March 7, 2011 - Thoughts on Oil and the Economy

Featured Trades: (THOUGHTS ON OIL AND THE ECONOMY)

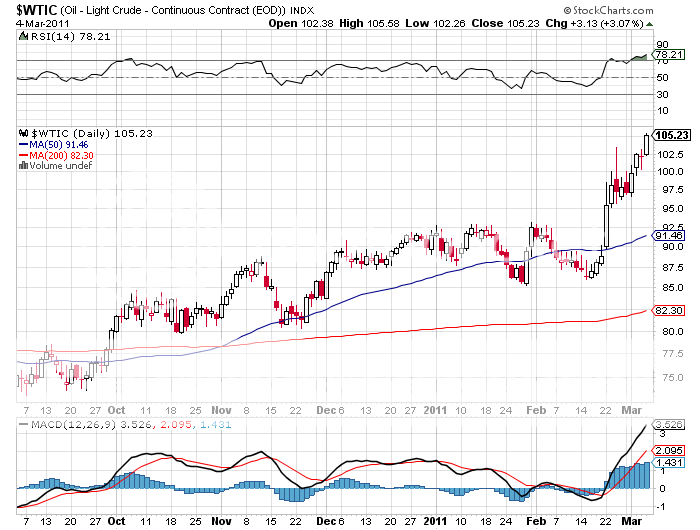

1) Thoughts on Oil and the Economy. If at the beginning of the year I had told you that oil would go well above $100/barrel within two months, there would be a civil war in Libya, and the stock market would hit a new three year high, you would have immediately canceled your subscription to this newsletter and initiated proceedings to have me committed to an insane asylum. Except in Texas, where I would have been taken out and summarily shot, and rightfully so. Not in a vindictive way, but in a humanitarian attempt to put me out of my misery, like a thoroughbred race horse with a broken leg.

Yet, here we are. Go figure. The transportation index, that prodigious user of all types of fuel, is getting slaughtered. Both sides in the Libyan civil war are threatening to attack the other's oil supplies. The rebels say they have sold a supertanker worth of crude. To whom? How did they accept payment? Where is the contract? Who would you contract with? If true, why doesn't Khadafi sink it? It's not like it is a small target. While all western companies have eased oil shipments from Libya, Chinese and Indian companies are picking up the slack on the spot market.

In the meantime, US naval ships are steaming through the Suez Canal in a show of force, and we are days away from Saudi Arabia's 'Day of Rage.' If you think this is just talk, see what the Arab cable news network, Aljazeera, has to say about it by clicking here . I can easily see a carrier group sitting in the Gulf of Sidra, declaring a 'No Fly Zone', and then shooting down any plane that leaves the ground. Remember, our air-to-air missiles have a 100 mile range, and we know that the Libyans don't know how to use theirs. Hey, if you can't win two Middle Eastern wars, maybe the third time is the charm? It couldn't happen to a nicer guy.

If oil stays at the current triple digit altitude, some $70 billion gets lifted out of consumers' pockets, knocking 0.5% off of US GDP this year. Keep in mind that there is absolutely no dearth of oil in the US. Private storage facilities at the Cushing, Oklahoma hub are bulging, and the government's strategic petroleum reserve is chock full. It is fear and speculative buying by hedge funds that is driving prices up, not physical shortages.

Former Chairman of the Federal Reserve, Alan Greenspan, made some interesting comments this morning as to why dear oil wasn't having a bigger impact on the financial markets. Energy conservation has become far more pervasive than any of us realize. All of those subsidized solar panels and hybrid cars are starting to have a major impact on our energy consumption.

Also, thanks to the Great Recession, companies held back investment in productivity increases and cost cutting that have only recently been unleashed. What is one of the biggest of these investments? Spending on energy conservation measures across a vast array of industries.

Remember that busted home heater that I told you about yesterday? I had the engineer take apart both the outgoing and incoming units, and I couldn't believe what I saw. The 20 year old one was a simple gas fired affair. The new one included a built in radiator that sucked every bit of heat out of the apparatus, greatly improving its efficiency. These tiny, incremental sorts of savings are going on in a million imperceptible ways around the world every day, all adding up into something really big.

-

Khadafi's New Negotiating Strategy?