Market Outlook for the Week of November 7th

For the first time this decade, I did not care a whit about the monthly Nonfarm Payroll report.

Not an iota, a scintilla, a modicum, or even a speck.

That?s because no matter high or low the number came it, it would be vastly overshadowed by tomorrow?s election.

Nationwide voting is not the 800-pound gorilla in the room. It is the 800-ton gorilla in the room.

Like everyone else in the country, I feel like I have been the subject of a vicious child support battle between warring parents.

I just want it over.

The big question about the Federal Reserve is not about its possible move to raise interest rates in December. It?s whether our central bank will exist at all in the New Year!

Will Janet Yellen be demoted to washing Tesla windshields on street corners in Berkeley?

As it turned out, the Employment Situation Report could not have been more boring, missing the consensus by a mere 12,000.

The October Nonfarm Payroll Report came in at 161,000, versus a consensus expectation of 173,000.

The headline unemployment rate fell to 4.9%, a decade low.

The hourly earnings jumped an eye popping 0.40%, bringing the year-on-year gain to 2.8%, the largest increase since June, 2009.

Are these the early seeds of inflation? One can only hope.

The back month revisions were big, with September bumped up by 9,000, and July goosed also by 9,000.

Professional and business services led by 43,000 jobs, health care with 31,000, and government, mostly at the local level, at 19,000.

Hurricane Matthew seemed to have caused a drag on the numbers coming from the Southeast.

Another shocker was the U-6 long-term structural unemployment rate, which plunged to 9.5%, another ten year low.

Traders will certainly have their hands full this week.

The polls close at 8:00 PM, and network projections of the winners of the obvious states should be out a few minutes later.

However, it?s the battleground states that count, and the early results will be misleading.

Clinton?s support in the cities is overwhelming which will report first. Trumps voters are largely rural, and results will come in slowly.

So don?t be fooled by reports of an early Clinton landslide win. Trump will make up the gap as the night wears on, but not enough to win in the Electoral College.

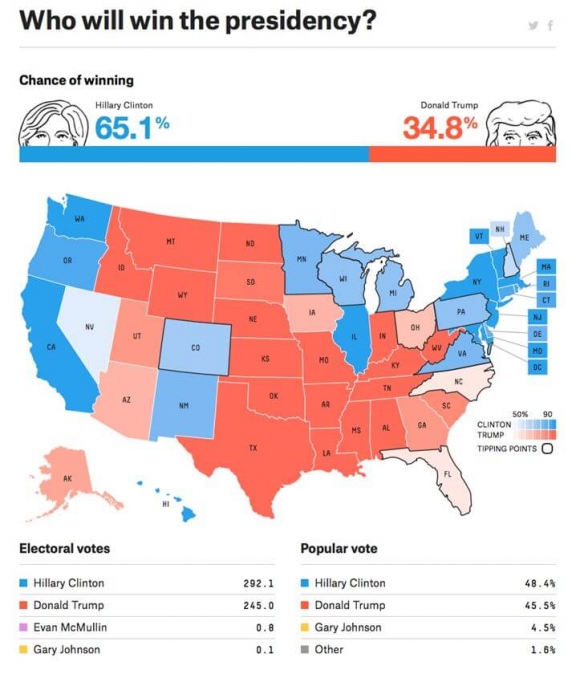

Nate Silver?s FiveThirtyEight has the best long-term record of predicting election outcomes using mathematical models (click here for his site at? http://fivethirtyeight.com/?ex_cid=2016-forecast . As of Friday, he had Hillary winning by at least 58 electoral votes (see map below).

I think the margin will be much wider, as the polls are missing millions of Hispanics who have never voted before.

This will give Hillary the majority of the battleground states, especially Florida, North Carolina, Georgia, Colorado, Virginia, Arizona, and Nevada, where I voted, and was presented with a ballot in Spanish.

Evan McMullin, a practicing Mormon, could take Utah, depriving Trump of a further 6 electoral votes.

That?s why I dipped my toe in the water by adding a modest 5% position in the Velocity Shares Daily Inverse VIX Short Term ETN (XIV) at the close on Friday, a bet that the Volatility Index (VIX) goes down.

Once the markets get a whiff of a Clinton win, it is going to be really hard to sell the Volatility Index (VIX) fast enough. Time to put my money where my mouth is. If the (VIX) rises on Monday, I?ll double up.

This renders all economic data releases for the coming week essentially meaningless. But I?ll go through the motions anyway.

Monday, November 7th at 8:30 AM EST, we get the Gallup Consumer Spending Report.

On Tuesday, November 8th at 6:00 AM EST we get a new update on the NFIB Small Business Optimism Index.

On Wednesday, November 9th at 7:00 AM EST, the MBA Mortgage Applications are published.

Thursday, November 10th we learn the Weekly Jobless Claims at 8:30 AM.

On Friday, November 11th at 10:00 AM EST we get the October Consumer Sentiment, and 1:00 PM delivers us the Baker Hughes Rig Count.

I hope everyone gets out there and votes. This time, it really IS the most important election in history.