March 17, 2011 - QE2 Just Ended Early

Featured Trades: (QE2 JUST ENDED EARLY), (DIG), (JJG), (AAPL)

1) QE2 Just Ended Early. Many observers believe that the massive sell off that we have seen in global equity markets are purely the result of the Great Sendai Earthquake. Fat chance. I think the earthquake is masking the true causes of the liquidation, the end of Ben Bernanke's quantitative easing.

When the market would start discounting the demise of this free lunch for all asset classes and the hedge funds that trade them has been one of the great guessing games this year in the financial markets. Up until last week it was thought that the weakness since February was just another dip to buy into the great liquidity bubble. But no more.

You can see this in the violence and the severity of the sectors that have sold off the most. The ones that flaunted the biggest gains since QE2 started in August are now suffering the worst of the damage. Look no further that my favorite sectors, which were all heavily owned by hedge funds, and now being mercilessly dumped.

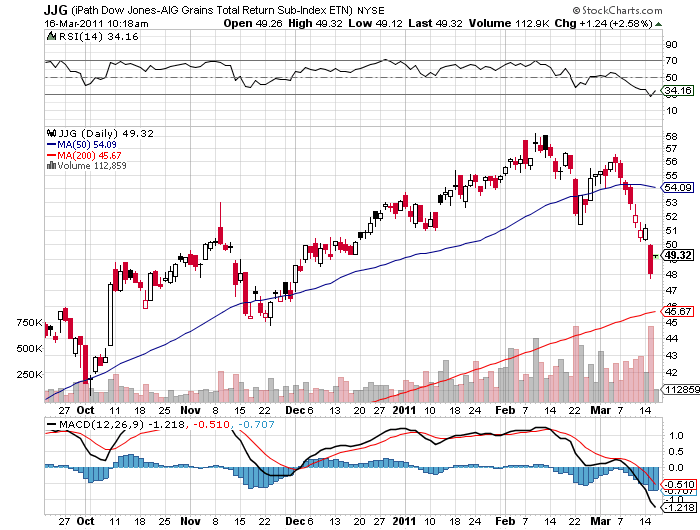

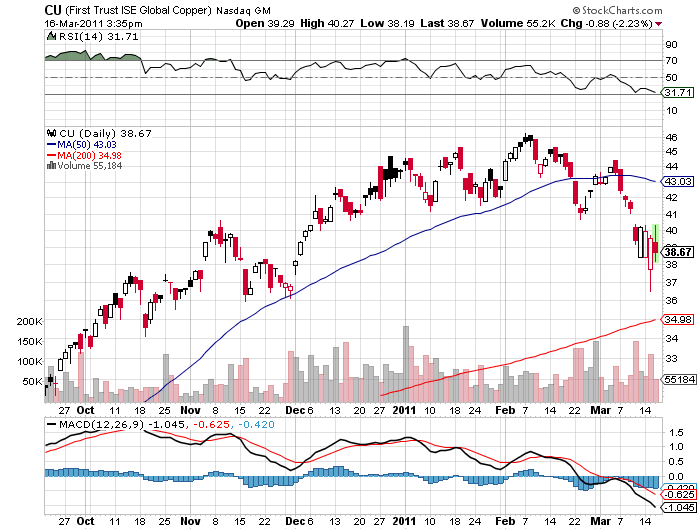

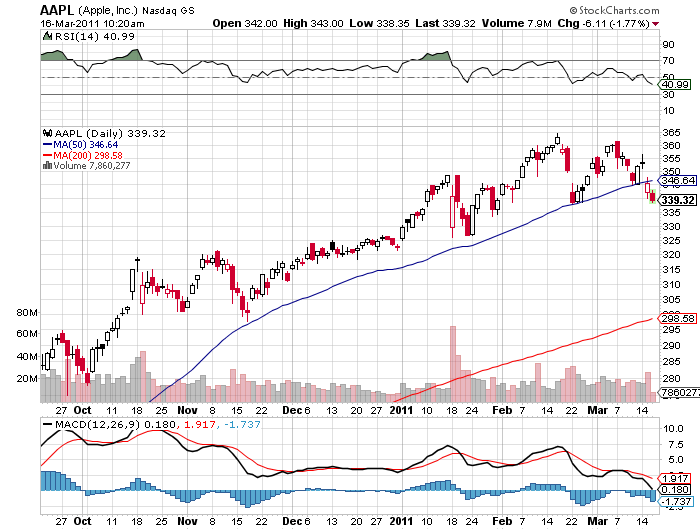

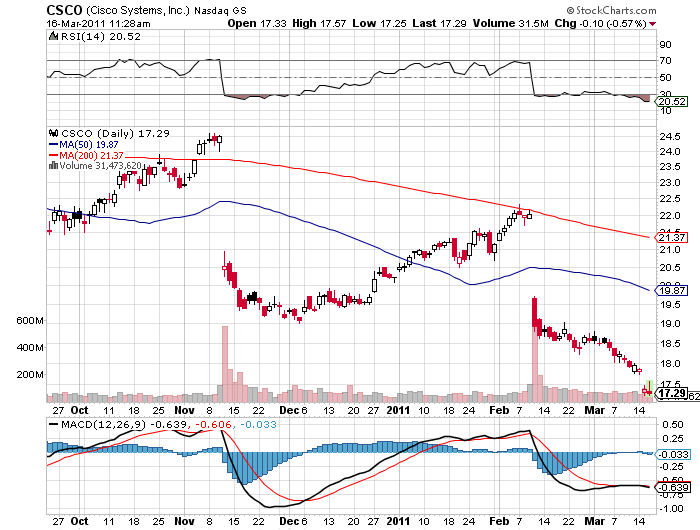

In a mere two weeks, my energy play (DIG) plunged 16%, the grain ETF (JJG) is off 17%, while technology bellwether Apple (AAPL) has taken a 7% hickey. The double top in the Apple chart is particularly ominous. And look at Cisco Systems (CSCO) where we snagged a double on a call spread and exited post haste. My friend, Dr. Copper, seems to have taken and extended vacation, with its ETF (CU) off 20%. Ouch!

Regular readers of this letter know that I have been expecting this and have been judiciously scaling out of long since the end of January.

The implication is that this sell off may continue longer and go farther than many traders realize. What will be the next driver to take stock prices skyward? QE3? You must be smoking something. The political balance in Washington will permit no more support for the economy. Tax cuts? We have already gorged ourselves on these for the next two years.

Rising earnings? Coming off a great quarter, forecasts going forward are being ratcheted downward, thanks to the earthquake. I think people will be amazed when they discover how much US manufacturing is dependent on high value added, irreplaceable Japanese parts, from autos to electronics.

I don't think the abundant 'crash' gurus are going to get any satisfaction this year either. The news is bad, but it is not that bad. We are far more likely to die of ice than fire. Sounds like it may be a good time to sell out of the money calls on equities everywhere.

-

More Likely to Die from Ice That Fire

-

-

-

-

Watch Closely. He's About to do a Disappearing Act