Mad Hedge Fund Trader Hits New All Time High With 41.6% Gain in 2014

I am writing this to you from my lakefront estate at Incline Village, Nevada. I thought I?d get one more 100-mile hike in before the heavy snow falls. By now the mountain lions have migrated to lower altitudes so it?s safer.

I?ll need the fresh air to map out my trading strategy for 2015 to please the many new subscribers who have recently come on board. This market has killed off a large number of pros this year, and is getting trickier by the day.

After enduring the turmoil of one of the worst Octobers on record, it turned out to be our best month of the year. Followers closed the month up a mouth watering 6.69%.

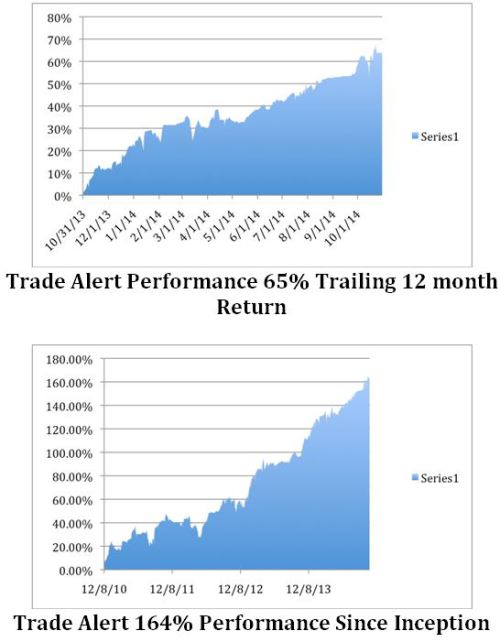

That brings us to a profit of 41.6% for 2014, not a bad number to nail to the mast.

This is compared to the miserable performance of the Dow Average, which is up only 2% during the same period. That was on the heels of blockbuster 5.01% gain in September.

The nearly four year return is now at an amazing 164%, compared to a far more modest increase for the Dow Average during the same period of only 35%.

I was actually up 10% at the highpoint last month. I played the month perfectly, running big shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) and covering them right at the bottom.

Then, I went aggressively long Delta Airlines (DAL), Gilead Sciences (GILD), Apple (AAPL), and the (SPY), catching the ferocious rally that followed, and shaking it by the lapels for all it was worth.

Hefty short positions in the euro (FXE), (EUO), and the Japanese yen (FXY), (YCS) were worth their weight in gold. When the Bank of Japan let loose a flock of black swans with their shock and awe monetary easing, the profit on our (FXY) had already been maxed out, while the (YCS) holders caught the entire once in a lifetime, one day 6 point move.

To show you how perfectly things were going, I even managed to come out of a long suffering (TBT) position for a small profit after yields backed up on the ten year Treasury from 1.86% to 2.35%.

Then I came to the bridge too far. Thinking that the market couldn?t possibly rise 10% in two weeks, I sold short an (SPY) November $197-$202 call spread. Wrong! By the time I was stopped out some 6% was knocked off my performance this year.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past seven years. No one got wiped out. No one got a margin call. I quickly cut the highest risk positions, enabling me to ride out the storm with the rest. It all worked.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes?Global Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

You Really Needed a Suit of Armor to Survive October!

You Really Needed a Suit of Armor to Survive October!