July 16, 2010 - The Baltic Dry Index Versus Container Rates

Featured Trades: (BALTIC DRY INDEX), ($BDI),

(CONTAINER RATES), (US RAIL TRAFFIC)

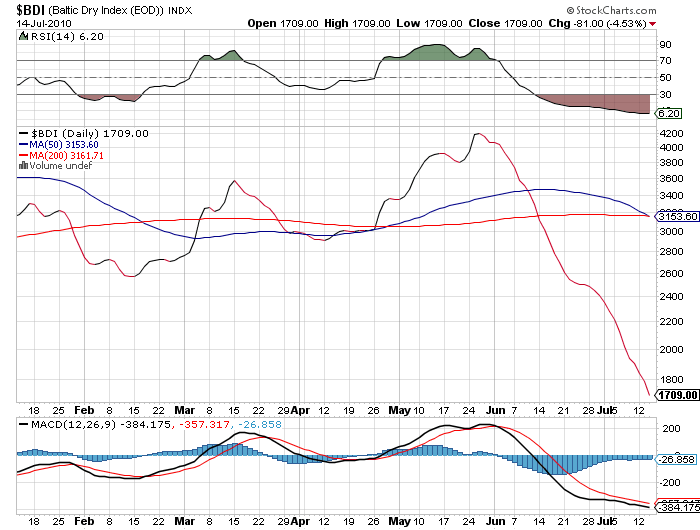

1) The Baltic Dry Index Versus Container Rates: Who to Believe? There is a ferocious debate underway among economists over which leading indicator to believe, the Baltic Dry Index, or international container shipping rates. The BDI, a measure of the cost of chartering bulk carriers for coal, iron ore, wheat, and other dry commodities, has just suffered one of its most dramatic sell offs in history, plunging some 60% since May. The downturn has been accelerated by the recent delivery of a glut of new ships that were ordered during the boom years 3-4 years ago, when getting cheap money was as easy as falling overboard. There is no doubt that this index is shouting loud and clear for a double dip in the world economy. On the other hand, and if you notice, most economists are two handed, the rates for standard 20 foot containers shipped to international destinations has gone absolutely through the roof. The Maersk Line has even gone to the extreme of diverting its fastest ships to return empty containers from the U.S. to China. The big driver here has been intra Asian trade, as well as rising imports by big US customers like Wal-Mart (WMT). This shortage has been exacerbated by the large scale cancellation of orders to build new containers during the 2008-09 crisis, and strikes at key manufacturers in China. The data points to a global economic recovery centered in Asia, and trickling down to the U.S. and Europe. Who to believe??? I'll let American rail traffic cast the tie breaking vote, which you can see in the chart below. After crashing in 2008-09, it performed a 'V' shaped recovery, and has been holding its gain's ever since, although is only at 80% of full capacity. This is my 'gull winged' chart, which you see for the prices of almost all financial assets these days. And the envelope, please! The conclusion is unequivocal. We are in for a slow, bumpy long term recovery that will deliver the long term U.S. growth rate of 2% that I have been predicting all year. Too bad the stock market doesn't know this yet.