July 16, 2009

July 16, 2009

Featured Trades: (INTC), (ORCL), (HPQ), (IBM), (MSFT), (INDIA), (SENSEX), ($BSE), (AGU), (MON), (MOO), (POT)

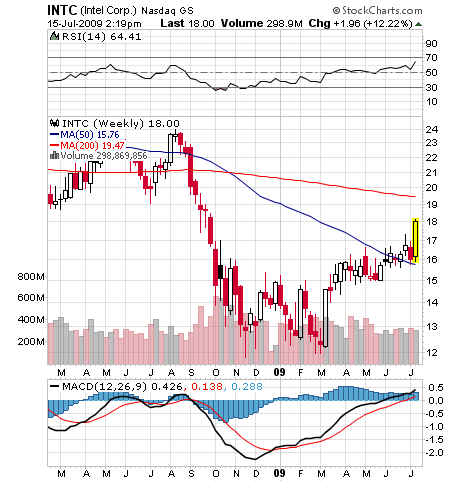

1)?? Intel's blowout earnings yesterday made crystal clear who is going to be buttering our bread for the next few decades (see income statement). More than 80% of their earnings came from foreign sources, far and away the main driver of economic activity in the world today. If it weren't for the outrageous $1.4 billion antitrust fine from the EC, the earnings would have been even better. If you are going to own equities, make them BRIC ones. If allocation restrictions won't let you go 100% foreign and you must buy the US, make sure they are American companies that are really foreign ones in disguise. Intel (INTC), Oracle (ORCL), Hewlett Packard (HPQ), IBM (IBM), and Microsoft (MSFT) all get 70%-80% of their earnings from abroad. You don't want to own anything that is dependent on newly impoverished Americans buying their products.

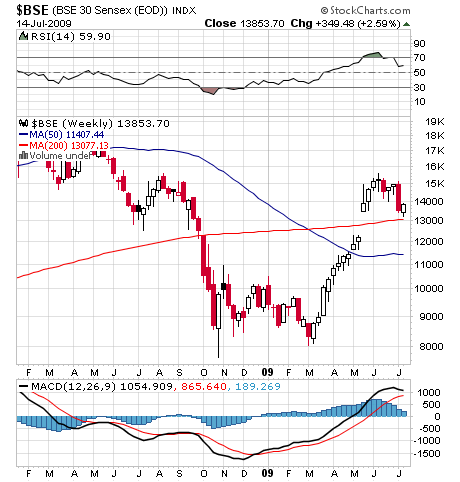

2) Regular followers of this letter know that I have been a huge bull on India since the beginning of the year (see my last update ). After doubling since November, the Bombay Sensex index has backed off 15%, along with the global risk reversion trade. The immediate road may be a rocky one as the new government brought in by the Congress Party's smashing May win imposes some Obamaesque changes on the economy. That means a lot more borrowing and higher inflation. For a quick snapshot of the state of play in India, please read Martin Hutchinson's excellent piece at Money Morning.

3) Fortune magazine ran an excellent article about the flood of institutional money pouring into agricultural land, a sector I have been harping on for some time (see earlier piece). The amount of arable land per person has fallen precipitously since 1960, from 1.1 acres to 0.6 acres, and that could halve again by 2050. Water is about to become even more scarce than land. Productivity gains from new seed types are hitting a wall. Rising incomes in emerging markets is producing more meat eaters, another huge call on grain and water supplies. To produce one pound of beef, you need 16 pounds of grain and over 2,000 gallons of water. China, especially, is in a pickle because it has 20% of the world's population, but only 7% of the arable land, and it has committed $5 billion to agricultural land in Africa. Similarly, South Korea has leased half the arable land in Madagascar to insure their food supplies. George Soros has snatched up 650,000 acres of land in Argentina and Brazil on the cheap, an area half the size of Rhode Island, and has become the largest shareholder in Potash (POT). Even hedge funds are getting into the game, quietly building portfolios of farms in the Midwest and the South.?? Time to take another look at Agrium (AGU), Monsanto (MON), and the ag ETF (MOO).

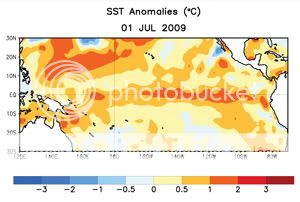

4) I stopped by to visit some old friends at the National Oceanic and Atmospheric Administration (NOAA) in Tiburon, California, located at the abandoned Navy base that was home to the Golden Gate Bridge's antisubmarine net during WWII.?? They warned me that we could be headed for an El Ni??o winter (check their site). So named because all of the fish disappeared off the coast of Chile one Christmas, El Ni??o's are caused by a sudden warming of ocean temperatures in the Central and Eastern Pacific, which lead to unusual weather patterns. During the last El Ni??o in 1998, the rainfall in San Francisco soared from 20 inches to 100 inches, the American River dykes broke, railroads were destroyed beyond repair, the Sierras got 40 feet of snow, and species of fish like mahi mahi normally found in Hawaii suddenly hit the hooks of happy fishermen in San Francisco Bay. Australia endured a terrible draught. This could all be great for wheat prices and bad for insurance companies, and no doubt many will claim it is all caused by global warming.

QUOTE OF THE DAY

'Just because you do not take an interest in politics doesn't mean politics will not take an interest in you,' said Pericles, ruler of ancient Greece during the golden age, and builder of the Parthenon.