(PLTR), (ARM), (AMZN), (MSFT), (GOOGL), (NVDA)

Investing trends come and go faster than your wives or girlfriends can change their minds about dinner plans. But every once in a while, a trend comes along that's got some serious staying power. I'm talking about the kind of trend that makes investors filthy rich and leaves the rest of us kicking ourselves for not jumping on the bandwagon sooner.

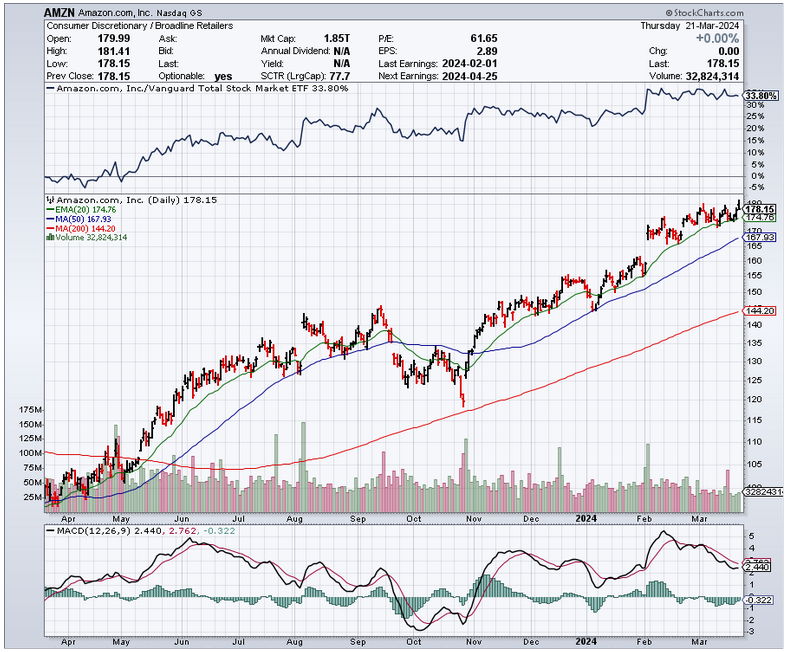

Just look at the cloud computing craze. Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL) have been raking in the dough with their fancy cloud services, to the tune of $64 billion in just the last quarter.

But before the cloud, it was the internet that had everyone buzzing. And let's not forget about the automobile – that baby dominated the 20th century like a boss. The common thread? Efficiency and practicality. We humans just can't resist anything that makes our lives easier and more productive.

And that brings us to the latest and greatest enduring trend: artificial intelligence (AI).

Now, I know you're probably thinking, "Hey, isn't everyone and their mother investing in AI these days?" And you'd be right.

But here's the thing – not all AI stocks are created equal. You need to be smart about where you put your money, or you'll end up with a portfolio full of duds.

As the legendary investor Peter Lynch once said, "Know what you own and why you own it." In other words, before you jump on the AI bandwagon, make sure you understand the companies you're investing in and the reasons behind their potential for success.

It's not just about chasing the hottest trends or getting caught up in the hype. It's about doing your due diligence, looking under the hood, and identifying the businesses with the right ingredients for long-term growth and profitability.

And that's exactly why I'm excited about companies like Palantir Technologies (PLTR) and Arm Holdings (ARM). These aren't just any old AI stocks – they're well-established players with unique strengths and a proven ability to innovate and execute in this fast-moving field.

Let's start with Palantir. Now, I know their stock might seem a bit pricey, but trust me, they're proving the naysayers wrong.

The knock on Palantir was that they couldn't turn a profit to save their lives. Well, guess what? They just reported their fifth straight profitable quarter. And don't even get me started on their commercial business – it's growing like a weed on steroids.

At its core, Palantir's software is all about helping businesses and governments make sense of their data. It's like having a super-smart assistant who can crunch numbers, spot patterns, and give you the insights you need to make better decisions. And with their new Artificial Intelligence Platform (AIP), they're taking things to a whole new level.

Next, let's talk about Arm Holdings.

Back in 2020, Nvidia (NVDA) was so hot to trot for Arm Holdings back, to the tune of $40 billion. Do you know why? It's simple, really – Arm is the backbone of the semiconductor industry, and without them, the AI revolution would be running on fumes.

You see, for AI to work its magic, you need some seriously powerful chips that can crunch through massive amounts of data at breakneck speeds, all while sipping power like a Tesla (TSLA). And that's where Arm comes in.

But, here's the thing – Arm doesn't actually make the chips themselves. They're more like the brains behind the operation, designing the blueprints (or "architecture," as they like to call it) that other companies use to bring these high-tech wonders to life.

And every time someone uses an Arm design, ka-ching! Arm gets a nice little payday in the form of royalties and license fees.

In fact, 99% of smartphones out there already have Arm's technology inside. That's right, you're probably using Arm's tech every single day without even realizing it.

We're talking about a massive market here. To date, a whopping $280 billion worth of chips built on Arm's designs have been shipped worldwide. That's a lot of zeros, and it just goes to show how critical Arm is to the future of AI and the semiconductor industry as a whole.

And with the AI race heating up, demand for Arm's designs is going through the roof. Their revenue might not be mind-blowing yet, but the backlog of orders tells a different story – it's up a whopping 38% to $2.4 billion.

Now, I know what you're thinking – these stocks aren't exactly cheap. But, the reality is, sometimes you've got to pay up for quality. And when it comes to AI, Palantir and Arm Holdings are the cream of the crop.

My advice? Don't go all-in on one stock. Spread your bets, buy a little at a time, and be ready to pounce when the market gives you a discount. AI is the future, and these two companies are leading the charge.