March 26, 2010 ? California Muni Bonds Are a Steal Here

Featured Trades: (CALIFORNIA), (VCV), (NCP), (NVX)

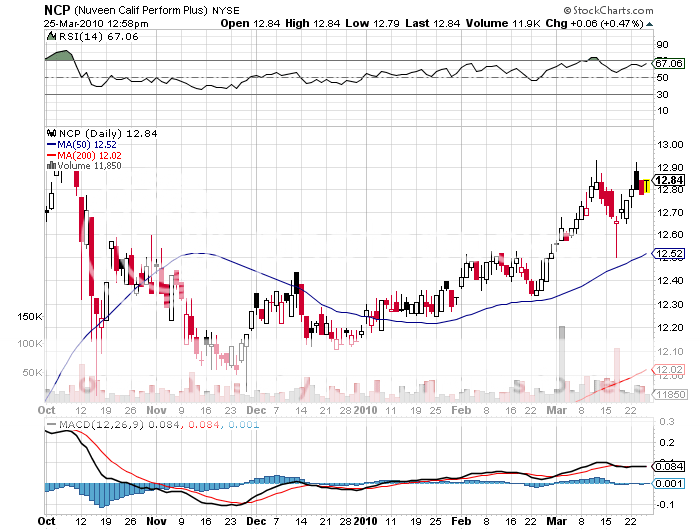

2) California Muni Bonds Are a Steal Here. The California governor's election is heating up, and the muck slinging is getting hot and heavy. The downside is that front runner Meg Whitman, of EBay fame, has launched such an aggressive, saturating, and negative TV campaign against rival, Steve Poizner, that he won't be able to safely walk the streets in a few months. And this is just to capture the Republican nomination! The upside is that a treasure trove of data is coming out that puts a glaring spotlight on the root of the Golden State's problems. It's really all about prisons, which have soared from 3% of the state's domestic product in 1979 to 11% last year, and 80% of that spending is going to compensation. It costs $6 billion a year to pay 60,000 prison guards, most of whom make over $100,000 a year with overtime, more than it costs the state to educate 670,000 college students. You can thank three strikes laws, vastly expanded sentencing, and sweetheart deals over benefits with the prison guards union, the state's most powerful. During the same three decades, spending on health and human services has remained stable at 32%. Whatever the outcome of the election, I think tax free California municipal bonds are a screaming buy here, for this simple reason. The state's $70 billion in general obligation debt, which is used mostly for infrastructure, is at the very top of the seniority structure, followed by $150 billion in retirement benefits debt. These claims are untouchable. All of the budget cuts going forward will take place with the junior claims in the obligation structure, mostly schools and social services. That is why we are seeing rioting at UC Berkeley every week. And with the stock market up 70% in a year, capital gains will start kicking in, which in peak years account for 40% of total state tax revenues. Buy the California municipal bond funds, (VCV), (NCP), and the (NVX).