July 14, 2011 - The Gold Bulls Are Vindicated

(SPECIAL GOLD ISSUE)

Featured Trades: (GLD), (RGLD), (AEM), (GBG)

1) The Gold Bulls Are Vindicated. For the faithful who have successfully crossed the desert and suffered the slings and arrows of critics and the ridicule of non-believers, gold's move today to an all-time high of $1,586 delivers the greatest of all vindications. All it took was some comments by Ben Bernanke about the remote prospect of a future QE3, and it was off to the races. Another round of the European sovereign debt crisis is sending panicky continentals into gold in droves. Yesterday, buying of gold ETF's like (GLD) reached 21 tonnes in gold equivalent, one of the largest days on record.

It didn't hurt that we are about to enter a period of traditional strength in the gold market, with the Indian wedding season only two months away. Actually, it wasn't much of a desert, maybe more of a Zen rock garden, as the barbarous relic was stuck in a tedious and tiresome $100 range before it resumed its recent ascent. The Chinese buying I predicted put a floor under the price much higher than traders anticipated, frustrating hoards of buyers lower down.

So now the question arises of what to do with your bounteous profits, and how much risk does the yellow metal present here. I get asked this question a dozen times a day, by some who have been long since the current move started more than a decade ago at $260, and others who stood on the sidelines and watched in awe as it went to the moon, kicking themselves all the way. Is it too late to get in?

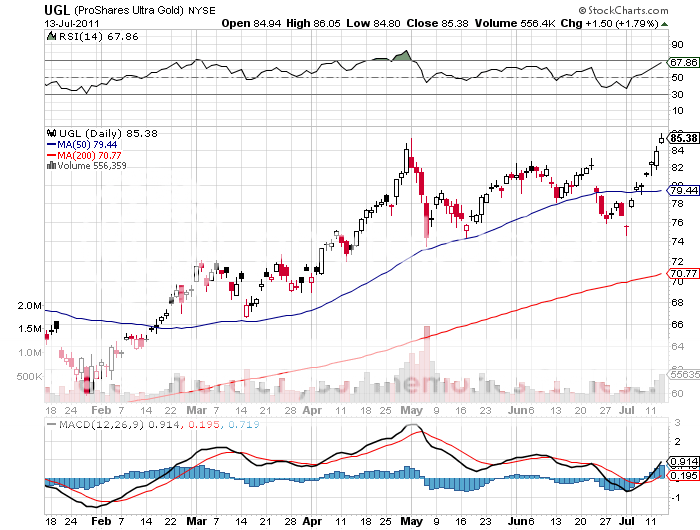

They call the yellow metal the barbarous relic for a reason. Let's face it. We've had a great run. Gold has been one of the top performing assets by a long shot, soaring some 510% since 2002, while most other asset classes sucked. Investors did even better in the futures, leveraged ETF's like the (UGL), and gold mining shares or their out of the money calls.

Anyone considering a short here will be insane to do so, as you will be going against the long term trend. Obama has not suddenly turned into a paragon of fiscal rectitude, and Ben Bernanke still has the keys to the printing presses. The Fed has yet to even admit its role in the credit bubble of the last decade. Fiat paper currencies are still running a frenzied race to the bottom. Politicians of both parties see the only way to win elections is to inflate, and to debase the greenback.

Almost all short term money market alternatives globally are yielding close to zero, meaning that the opportunity cost of owning the gold is nil. It turns out that they aren't making gold any more. The output of gold has fallen by 12% annually for the past decade, compared to a doubling of production costs to over $500/ounce.

Reserves everywhere are playing out, and top producer Barrick Gold (ABX) isn't opening a new mine at 15,000 feet in the Andes because it likes the fresh air. The upcoming slugfest in Congress over the debt ceiling will almost certainly cause many investors to just throw up their hands in despair and start shopping for American gold eagles at Amazon.

Now that we have broken out to a new high, many traders think the yellow metal won't pause to catch its breath until we hit $1,600. I still think my long term target of $2,300 is a chip shot, but it might take three years to get there. There are higher predictions of $5,000, $10,000, and $50,000 based on ratios of gold to broadening definitions of monetary assets (see below).

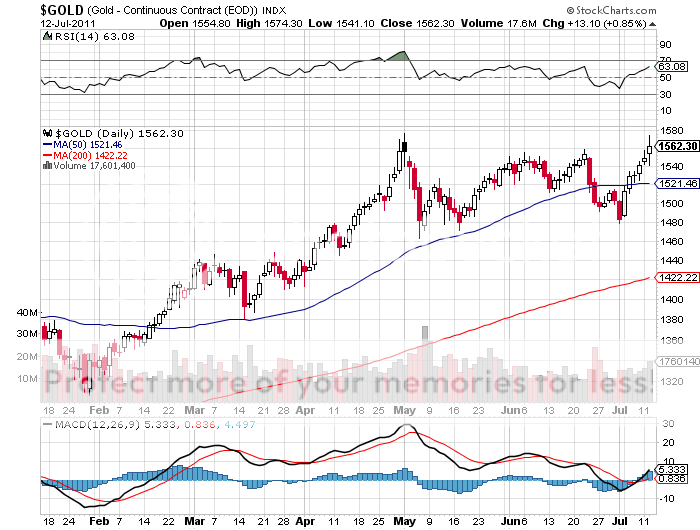

Below are the downside support points on the charts, with my comments.

$1,521 -50 day moving average, probably holds, but a break signals a more serious pull back

$1,422 '? 200 day moving average held last time, should work again. Unlikely to get there, but the world is a big buyer if it does.

$1,050- The 2010 low, the old multiyear high, and the place where the Reserve Bank of India kicked off the current love fest with its surprise 200 tonne purchase in 2009 months ago. Unlikely to get there, but the world is a big buyer if it does. Bet the ranch here.

$680 '? The 2008 low- In your dreams. We aren't going to get a full blown flight to liquidity we saw in that dreadful year. Relegated to the history books for good.

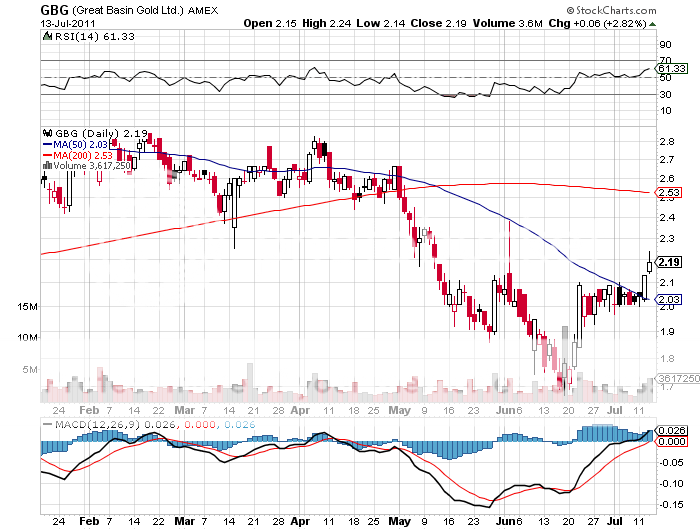

Use any serious dips to accumulate low cost, growing, gold miners with decent valuations, which are enjoying escalating operating leverage the higher the barbaric relic runs. Some new names you might entertain are Royal Gold (RGLD), Agnico-Eagle Mines (AEM), and Great Basin Gold (GBG).

-

-

-

-