July 11, 2011 - Buy Russia, But You May Want to Take a Shower

Featured Trades: (BUY RUSSIA, BUT YOU MAY WANT TO TAKE A SHOWER), (RSX)

2)Buy Russia, But You May Want to Take a Shower.? If you wonder why I recommend a shower after investing in Russia, Bill Browder will give you the reasons at length on his YouTube video (click here for the link). Bill is the founder and CEO of Hermitage Capital Management, one of the firms that pioneered equity investment in the former Soviet Union in the nineties.

After a decade of pursing a campaign of activist investing that brought major changes in corporate governance in big companies like Gazprom (OGZPF.PK) (click here for the link at http://www.gazprom.com/ ) and Sberbank (SBRPF.PK), a mafia connected government struck back with a vengeance. It deported Browder in 2005, arrested his lawyer, and pressured him to provide false testimony against his boss, which he refused. A year later, the man died in prison from 'natural causes.'

The Russian government then seized Browder's operating companies, but fortunately for investors, not before he was able to sell off $4.5 billion in holdings and spirit the funds out of the country.

Browder, who is of Russian descent, and whose grandfather was chairman of the American Communist Party, says his case is but the tip of the iceberg. Major multinationals like Shell, BP, and Ikea have also been the victims of corruption and faced arbitrary seizure of assets by the well connected. This lawlessness is the reason why Russian companies perennially trade at single digit multiples. They are cheap on paper, but carry hidden, unquantifiable risks.

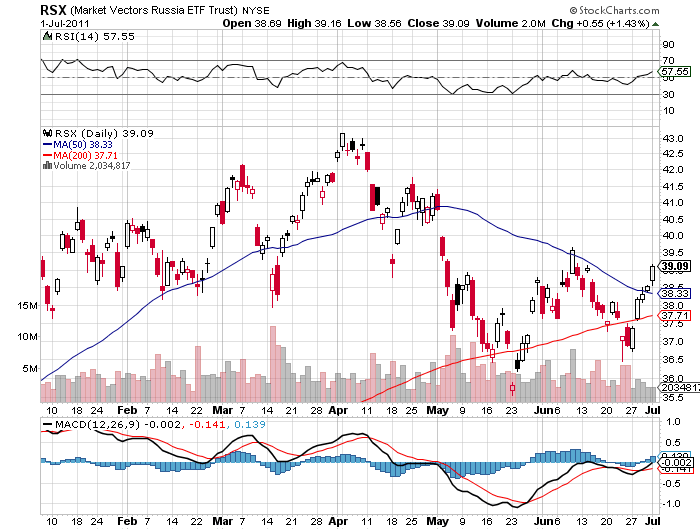

Despite all of the above, mega hedge fund Traxis Partners founder, Barton Biggs, says there is still a case to make for investment in Russia. It is the classic emerging middle class story. Russians have no credit card debt, no home mortgages, and terrible housing, but the resource wealth to buy what they need. Barton sees Russia eventually becoming a basic, functioning European country, but will first have to engineer a growth spurt to get there. That is the play. The principal vehicle for most foreigners to get into the land of Lenin and Red Square is to buy the ETF, (RSX).

No doubt that investing in Russia is a double edged sword. It offers enormous oil reserves and natural resources, with GDP flipping from a -7.9% rate in 2009 to an expected 3.2% in 2010. But you run the risk of a knock on the door in the middle of the night.

-