Just Good Enough

This earnings season is chugging along exactly like I thought it would play out.

The haves are covering for the have-nots.

Sadly, the pixie dust isn’t encompassing all tech stocks, but just enough sprinkles so investors don’t start selling.

That is what matters most and sure, investors can knit-pick all they want, but there have been just enough positive numbers to be repackaged as a win for AI and the advancement of tech even if the proverbial goalposts are widening.

Competition has reared its ugly head as tech services fight for the extra consumer and enterprise dollar in a global economy where demand is being squeezed by sticky inflation.

That’s not good news for many of the smaller companies that are unproven and tap debt by delivering a promising story to prospective investors.

Remember that Mr. Market is undefeated and price will always find its natural equilibrium.

The question is how long will it take to find that natural equilibrium?

Since 2020, many would say that the irresponsible monetary policy in many areas of the world has contributed to markets unable to match up buyers and sellers at a reasonable price.

There is some truth to that but let’s see who that benefits.

My belief is that strong tech companies have overly benefited from this type of fiscal backdrop because they can always fall back on a strong balance sheet like in Google’s case where it suddenly issued a dividend.

View it as a rainy day fund if you will where they can wield when need be.

The extra buffer zone of safety has allowed a company like Microsoft to focus on Azure growth, of which 7% was related to AI, up from 6% of impact in the previous quarter.

Microsoft provides cloud services for the ChatGPT chatbot from startup OpenAI, and companies have been increasingly adopting Azure AI services to develop their capabilities for summarizing information and writing documents.

It’s a good problem to have when capacity bottleneck cuts into the AI portion of Azure growth.

Companies tapping that AI story are the only tech companies in 2024 that Mr. Market is keeping safe and that must scare or enthrall you depending on who you are.

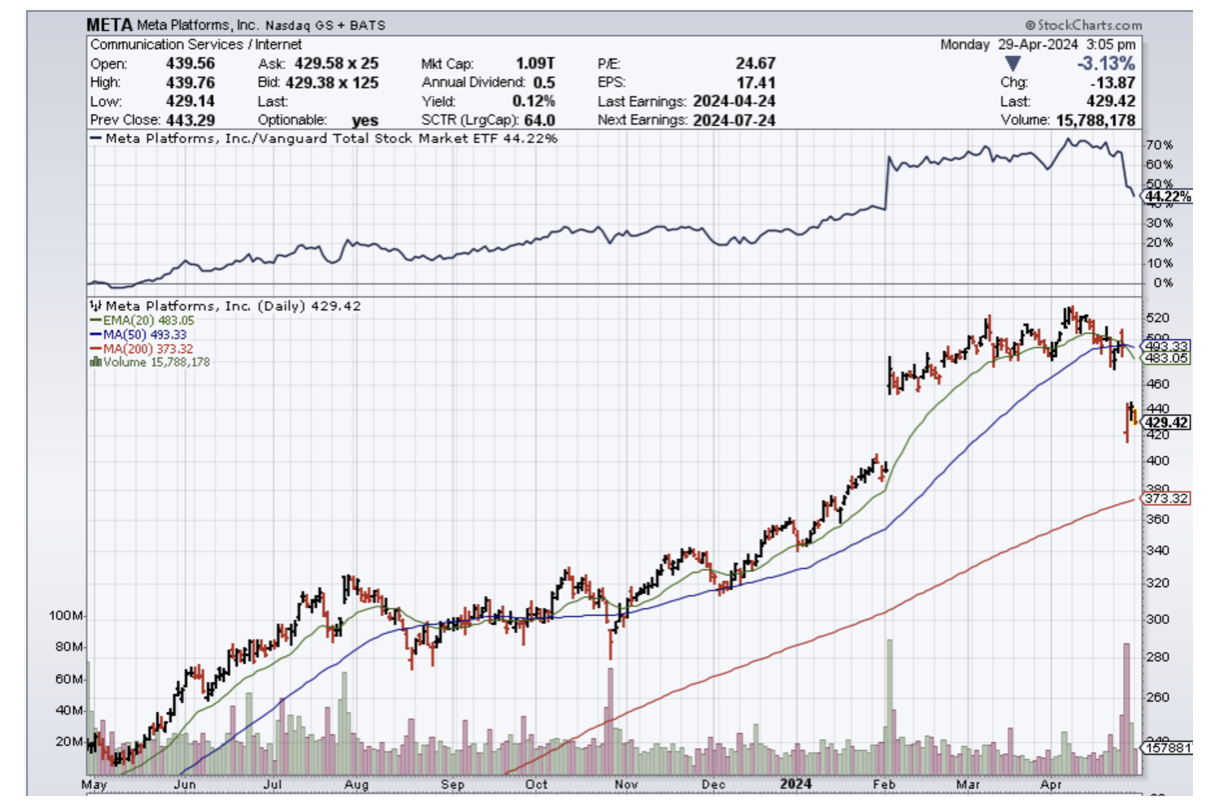

Meta (META) materially lifted its full-year capital expenditures guidance and signaled even bigger spending in 2025 — all because of unknown AI projects. Running tech businesses isn’t getting cheaper so imagine how small companies feel about that.

It’s Ford (F) losing lots of money on EVs because of higher-than-expected costs.

Meanwhile, IBM (IBM) CFO Jim Kavanaugh struck a more cautious note when asked about soft sales at its lucrative consulting business blaming the macroeconomic backdrop.

It’s not all smooth sailing in tech land and readers need to be vigilant.

It’s not the time to take some speculative Hail Mary on some far reach.

Don’t draft a 7th-round prospect in the 1st round.

Price action has been unkind to tech firms with poor balance sheets in 2024 and I believe that trend to continue until the Fed can finally tamper inflation back to reasonable levels.