March 1, 2010

Global Market Comments

March 1, 2010

Featured Trades: (CYB), (YUAN), (AGU), (POT) (MON), (DBA),

(COPPER), (FCX), (CHILE), (ECH)

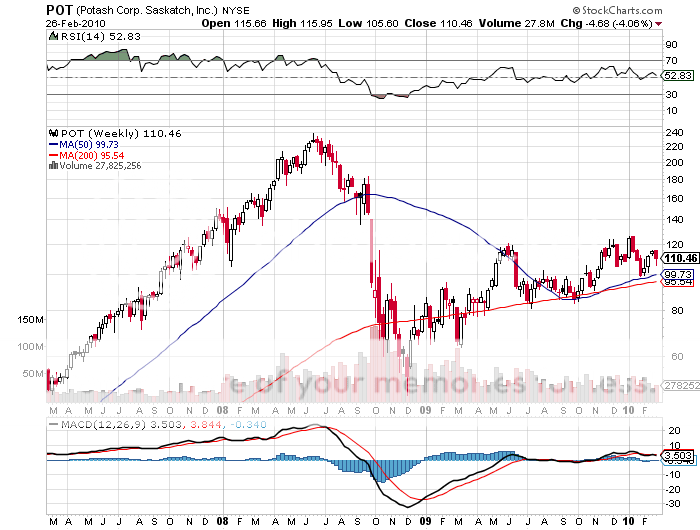

2) During the sixties, new dwarf varieties, irrigation, fertilizer, and heavy duty pesticides tripled crop yields, unleashing a green revolution. But guess what? The world population has doubled from 3.5 to 7 billion since then, eating up surpluses, and is expected to rise to 9 billion by 2050. Now we are running out of water in key areas like the American West and Northern India, droughts are hitting Africa and China, soil is exhausted, and global warming is shriveling yields. Water supplies are so polluted with toxic pesticide residues that rural cancer rates are soaring. Food reserves are now at 20 year lows. Rising emerging market standards of living are consuming more and better food, with Chinese pork production rising 45% from 1993 to 2005. The problem is that meat is an incredibly inefficient calorie transmission mechanism, creating demand for five times more grain than just eating the grain alone. I won?t even mention the strain the politically inspired ethanol and biofuel programs have placed on the food supply. It is possible that genetic engineering, sustainable farming, and smart irrigation could lead to a second green revolution, but the burden is on scientists to deliver. In 2009 one of the greatest crop yields in history, brought on by perfect summer weather, delivered one of the largest grain crops in history. Fall rains and an early frost meant that much of this bounty ended up rotting in the field, providing the backdrop for price rises of 30% across the board. The US Dept. Of Agricultural January crop report then predicted that we are going to see a replay of record production this year, slamming prices once again, and delivering limit down moves in the futures markets. But the weather may not cooperate, as it did last year. The net net of all of this is that food prices are going up, a lot. Entertain core long positions in corn, wheat, and soybeans on this dip, as well as the second derivative plays like Agrium (AGU), Potash (POT) and Monsanto (MON). You might also look at the PowerShares Multi Sector Agricultural ETF (DBA). These will all surpass last year?s stratospheric highs at some point.

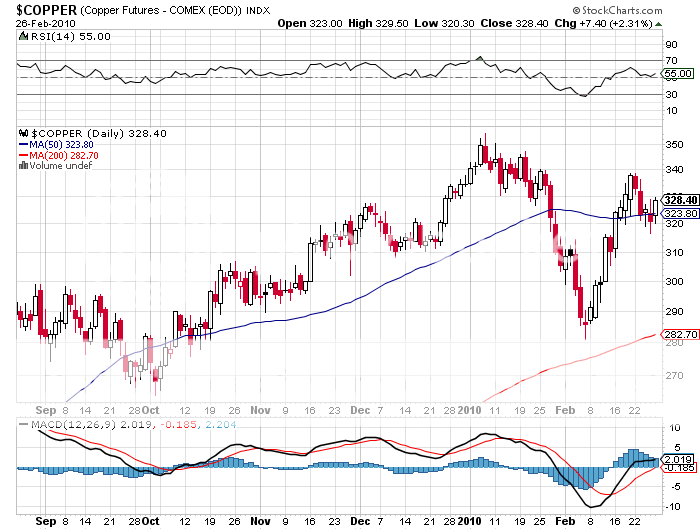

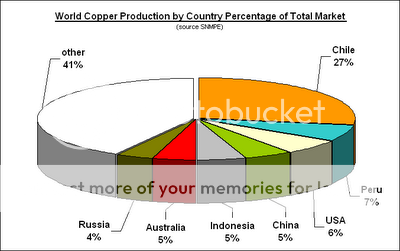

3) Readers of this letter are aware that I have been recommending liquidation of longs in copper futures and physical ingots from the $3.55/pound January high on down, along with major producer Freeport McMoRan (FCX). When trading resumes at the Shanghai open on Sunday afternoon US time, you can expect prices to open up huge. The 8.8 magnitude which decimated Chile on Saturday morning knocked out 27% of the world?s copper supply. Of the 19.7 million tons of the red metal produced globally in 2009, Chile accounted for 5.3 million tons. The earthquake was the fifth most powerful in history, and was the same magnitude that flattened San Francisco in 1906. While the epicenter is several hundred miles away from the main copper mining regions, Chile?s infrastructure has sustained major damage. There is no way to get the ore to smelters, or ingots to the market. Mines can?t operate without fuel or electric power. Roads, rail lines, bridges, and ports have been damaged. Banks can?t carry out trade finance without communications. If you haven?t unloaded your copper yet, this is an ideal chance to do so. If the markets really get the bit between their teeth and make it as high as $4.00/pound there could even be a shorting opportunity in copper setting up. With the global economy coming off of last year?s sugar high, base metals are looking to go sideways at best in the near future, and possibly down. You can also expect Chile?s stock market to get slammed when it reopens, whenever that is. If we get a major sell off, it could create a great buying opportunity for one of the few countries in Latin America that is doing everything right. I?ll be doing more research on this in the near future.

QUOTE OF THE DAY

?Inventories generate recessions, they don?t generate recoveries,? said my old buddy, David Gerstenhaber, President of Argonaut Capital Management.