(THE BIGGEST FINANCIAL POWERHOUSE ON EARTH IS…THE CATHOLIC CHURCH)

May 12, 2023

Hello everyone,

I’ve just been looking into Avro Manhattan’s book called The Vatican Billions, which gives us a glimpse of the true financial worth of the catholic church.

My goodness! They do have quite a few bucks tucked away in various assets around the world.

Let’s see. There are large investments with the Rothchilds of Britain, France, and America, with the Hambros Bank, and with the Credit Suisse in London and Zurich. In the United States, it has large investments with the Morgan Bank, the Chase-Manhattan Bank, the First National Bank of New York, the Bankers Trust Company, and others.

Then there are investments in commodities. They have billions of shares in corporations such as Gulf Oil, Shell, General Motors, Bethlehem Steel, General Electric, International Business Machines, T.W.A, etc.

A member of the New York Catholic Conference believes that “his church probably ranks second only to the United States Government in total annual purchase.”

The Vatican, independently of each successive pope, has been increasingly orientated towards the U.S. The Wall Street Journal said that the Vatican’s financial deals in the U.S. alone were so big that very often it sold or bought gold in lots of million or more dollars at a time.

The Vatican’s treasure of solid gold has been estimated by the United Nations World Magazine to amount to several billion dollars. A large bulk of this is stored in gold ingots with the U.S. Federal Reserve Bank, while banks in England and Switzerland hold the rest.

But this is just a small portion of the wealth of the Vatican, which in the U.S. alone, is greater than that of the five wealthiest giant corporations of the country. When you add real estate, property, stocks, and shares abroad, then the staggering accumulation of wealth of the Catholic church almost defies rational assessment.

Mr Manhattan asks some serious questions in the book.

Jesus was poor and it is claimed Roman Catholicism was His Church. How can the richest organisation or corporation in the world – the Catholic Church – represent Jesus, who was the poorest of the poor?

The Church has the power to stop wars, create social programs to end famine on Earth, invest in “green technology” to create an Eco-friendly planet. Is it financially savvy for them to do this?

These are the questions that Manhattan poses.

For an organisation that has been rocked by many sexual abuse scandals and financial corruption, it appears immune to the consequences of such crimes. Any other organisation would probably collapse under the weight of its peoples’ crimes.

So, if you are interested in the Catholic Church and its Wealth, this is an interesting book to read. Another book is listed below.

Wishing you all a great weekend.

Cheers,

Jacque

(IT’S ALL ABOUT THE DEBT CEILING)

May 10, 2023

Hello everyone,

The debt ceiling is on everyone’s mind now and is a constant topic of discussion in the financial media. So, I thought I would provide everyone with a Q & A on the issue - which I researched from several articles - to enlighten you. Enjoy.

What is the debt ceiling?

It is the total amount of money that the United States government is authorised to borrow to fulfill its financial obligations. The limit applies to almost all federal debt, including the rightly $24.6 trillion of debt held by the public and the roughly $6.8 trillion the government owes itself because of borrowing from various government accounts, like Social Security and Medicare, and trust funds. As a result, the debt continues to rise due to both annual budget deficits financed by borrowing from the public and from trust fund surpluses, which are invested in Treasury bills with the promise to be repaid later with interest.

When was the debt ceiling established?

The debt ceiling was first enacted in 1917 through the Second Liberty Bond Act and was set at $11.5 billion. In 1939, Congress created the first aggregate debt limit covering nearly all government debt and set it at $45 billion, about 10% above total debt at the time.

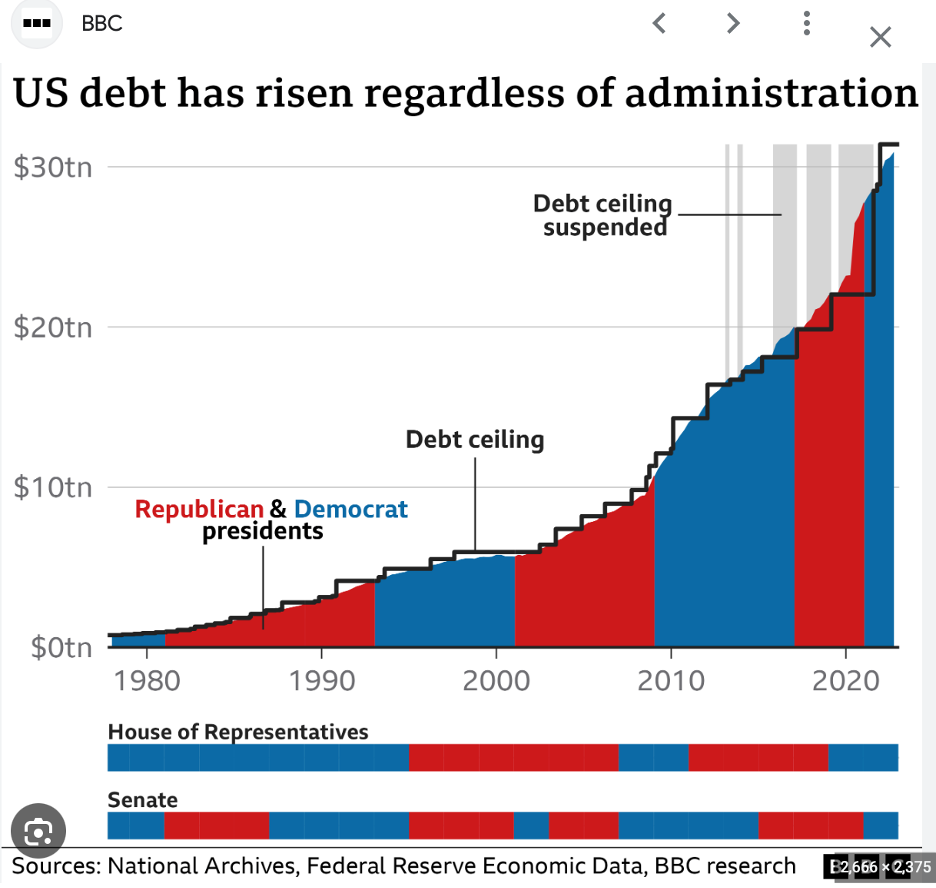

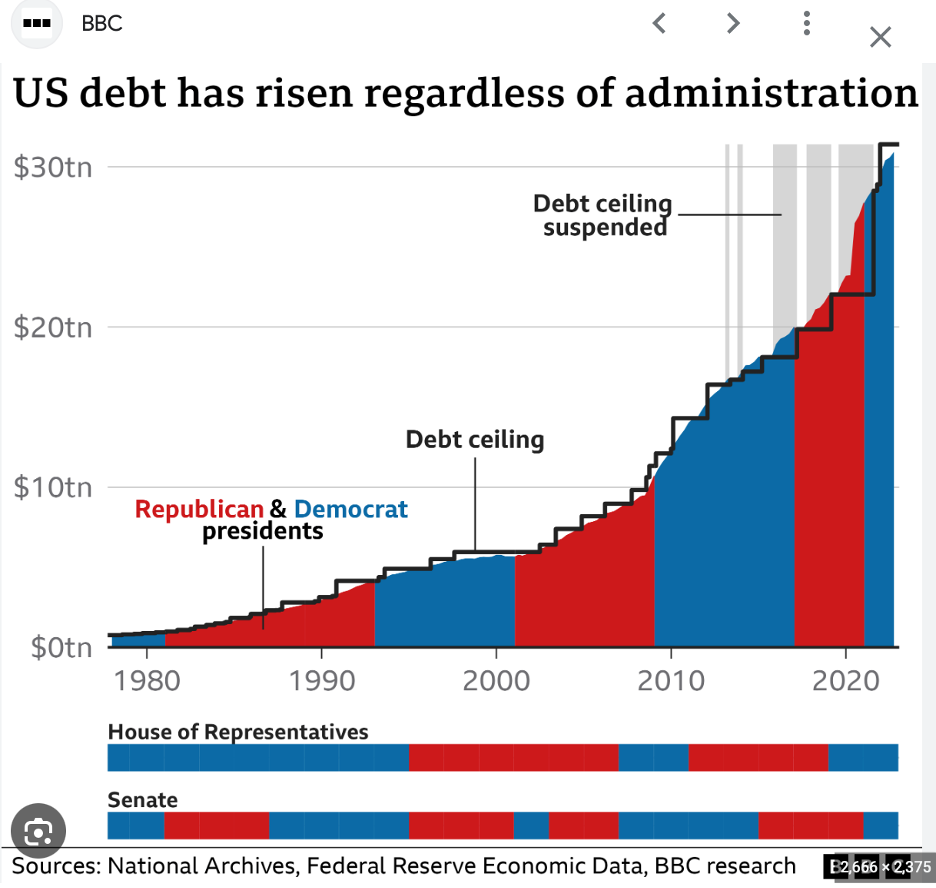

How much has the debt ceiling grown?

Since the end of World War II, Congress and the President have modified the debt ceiling more than 100 times, according to the Congressional Research Service. During the 1980s, the debt ceiling was increased from less than $1 trillion to nearly $3 trillion. Over the course of the 1990s, it was doubled to nearly $6 trillion and in the 2000s it was gain doubled to over $12 trillion. The Budget Control Act of 2011 automatically raised the debt ceiling by $900 billion and gave the President authority to increase the limit by an additional $1.2 trillion (for a total of $2.1 trillion) to $16.39 trillion. Lawmakers have suspended the debt limit, rather than raising it by a specific dollar amount, seven times since the beginning of 2013. The debt limit was increased – not suspended – twice in 2021, mostly recently in a December 2021 bill that formally increased the limit to $31.381 trillion.

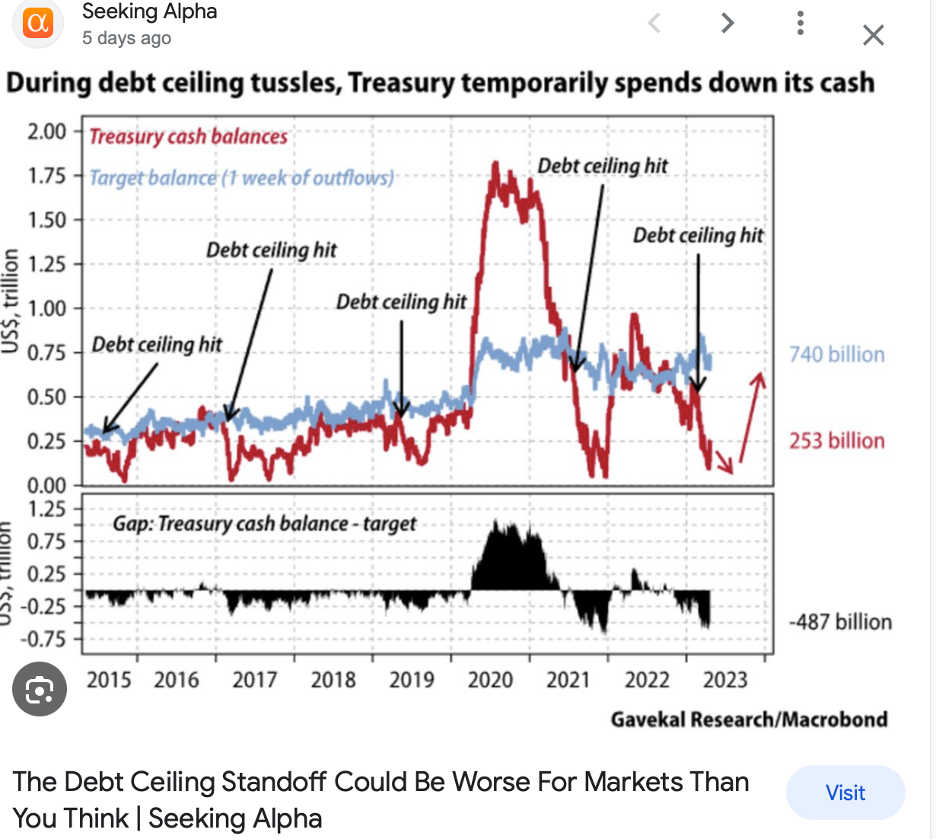

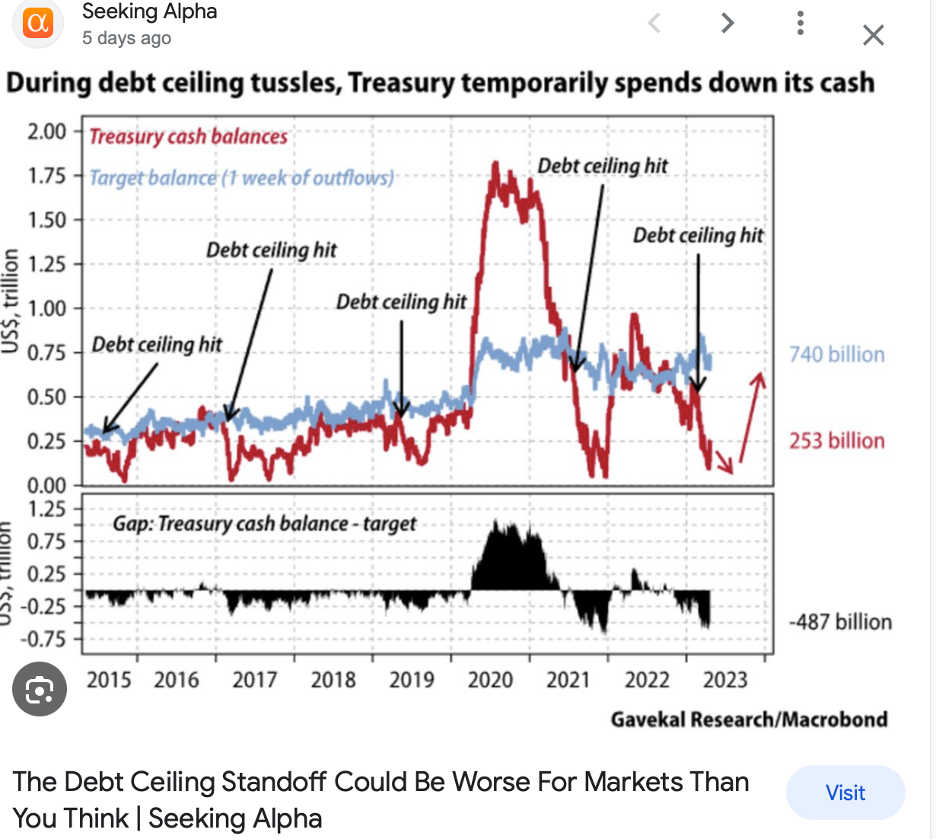

What are extraordinary measures?

When the debt limit is reached, the Treasury Department both relies on cash on hand and uses a variety of accounting maneuvers, known as extraordinary measures, to avoid defaulting on the government’s obligations. For example, the Treasury has prematurely redeemed Treasury bonds held in federal employee retirement savings accounts (and replaced them later with interest), halted contributions to certain government pension funds, suspended state and local government series securities, and borrowed from one set aside to manage exchange rate fluctuations. The Treasury Department first used these measures in 1985, and there have been nine distinct “debt issuance suspension periods” since enactment of the Budget Control Act in 2011, including the current one.

Can hitting the debt ceiling be avoided without Congressional action?

The Treasury Department’s use of extraordinary measures simply delays when the debt will reach the statutory limit. Spending more than incoming receipts has already been legally obligated; that spending will push debt beyond the ceiling. There is no plausible set of changes that could generate the instant surplus necessary to avoid having to raise or suspend the debt ceiling indefinitely.

Some believe the Treasury Department could buy more time by engaging in other unprecedented actions such as selling large amounts of gold, minting a special large-denomination coin, issuing IOUs that could be sold and traded in private markets, or invoking the Fourteenth Amendment to override the statutory debt limit. Whether any of these tools is truly available is in question, and the potential economic and political consequences of each of these options are unknown. Realistically, once extraordinary measures are exhausted, the only option to avoid defaulting on our nation’s obligations is for Congress to change the law to raise or suspend the debt ceiling.

What happens if the debt ceiling is hit?

Once the government hits the debt ceiling and exhausts all available extraordinary measures, it is no longer allowed to issue debt and soon after will run out of cash-on-hand. At that point, given annual deficits, incoming receipts would be insufficient to pay millions of daily obligations as they come due. Therefore, the federal government would have to default on many of its obligations at least temporarily, from Social Security payments and salaries for federal civilian employees and the military to veterans’ benefits and utility bills, among others.

So-called “prioritization” of payments, or making sure certain obligations among the more than 80 million that get paid per month are paid before others – such as servicing debts to bondholders before making other payments in order to avoid technical default – has been criticized as unrealistic by Treasury officials and economists. A Treasury Inspector General report from 2012 outlined scenarios that were considered during the 2011 debt ceiling run-up and found that delay of payments, which suspended all government payments until they could all be paid on a day-to-day basis, was the least harmful scenario.

How bad are the consequences of default?

A default, or even the perceived threat of one, could have serious negative economic implications. An actual default would roil global financial markets and create chaos, since both domestic and international markets depend on the relative economic and political stability of U.S. debt instruments and the U.S. economy. Interest rates would rise, and demand for Treasuries would drop as investors stop or scale back investments in Treasury securities if they are no longer considered perfectly safe. Even the threat of default during a standoff increases borrowing costs. The Government Accountability Office (GAO) estimatedthat the 2011 debt ceiling standoff raised borrowing costs by a total of $1.3 billion in Fiscal Year (FY) 2011, and the 2013 debt limit impasse led to additional costs over a one-year period of between $38 million and more than $70 million.

If interest rates for Treasuries increase substantially, interest rates across the economy would follow, affecting car loans, credit cards, home mortgages, business investments, and other costs of borrowing and investment. The balance sheets of banks and other institutions with large holdings of Treasuries would decline as the value of Treasuries dropped, potentially tightening the availability of credit as seen most recently in the Great Recession.

A Moody’s Analytics report released in early 2023 estimated that a default could have similar macroeconomic consequences to the Great Recession: a 4 percent Gross Domestic Product (GDP) decline, nearly 6 million lost jobs, and an unemployment rate of more than 7 percent. In addition, Moody’s predicted a $12 trillion loss in household wealth, with stocks dropping by as much as one-third at the depths of the selloff.

The White House Council of Economic Advisers (CEA) has warned that the macroeconomic effects stemming from default – or even getting too close to one – can last months or even years. A CEA report found that following the debt limit run-up in 2011, mortgage rates rose 0.7 to 0.8 percentage points for two months following the crisis and rates for auto and other consumer loans also remained elevated for months. In the event of an actual default, increased unemployment rates could persist for two to four years, the report warned.

In addition, default could also ultimately add significantly to the national debt in the form of increased borrowing costs.

How does a shutdown differ from a default?

A shutdown occurs when Congress fails to pass appropriations bills that allow agencies to obligate new spending. As a result, the government temporarily stops paying employees and contractors who perform government services (see Q&A: Everything You Should Know About Government Shutdowns). However, many more parties are not paid in a default. A default occurs when the Treasury does not have enough cash available to pay for obligations that have already been made. In the debt ceiling context, a default would be precipitated by the government exceeding the statutory debt limit and being unable to pay all its obligations to its citizens and creditors. Without enough money to pay its bills, any of the payments are at risk, including all government spending, mandatory payments, interest on our debt, and payments to U.S. bondholders. While a government shutdown would be disruptive, a government default could be disastrous.

Have policymakers used the debt ceiling to pursue deficit reduction in the past?

Although policymakers have often enacted “clean” debt ceiling increases, Congress has also coupled increases with other legislative priorities. In several cases, Congress has attached debt ceiling increases to budget reconciliation legislation and other deficit reduction policies or processes.

Indeed, most of the major deficit reduction agreements made since 1980 have been accompanied by a debt ceiling increase, although causality has moved in both directions. On some occasions, the debt limit has been used successfully to help prompt deficit reduction, and in other cases, Congress has tacked on debt ceiling increases to deficit reduction efforts. For example, the 2011 Budget Control Act was enacted along with a debt ceiling increase, as was the Gramm-Rudman-Hollings Balanced Budget and Emergency Deficit Control Act of 1985.

In nearly all instances in which a debt limit increase was either accompanied by deficit reduction measures or included in a deficit reduction package, lawmakers have generally approved temporary increases in the debt limit to allow time for negotiations to be completed without the risk of default. For example, Congress approved a modest increase in the debt limit in December of 2009 while negotiations over statutory pay-as-you-go (PAYGO) and the establishment of the National Commission on Fiscal Responsibility and Reform were ongoing. Similarly, during the negotiations and consideration of the 1990 budget agreement, Congress approved six temporary increases in the debt limit before approving a long-term increase as part of the reconciliation bill implementing the deficit reduction agreement.

The Appendix contains further discussion of provisions attached to debt ceiling legislation, including bills in 1993, 1997, 2013, 2015, 2018, and 2019.

What should policymakers do?

Policymakers should work promptly to raise or suspend the debt ceiling by the deadline. Failing to raise the debt ceiling would be disastrous. It would result in severe negative consequences that experts are not capable of fully predicting in advance. Even threatening a default or taking the country to the brink of default could have serious implications. Importantly, though, failing to control the national debt would also have negative consequences; rising debt could ultimately stunt economic growth, reduce fiscal flexibility, and increase the cost burden on future generations. Thus, lawmakers should consider accompanying a debt ceiling increase with measures to begin addressing the debt.

To be sure, political advantage should not be sought by threatening default, and the debt ceiling must be raised or suspended. Lawmakers must not jeopardize the full faith and credit of the U.S. government. At the same time, the need to raise the debt ceiling can serve as a useful moment for taking stock of our fiscal state and for pursuing revenue increases, entitlement reform, and/or spending reductions.

What are the options for improving the debt ceiling?

Increasing the debt ceiling requires frequent and often contentious legislative action. While several increases have been used to enact fiscal reforms, many increases are not necessarily tied to fiscal health. For instance, debates regarding the debt ceiling often take place after the policies producing the debt have already been put in place. The debt ceiling also measures gross debt, which means that even if the budget was balanced, the debt ceiling would still have to be raised if surpluses accumulated in government trust funds like Social Security.

In The Better Budget Process Initiative: Improving the Debt Limit and subsequent publications, we have suggested reforms to the debt ceiling, grouped in four major categories:

• Linking changes in the debt limit to achieving responsible fiscal targets, so that Congress would not need to increase the debt ceiling if fiscal targets are met.

• Having debate about the debt limit when Congress is making decisions on spending and revenue levels, not after those decisions have been made.

• Applying the debt limit to more economically meaningful measures, such as debt held by the public or debt as a share of GDP.

• Replacing the debt limit with limits on future obligations.

Wishing you all a great week.

Cheers,

Jacque

(THE MONDAY BRIEF ACCORDING TO JOHN)

May 8, 2023

Hello everyone,

According to John, the U.S. banking sector may be in for a shake-up in the future.

• It’s the last unconsolidated U.S. industry along with healthcare.

• In the U.S. there are five railroads, four airlines, three trucking companies, three telephone companies & two cell phone providers … and 4000 banks.

• England has five major banks.

• Australia has four major banks.

• Germany has two major banks.

• Do you think the banking system in America could be seen as a bit anachronistic?

•

Much like its federal system where the 50 states run themselves like mini countries.

The U.S. could pivot from 4000 banks to 4 major banks.

And the JPMorgan takeover of First Republic may be the genesis of such a movement.

John boils down the details here:

Look at the details of the (JPM)/(FRC) deal and you will become utterly convinced.

(JPM) bought a $90 billion loan portfolio for 87 cents on the dollar, despite the fact that the actual default rate was under 1%. The FDIC agreed to split losses for five years on residential losses and seven years on commercial ones. The deal is accretive to (JPM) book value and earnings. (JPM) gets an entire wealth management business, lock, stock, and barrel. Indeed, CEO Jamie Diamond was almost embarrassed by what a great deal he got.

It was the deal of the century, a true gift for the ages. If this is the model going forward, you want to load the boat with every big bank share out there.

So, I guess that is a big hint to buy the big banks or at least one of them now or in the future. Perhaps Bank of America could be a good pick – that’s Warren Buffett’s choice. But JPMorgan, Citibank, Wells Fargo – are all good choices too.

The next question to consider here is where are the big banks concentrated?

The East Coast – New York.

So, there will be a transfer of funds out of the Midwest and the South to the coast, which may well collapse local economies because of lack of funding. The west coast will do well because of technology companies churning out large cash flows.

John says the other big story here is:

… the dramatic change in the administration’s antitrust policy. Until now, it has opposed every large merger as an undue concentration of economic power. Then suddenly, the second largest bank merger in history took place on a weekend, and there will be more to come.

John’s performance details …

So far in May, I have managed a modest +0.55% profit. My 2023 year-to-date performance is now at an eye-popping +62.30%. The S&P 500 (SPY) is up only a miniscule +8.40% so far in 2023. My trailing one-year return reached a 15-year high at +120.45% versus -3.67% for the S&P 500.

That brings my 15-year total return to +659.49%. My average annualized return has blasted up to +48.86%, another new high, some 2.79 times the S&P 500 over the same period.

Some 40 of my 43 trades this year have been profitable. My last 20 consecutive trade alerts have been profitable.

John says that…

You Only Need to Buy Seven Stocks This Year, as the rest are going nowhere. That include (AAPL), (GOOGL), (META), (AMZN), (TSLA), (NVDA), (CRM). Watch out when the next rotation broadens out to the rest of the market.

The next drama in the works is the Government Default date which has been moved up to June 1. Expect a lot of people to talk about this endlessly.

What would happen to the market if they didn’t raise the ceiling?

Maybe a 20% dive in the market. Jot it down on a sticky label and paste it to your laptop as a reminder that it could happen, so you can be prepared.

Non-Farm Payroll jumps by 253,000 – further proof that the labour market is still hiring, and AI is creating more jobs than it is destroying keeping the Fed focused on the wrong data.

So, do we conclude that rate hikes are over for now or perhaps we pause for a time and then hike again? (These are my thoughts).

Monday, May 8 – Consumer Inflation Expectations are out.

Wednesday, May 10 – U.S. Inflation rate is printed.

I’ll sign off today with thoughts from Warren Buffett. He held his annual general meeting in Omaha, Nebraska on Saturday.

“It’s been an incredible period for the economy but that’s coming to an end”. Buffett expects earnings at the majority of Berkshire’s operations to fall this year as a long-predicted downturn slows economic activity. Berkshire posted an almost 13% gain in operating earnings to $8.07 billion for the first quarter.

Wishing you all a fantastic week.

Health, wealth, and wisdom to you all.

Cheers,

Jacque

(TREMORS IN THE FINANCIAL SYSTEM)

May 5, 2023

Hello everyone,

Tremors are being felt in the financial system and the feeling is that they will become a lot stronger.

What will be the consequence of those tremors??

We’re not sure yet, but things could get “interesting” in the markets in the next few months.

Let’s look at what Cathie Wood is saying.

She thinks a credit crunch is underway, and it’s going to get a whole lot worse. Wood has said that customer deposits are still leaving regional banks and are going into Treasury funds, limiting the ability for banks to potentially produce loans in the future.

Treasury funds can’t be loaned out, and therefore can’t encourage business activity. So, her idea is that we are in the early stages of a credit crunch that is going to be much more serious than most are expecting.

Wood has cited the downward trajectory of the SPDR S&P Regional Banking ETF (KRE) as a basis to forecast a continued deposit outflows from regional banks. The ETF has declined roughly 14% in the past five days alone. It’s also down about 17% over the past month.

Most of us are aware that regional banks have most definitely been hammered since the collapse of the Silicon Valley Bank and Signature Bank, which has stoked worries over the health of the U.S. banking system. Last weekend, First Republic was taken over by JPMorgan Chase.

Wood argues that the Federal Reserve will be forced to cut benchmark interest rates to stop the bleeding from these losses.

Wood points out that the (KRE) has broken down, which tells us deposits will continue to outflow until the Fed reverses its position – until it pivots. The Fed hiked rates by 25 basis points Wednesday, even as tighter monetary policy appears to have exacerbated the banking issues.

DoubleLine Capital CEO Jeffrey Gundlach agrees with Wood’s sentiment. He says that the Fed will need to pivot to end the regional banking crisis. On Thursday, European Central Bank chief, Christine Lagarde said tighter credit conditions would similarly weaken further bank lending.

Wishing you all a wonderful weekend.

Cheers

Jacque

The wealth which enslaves the owner isn’t wealth.

(WHAT’S NEXT FOR BANK STOCKS AFTER THE FAILURE OF FIRST REPUBLIC)

MAY 3, 2023

Hello everyone,

It’s the latest theme in social investment circles. Are there cracks underneath regional banks or are they good bets in the future or is something bubbling we are not aware of?

The seizure and sale of First Republic Bank over the weekend closed the book on the most glaring problem left from the U.S. regional banking crisis, but now investors will turn to see if new stresses emerge and evaluate whether midsize banks can become good bets in the future.

First Republic’s failure was the third regional bank failure since early March, when Silicon Valley Bank and Signature Bank folded with days of each other. There seems to be cautious optimism on Wall Street that First Republic will be the last failure of this period.

Bank of America analyst, Ebrahim Poonawalla said that he believes the FRC sale should likely end forced sales of banks due to deposit flight. Although, there is no guarantee that other banks will not experience profitability challenges in the future.

First Republic’s final slide came after its first-quarter earnings report on April 24, which showed a 40% drop in deposits over the first three months of the year. Reports from other banks were not nearly as dire, with many reporting that deposits had stabilized and were growing again.

For example, PacWest Bancorp – which was seen as a potential area of stress after SVB’s collapse, and whose shares fell more than 10% Monday – said last week that it had brought in about $1.8 billion of deposits since March 20.

While the immediate crisis is over, the failure of First Republic could cause some more turbulence, at least in the short term, for both deposits and bank stocks.

The effect of SVB and other recent failures on the broader banking system is far from fully realized. The Federal Reserve report on the bank’s collapse hinted at regulatory changes that could make life tougher for midsize regionals for years to come.

KBW analyst David Konrad said yesterday that he believes banks with assets > $500B and <$60 are the clearest winners in the new world order, while there is likely to be a no-man’s land between $80 -120B, as banks in this range may need to shrink to avoid new regulations or more actively engage in M&A to increase scale and absorb regulatory costs.

Konrad went on to say that regulatory shifts could create a wave of asset sales and small deals as banks try to adjust to a new rule book.

Goldman Sachs analyst, Ryan Nash expects regional banks to likely respond by reducing capital returns, optimizing lending, and potentially disposing of assets to strengthen capital.

It is possible that commercial real estate concerns could be one area that causes bank stress, with Charlie Munger among the many investors warning the public about that sector.

Investors may want to sit on the sidelines until the coast is clear.

Happy Wednesday.

Enjoy the rest of the week.

Cheers,

Jacque

(IS IT SELL IN MAY AND GO AWAY?)

Monday, May 1, 2023

Hello everyone,

Welcome to May.

Is it going to be a sell in May and go away time now?

This post will be a summary of John’s latest webinar, which was done last Wednesday.

Webinar Title: Man the Lifeboats.

Markets have gone from very low risk to very high risk. We are now at the top end of a high-risk range, with asset classes diverging sharply in outlook.

Bonds, foreign currencies, and precious metals now discounting a recession, while stocks at these prices are discounting a soft landing.

Gold and Silver – be patient -the upside breakout will happen soon.

US$ is fading away on recession prospects.

Look for S&P 500 to correct 10%.

Target is 4,800 for S&P 500 In the medium term.

Vix plunges to $15 – nothing to do here.

FCX target is $100 a couple of years from now.

Recession and debt default are crushing economically sensitive stocks now. Will go lower.

What to do: go to cash.

GLOBAL ECONOMY – FADING

The Fed is looking for “One and Done” with the next 25 basis point rate hike on May 3.

If you’re looking for yield and a safe place to put your funds go to 90-day T-bills. Offering 5% and they may be higher after May 3.

Short sellers take billion dollar hit, betting that European bank shares would collapse in the aftermath of the U.S. regional banking crisis.

Inflation takes a dive, dropping to a 5.6% YOY rate – the 9th consecutive month of decline.

Cash is pouring into money market funds as fears of a market correction mount.

Invest in 90-day T-bills.

PPI gives another deflation hint dropping 0.5% in March for only a 2.7% YOY rate.

Earnings Season sees best start in a decade with 90% beating estimates, albeit low ones.

Only 20% (SPY) companies have reported so far with (JPM) our biggest long, leading the charge.

Consensus (SPY) earnings are currently $220 a share giving moderate price/earnings multiple of 18.77x

All technical indicators are now flashing RED.

Seasonals are now turning strongly against stocks.

Volatility plunges to $15 putting the market to sleep.

Looking for flat first half and strong second half to take us to S&P500 4,800 by year-end.

S&P500 screaming caution.

Everything is rolling over.

UPS -big earnings disappointment – recession warning lights flashing here.

CAT – is a BUY – but wait for the main market to recover.

FCX – selling off – if gets down to 200MA we may go into a buy or even a LEAP.

Buy T-bills direct from U.S. government. Now pushing a 5.2% risk-free yield.

BONDS

10-year U.S. Treasury yields back up. Still looking like a 2.5% yield by the end of 2023.

Keep buying TLT calls, call spreads, and LEAPs but only on dips.

Junk bonds are a great high-yield play. Buy JNK and HYG.

FOREIGN CURRENCIES

Weak U.S.$. Buy Aussie, Pound, Euro, and Yen.

Wishing you all a great week.

Cheers,

Jacque

(THE U.S. IS FACING AN INCREASING STAGFLATION THREAT)

April 28, 2023

Hello everyone,

Stagflation could be knocking on your door for quite a lengthy visit soon. Thursday’s gross domestic product reading for the first quarter showed lackluster economic growth and high inflation.

First quarter growth came in at a 1.1% annualized pace, much slower than the 2% growth expected by economists polled by Dow Jones. Data inside the report showed the personal consumption expenditures price index, an inflation measure that the Federal Reserve closely follows, increased by 4.2%, higher than estimates.

So, you might be scratching your head, wondering what Stagflation is.

Let me enlighten you.

Stagflation is an economic condition the U.S. experienced in the 1070s, characterized by slow economic growth and elevated inflation, along with high unemployment. The one ingredient missing today is the high unemployment, but mounting layoffs are raising fears that will change soon too. Cases in point, Lyft has just announced it will lay off 26% of its workforce and Dropbox also has announced it will lay off 16% of its workforce.

With most economists expecting the economic picture to darken further in the second half, what can you do as an investor?

It’s reasonable to assume that certain stocks with pricing power and resilient revenue sources could outperform in this kind of environment.

Bank of America ran a screen earlier this year to find stagflation beneficiaries. The firm looked for S&P 500 companies with the best relative performance during periods of “below-trend growth with above-trend but decelerating inflation, an environment that we will likely be in this year.”

Here are the top 10 stocks from that screen of the past 50 years.

STAGFLATION SCREEN

On that cheery note, I will wish you all a wonderful weekend.

Cheers,

Jacque

(WHAT TO EXPECT FROM AI AND RETAILERS)

April 26, 2023

Hello everyone,

Artificial Intelligence will transform the retailing industry.

Retail operations may undergo significant change over the next decade as retailers incorporate AI-powered technologies into storefronts and warehouses to increase efficiency and enhance personalization across various sales and marketing channels.

What this means is that the days of mass marketing may be over.

The future of marketing will be all about personalization. And AI will be a big part of that.

AI will enable businesses to identify customers’ needs based on their previous purchases and browsing patterns and create personalized marketing.

So, if you are gift shopping for a special someone and are looking for swimwear, for example, you may just get those types of the latest swimwear options landing in your inbox.

And the best part of all this AI revolution is that you may not have to wait in lines in a store again. Shoppers may be able to go in and out of stores without having to wait online and check out. Warehouse operations can be streamlined and merchandise placement in stores can be optimized. E-commerce should also see a boost with AI driving more retail dollars online.

Amazon is obviously a big winner with the advancements in AI.

When you shop online with Amazon, especially for groceries, you already are offered suggested items you may like, if they are not already in your cart (as you have purchased them previously).

Even the type of language each company uses for each customer will be different. AI will be able to generate a language that resonates with specific individuals and drive them to act.

So, for example, you click on a dress or suit you want to check out in detail online. AI generates that you have “great taste” and a “sense of style”. This all speaks to our sense of self and targets our human emotions.

Eventually AI can help retailers pitch tailored products to each potential customer based on their prior history. That not only can help drive sales, but it can also actually lower costs as well.

Furthermore, improve customization can cut down on waste because shoppers will see items that are a better fit or are closer to what the person was seeking.

This all makes perfect sense. Imagine the efficiency and savings. When you think of all the apparel, footwear and accessories that were returned because they didn’t fit or were unsuitable, this customization is a win-win situation.

Machine learning may also help reimagine how companies sell their merchandise inside their bricks and mortar stores. Machine learning analyses data and identifies patterns, which attempts to imitate how the brain imitates how the brain processes information. Furthermore, ML can identify and track stock-keeping units and can therefore help facilitate automated in-store inventory management and autonomous checkout processes. A 1% improvement in inventory efficiencies can be worth millions of dollars.

Customer service will also benefit from the revolution. Company teams will use AI-enabled chatbots, virtual assistants and virtual idols, as well as text, voice and other applications to improve the customer’s experience.

It will be trial and error for many companies as they work out how best to use AI to add to their bottom line.

Happy mid-week.

Cheers,

Jacque

(THE BEST WAY TO PROTECT YOUR MONEY AND YOUR LEGACY)

April 24, 2023

Hello everyone,

Two-thirds of American adults don’t have a will, according to a 2023 survey from Caring.com.

In my mind, that’s a staggering number.

Although many people don’t think they have enough funds to worry about or even pass on, do people realize what can happen to those funds when they pass without any instruction left behind?

It may have to go through Probate. And your funds and assets may end up going where you don’t want them to go. Also, think about the costs involved. An estate valued at $500,000 may have probate fees of $11,000.

Despite the perilous period we have been through with rising interest rates and a recession on the horizon, everyone needs to take time to think holistically about their finances, including their estate plan. You need to protect your money and your legacy as best you can. It’s critical to have estate planning documents, including a will that dictates who will receive your assets upon death, and to keep your beneficiaries updated.

While a will outlines who receives certain types of property, other assets pass to heirs through your beneficiary designations, such as bank accounts, 401(k) plans and individual retirement accounts, life insurance policies and annuities.

While Covid -19 has prompted a rise in estate planning, nearly 66% of American adults still don’t have a will.

It’s not only about leaving a will either. It’s also important to have documents for powers of attorney, allowing someone to make financial or health care decisions on your behalf if you were unable.

So, my advice is to take the time to create a will, or even update it. Your family will thank you for your estate financial planning.

Have a wonderful week.

Cheers,

Jacque

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.