June 19, 2009

June 19, 2009Featured Trades: (EEM), (FXI), (MSFT)

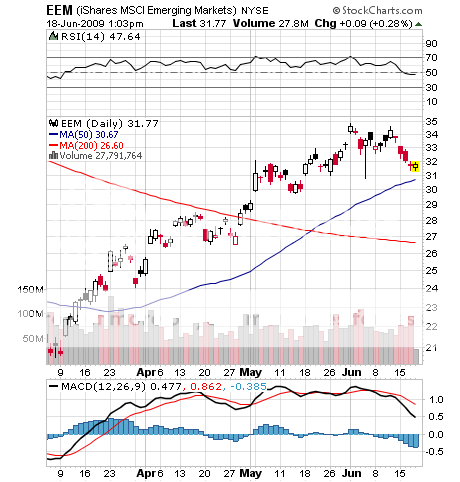

1)I managed to get my former Morgan Stanley client on the phone, Templeton emerging market honcho Mark Mobius. This is almost impossible to do, since Mark virtually lives on his Gulfstream, jetting near and far in search of the next great undiscovered investment pick. Mark is the only guy I know who has been studying emerging markets longer than I, as long as I don?t count that time I almost got my ass shot off in Algeria in 1968. We?ve both been doing this since most of the populations in these countries were barefoot. Emerging markets are still the place to be, especially China, Thailand, Brazil, Mexico, Turkey, and South Africa, but don?t take your eye off the ball, because the volatility in these markets can be huge. China will continue to lead the global market recovery. Commodities are a buy, as are their producing stocks. You also want to own consumer stocks in countries where there are rising standards of living.?? Russia took it on the nose last year, but will get bailed out by a rising price of oil, and in any case, is economically much stronger than its last crisis in 1998.?? If you are going to play in this space, it is best to diversify to spread around?? risks. No country has a monopoly on making money. Also be patient and invest for the long term. These markets can be tough to trade. All great advice to live by. I think you need to keep the emerging market ETF (EEM) and the China ETF (FXI) permanently on your radar.

2) I had a chat with Bill Gates, Sr. last night, co-chairman of the Bill and Melinda Gates Foundation, the world?s largest private philanthropic organization. There, a staff of 800 help him manage $30 billion. The foundation will give away $3.1 billion this year, a 10% increase over last year. Some $1.5 billion will go to emerging nation health care, and another $750 million to enhance American education. The foundation?s spending in Africa has been so massive, that it is starting to have a major impact on conditions, and is part of the bull case for investing there. The fund happens to be one of the best managed institutions out there, having sold the bulk of its Microsoft (MSFT) stock just before the dotcom bust and moving the money into Treasuries. Mr. Gates? pet peeve is the precarious state of the US K-12 public education system, where teaching is not as good as it could be, expectations are low, and financial incentives and national standards are needed. When asked about retirement, he says ?having a son with a billion dollars puts a whole new spin on things.??? Now a razor sharp 83, his favorite treat is the free Net Jet miles he gets from his son Bill every year. In his memoir Showing up for Life, he says a major influence on his life was his Scoutmaster 70 years ago. Being an Eagle Scout myself, I quickly drilled him on some complex knots, and he whipped right through all of them. The world needs more Bill Gates Srs.

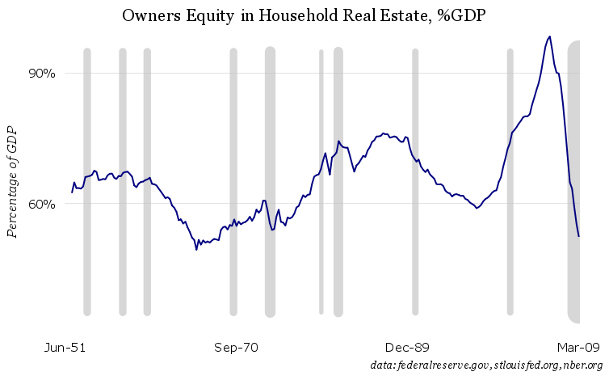

3) Henry Blodget?s Clusterstock (http://www.businessinsider.com/clusterstock) has this great service called the ?Chart of the Day?, which occasionally sends out some real lulu?s. Take a look at the chart below, which illuminates the incredible decline in American home equity since 2007, plunging from 100% to 50% of GDP. We are rapidly approaching the 1965 level, and could reach a percentage not seen since the fifties this year. If you know any ?green shoots? cheerleaders out there, you better e-mail them this chart. If Americans have just lost much of their largest asset, who is going to spend us out of this recession?

4) Since I am an avid collector of investment scam stories, I?ve got to update you on what?s been coming out of Switzerland. Two Japanese nationals were caught smuggling $134 billion in US Treasury bonds from Switzerland to Italy in a false bottom suitcase. No that is not a typo, that is ?b? for billion. The two were mysteriously let go the next day. The blogosphere is exploding with conspiracy theories about the paper, which is almost certainly fake. Are there now so many T bonds out there that $139 billion of bogus ones can easily disappear into the mix? Personally, I see North Korea?s and the Japanese yakuza?s fingerprints all over this. Fake bonds can?t be traded, but I can think of any number of banks in Switzerland that would unwittingly accept them as collateral. But collateral for what? Why do I expect George Clooney and Brad Pitt to pop up on this one. (Ed note: please see gratuitous attempt to include George Clooney?s photo in a financial newsletter for the female readers).

QUOTE OF THE DAY

?Some of the green shoots may be poison ivy,? said Art Cashin, director of floor operations at UBS Financial Services.