March 17, 2010

Global Market Comments

March 17, 2010

(TRES AMIGAS TRANSMISSION PLANT),

(SPX), (DOLLAR BILL)

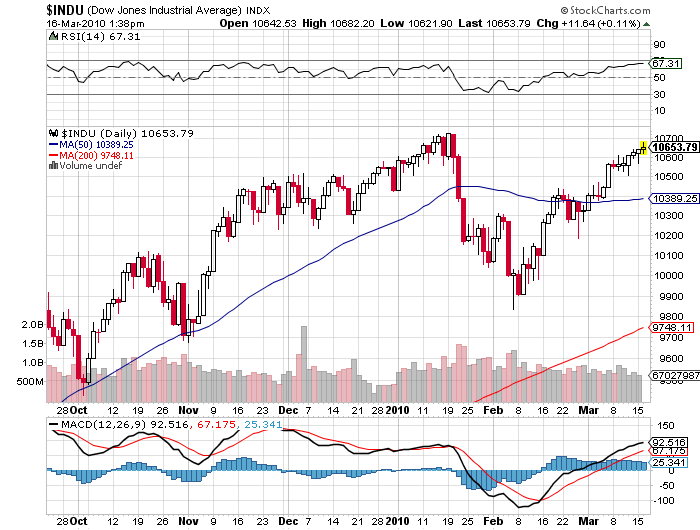

2) A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, who shall remain nameless. Suffice to say, she has a sports stadium named after her. The bids soared to $6,000, $7,000, $8,000. After all, it was for a good cause. But when it hit $10,000, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his new date back to me for $9,000.? I said ?no thanks.? $8,000, $7,000, $6,000? I passed. It was embarrassing. The current altitude of the stock market reminds me of that evening. If you rode gold from $800 to $1,220, oil from $35 to $80, and the FXI from $20 to $40, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. One of the headaches in writing a letter like this is that while I publish 1,500 words a day for 250 days a year, generating about half the length of War and Peace annually, you really need to tinker with your portfolio on only a dozen or so of those days. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again. And no, I never did find out what happened to that date.

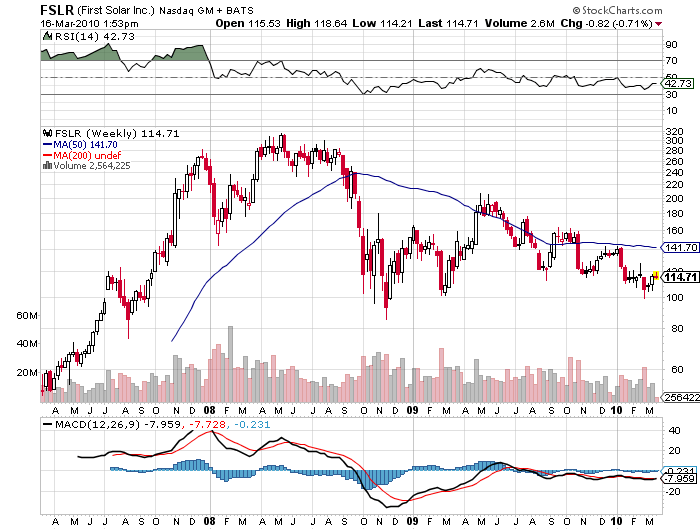

3) Until now, the country?s power grid has been divided into three unconnected chunks, making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from brown outs and sky high prices, electricity was given away virtually for free in Texas. A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms on the drawing board in the Midwest to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With Obama sending tidal waves of government cash towards the sector, the timing couldn?t be better. It is also great news for major alternative suppliers like First Solar (FSLR). Some of these projects might now actually make some sense.

4) If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.? The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds. Thank freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie National Treasure. The balanced scales in the seal are certainly wishful thinking and a bit quaint. Study the buck closely, because there are going to be a lot more of them around.

QUOTE OF THE DAY

?When it? raining gold, reach for a bucket, not a thimble,? said Oracle of Omaha Warren Buffet.