March 15, 2010

March 15, 2010

Featured Trades: (CHARLES NENNER), (SPX), (DOW), (YEN), (PALLADIUM), (PALL), (DEMOGRAPHICS)

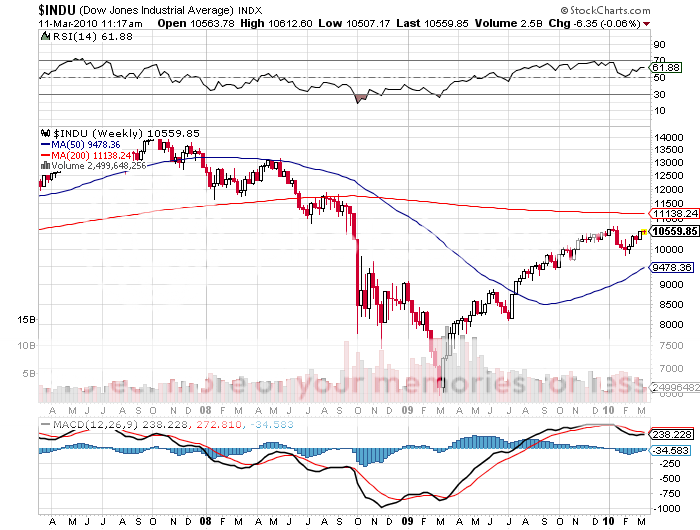

1) After much pleading and cajoling, I managed to get a no holds barred, no stone unturned 40 minute interview with technical analyst to the stars, Charles Nenner of Charles Nenner Research in Amsterdam, for Hedge Fund Radio. Bottom line: A? second deflationary tidal wave could hit the US as early as April. If it does, the Dow is going to crash, possibly heading for a double bottom at 6,000, and bonds are going up for the rest of the year. Oh, and by the way, crude oil futures are discounting war with Iran by 2013. Charles has a long career that includes stints at medical school, Merrill Lynch, Rabobank, and 12 years at Goldman Sachs. He has spent three decades developing his proprietary Cycle Analysis System, which generates calls of tops and bottoms for every major market in the world. Charles developed a huge following after 2007, when he accurately nailed the top in the Dow at 14,500 and urged his clients to put on short positions when everyone else was predicting that the market would keep grinding higher. I have been following Charles? daily research reports myself for two years, and found them to be uncannily accurate. Today, Charles counts major hedge funds, banks, brokerage houses, and high net worth individuals among his clients. You can find out more about Charles? work by clicking here to get to his website at his website at www.charlesnenner.com. This will no doubt be the hottest show of the year. Listen in before listeners blow up my server, melt my fiber optic pipes, and bring the entire Internet to a screeching halt, as they did last time. To catch the entire sizzling interview, please click here to get to Hedge Fund Radio.

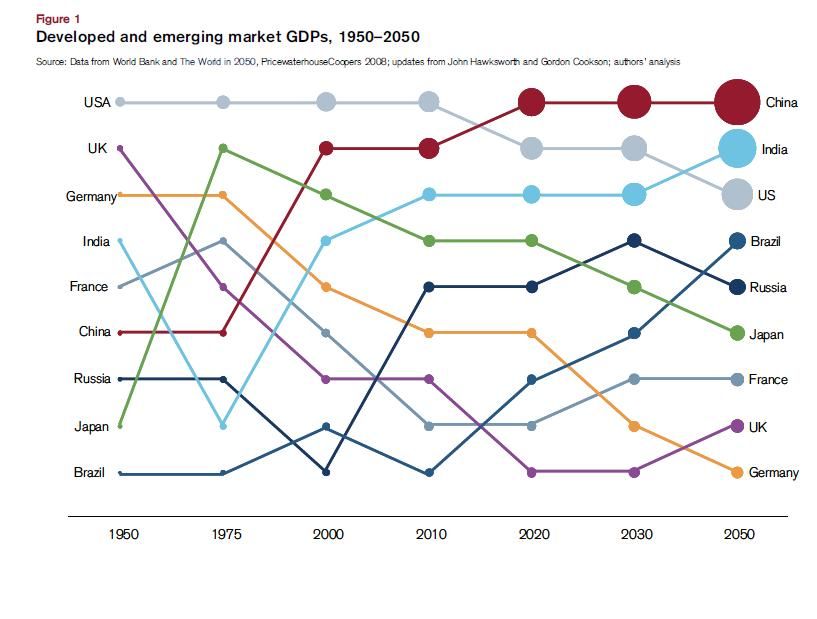

2) I love making very long term forecasts, because they give tremendous insights into the future of the global economy, and because at my advanced age, I won?t live long enough to see if I am right or wrong. I pulled this chart off of Paul Kedrosky?s Infectious Greed website which shows GDP growth rates for a 100 year period from 1950 to 2050. It shows why you should be infatuated with emerging markets (EEM) like Brazil (EWZ), China (FXI), and India (PIN), lukewarm about the US (SPX), and avoiding Europe and Japan like the plague. It also gives the underlying argument behind my long term currency calls to stay short the yen. The basic trade is to be long countries and currencies with high growth rates, and be short, or at least stay out of, countries and currencies with low growth rates. As exciting as this chart is, I really don?t see myself living another 40 years to 2050. But who knows? Maybe if I take some of those pills they sell late at night on CNBC? What are they called? Extenze?

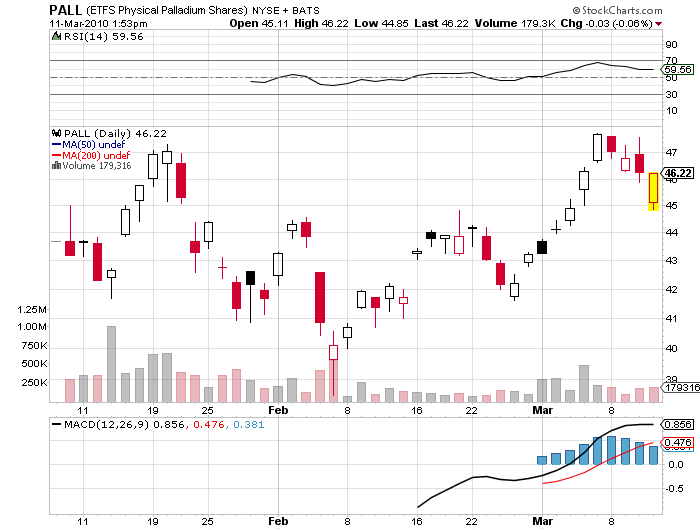

3) My editor in charge of the ?I Told You So Department? is having a busy year. Not only did we catch the dead market in equities, the collapse of volatility, the selloff in the Euro and the yen, the rallies in the Ausie/Euro and Ausie/Yen crosses, and the bounce in Toyota, we now have Palladium (PALL) to crow about. Palladium hit a two year high of $477 an ounce last week and speculative longs in the market have hit an all time high. I discussed the potential of the ?poor man?s platinum? in January (click here for the piece). My sources at the London Metals Exchange tell me that investment demand from big hedge funds is clearly overwhelming traditional demand from the auto industry, who use it to build catalytic convertors. The ETF (PALL) has popped 17% since my initial call. Watch this space.

4) Since I am in the long term forecasting business, it was with some fascination that I caught the Associated Press report that minority children born this year may exceed white children for the first time. Whites lost their majority in San Francisco many years ago, and will do so in California as a whole in the near future. The report said that the US will have a ?minority? majority by 2050. Whites now account for 2/3 of the population. While minorities now dominate only 10% of counties, they account for 40% of new births. Demographers say the trend will be reinforced by a large number of Hispanic women entering their prime child bearing years, who historically have more children than other races. More white women are delaying childbearing, reducing fertility. As demographics is destiny, this is bound to have huge political and economic ramifications for the country going forward. It is also going to influence the marketing priorities of corporations. A decade ago Betty Crocker anticipated this trend by using shorter, darker skinned models on the boxes of its cake mix boxes. Companies that target specific ethnic groups are going to gain a competitive advantage. Furthermore, the rate of interracial mixing is accelerating at a tremendous rate. In California, 50% of all Chinese woman and 60% of Japanese women marry whites. This is amazing, given that this was illegal until the Civil Rights Act was passed as recently as 1962. Millennials are virtually color blind. Personally, I think genetically recessive blonde haired, blue eyed people, who sprang out of a mutation in the Caucuses 7,000 years ago, may completely disappear in 200 years. Pure Caucasians themselves may eventually go too, as they only account for 15% of the world?s population, and that number is falling.

?If you can?t make yourself loved, make yourself feared,? said Meyer Amschel Rothschild, founder of the banking dynasty.