July 13, 2011 - Markets Get a Stiff Dose of Reality

Featured Trades: (MARKETS GET A STIFF DOSE OF REALITY),

(GLD), (SLV), (TLT), (SPX)

1) Markets Get a Stiff Dose of Reality. The global 'RISK ON' TRADE was administered with a stiff dose of smelling salts on Friday with the horrific nonfarm payroll report. The stock market was really leading with its chin. It expected 150,000-200,000 in job gains but got only a pitiful 18,000. The ensuing melt down was global in scale.

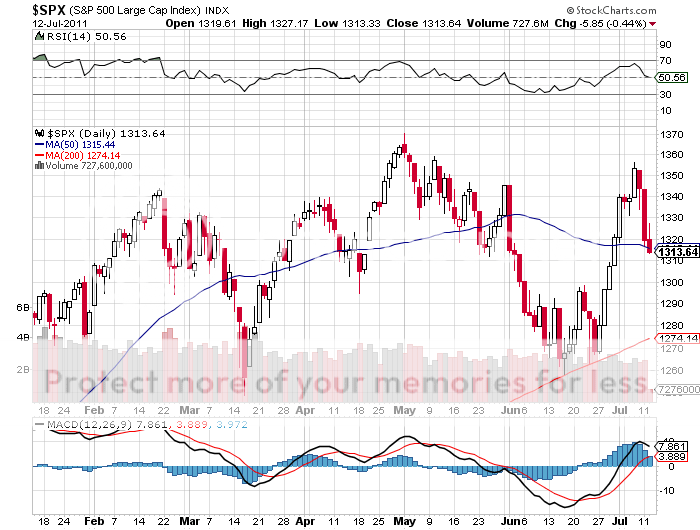

The moves recently have been nothing less than stunning. In the last two weeks, the S&P 500 has rallied 100 points and then given up 65. Technical levels have been rendered meaningless, falling like a hot knife through butter. Surveying the carnage from the comfort of a 99% cash position, it's like watching the games in the coliseum where all of the gladiators are getting the thumbs down. Only those in the stands will be left standing.

The data are entirely consistent with the 2%-2.5% GDP growth forecast that I have been pounding the table about since the beginning of the year. On by one, others have come into my fold, continuously ratcheting down their own ebullient predictions, from Goldman Sachs to the Federal Reserve. As a result, traders are getting chopped to death, their momentum driven models forcing them to buy every rally and sell every dip.

I still think too many analysts, economists, and fund managers are working off of old models, expecting unemployment to fall back to 5%, as it has done in past recoveries. I think we will be lucky to see the 7% handle, if that. Structural unemployment is here to stay, no matter how much money the government throws at it. What people seem to be missing is that corporate profits were so good in Q1, and will be nearly as good in Q2, because they aren't hiring anyone.

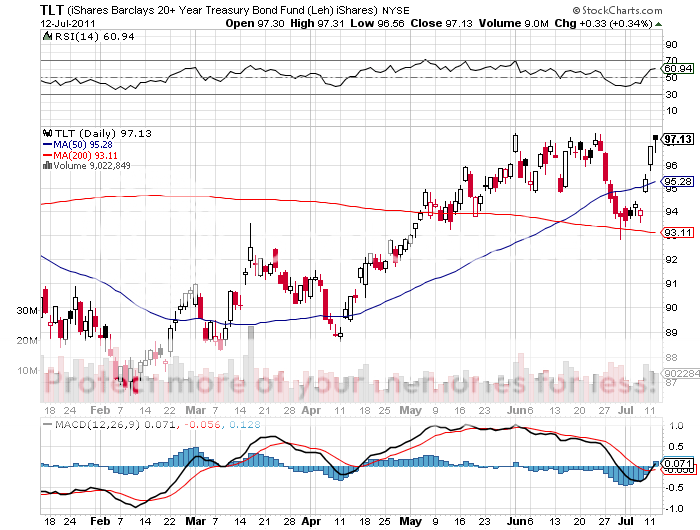

My only position, short calls on the (TLT) is still looking good. While the ten year Treasury bond has risen four points against me in the latest shakeout, time decay means my position has dropped by a welcome 57%. I'll be looking to increase this short at the next peak in bond prices.

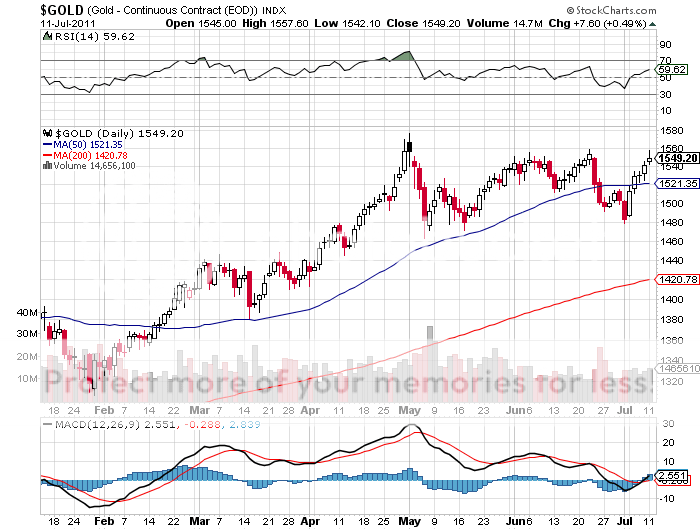

Only gold (GLD) seems to be doing well here, the barbarous relic probing the top end of its six month range. Europeans spooked by the new crisis in Italy and the potential demise of the European currency system are pouring into the safe haven of the yellow metal. Silver (SLV) in the meantime, has taken a nosedive.

All I can say is if Paul Tudor Jones, Louis Bacon, and John Paulson can't make money in this market, I bet you can't either. Better to watch in awe from the sidelines and until the dust settles and let others do the bleeding.

-

-

-

Did You Say Buy, or Sell?