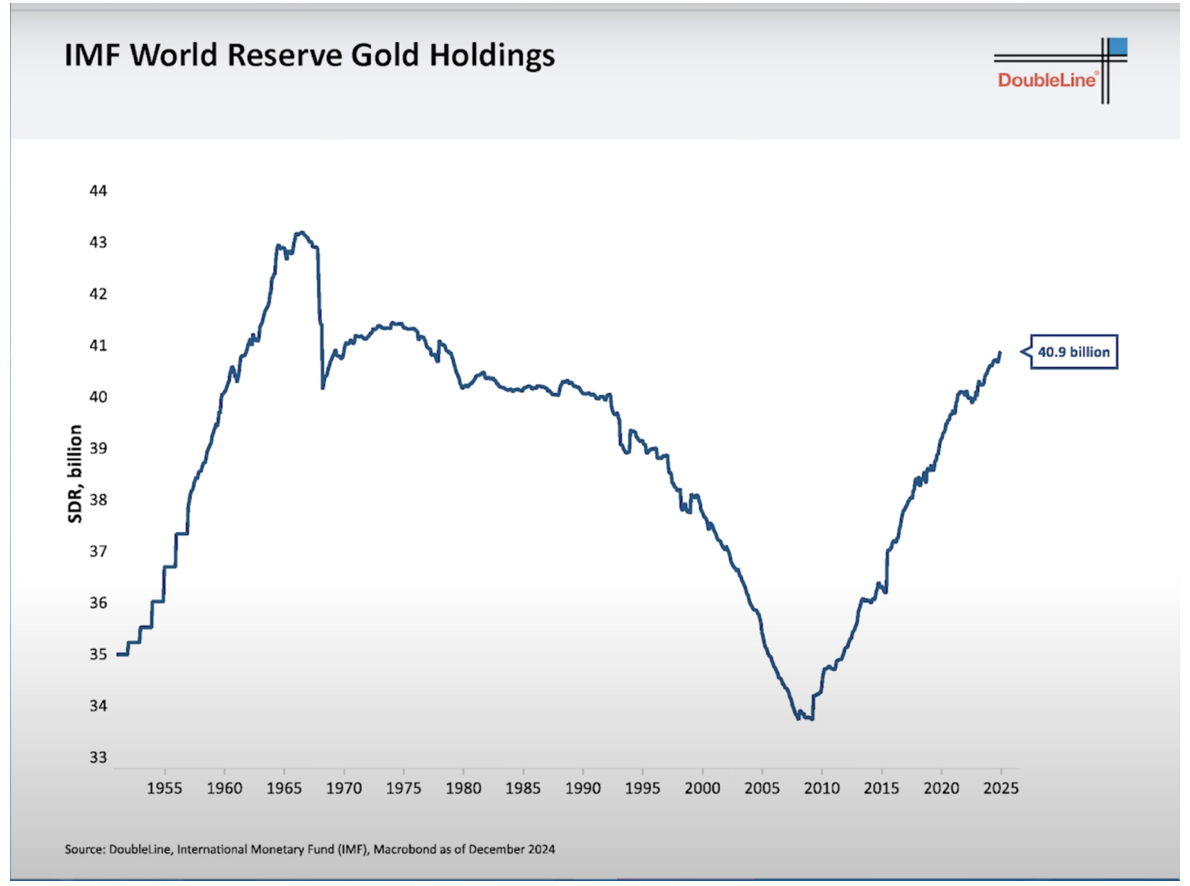

GOLD

Gold has pushed to another new high, but the market is seen within the final up leg in the rally from the Feb 28th low (wave v) as well as the larger up move from the Nov. low at $2537, which suggests a rising risk of a peak for at least a few months.

Support: ~$3050/$3025/$2995

Resistance: $3095

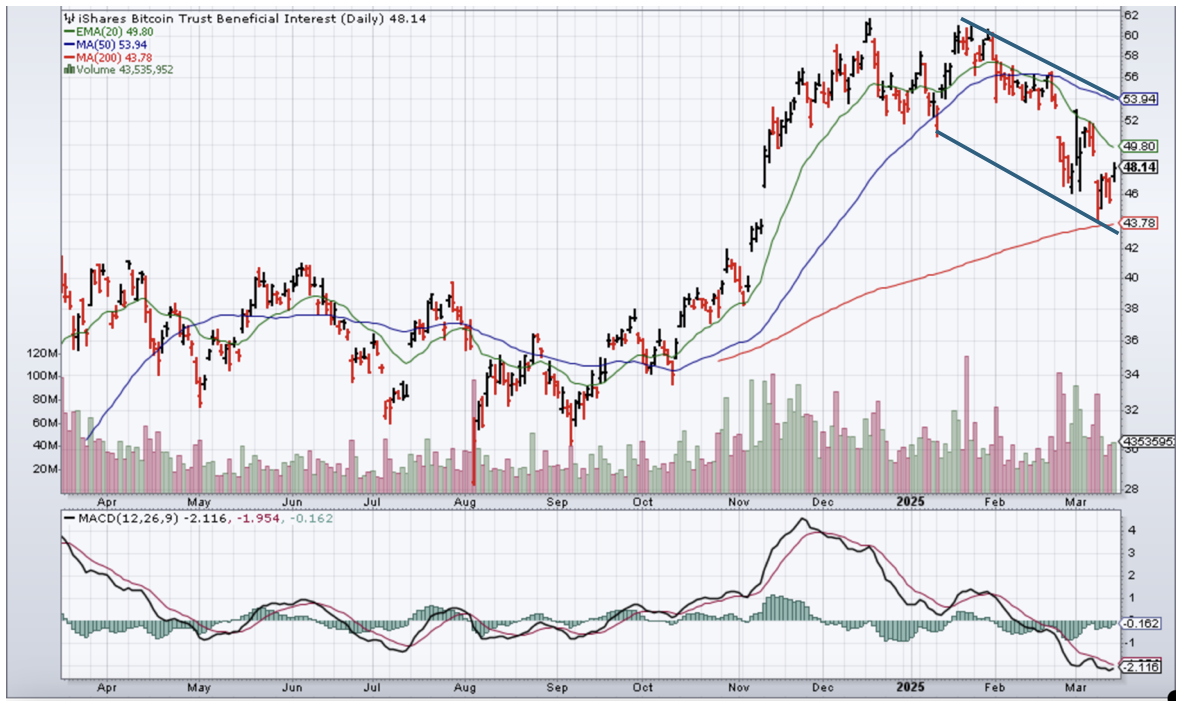

BITCOIN

No change. Bitcoin is still seen basing in a large correction, with eventual new highs above that $109 area after. As I have already pointed out, we could see lower lows in the low $70’s or even the high $60’s, before the correction is exhausted.

Support: $81.5k/$77k/$73.5k

Resistance: $$88/$89 area/$92/$99.5k

QI CORNER

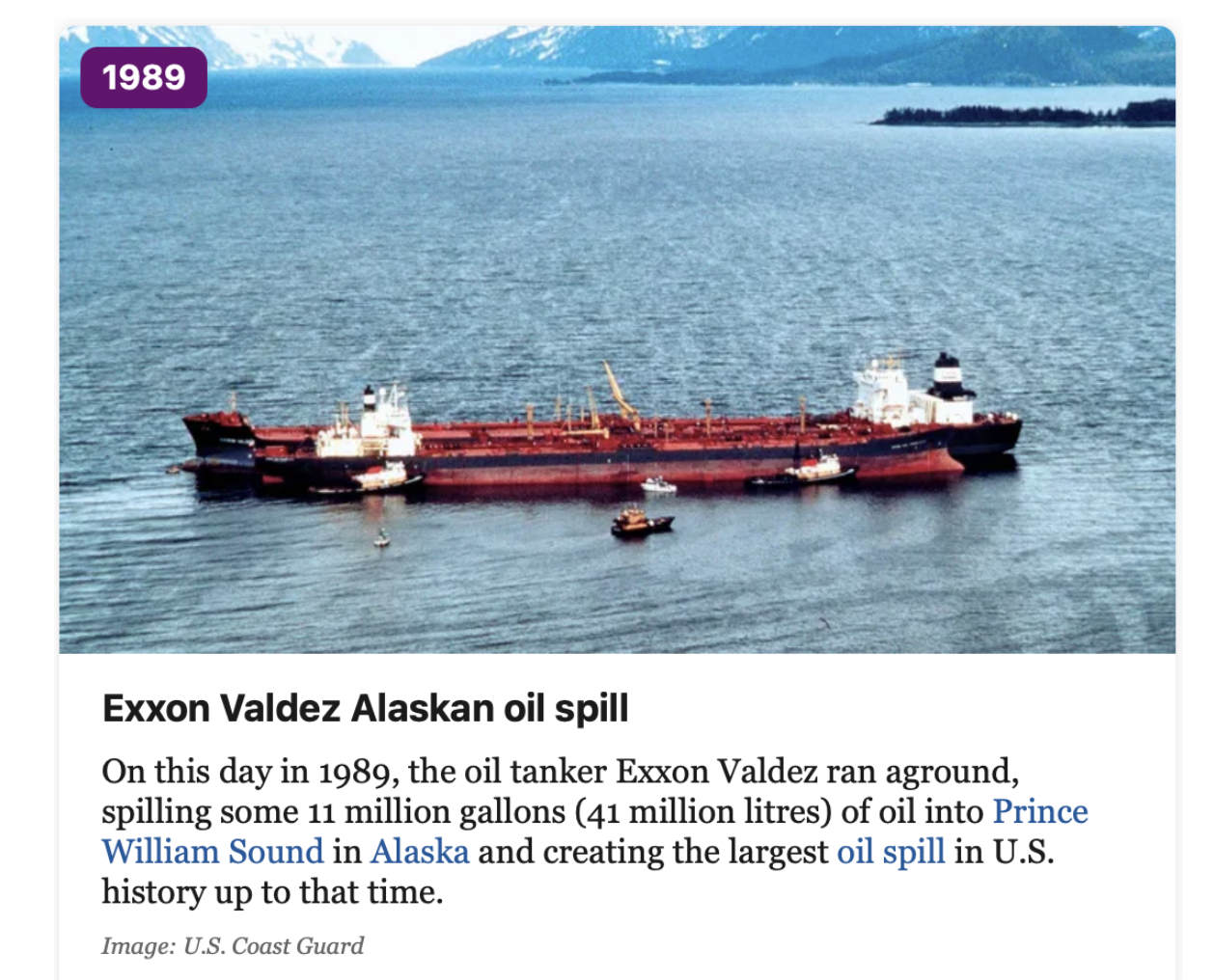

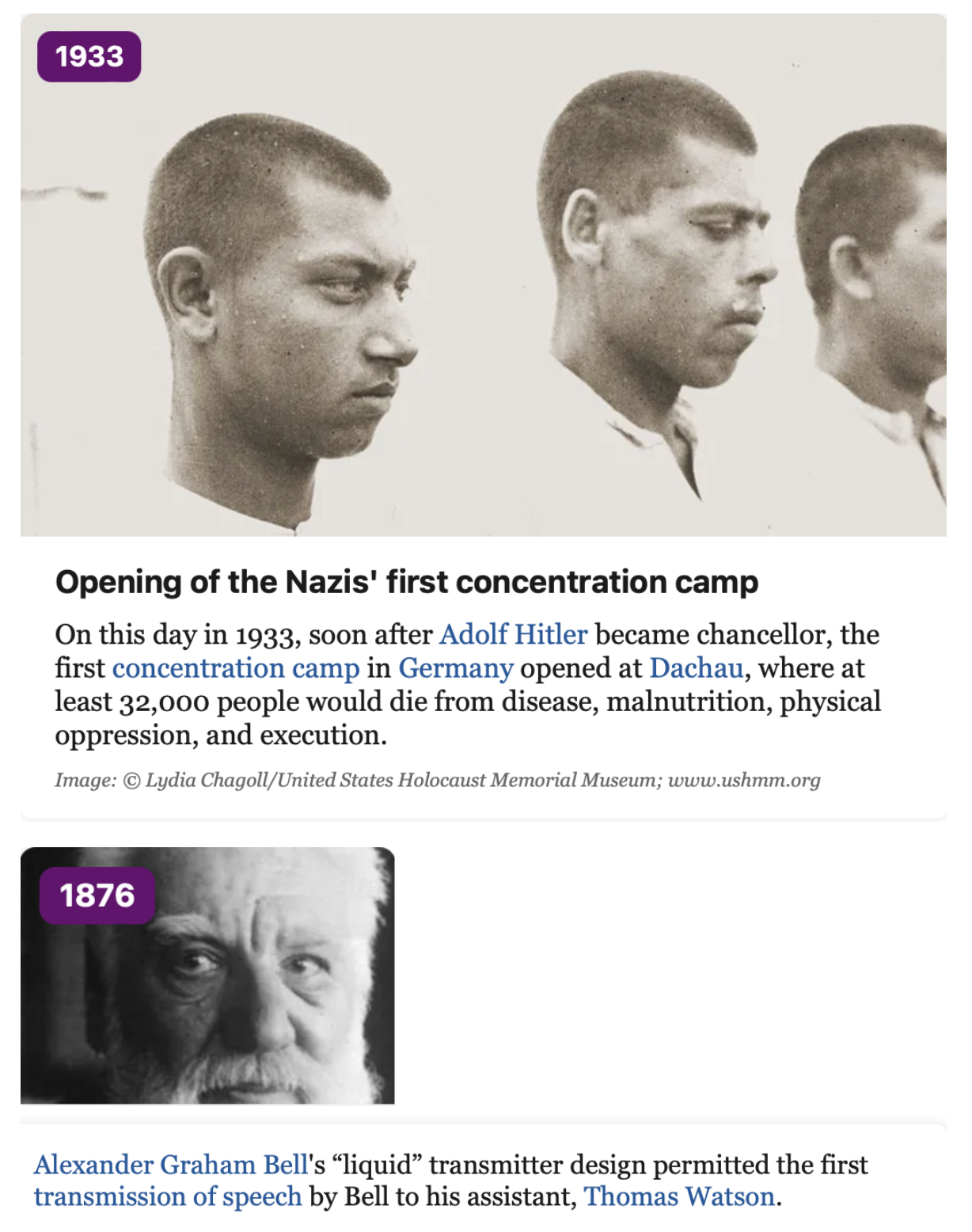

HISTORY CORNER

On March 31

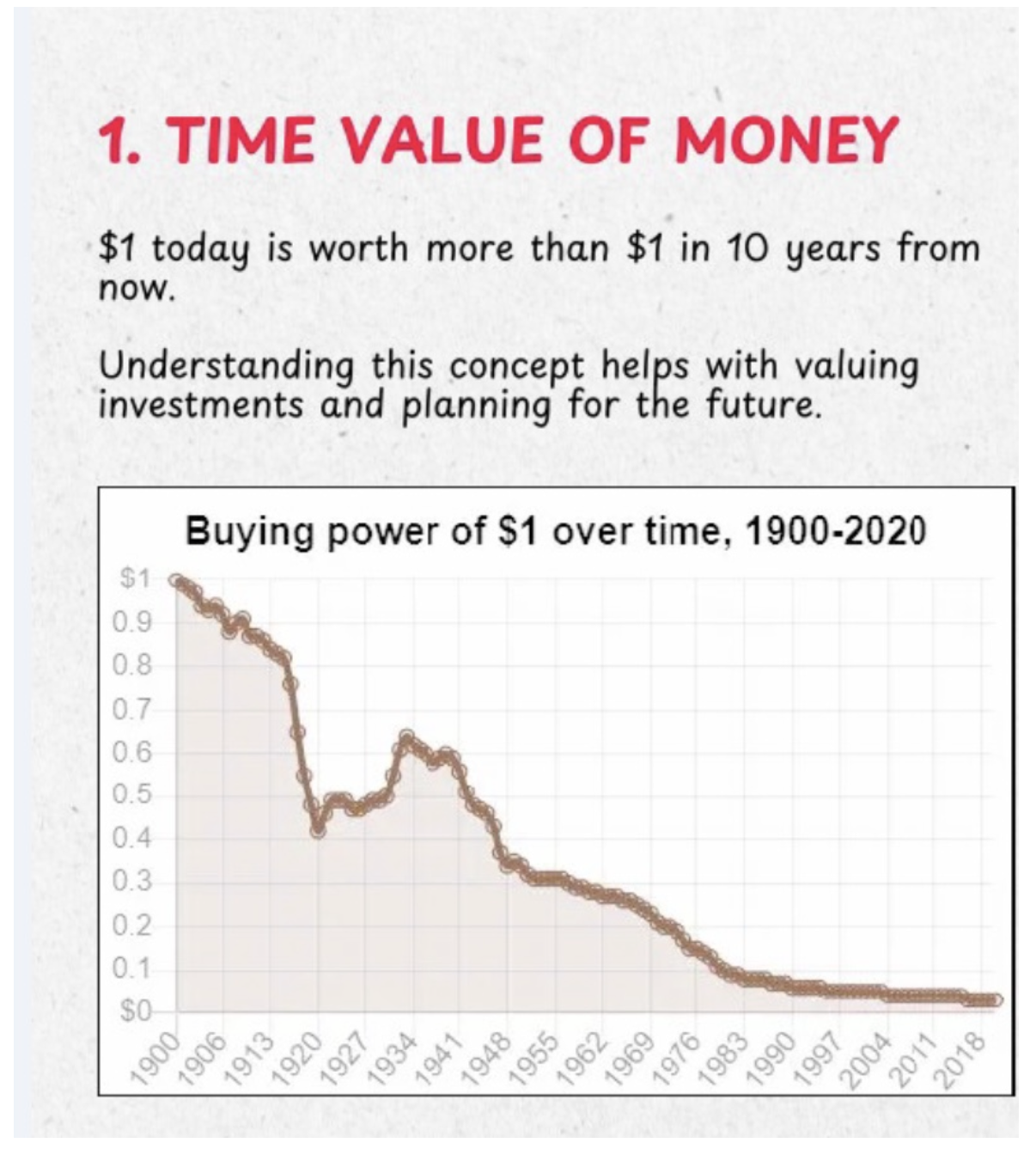

SOMETHING TO THINK ABOUT

Cheers

Jacquie