(EUROPE FORMS A COALITION WHILE TRUMP WAGES WAR WITH TARIFFS)

March 5, 2025

Hello everyone

GEOPOLITICS CORNER

President Zelensky meets the King at Sandringham in the U.K.

EUROPE TAKES THE REINS

British Prime Minister Keir Starmer says the UK, France, and Ukraine will devise a peace plan to end the conflict. Many European nations have vowed to join a coalition willing to help Ukraine. Member states also promised to continue supplying arms to Ukraine during the war and to provide military equipment afterward to ensure the country can defend itself in the event of further Russian aggression.

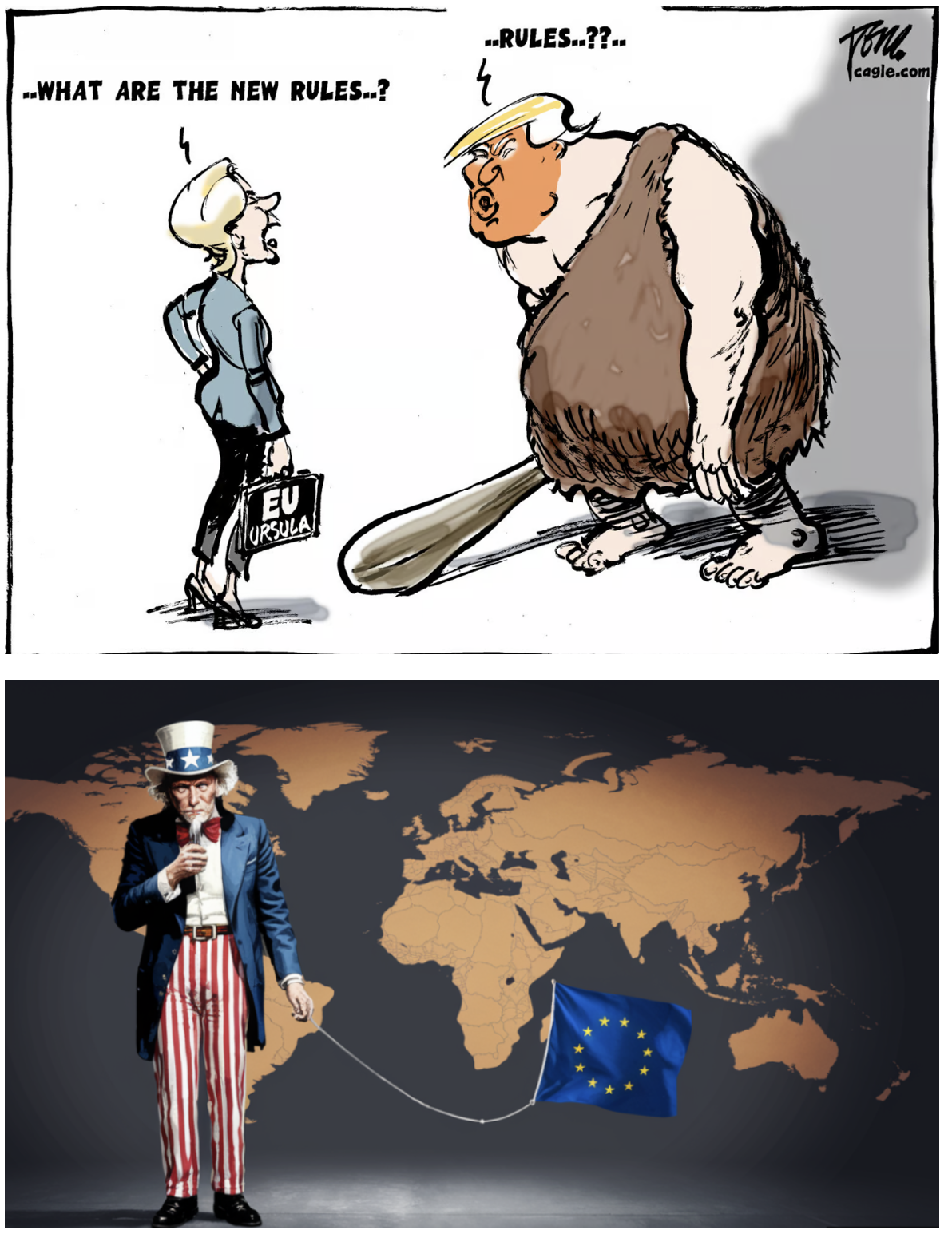

European Commission president Ursula von der Leyen said she planned to inform EU member states of her plans to strengthen the continent’s defence industry and military capabilities.

The European Commission president has stated that “lasting peace can only be built on strength, and strength begins with strengthening ourselves.”

Following the crisis summit on Sunday, French President Emmanuel Macron said that France and Britain were proposing a one-month truce in Ukraine “in the air, at sea and on energy infrastructure”, although not, initially at least, covering ground fighting.

Even our Australian Prime Minister, Anthony Albanese, has stated that he is open to Australian troops joining a Ukrainian peacekeeping coalition.

Mr Zelensky told journalists shortly before departing Britain that “it will be a failure for everyone if Ukraine is forced into a ceasefire without serious security guarantees.”

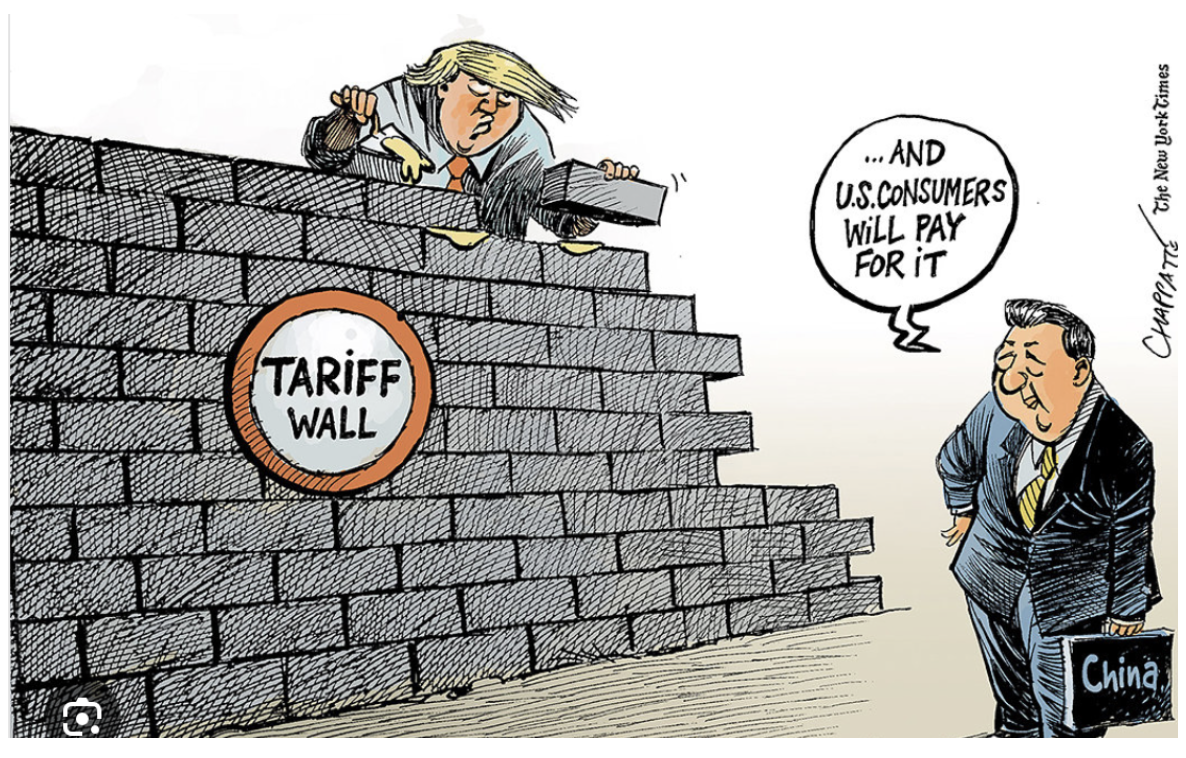

TARIFF TRADE WAR

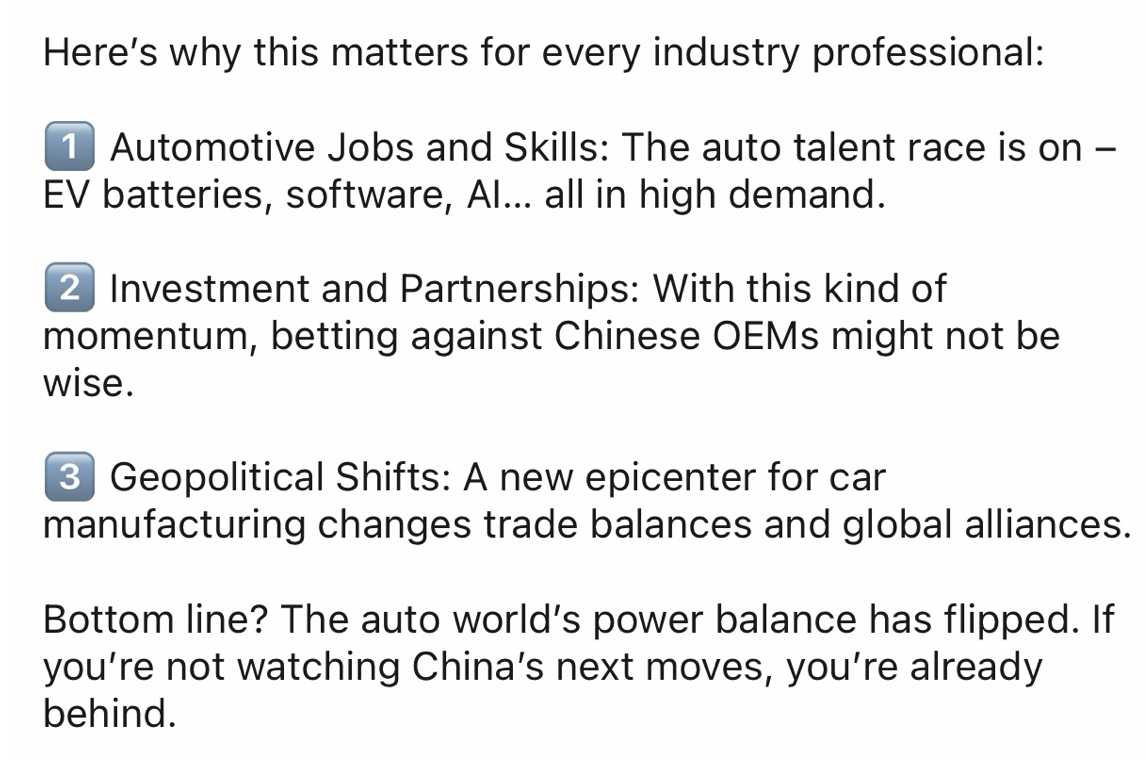

The Trump tariffs will create victims across the world if he continues to escalate the trade war with China.

Mark Carney, the Bank of England’s governor, has warned that a trade war could cut US growth by as much as five percent, twice that of the rest of the world. But Trump does not seem to care about the disproportionate damage that the tariffs are expected to do to the US or that there could be severe unforeseen consequences.

Trump’s electoral success was partially a result of his “America First” rhetoric: Sticking up for the workers who lost their jobs when industries such as manufacturing or mining either moved abroad or became obsolete.

Globalization hasn’t been fair: it has delivered prosperity to an increasingly small few rather than to everybody. But tariffs on imports will mean higher prices for everybody, consumers and businesses alike.

The International Monetary Fund (IMF) stated on Monday that if Trump escalates the trade war with China, the US will be “especially vulnerable.” Americans will lose jobs and have to pay more for items ranging from food to electronics, and international businesses that have positioned themselves as vital cogs in the global supply will be put at risk.

To pursue policies that hurt communities that have already suffered is simply perverse. Everyone gets hurt in trade wars, but ordinary citizens get hurt more than most.

Today, China has retaliated with additional tariffs of up to 15% on some U.S. goods, from March 10.

Canada has also fired back with potential tariffs on US imports. The Canadian Prime Minister, Trudeau, has indicated that should American tariffs come into effect on Tuesday, Canada will, effective 12.01 a.m. EST tomorrow, respond with 25 percent tariffs against $155 billion of American goods. In addition, Trudeau stated that there would be a discussion with the provinces and territories to pursue several non-tariff measures.

I wonder if Mr Trump considered how these sweeping levies will affect supply chains for key sectors like cars and construction materials. Supply chains could be effectively choked, risking a hike in consumer prices.

This fact could indeed mess with Mr Trump’s effort to fulfil his campaign promises of lowering the cost of living for households.

It’s also recently come to light that tariffs on agricultural imports would come into effect on April 2.

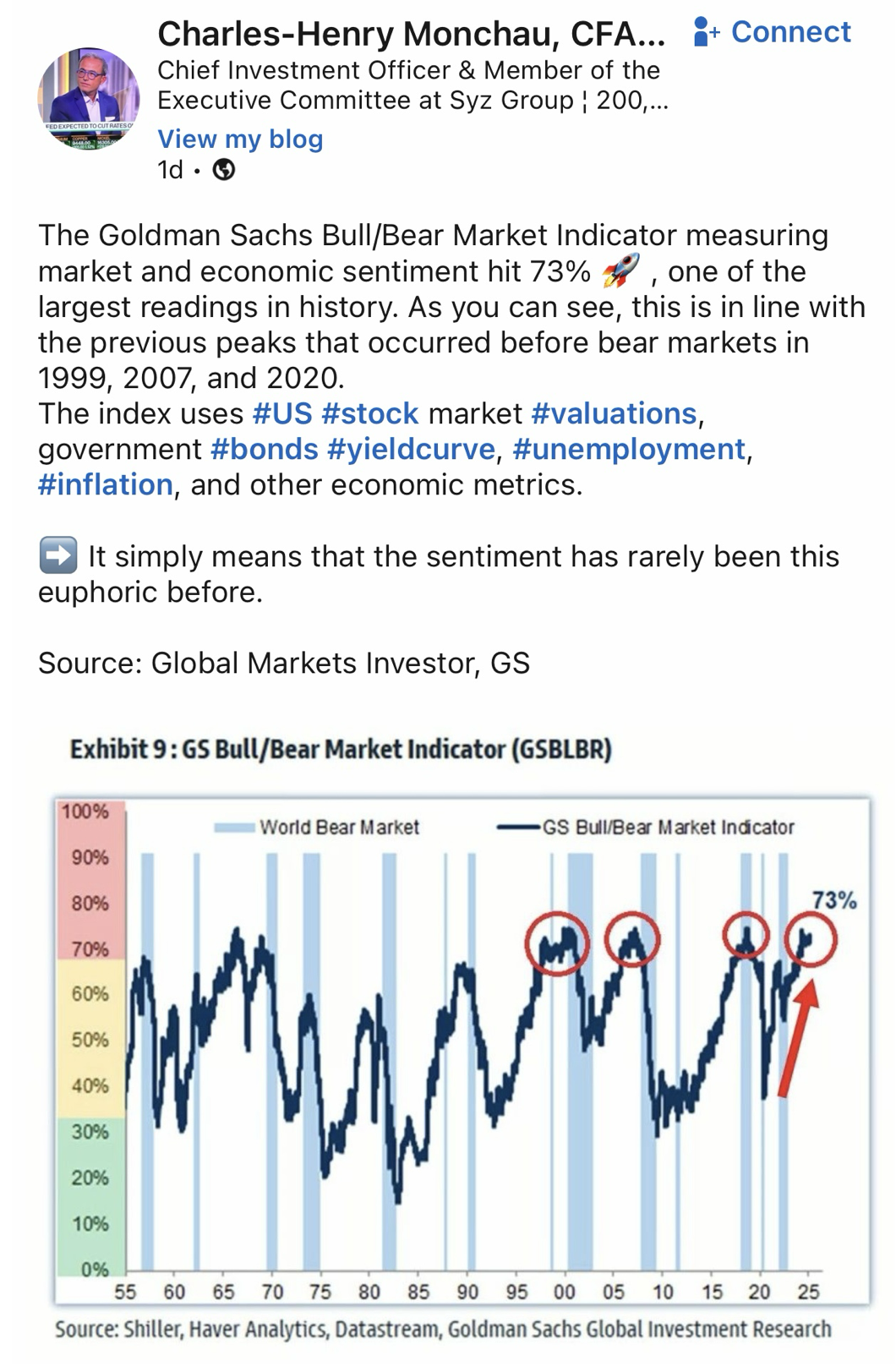

While U.S. stocks declined yesterday, Europe’s defence stocks surged in the wake of renewed talks over the fate of the Russia Ukraine war, with BAE Systems, Thales, and Rheinmetall rallying as leaders met for crisis talks about the conflict.

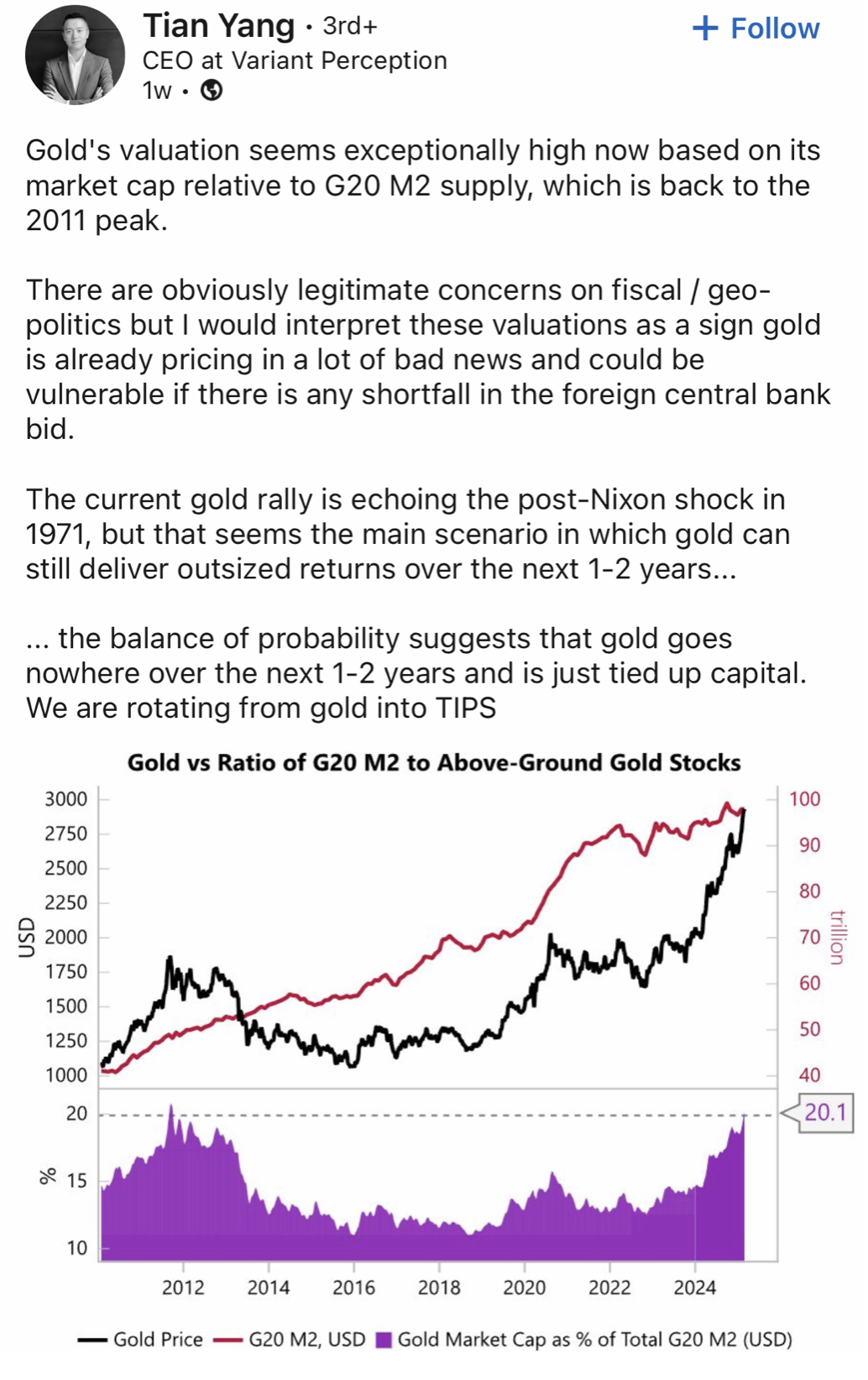

QI CORNER

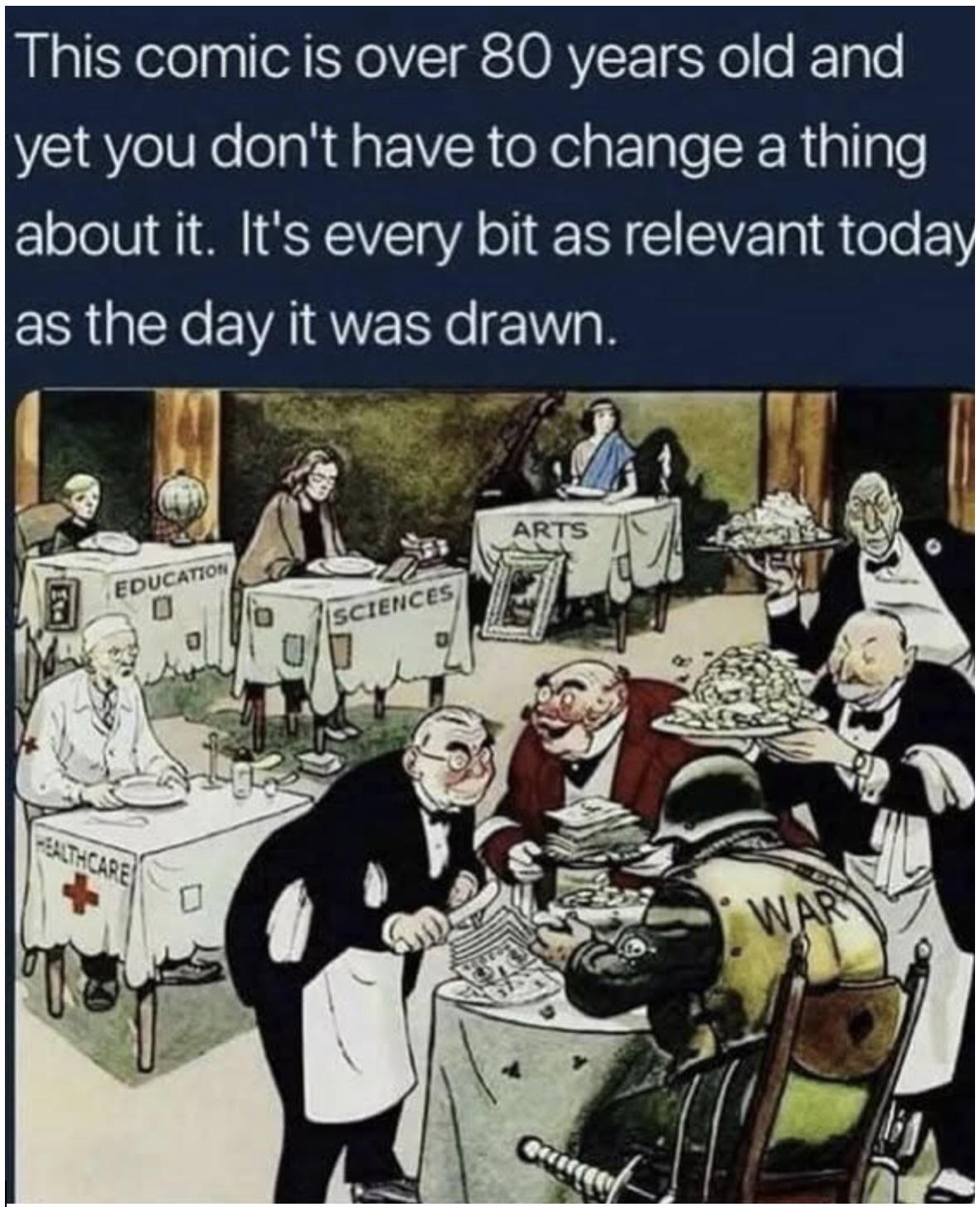

SOMETHING TO THINK ABOUT

Cheers

Jacquie