June 12, 2009

June 12, 2009 Featured Trades: ($WTIC), (CRUDE), (COPPER), (FCX)

1) Since energy is going to be the dominant factor in making our investment decisions for the next decade, I thought it would be a good time to sit down with Carl Pope, Executive Director of the Sierra Club. Carl is as sharp as a tack, with the fervor of an evangelist, always a dangerous combination. In the spirit of full disclosure, I have to tell you that I was a member of the Sierra Club back in the sixties when they were mostly interested in identifying mountain wildflowers and bird calls. They changed a little after that. Carl says that the ?Earth has a fever,? with temperatures rising, glaciers melting, forests burning, oceans rising and acidifying, and the overwhelming cause is hydrocarbon burning. The US needs to cut CO2 emissions to 2 tons per person, per year, by 2050, or down 90% from today?s levels. To do this we need to ban the burning of coal by 2030, unless it is sequestered, and stop all petroleum consumption by 2040. We can accomplish this by converting all cars to electric and moving freight via an electrified rail system. Petroleum needs to be classified as toxic waste, and a cleanup superfund needs to be set up, funded by 10% of the earnings of the oil companies for the next ten years. If we eliminate oil consumption, our trade deficit will improve by $100 billion/year, that money can be invested in the US to create 10 million jobs, and we will all be a lot healthier. The biggest and quickest way to cut CO2 emissions is to convert all coal fired power plants to natural gas immediately, and Carl likes the Pickens plan (see my May 15, 2009 Newsletter ). Carl is not shy about using his 40 man Washington DC office to twist the arms of recalcitrant Senators and Congressmen to achieve these ambitious goals. I had to pinch myself. The Sierra Club has backed off from its earlier, more radical positions, and that much of what they are saying makes good economic sense. No more going back to a bicycle based economy. While 40 years is not exactly tomorrow, look how fast the last 40 have gone by. Remember pedal pushers, thin ties, fins on Chevy?s, and the Bay of Pigs? When contemplating your risk positions, you always have to consider all views. Who knew that $147/barrel would turn us all into environmentalists?

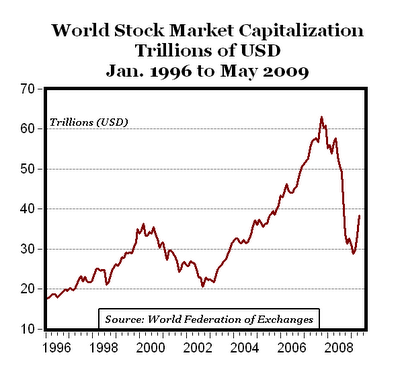

2) I am constantly in search of the big macro numbers that explain the world to me, so it is with some fascination that I publish the chart below, courtesy of Mark Perry, which wonderfully quantifies the carnage we have endured since the 2007 peak.?? World stock market capitalization fell $35 trillion, or 54%. It has since bounced by $10 trillion over the last three months. Do you feel $10 trillion richer? I don?t think so. And you may be about to give up $5 trillion of that. If you throw in real estate and commodity losses, and net out gains from US Treasuries with losses in private bonds and derivatives, the net, net, net is that we went from a $100 trillion world to a $50 trillion world in two years. If I?m wrong on these figures, you can always deduct the difference out of my next paycheck.

3) Very, very rarely I find a comment that is so brilliant, that I feel obligated to quote it verbatim, in its entirety. Anything less would dilute its meaning. This is what Defense Secretary Robert Gates said in a recent issue of Foreign Affairs. ?Repeatedly over the last century, Americans averted their eyes in the belief that events in remote places around the world need not engage the United States. How could the assassination of an Austrian archduke in the unknown Bosnia and Herzegovina affect Americans, or the annexation of a little patch of ground called Sudetenland, or of a French defeat in a place called Dien Bien Phu, or the return of an obscure cleric to Tehran, or the radicalization of a Saudi construction tycoon?s son?? There is wisdom here for hedge fund managers and the rest of us too.

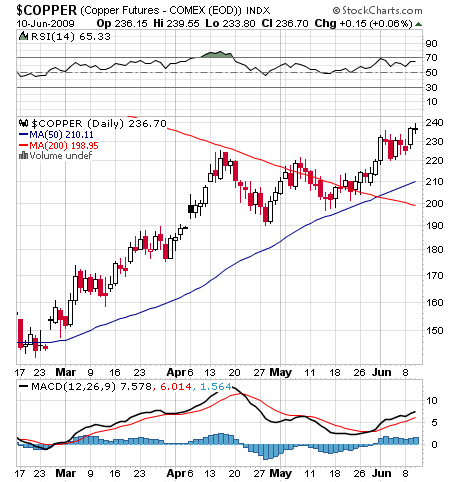

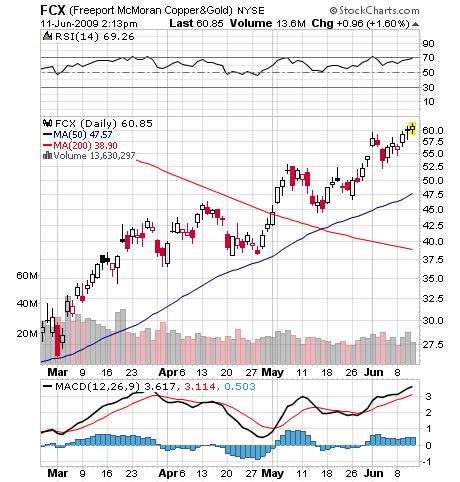

4) I have to tell you that my old friend, Dr. Copper, the only commodity that has a PhD in economics, has decisively broken resistance at $2.25 and hit a new high for the year at $2.40, up 78% from the year?s low. If you recall, I was feverishly pounding on the table trying to get people to buy the red metal at $1.35 in January. I also was pushing the world?s largest copper producer, Freeport McMoran (FCX) at $30. Is this the definitive breakout that will lead us into the next leg of the global equity bull market? I don?t know, but there is one thing that makes me feel queasy. Our illustrious state?s public employee pension fund, CALPERS, has announced that it is again making asset allocations to the commodities area. When they did this a year ago, it all ended in tears, putting in the spike tops in every commodity across the board, followed by the mother of all crashes. California teachers saw their pension payments cut. You would think that once burned is twice forewarned. Is history about to repeat itself? CALPERS, with $170 billion in assets, down a third from the peak, it?s just too big to play in this space. This is the playground of end commodity producers and professional traders. It?s like sharing a very small cage with a very large, 800 pound gorilla, who, oops, is horny. All they can do is damage. Better for them to go back to being a closet global index fund. But keep an eye on Dr. Copper anyway.

QUOTE OF THE DAY

?I?d rather lose an opportunity than lose capital,? said Doug Kass, President of Seabreeze Partners.