July 28, 2010 - Is it Time to Buy Google on the Cheap?

Featured Trades: (GOOGLE), (IBM), (MSFT), (YHOO), (BIDU)

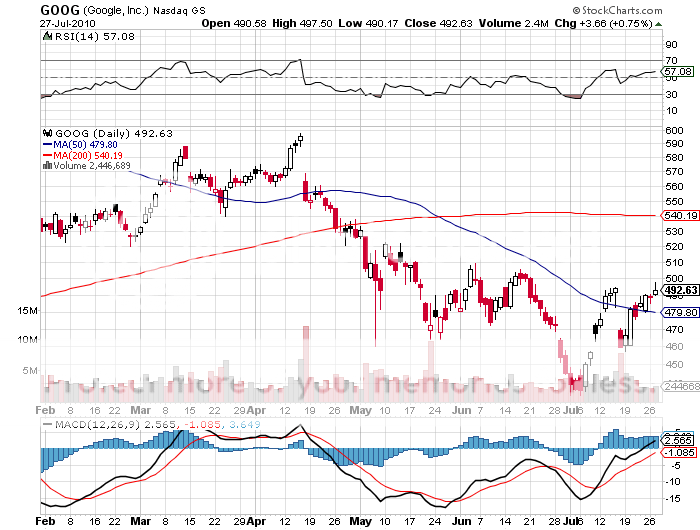

3) Is it Time to Buy Google on the Cheap? As much as I adore Google products and use their search engine all day long, the stock definitely left something to be desired when it was trading in the $600'S. That's why I steered readers away with my piece 'Why I'm Not Buying Google on This Dip' (click here for the link). At the time, Google was at war with China over censorship, the antitrust lynch mob in Europe was baying for blood, Apple was eating its lunch on the mobile front, and copyright and anti piracy lawyers were sharpening their knives. Naysayers predicted that GOOG was the next slow growth IBM (IBM), or worse, Microsoft (MSFT). While these challenges remain, the $400 handle puts it in a completely different kettle of fish. After much sturm and drang, the company renewed its license in the Middle Kingdom. It sits on a staggering $30 billion of cash worth $95 a share, and annually generates another $27 in free cash flow. While it may be a one trick pony, with 97% of its revenues coming from search, that's not a problem if the equine's name is Seabiscuit, with a 70% global market share. Even acquisitions that people originally laughed at, like YouTube, have been turned around, with the online video forum thought to bring in $500 million in profits this year through ad sales, something Google is incredibly good at. Revenues are expected to rise by a not bad 24% this year, delivering profit margins of 32%, on an anticipated $30 billion in revenues, giving it an ex-cash flow multiple of 13. That compares to 19 for Yahoo (YHOO), and a stratospheric 39 for Chinese competitor Baidu (BIDU). I confess, this all appeals to my inner tightwad. It's enough earnings momentum to take the stock back to $700 in a couple years, up 42% from today's level of $492. You might consider adding GOOG to your buy on dips list, especially if a technology frenzy returns, which it inevitably will. Just ignore their space program.