(MSFT), (AMZN), (GOOG), (PLTR), (LMT)

Here's something that would have sounded crazy a few years ago: the US government has suddenly developed an expensive taste for artificial intelligence.

Not just a casual interest, mind you, but the kind of enthusiasm usually reserved for Pentagon hardware projects.

In fact, the Department of Defense is positioning itself to become the most eager AI customer since ChatGPT hit the scene.

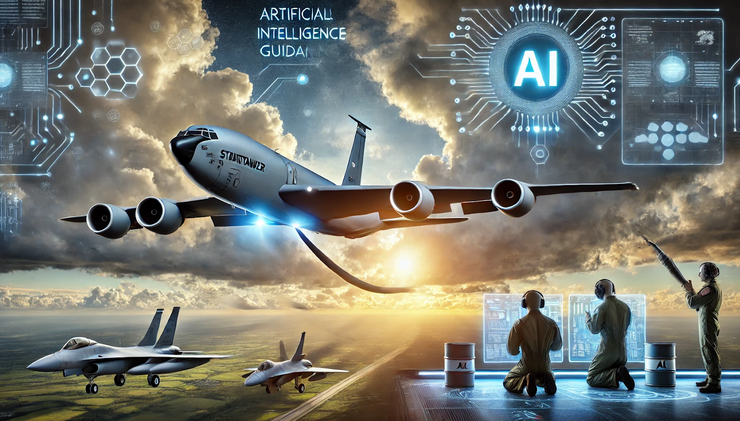

While traditional defense giants like Lockheed Martin (LMT) still dominate military hardware contracts, Microsoft (MSFT), Amazon (AMZN), and Google (GOOG) are already expanding their AI data centers.

Though if you ask them directly, they'll probably just call it "infrastructure investment." That sounds better in shareholder meetings.

But the real story here is how companies like Palantir (PLTR) might hit the jackpot.

They've spent years building technology that makes government agencies salivate, and now their patience might finally pay off. The shift is so significant that even traditional defense contractors are probably wishing they'd paid more attention during those early AI briefings.

Speaking of unexpected winners, let's also talk about Tesla (TSLA).

While most electric vehicle companies are bracing for a rough ride under potential policy changes, Tesla's sitting pretty.

It's not just because Elon Musk has friends in high places - though that certainly doesn't hurt. Tesla's built the kind of manufacturing scale that makes government incentives nice to have but not essential for survival.

Add in some potential tariffs that might keep Chinese EVs at bay, and suddenly Tesla's position looks even stronger.

Let's take a quick look at Tesla's autonomous driving program - because this is where things get really interesting.

Internal timelines are getting more aggressive, especially as they're neck-and-neck with Chinese companies in the self-driving race.

When I look at the numbers, I almost have to do a double-take: we're talking about a potential $40-$50 jump in share price and a market cap cruising past $1 trillion if they roll out full autonomy in 2025.

Everyone seems to buy the story - Tesla stock recently shot up 14.8% to $288.53, and I suspect that's just the beginning.

The FTC situation adds another layer to this already complex cake. Their commissioner, Lina Khan, who's been giving tech executives headaches, might be heading for the exit.

The Street's betting that her departure could spark the kind of merger activity we haven't seen since AOL thought buying Time Warner was a good idea.

Meanwhile, Apple (AAPL) presents its own peculiar puzzle. Despite all the tough talk about 60%+ tariffs on Chinese goods, Tim Cook's empire might get special treatment.

It makes sense when you think about it - having 80% of your iPhone production in China tends to focus the mind wonderfully.

As for Amazon, they’re sweating bullets. Their marketplace sellers are more tied to Chinese manufacturing than a factory in Shenzhen.

Which brings us to semiconductors, where the story gets even more complex. Remember the CHIPS Act? It was supposed to be America's answer to Asia's chip dominance.

Now it's caught in political crosswinds, with House Speaker Mike Johnson performing the kind of policy reversal that would make an Olympic gymnast proud - first suggesting repeal, then backing away faster than a cat from a cucumber.

Even Trump jumped into the fray on Joe Rogan's show, calling the chip deal "so bad" it made his trade war look subtle.

His solution? Classic Trump: slap tariffs on imported chips until companies build factories here. It's like using a sledgehammer to hang a picture - effective, maybe, but subtle it ain't.

For those trying to navigate this policy maze, the message is clear: government AI initiatives aren't just another Washington fad. They're reshaping the tech landscape more dramatically than any single company could.

Whether you're looking at cloud providers, chip makers, or AI specialists, understanding these policy shifts isn't optional - it's essential.

I've been watching tech trends since before the iPhone was a twinkle in Steve Jobs' eye, and I'll tell you this much: when government and technology interests align, fortunes are made.

The last time I saw this level of government interest was during the early days of the internet. Back then, everyone focused on the technology. The smart money focused on who was getting the contracts.

Some things never change.