March 11, 2010

Global Market Comments

March 11, 2010

Featured Trades: (PCY), (TBF), (TM), (THE PACIFIC)

NOTE TO SUBSCRIBERS: There will be no letter tomorrow, as I am taking a research day.

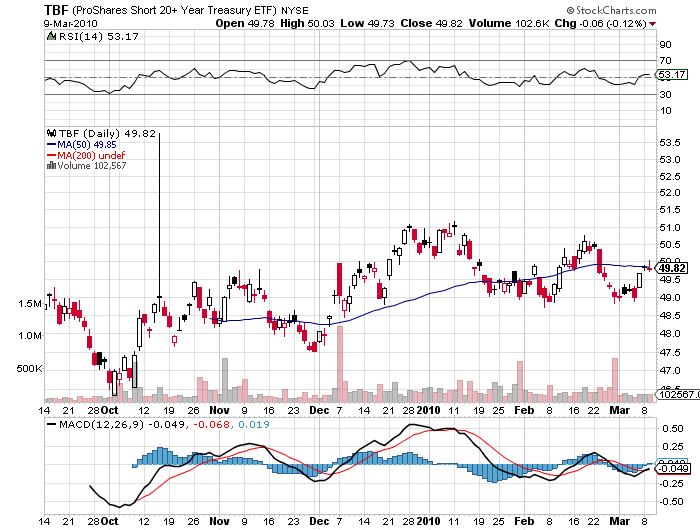

1) Get Ready for the April Surprise. I have a feeling that the markets are on a final countdown, but don?t know it yet. No, I am not talking about the next issue of the TV show 24. On April Fool?s Day, the Fed brings to a close its $1.25 trillion program to prop up the mortgage market in which essentially all home mortgages are ending up, either directly or indirectly, on the books of our esteemed central bank. As we approach this rendezvous with destiny, a growing number of hedge funds are piling on the short side of the bond market, betting that nobody will be there when the purely commercial market is reborn. It harks back to an old Wall Street saw that ?Success has many fathers, but failure is an orphan?. I expect stocks to rally until then, bonds to grind down, and yields possibly climbing as high a 4.00% on the ten year Treasury bond. This pessimism will drag mortgage rates up 15-25 basis points. The government will help the process along with increasingly bloated new issuance. This is a good reason why the credit markets have become ultra sensitive to developments in Japan, California, Dubai, Greece and other PIIGS (oink!). Seasonally, we are in a period of weak bond prices. To really throw the fat on the fire, the highly anticipated March nonfarm payroll, the number of the month, will be released the next day. When everybody and his dog is positioning for something to happen at a certain time, you can count on either the opposite to happen, or for nothing to happen. I vote for the former. After all, who is overweight mortgage backed securities these days? The market has been closed for 18 months, and everything institutions still own is probably down by a third in value. Look for an upside surprise in the nonfarm payroll report to produce a peak in equities and bond yields, an intermediate bottom in bond prices, and a reversal of everything from there. My bet is that the drastic jump in home mortgage rates that many are forecasting for April is going to do a no show. This is just a humble trader?s musings.

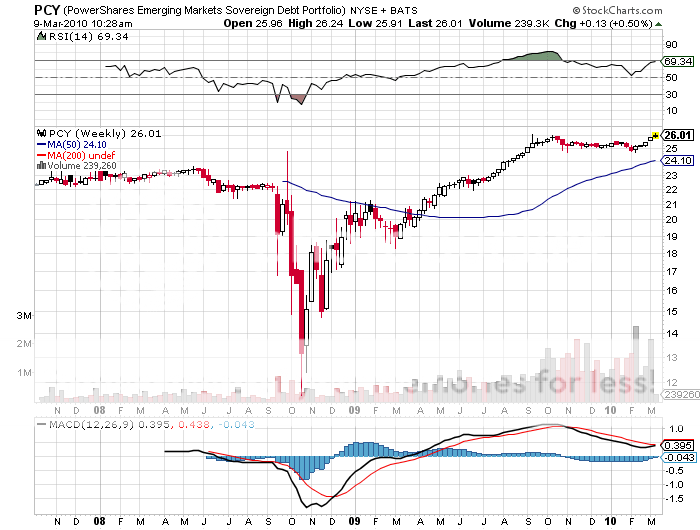

2) Where to Hide. I am constantly asked where to find safe places to park cash by investors understandably unhappy with the risk/reward currently offered by the markets. Any reach for yield now carries substantial principal risk, the kind we saw, oh say, in the summer of 2007. I have had great luck steering people in the Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY) for the last seven months, which is invested primarily in the debt of Asian and Latin American government entities, and sports a generous 6.44% yield. This beats the daylights out of the one basis point you currently earn for cash and the 3.66% yield on 10 year Treasuries. The big difference here is that PCY has a much rosier future of credit upgrades to look forward to than other alternatives. It turns out that many emerging markets have little or no debt, because until recently, investors thought their credit quality was too poor. No doubt a history of defaults in Brazil and Argentina in the seventies and eighties is at the back of their minds. With US government bond issuance going through the roof, the shoe is now on the other foot. A price appreciation of 120% off one year lows tells you this is not exactly an undiscovered concept. Still, it is something to keep on your ?buy on dips? list.

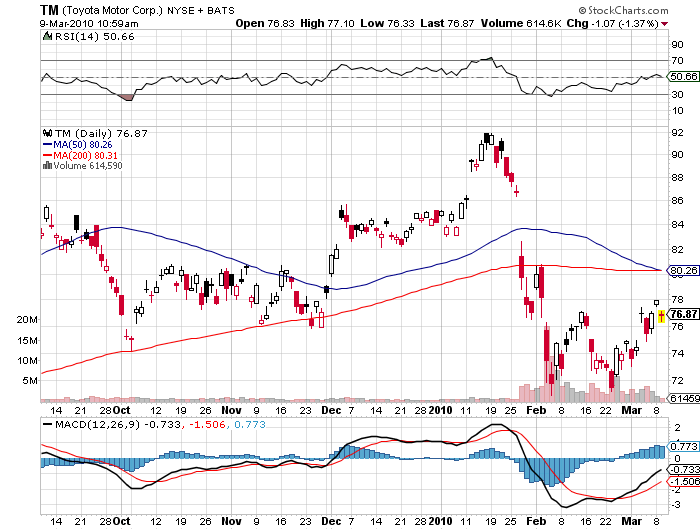

3) Those of you who wisely bought Toyota (TM) when there was literally blood in the street a month ago are now sitting on a healthy 10% profit (click here for the link at http://madhedgefundtrader.com/February_3__2010.html ). Those of the short term trading persuasion may want to book some profits here. Only this morning there was yet another dramatic report about a Highway Patrol officer who bravely placed his vehicle ahead of a runaway Prius racing down a San Diego freeway at 94 miles an hour in order to stop it. I thought a Prius could only go this fast if you dumped it out the back of an airplane, or parked on San Francisco?s Kearney Street. Another recall on brake pedals was triggered. I have no doubt that many of these stories are true. I also have no doubt that many of them are hoaxes in search of a class action law suit hungry, ambulance chasing lawyer. The odor of the US car makers and the unions is also in the room, who have lost market share to Toyota for 40 years and are looking for payback. We rue the day that lawyers were first allowed to advertise on TV. Toyota is now the butt of jokes from David Letterman, Jay Leno, and even the Academy Awards. I have no doubt this incredibly well run company will resurrect. Their dominant share of the global car market isn?t going away. If my scenario of a yen collapse to ?120 to the dollar in a year comes true, their foreign earnings will absolutely go through the roof. But they may have to pay more penance and cry a little more in public before they return to greatness in the minds of consumers.

4) TV Review. I highly recommend the HBO miniseries that premiers this Sunday night called The Pacific, which dramatizes the history of the First Marine Division during WWII. This is the Pacific version of the Band of Brothers and is made by many of the same people. My uncle, Col. Mitchell Paige (click here for the link to his site at http://www.homeofheroes.com/mitch/index.html ), who won the first Medal of Honor of the war, was a technical consultant to the project before he passed away in 2003. In one night, he managed to single handedly mow down 2,000 suicide attacking Japanese with three Browning 30 caliber, water cooled machine guns, thus saving Henderson Field, and shortening the war by a year. I still have the samurai sword that he retrieved from the battlefield the next morning. My father was with the First Marines at Guadalcanal, I flew for them during Desert Shield and Desert Storm, and my nephew joined to fight in Afghanistan and Iraq. Maybe I?ll find out why dad never spoke a single word about what went on there.

< p style="text-align: center;">?The American public has a whole new mindset about buying things than they had a couple of years ago,? said Oracle of Omaha, Warren Buffett.