March 2, 2010

Global Market Comments

March 2, 2010

Featured Trades: (30 YEAR TREASURY BOND), (TBF), (TBT),

(RSX), (IDX), (THD), (PIN),

(CGW), (PHO), (FIW), (VE), (TTEK), (PNR)

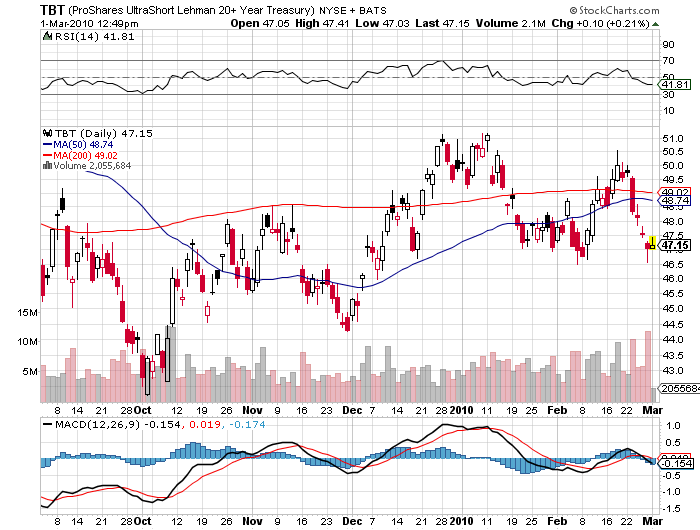

1) Louise Yamada, one of the most widely followed technical analysts in the market, says the 29 year bull market in Treasury bonds is coming to a close. Looking at the 200 year history of interest rates in the US, such bull markets are historically 22-37 years in length, and this one is definitely looking long in the tooth. Although doubters insist that you?ll never get a collapse in bonds in a deflationary environment, Louise says that all bond peaks occur in such conditions. Yields show prolonged, saucer like bottoms, much like we are seeing now. She also says that retail interest in such paper also surges when interest rates are at multi decade highs, as we saw clearly with last year?s flow of funds. When foreign buyers lose interest in our debt, the 30 year Treasury bond is the first place their lack of interest will show up. The charts for the 30 year are setting up a perfect head and shoulders top, and when the yield break through 4.8%, watch out. The next stop may be 7%. Her advice is that if you are going to stay in the government bond market, shorted your duration as much as possible. My advice? Sell the 30 year bond futures, which today are selling at 119, up 2? points from last week?s low. If Louise?s scenario plays out, it will take the futures well below 100. If you can only sleep at night with less leverage, buy the (TBF) and the (TBT). We are about to enter the golden age for these short bond ETF?s.

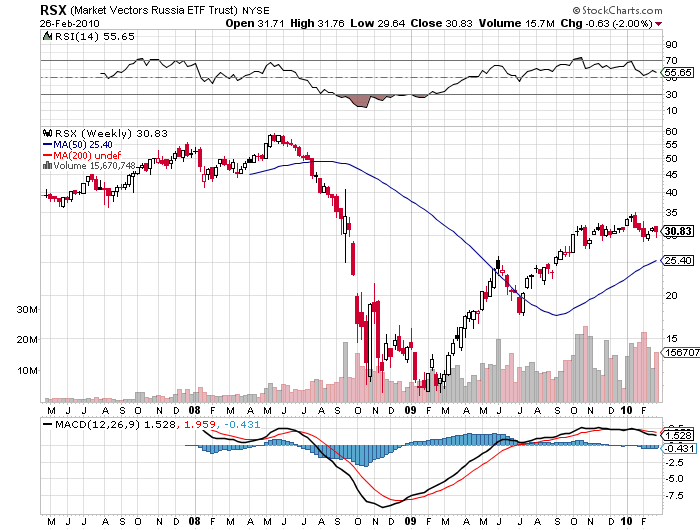

2) If you wonder why I recommend a shower after investing in Russia, Bill Browder will give you the reasons at length on his YouTube video (click here for the link ). Bill is the founder and CEO of Hermitage Capital Management, one of the firms that pioneered equity investment in the former Soviet Union in the nineties. After a decade of pursing a campaign of activist investing that brought major changes in corporate governance in big companies like Gazprom and Sberbank, a mafia connected government struck back with a vengeance. It deported Browder in 2005, arrested his lawyer, and pressured him to provide false testimony again his boss, which he refused. A year later, the man died in prison from ?natural causes.? The Russian government then seized Browder?s operating companies, but fortunately for investors, not before he was able to sell off $4.5 billion in holdings and spirit the funds out of the country. Browder, who is of Russian descent, and whose grandfather was chairman of the America Communist Party, says his case is but the tip of the iceberg. Major multinationals like Shell, BP, and Ikea have also been the victims of corruption and faced arbitrary seizure of assets by the well connected. This lawlessness is the reason why Russian companies perennially trade at single digit multiples. They are cheap on paper, but carry hidden, unquantifiable risks. Browder has since refocused his interests, and is now managing $1.2 billion in other safer emerging markets, like Indonesia (IDX), Thailand (THD), and India (PIN). No doubt that investing in Russia is a double edged sword. It offers enormous oil reserves and natural resources, with GDP flipping from a -7.9% rate in 2009 to an expected 3.2% this year. Russia?s stock market (RSX) brought in a blazing 125% return in 2009. But you run the risk of a knock on the door in the middle of the night.

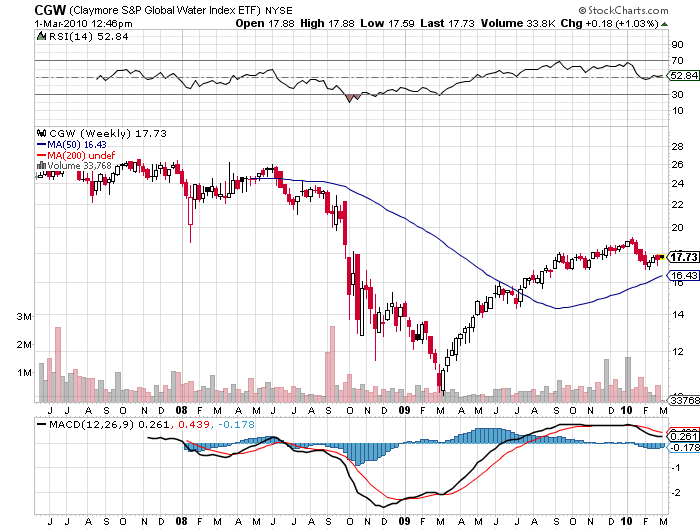

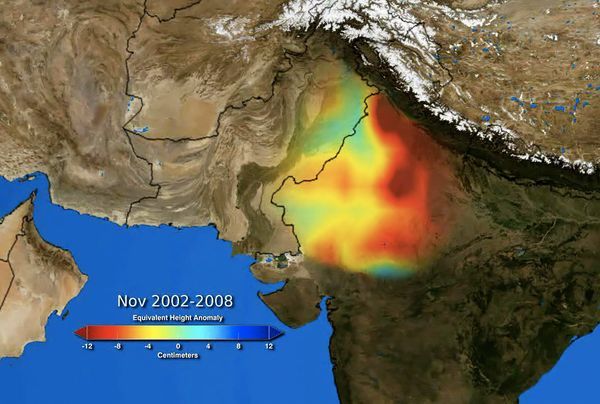

3) If you think that the upcoming energy shortage is going to be bad, it will pale in comparison to the next water crisis. Investment in fresh water infrastructure is undeniably going to be a recurring long term investment theme. One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights. Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. In places like China, with a quarter of the world?s population, up to 90% of the fresh water is already polluted, some irretrievably so with toxic heavy metals. Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% over the next 20 years. Underground water sources in the US, like the Oglala Aquifer, which took nature millennia to create, are approaching exhaustion. Take a look at the photo below, which I pulled off the NASA website, showing dramatic falls in the water tables in the largest food producing areas of India and Pakistan, as measured by the Gravity Recovery and Climate Experiment (GRACE) satellite. While membrane osmosis technologies exist to convert sea water into fresh, they require ten times more energy than current treatment processes, a real problem if you don?t have any, and will easily double the end cost to consumers. While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of last year?s stimulus package was similarly spent. It says a lot that when I went to the UC Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds! At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW), which brought in a positively effervescent 46% return in 2009. You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR). Who has the world?s greatest per capita water resources? Siberia, which could become a major exporter to China in the decades to come.