(SCAMMERS ARE MAKING A MINT OUT OF THE REAL ESTATE MARKET)

February 10, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY FEB. 10

9:00 a.m. Euro Area ECB Speech

Earnings: ON Semiconductor, Rockwell Automation, McDonalds.

TUESDAY FEB. 11

6:00 a.m. NFIB Small Business Index (January)

3:30 p.m. New York Federal Reserve Bank President and CEO John Williams gives keynote remarks at Pace University, New York.

Earnings: Gilead Sciences, Coco-Cola, Fidelity National Information Services, Ecolab, Marriott International, Humana.

WEDNESDAY FEB. 12

8:30 a.m. Consumer Price Index (January)

8:30 a.m. Hourly Earnings (January)

8:30 a.m. Average Workweek (January)

2:00 p.m. Treasury Budget (January)

Earnings: Paramount Global, MGM Resorts International, Global Payments, Cisco Systems, Tyler Technologies, Dominion Energy, Albemarle, Kraft Heinz, CME Group, Martin Marietta Materials, Westinghouse Air Brake Technologies, CVS Health, Generac Holdings, Exelon, Biogen.

THURSDAY FEB. 13

2:00 a.m. UK GDP Growth

Previous: 0%

Forecast: -0.1%

8:30 a.m. Continuing Jobless Claims (02/01)

8:30 a.m. Initial Claims (02/08)

12:20 p.m. New York Federal Reserve Bank Director of Research Kartik Athreya speaks at the University of Bridgeport, Ernest C. Trefz School of Business.

1:00 p.m. New York Federal Reserve Bank Interim Head of the Markets Group Anna Nordstrom gives opening remarks in “Women in Fixed Income Conference”, New York Fed.

4:00 p.m. New York Federal Reserve Bank Director of Research Kartik Athreya speaks on “Economic Outlook with a Focus on Regional Business Conditions”, Connecticut

5:15 p.m. New York Federal Reserve Bank Deputy SOMA Manager Julie Remache gives closing remarks in “Women in Fixed Income Conference”, New York Fed.

Earnings: Motorola Solutions, Airbnb, Wynn Resorts, Applied Materials, Ingersoll Rand, GoDaddy, DexCom, PPL, Howmet Aerospace, Duke Energy, Molson Coors Beverage, GE Healthcare Technologies, West Pharmaceutical Services, PG&E, Deere & co.

FRIDAY FEB. 14

8:30 a.m. Export Price Index (January)

8:30 a.m. Import Price Index (January)

9:15 a.m. Capacity Utilization (January)

9:15 a.m. Industrial Production (January)

9:15 a.m. Manufacturing Production (January)

10:00 a.m. Business Inventories (January)

Earnings: Moderna

It will be a quieter week on the economic data front, but that doesn’t mean markets will be calm. The CPI and PPI are on deck this week, so investors will be paying close attention to the numbers here after Friday’s economic data revived concerns around inflation. The January jobs report showed strong wage growth, an inflationary signal. But it was the drop in consumer sentiment that represented growing concerns about rising price pressures from tariffs that turned the market off. The angst was felt in the bond markets as we saw yields spike higher. US Retail Sales data will show whether the health of the American consumer is humming along nicely.

Take the long way round when dealing with real estate financial transactions.

I have heard of this tale so many times, it is heartbreaking. Singles or couples who have saved up a deposit to buy a property. They transfer it to the bank account indicated by the real estate agent/and associated bank and then find it has evaporated.

Australians lost more than $318m to scammers last year. When it comes to real estate scams, buyers, sellers, and renters are all at risk.

So, it is wise to keep up with the latest scams and know what to look out for. This will help you minimise the threat and keep your money as safe as possible.

Payment redirection scams are one of the biggest ways consumers are getting fleeced in the property market. This is where a scammer will impersonate a real estate agent to convince the unsuspecting client to deposit funds into a different bank account.

Ray White warns consumers that scammers will create a very similar email address and start emailing the client pretending to be the agent. Furthermore, the real estate company goes on to point out that the scammers provide updated banking details, trying to get the client to deposit funds into the scammer’s account.

The rental market is not safe either. Scammers are imitating offices and trying to redirect rental payments into scam accounts. There are new scams coming out daily – and these messages can be sent via post and not email.

REIA (Real Estate Institute of Australia) President Leanne Pilkington says it is crucial to pick up the phone and speak with the real estate agent before transferring funds if you have received a payment request with new account details.

Buyers are losing their deposits.

Another common scam operating in the market now is when fraudsters use the photos and information from a legitimate rental listing and create a fake private listing on a consumer trading site.

Posing as the landlord of the property, they give excuses about not being able to run inspections while offering deals that seem too good to be true.

They request a deposit and indicate that once that is received, the place will be yours. When it comes time to collect the keys, there are no keys – no owners.

Many people who are feeling vulnerable due to the rental crisis in Australia have found themselves easy targets for such scammers. Depositing money without physically walking through the premises is not safe – better to take the long route and check things out thoroughly. It could save you a mint in the end.

RED FLAGS

A change of account request.

Do not reply to the email. Instead, call the agent directly and ask them for confirmation. Even better, make an appointment and physically visit the branch.

Avoid clicking links.

It is possible that this link could take you to an unsecured website where you are tricked into entering sensitive information.

Choose secure payment platforms.

Many agencies offer BPAY or DEFT for making rental payments or PEXA for buying and selling rather than transferring funds into a bank account.

Private rentals – be careful.

Request documentation from the landlord.

Check if the owner is registered with Bonds Online.

Contact your bank.

If you think you have been scammed, contact your bank straight away and follow the instructions given.

The goal is prevention.

Even better than a phone call, walk into your agency/bank and verify bank details and emails you have received. It is worth the effort and the time.

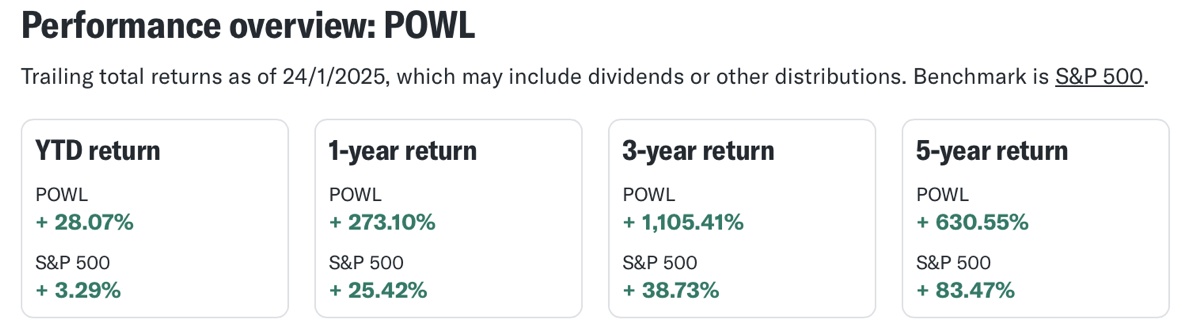

MARKET UPDATE

S&P500

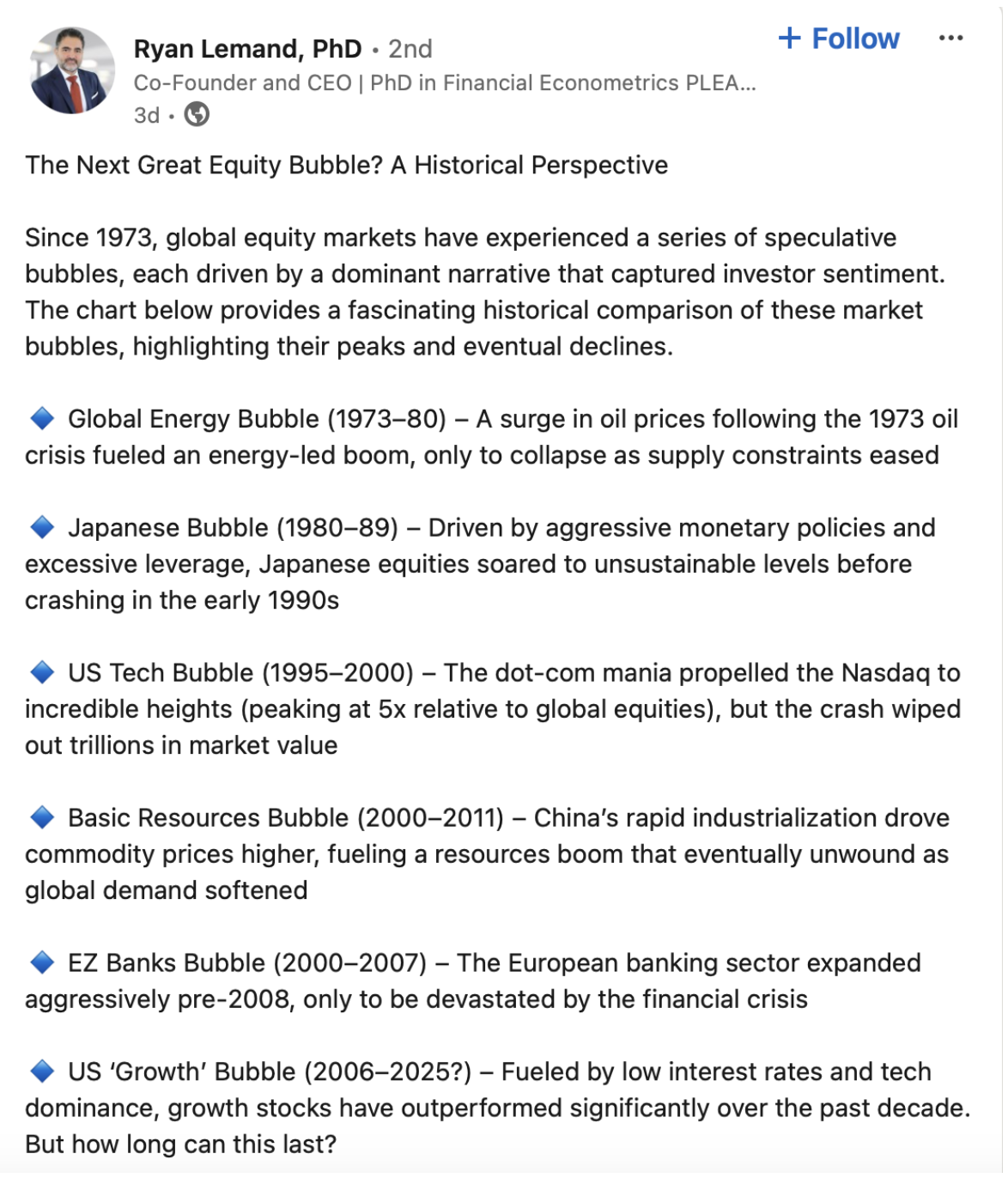

The bull market is looking shaky; the market is showing wide-ranging swings, which can be representative of tops forming. Most are expecting the bull market to continue making new highs in its third year; however, I am being more cautious than the consensus.

Support: $5900/$5775/$5750

Resistance: $6110/$6100.

GOLD

Gold can continue this rally for some time, but I am expecting the metal to eventually sell off in the medium term down to at least the $2,500 area.

Support: $2830/$2732

Resistance: $2900/$3000

BITCOIN

We can expect some more ranging behaviour for Bitcoin this week.

Support = ~ 91,000/89,000/85,000/80,000. Resistance = $108,000/$105,000

QI CORNER

HISTORY CORNER

On February 10

QUIZ CORNER

1/ In what decade was the internet created?

2/ What was the name of the first computer virus?

3/ What company was initially known as “Blue Ribbon Sports”?

4/ Who created the first credit card?

SOMETHING TO THINK ABOUT

“The decline of literature indicates the decline of a nation.”

(Johann Wolfgang von Goethe)

Cheers

Jacquie