June 3, 2011 - Here Comes the Double Dip

Featured Trades: (HERE COMES THE DOUBLE DIP), (TLT), (TBT), (JNK), (SJB)

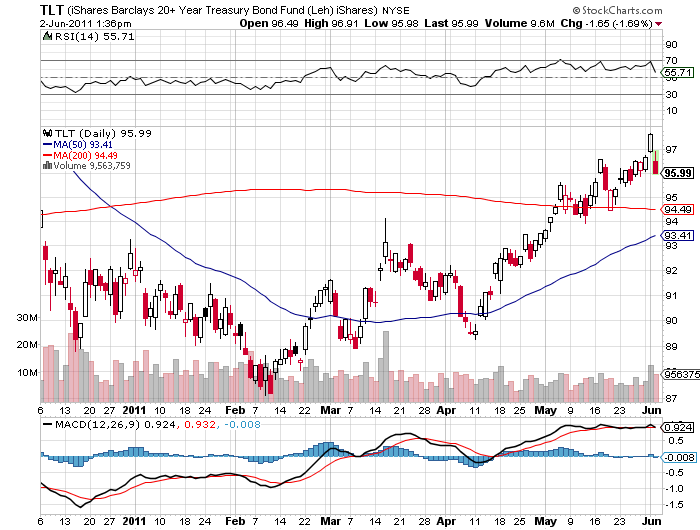

1) Here Comes the Double Dip. With yields on ten year Treasury bonds piercing below the 3.00% level through to 2.95%, you now have to take seriously the possibility of a double dip recession. This is particularly concerning given that bond markets are usually right, and equity markets are usually wrong, when forecasting the future direction of the economy. That makes stocks look especially expensive right here.

Look at the chart below to see that the ETF long dated bonds (TLT) has rallied a full ten points since I made my bullish call on fixed income in March. This was not an easy call to make, as the consensus then was for a coming collapse of Treasury bond prices in the run up to the end of QE2.

It was such a bold call that others talked me into keeping the position small, always a big mistake. As hedge fund legend George Soros taught me, 'Anything worth doing is worth doing big.' The chart for the (TLT) is now starting to resemble that for silver a month ago. You would be mad to initiate new longs here.

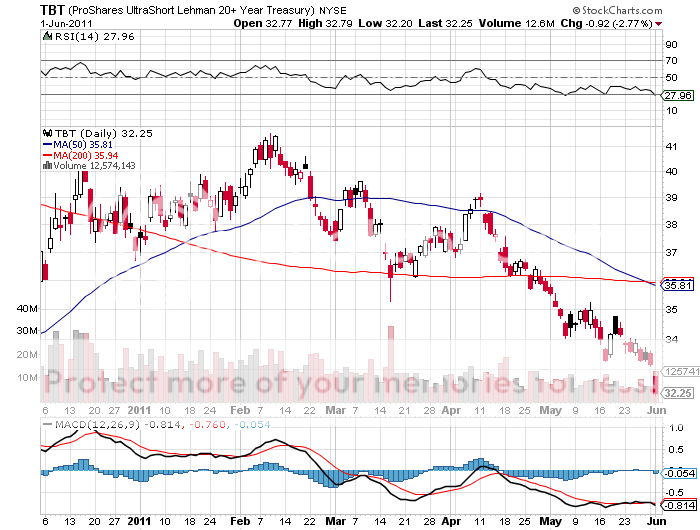

Which brings me to the chart for the inverse long dated Treasury short ETF (TBT). No security has been taken out to the woodshed and spanked more severely, falling 24% since its February peak. I made a killing in the (TBT) in December, nimbly stepped out in January, and never went back. The (TBT) has a double burden here, since as a -2X leveraged fund you are short twice the coupon on the underlying bonds. That takes the cost of carry to a hefty 7% a year, more than 50 basis points a month, down from the 9% we saw at the beginning of the year. When it gets to 6%, last year's low, call me.

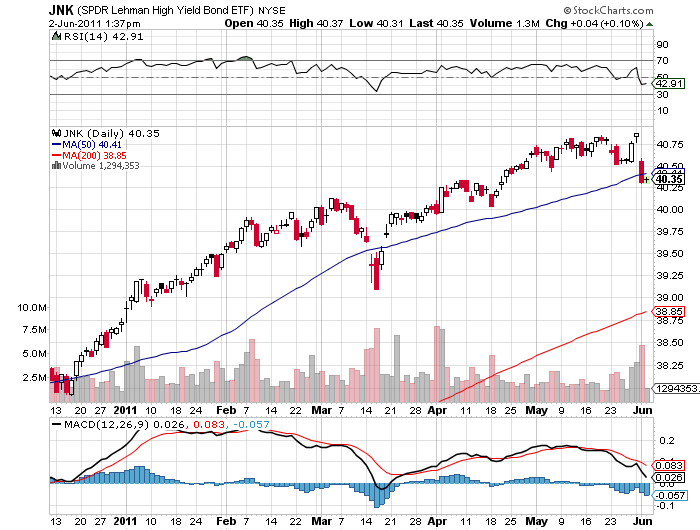

There is one corner of the fixed income universe that continues to pique my interest. If stocks fall, junk bonds will not be far behind, as these issuers are least able to cope with the blunt force of another slowdown in the economy. They are historically very expensive, with spreads over Treasuries at all-time lows. That makes the newly issued short junk ETF (SJB) especially interesting.

-

-

-

-

Is the Double Dip Coming?