Keep a Close Eye on Freeport-McMoRan

It is clear from the improving economic data from China that the hard landing scenario is off the table. It is all part of the synchronized global economic recovery that is powering financial markets everywhere.

This is great news for the producers of everything that the Middle Kingdom buys in bulk, especially copper.

If you like copper, you've got to love Freeport-McMoRan (FCX), one of the world's largest producers for the red metal. These factors explain the sizeable insider buying that has been taking place in the shares over the past months.

The technical picture is looking pretty positive as well. The chart is showing that a strong upside breakout took place in the fall, supported by a sharp turn up in the 50-day moving average. This is universally positive for share prices.

This commodity is known in the investment industry as Dr. Copper, the only metal that has a PhD in economics. That's because of its uncanny ability to predict the future of the global economy.

Copper is now screaming of better things to come, along with the stock market, like a 3.5% GDP growth rate in the US this year, and stronger growth elsewhere.

The recent strength further is confirmed by longer-term charts for the Shanghai index ($SSEC), which is showing that a double bottom may well be in place.

Copper was the first metal used by man in any quantity. The earliest workers in the red metal found that it could be easily hammered into sheets and worked into shapes, like swords, which became more complex and artistic as their skill increased.

The ability to resist corrosion ensured that copper, bronze and brass remained as functional as well as decorative materials during the Middle Ages and through the Industrial Revolution to the present day.

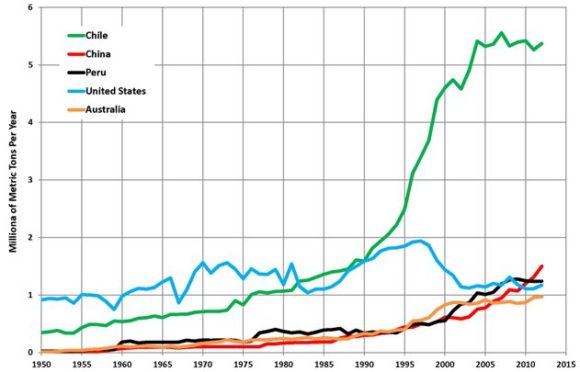

Of the 19.1 million metric tonnes of copper produced in 2015, the latest year for which figures are available, Chile was far and away the leader, with 5.76 million metric tonnes. It was followed by China at 1.71 million tonnes, Peru at 1.7 million tonnes, and the US at 1.38 million tonnes.

This makes the Chile ETF (ECH) another great backdoor play in copper, which is up a ballistic 178% in two years.

As copper is a great electrical conductor, it is primarily used for electrical wiring, followed by the construction industry and shipbuilding, and the auto industry, especially in the rapidly growing electric vehicle space.

It's true that copper is no longer the dominant metal it once was, due to a structural global oversupply in shipping and the ongoing transition of the Chinese economy from a manufacturing to a services economy. Their copper intensive infrastructure is already largely built out.

Because of the lack of a consumer banking system in the Middle Kingdom, individuals have been hoarding 100-pound copper bars and posting them as collateral for loans. Get any weakness of the kind we saw in 2015, and lenders panic, dumping their collateral for cash. That's what made the early 2016 bottom.

The high frequency traders are now also in there in force, whipping around prices and creating unprecedented volatility. You can see this also in gold, silver, oil, coal, platinum, and palladium.

This is why I am spurring readers into the shares of Freeport McMoRan. The gearing in the company is such that a 50% rise in the price of copper triggers a 100% rise in (FCX).

More conservative and less leveraged investors can buy the First Trust ISE Global Copper ETF (CU).