Looking Forward to Tech in 2022

Another pandemic year is on the verge of being in the books and we need to look yonder to 2022 and what it can offer.

Now that billions are being poured into the project, it’s not weird to say that advanced technology and the arteries and ventricles surrounding it, will all lead to developing this new world called the Metaverse.

The metaverse is a hypothesized iteration of the Internet, supporting persistent online 3-D virtual environments through conventional personal computing, as well as virtual and augmented reality headsets.

And I am not saying this is a new thing just to be cool, analyzing thousands of earnings reports, it’s clear that companies are deploying human capital around gaining a slice of this future Metaverse.

This idea is so prominent that Facebook (FB) changed its name to Meta to signal its commitment to this new technology.

Next year will be the year that we get closer to the real deal — a fully functioning Metaverse even if it might just be a beta version.

And it’s not just Facebook, Apple (AAPL), and Microsoft (MSFT) and the rest are in it too with Nvidia’s (NVDA) chips serving as a building block of the Metaverse.

Naturally, related technologies will be of great importance, and I can easily see a greater surge in augmented reality (AR) interest.

People should also keep a close eye on the introduction of Meta's internet-of-VR.

The idea of the metaverse and an advanced VR world must be seen through the prism of the pandemic which has forced us to become digital first even if many of us aren’t native digital users.

Many of us have had to learn on the go, for instance, download that Zoom video conferencing software or upgrade our home office.

This torrent of internet usage has its pitfalls like explosive growth in cyberattacks, making cybersecurity more important than ever.

Cybersecurity will no longer be seen as an “added extra” by organizations and will be built into the DNA of any and every IT system, from supply chains to infrastructure and devices.

Our reliance on internet leads nicely into 2022 becoming the year when 5G became mainstream.

We are edging towards that point where we need that extra speed to harness our work devices and to wield them in the most efficient and optimal way.

Many of you have had to upgrade data packages, build robust infrastructure into your home office and I don’t mean just buying a better office chair.

This could see the rise of “digital cities” along with new smart mobility services such as autonomous vehicles and 5G connected bicycles. We could also see a rise in private 5G networks for businesses in manufacturing and logistic sectors.

A new era of private connection for businesses will be launched, enabling greater data-driven insights and real-time business decisions.

2022 will see businesses continue to neglect the traditional office and many companies will be at best — hybrid.

We might start seeing companies go bankrupt because they can’t convince any workers to show up in physical form.

It’s already happening to the workers I talk to where limited remote working opportunities when interviewing for new jobs is a deal-breaker.

Next year is also when we finally see artificial intelligence on steroids.

The explosion of AI-powered gadgets, apps, websites, and tools is here for 2022.

It'll become harder to differentiate chatbots from human customer support agents. Other products such as future content recommendations on social media and streaming websites are likely to come from an AI rather than traditional data analysis.

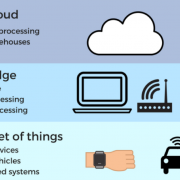

The Internet of Things, AI, and automation will aid businesses to fill gaps created by the labor shortage while optimizing staff. In retail and hospitality, this will take the form of self-serve kiosks, autonomous order fulfillment, and AI-enabled drive-thrus, all freeing people up for higher-skilled roles.

Ultimately, an explosion of data requirements will offer complex challenges to firms that must manage large amounts of data.

This goes triple for many companies still struggling to fully digitize.

Although it’s hard to visualize, our reliance on technology will keep growing and the winners will be the ones who can harness these new technologies to supercharge their financial profiles.

It’s not that I am boring, but the companies leading the new stage of digital technologies are the biggest and richest of Silicon Valley, and I would rather ride the bandwagon with them than try the sexy contrarian play, especially with higher interest rates hurting start-up culture.