Mad Hedge Market Timing Index Showing "Extreme Buy"

I found a new great way to predict the stock market. Launch a new technology research and trade mentoring newsletter and it will crash within days. It works 100% of the time.

It is often said that that the stock market has discounted 11 out of the last five recessions.

This is one of those times that the stock market has discounted a recession that isn't going to happen, not for at least two years anyway.

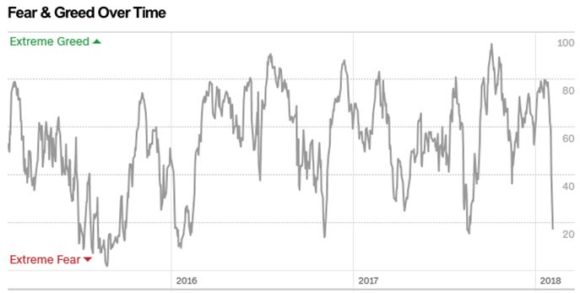

With my Mad Hedge Market Timing Index at a very rare "Extreme Buy" reading of 18, I have to buy stocks here or shoot myself in the head.

Not only is the index shouting out its strongest "BUY" signal in three years, all 30 of the data inputs are individually at the lowest levels in three years, or in nine years!

I believe the bottom in the stock market is in.

We may see continued high volatility. May see a terrifying marginal new low. We may see the Mad Hedge Market Timing Index bounce around here in the teens for a couple of weeks.

But for grizzled veterans like me it is now time to back up the truck and load up on the high-quality names which are on sale. The risk/reward of adding new positions here is overwhelmingly in favor of RISK.

It's "RISK ON" baby.

This is why I stopped out of my gold (GLD) long position with a small loss with only seven trading days to go. There is no need for a hedge in a rising market. Watching gold's price action today, other traders obviously feel the same way as me.

If you CAN'T bring yourself to hoover up stocks here, you better get out of the business.

Let me give you a few reasons why.

The short volatility industry is now completely gone. It disappeared in a few frantic hours on Monday night, leaving investors with some $8 billion in losses.

Never again will we see (VIX) short covering on such a massive scale, which then feeds into the stock market, triggering these massive 1,000 point air pockets we saw (more pilot talk here).

Not only that, all of the hot money is out of the market as well, stopped out when shares cratered. There is now a ton of money looking to get back in.

We also still have three more months of seasonal strength for shares, which usually ends in May.

Finally, the economy is getting stronger, not weaker. The last two weeks have been similar to 1987, when the Dow Average collapsed by 22% in a single day, but the economy just kept blithely powering on.

Those who held on in October, 1987, as I did, made back all their losses by the end of the year.

Even though the "BUY" signals are among the highest I have ever seen, I am still remaining my usually cautious, circumspect self.

As they teach you at the Marine Corps Flight School in Pensacola, "There are old pilots, and there are bold pilots, but there are no old, bold pilots."

All of my options spreads I am adding here will remain at their maximum potential profit point, even if the underlying shares fall another 10%-20%. You have to allow them room to breathe.

Keep in mind that I am taking a "Tiffany's approach to investment here. All of these companies I have been sending Trade Alerts on I have either been covering for 45 years, or with the tech names, since they were founded in the seventies, eighties, nineties, or 2000's.

In other words, I know them extremely well. You are only getting the best of the best.

So load the boat, fill your boots, and go pedal to the metal. If these stocks go wrong, they can always move in with you.