March 3, 2025

(IT’S MARCH 2025 – LET THE TARIFF WARS BEGIN)

March 3, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY MARCH 3

9:45 a.m. S&P PMI Manufacturing final (February)

10:00 a.m. Construction Spending (January)

10:00 a.m. ISM Manufacturing (February)

TUESDAY MARCH 4

2:20 p.m. New York Federal Reserve Bank President and CEO John Williams speaks at Bloomberg Invest in New York.

Earnings: Ross Stores, CrowdStrike Holdings, Best Buy, AutoZone

Tariffs on Canada, Mexico set to go into effect, and those on China are raised.

9:00 p.m. Presidential address to joint session of Congress is traditionally held.

WEDNESDAY MARCH 5

8:15 a.m. ADP Employment Survey (February)

9:45 a.m. PMI Composite final (February)

9:45 a.m. S&P PMI Services final (February)

10:00 a.m. Durable Orders final (January)

10:00 a.m. Factory Orders (January)

10:00 a.m. ISM Services PMI (February)

2:00 p.m. Federal Reserve Beige Book

6:15 p.m. New York Federal Reserve Bank SOMA Manager Roberto Perli gives keynote remarks on Monetary Policy Implementation in New York.

Earnings: Campbell’s Company

THURSDAY MARCH 6

8:30 a.m. Continuing Jobless Claims (02/22)

8:30 a.m. Initial Claims (03/01)

8:30 a.m. Unit Labour Costs final (Q4)

8:30 a.m. Productivity final (Q4)

8:30 a.m. Trade Balance (January)

10:00 a.m. Wholesale Inventories final (January)

Earnings: Broadcom, Hewlett Packard Enterprise, Costco Wholesale, Fastenal, Kroger

FRIDAY MARCH 7

8:30 a.m. February Jobs Report

10:45 a.m. New York Federal Reserve Bank President and CEO John Williams discusses at UD Monetary Policy Forum Report “Monetary Policy Transmission Post-Covid,” NY.

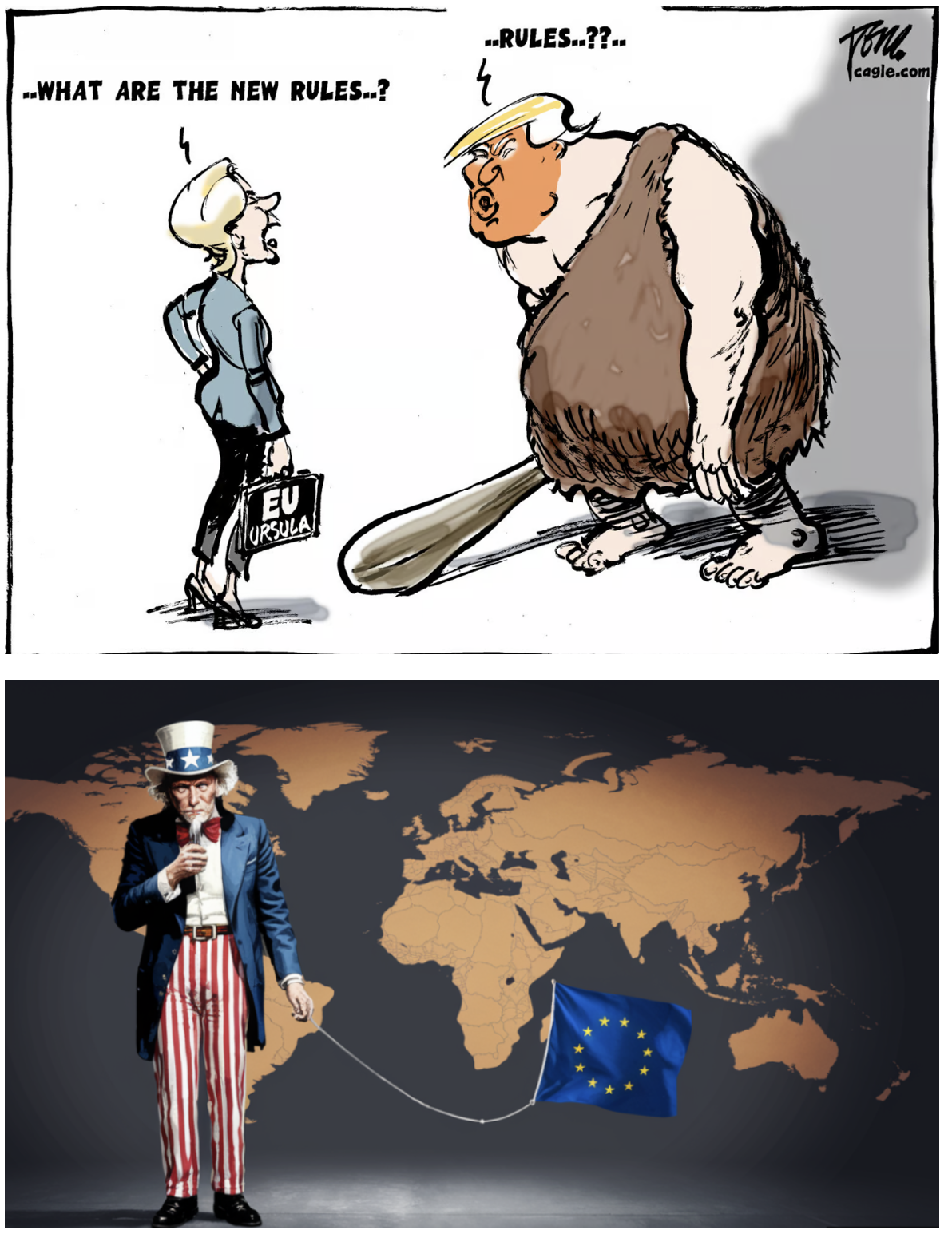

Welcome to the month of March. Investors may be hoping for some sort of relief from the volatility of late, but that may not arrive this month. There are many challenges ahead this month. President Trump’s tariffs on Mexico and Canada are expected to go into effect on Tuesday, March 4, along with an additional 10% on China.

With earnings season behind us, investors will be looking ahead to the Federal Reserve meeting on the 18th and 19th. There is hope that weak price data may pave the way to support a central bank rate-cutting path. Of course, investors are expecting that the weak data will be balanced by an economy strong enough to avoid concerns about growth and profits. However, I believe that any rate cuts will be a long shot and advise not to place your hopes on this outcome. Rather, investors should be prepared for the strong possibility of no rate cuts and eventual rate hikes later this year.

The February jobs report on Friday is expected to show that the labour market is easing, with fewer jobs being created and businesses shutting the door on new hires.

Economists expect that the U.S. economy added 160,000 jobs last month, up from 143,000 jobs in January, with the unemployment rate holding at 4.0%, according to FactSet.

Investors are wary of weakness in the months to come. However, many are confident that the stock indexes will see good advances this year despite their concerns around Trump’s trade policies.

Cryptocurrencies rallied on Sunday after President Trump announced the creation of a strategic crypto reserve for the United States that sill include Bitcoin and Ether, as well as XRP, Solana’s SOL token, and Carano’s ADA.

Trump posted on Truth Social that he wants to “make sure the U.S. is the Crypto Capital of the World.”

XRP surged 33%, Cardano’s coin soared more than 60%, Ether gained 13%, and Bitcoin rose 10% to $94,343.82 after dipping to a three-month low under $80,000 last Friday.

=========================================================================

Congratulations to ‘Anora’, the film that cleaned up at the Oscars.

=========================================================================

Cyclone Alfred is on track to strike the Southeast Qld coast later this week (very close to Brisbane). It is about 50 years since this part of Queensland has experienced a cyclone. Cars have formed mile-long lines to fill up sandbags to protect their properties and businesses. Some shelves in supermarkets are empty - bread, toilet paper, and water have been the most popular items. Generators, batteries, and torches have also been flying off the shelves in camping stores. Beaches along the Queensland coast are already feeling the effects of Alfred, with severe erosion seen in some areas, while out on the water, surfers have been enjoying three metres waves. By Wednesday and Thursday, cyclonic force winds are expected, and 20 inches of rain may fall. Batten down the hatches! Stay safe.

Taken Monday, this picture shows our beautiful sandy beaches have almost disappeared from the effects of Cyclone Alfred. We are waiting for it to cross the coast on Thursday.

Thank you to those who attended the February Jacquie’s Post Zoom Meeting over the weekend. Everybody was able to share their thoughts about world events, so a great meeting overall. A recording will be sent out shortly.

MARKET UPDATE

S&P500

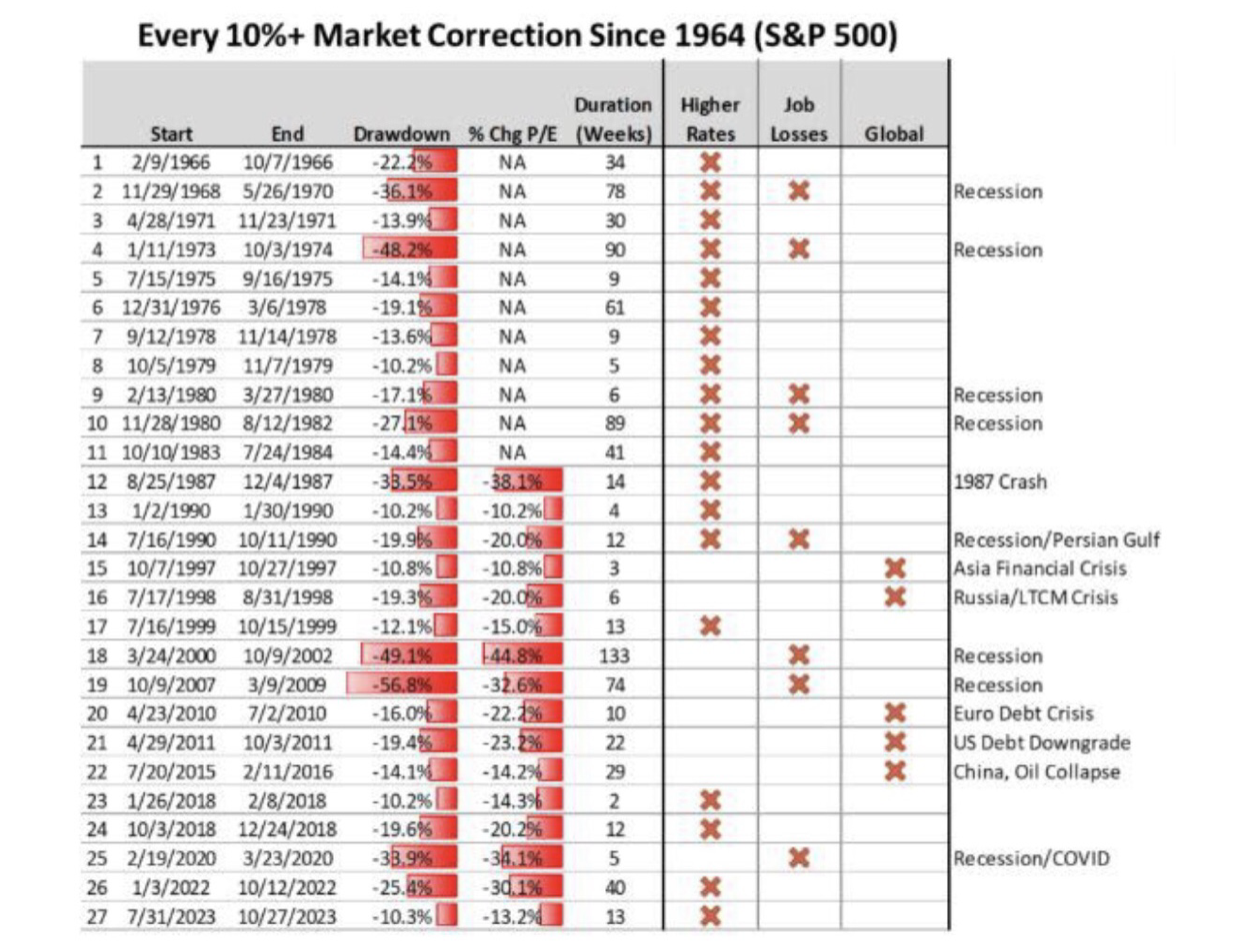

The index bounced last Friday from the base of the rising wedge (5825/50). There is scope for more ranging and potentially even gains back toward the Feb peak at 6147, or even between 6150 -6300, before we turn sharply lower. Please keep sell-stops in place on all your stock holdings. The next 3-5 years could be the most volatile since the Great Recession.

Resistance = 5955/65 and 5990/00

Support = recent low at rising wedge support ~ 5850

GOLD

WE have seen a correction in gold, which should be a precursor to new highs. (maybe within a month or so). Volatility is high, so if you are long gold in any vehicle, make sure you have sell-stops in place.

Resistance = $2865/70 and $2892

Support = $2829/$2790 area

BITCOIN

Bitcoin bounced off the $78.2k low. We could continue this range-like price movement for another couple of months. The odds remain high that Bitcoin will reach $150 in the next 12 months. (If you bought Bitcoin at the recent low, make sure you have a stop in place at $70k). However, if Bitcoin breaks $64,000 at any time in 2025, it will suggest a (b) wave has concluded. If that occurs, a 1–2-year decline is underway with a downside target below $32,000. Make sure your sell-stops are in place.

Resistance =92.1/92.6k

Support = 78.2/79.2k area/ 82.6/83 area

QI CORNER

HISTORY CORNER

On March 3

GEOPOLITICS CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie