July 30, 2009

July 30, 2009

Featured Trades: (SPX), (DOW), ($XAD), ($CDW), ($NZD), (COPPER), (LUMBER), (WHEAT), (NATURAL GAS), (GOLD)

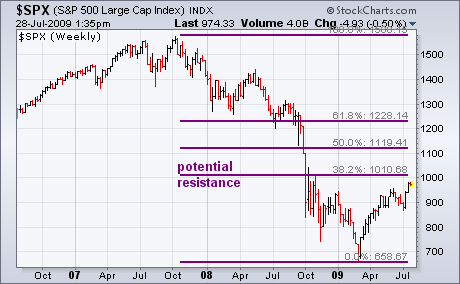

1) OK, so they didn't mention the mosquitoes, the poison oak, or the guy snoring in the next tent on the website. But I'd rather put up with all of that than the absolute dearth of trading opportunities I faced on my return. The S&P 500, the Dow, NASDAQ, the euro, the Australian, New Zealand, and Canadian dollars, gold, copper, lumber, and anything else I like are overbought, bumping up against Fibonacci's, moving averages, RSI's, oscillators, and any other technical warning light you want to mention. Only wheat looks cheap, the greatest growing conditions in history knocking a bushel down to the low five dollar handle (click here for the argument at http://madhedgefundradio.com/June_16__2009.html). Natural gas prices are low, not to be confused with cheap, with every uptick getting smashed with a new field discovery. Only a hurricane can save NG. It's amazing how many people have turned bullish now that everything has gone up for two plus weeks. The only thing that makes sense here is to go short, but not on my first day back. Give me some time to gird my loins and build a risk appetite. And pass the calamine lotion, please.

2) Chicago magnate Sam Zell thinks the big foreclosures won't hit commercial real estate until the institutional holders run out of money in 2-3 years. From 2000 to 2007, half of the commercial properties in the US were sold and releveraged, and even the weaker holders have enough cash flow and reserves to last until then. Having peaked at a higher top, single family homes are now crawling off a much lower bottom, giving a crucial boost to an economy based on consumer spending. I'd call this a future green shoot, if I didn't know that the grizzled property pro was talking his own book. After completing?? a brilliant sale of a huge portfolio of properties to the Black Rock Group at the absolute peak of the market, Sam is now suffering from buyer's remorse with a turbocharger, having rolled the money into the bed ridden and nearly comatose Chicago Tribune/Cubs combo. Sam's favorite overseas foray is Brazil, where a large, growing, educated population backed by rich natural resources, falling interest rates, and a strong currency provide a great backdrop for property investment. China looks good too, but you have to speak Mandarin.

3) A handful of positive data on residential real estate, and all of a sudden everyone is jubilant that the crisis is over. June new home sales popped by 11%, while the S&P Case Shiller Price Index flaunted two back to back monthly gains. Never mind that these are the same people that have been calling a bottom almost every day for the past two years, and who themselves have gone broke in the process. It's a basic law of economics that when you drop the price, the volume goes up. We have not paid enough penance yet. We have not atoned for a generation of under saving?? and overconsumption. The harsh reality is that the torrent of selling is being briefly staunched by a dwindling group of first time buyers once priced out of the market, who saved their cash, and stayed away from the stock market, and are now buying two thirds off the top. Take away the fantastically generous government subsidies that expire in a few months, throw in the next wave of Option ARM reset induced foreclosures, and this market folds like a wet taco shell. I'm waiting to buy at 20th century prices, and make that a home with an indoor swimming pool and basketball court.

4) With the British economy mired in recession, many are wondering if hosting the 2012 London Olympics was such a great idea. The original plan was to convert the one square mile Lower Lea Valley site into a new suburb, and sell the condos to hungry buyers at high prices. Market conditions today couldn't be more hostile. Runaway cost overruns have pushed the budget from $2.8 billion to a back breaking $9.3 billion. The East London neighborhood is so bad that 'when you take the tube out there, life expectancy declines with every stop,' said one staffer. A profusion of undiscovered WWII bombs, a stone aged cemetery, and a toxic waste dump have also caused delays. When I lived in England I flew over this area weekly to skirt the London control zone, and I will be charitable in calling this place an industrial wasteland. The last time the British attempted a major project like this, the 2000 Millennium Park, multibillion dollar losses resulted. But who can forget the film Chariots of Fire? Maybe it's worth it after all.

QUOTE OF THE DAY

'You've got to be the best company in the subspace you are looking at. The number three or the number four market share is worth effectively nothing these days. You see it in cellular, retail, packaged consumer goods, or anything else you are looking at.,' said Larry Haverty at Gabelli global Multimedia trust.