March 24, 2011 - Yen Post Mortem

Featured Trades: (POST MORTEM ON THE YEN)

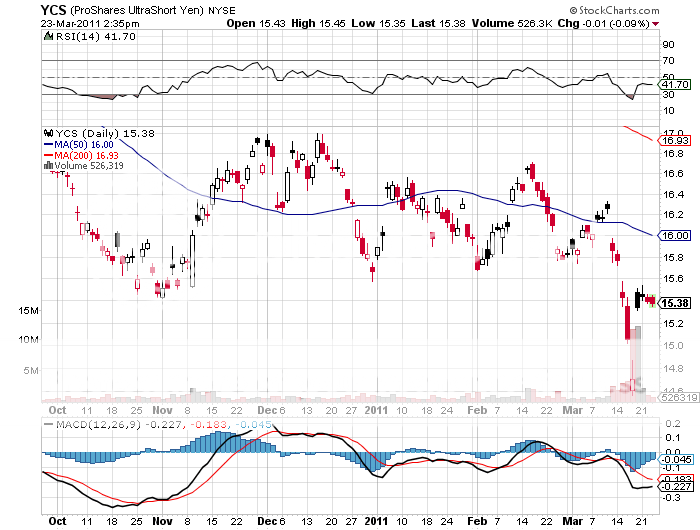

3) Yen Post Mortem. Since my bet that the Japanese yen would decline clearly didn't work, I thought I would sift through some alternative theories in an attempt to understand why this trade came undone so badly. After all, every loss is a lesson, best to be learned. You would think that with weak economic growth, horrendous demographics, feeble corporate management, inept national leadership, an incompetent central bank, and an enormous reliance on high priced imported energy and commodities, the yen would be the ideal currency to short.

Wrong and double wrong. For the second year in a row my short position in the yen has been my one loser of the year, condemning me to a series of stop outs. I know I have a lot of illustrious company, but that is never an excuse for taking a hit to the P&L. So I thought it might be instructive to examine alternative theories for the future of the yen, which see not, imminent weakness, but strength.

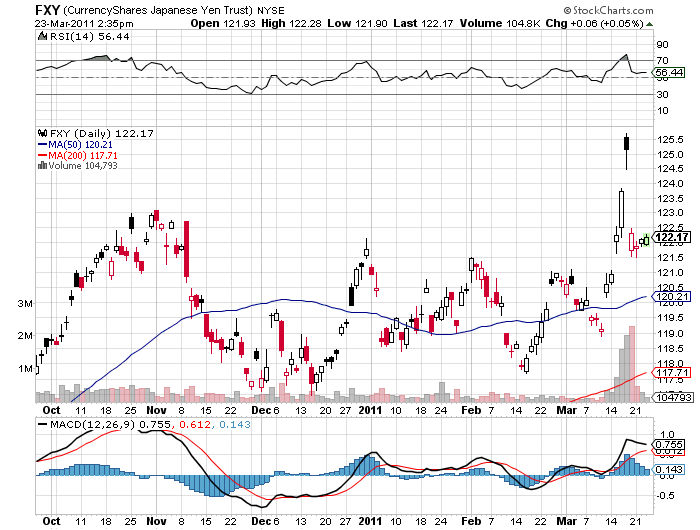

My old friend, Eisuke Sakakibara, the former Japanese vice minister of finance known in the foreign currency markets as 'Mr. Yen,' says that the ?79 of today is not the same as the ?79 of 15 years ago. Since then the country has suffered from relentless deflation, causing the prices of goods and services to plunge.

As a result, the yen today buys much more than it did in the previous millennium. That means that the currency should continue to appreciate, to at least ?70. American investment bank, JP Morgan, recently put out a report employing similar logic, arguing that the yen could go as high as ?50- ?60 before reversing. This has never happened in the history of modern developed economies, which is why this possibility never showed up on my radar, nor few others.

When a cat touches a hot stove and gets burned, it never goes near that stove again, even when it is cold. I feel like that cat. Since the dollar's 'flash crash' against the yen last week that took it from ?80 to ?76 in a nanosecond, the G-7 has come into the markets with a lot of big talk, but only a few feeble $6 billion rounds of token intervention. Yet, here the yen still hovers around ?80.

I think I've had enough of the yen for a while, and will happily watch from the sidelines. I'm not buying the breakout. The 'Madness of Crowds' comes to mind.

-

-

Once Burned, Twice Forewarned