July 9, 2010 - Why I Still Hate Japan

Featured Trades: (JAPAN), (EWJ), (NIKKEI)

Japan iShares ETF

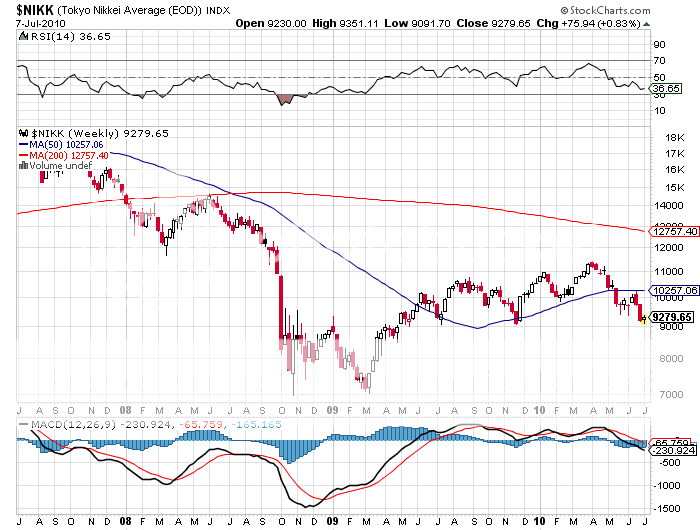

1) Why I Still Hate Japan. Like watching an old friend who fell from the high life as a special bracket investment banker to a stumbling drunk, I can't help but pity Japan's beleaguered stock investors. Since peaking in 1989 at 39,800, they have been mired in a 20 year bear market, the longest in history, and there is no sign of the index climbing substantially off the current 10,000 level anytime soon. I have watched with dismay as GDP growth shriveled from a white hot 10% in the sixties, to 7%, 5%, 3%, and now 1%, and share prices reflect this.

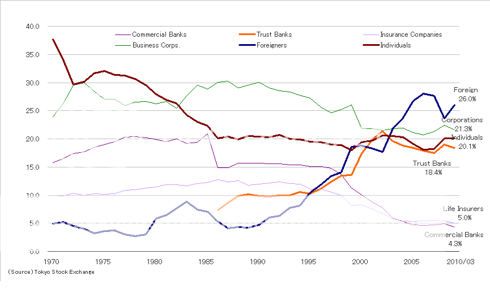

Not even the Japanese want to buy their own stocks, with foreign institutions accounting for up to 60% of trading volume on a good day, while domestic ones generate a paltry 10%. Local investors would much rather buy emerging market funds, currency funds, bond funds, anything but their own equities. This explains the miserable 1.15% yield investors get on ten year JGB's. Nikkei stock index volatility is driven by a handful of foreign hedge funds that rush in, and then right back out.

Although the government launched one Keynesian reflationary package after another during the nineties, the end result was a massive accumulation of debt and a thousand 'bridges to nowhere.' Obama take note.? In four decades I have watched the country degenerate from a paragon of fiscal rectitude to one of the most debt burdened nations on the planet. The country's total debt, net of cross holdings, is 111.6%, and is rocketing towards the 140% now seen in Greece.

Japan used to have a great story up until the eighties, when they were the world's low cost provider of quality manufactured goods. The Nikkei was the place to be when Japan's share of the US car market soared from 3% to 40%, and the yen went hyperbolic from ?360 to ?78. But then a beefy new kid showed up in the neighborhood called China, which has taken over that role. Sure, the quality isn't there yet, but you can't beat those prices! This is why global investors see Asia as a China only bet, and avoid the Land of the Rising Sun like the plague.

Equity price earnings multiples have fallen from 100 down to 15. But even that seems high if the country is only able to eke out 1% GDP growth rate for the foreseeable future. An appreciating yen serves only to tighten the screws on the country's prolific exporters even further. Now it seems they want to raise VAT taxes too. That will simply hobble consumption further. Some 12.7% of Japan's equity is still held in corporate crossholdings, a relic from the old zaibatsu days, that will continue to weigh on share prices. Great thing to have in a rising market, but not so good on the downside.

Japan has the world's worst demographic outlook (click here for my analysis). They're just not making Japanese anymore. Changing governments as often as I change my socks doesn't exactly inspire confidence among foreign investors. What does the center left Democratic Party of Japan (DPJ) stand for, anyway? Politics has degenerated into a scrum of conflicting interests to see who gets a share of an ever shrinking pie.

Independent research analyst Darrel Whitten of Japaninvestor.com (click here for the site ) believes that Japan has to engineer a substantially weaker yen to stimulate exports, aggressively use the Bank of Japan's balance sheet to create inflation, and draw up a new pro growth economic plan, much like the Ministry of International Trade and Industry (MITI) successfully engineered in the fifties. I won't be holding my breath. The strong leadership and ironclad consensus that created the Japanese economic miracle isn't to be found these days. Until then, Japan will, at best, be a single stock story, with money pouring into companies that can still prosper against these incredible force nine gales.

I have made such a massive personal investment in Japan, living there ten years, learning their impossible language, and publishing several books on the topic. I wish I had better news to report. But I don't.

Ownership of Japanese Equities