July 26, 2011 - Time to Scoop Up Some (CAT)

Featured Trades: (TIME TO SCOOP UP SOME (CAT)), (CAT)

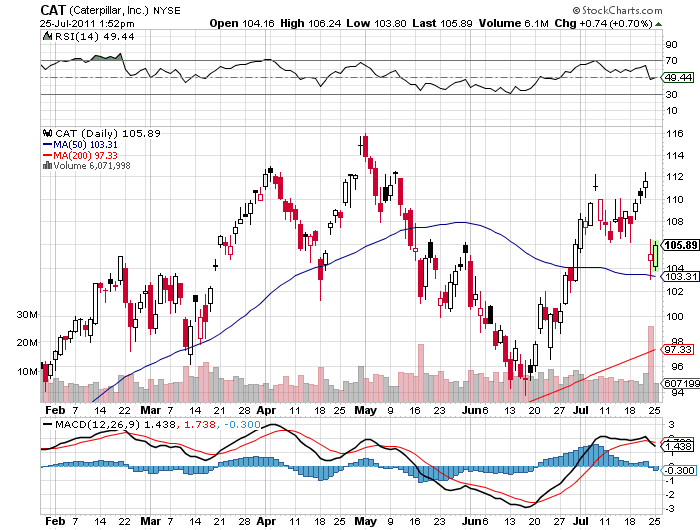

2) Time to Scoop Up Some (CAT). I love it when a world beating, best of breed company temporarily stumbles and gives me a great entry point for a new long position. That was certainly the case on Friday, when Caterpillar, the icon for manufacturing bulldozers and other heavy construction and mining equipment, released their Q2 earnings.

It was a good report. It raised its outlook for revenues by $2 billion to $55 billion, up big from $42 billion a year ago. Earnings soared by 44% YOY. It has a record backlog for new orders. CEO, Doug Oberhelman, expects profits for the company to rise through 2015.

But the dreaded words 'China slowing' were mentioned. Analysts' expectations had outrun reality, so traders trashed the stock, taking it down by 8%.

A closer inspection showed that all the company did was to cut its forecast of US GDP growth to my own, a lackluster 2.5% a year. It largest domestic clients, road and infrastructure builders and those involved in home construction, have seen business drop by half from the 2007 peak. With various stimulus programs running out, and state and local construction spending in free fall, business at home could drop by a further quarter to a third.

Caterpillar has in fact done a spectacular job boosting its international earnings to more than offset dreadful business at home. It's a good thing that Caterpillar occupies a sweet spot in the global economy. It does a massive amount of business with emerging markets, especially China, helping them build their own infrastructure from scratch.

It also is getting huge business around the world from producers of hard assets of every description, including iron ore, gold, silver, copper, uranium, nickel, zinc, and rare earths. The producers of these commodities, BHP Billiton, Rio Tinto, Xstrata, and Anglo American are all announcing record profits. It is a good rule of thumb in business that when your customer is coining it, you can too.

These all have great long term fundamentals. It recent acquisition of Bucyrus (BUCY), a major customer, will give it a leading position of the coal market, fast becoming one of America's largest exports.

-

Time to Scoop Up Some (CAT)