May 11, 2011 - How to Build a Top

Featured Trades: (HOW TO BUILD A TOP), (QQQ), (XLF), (SPX)

2) How to Build a Top. Yes, we are all in the instant gratification business. We all want to ride an uptrend for nine months, sell at the top tick, and stay short for the entire four month selloff that ensues. In real life, it really only happens in the movies. If someone tells you they actually did this, you want to run a mile. I carry around in my wallet a tattered and dog eared SELL ticket for Nikkei futures that I wrote in 1989 at ?38,800, right next to my spare condom. It has been 21 years since I came that close.

The reality is that putting in a market top is a choppy, bloody, stop and start affair, a lot like giving birth. A short term breakdown is followed by a medium term breakdown and then a long term breakdown, with a lot of confusion and contradictory indicators in between. They never do an on the dime, 180 degree turn.

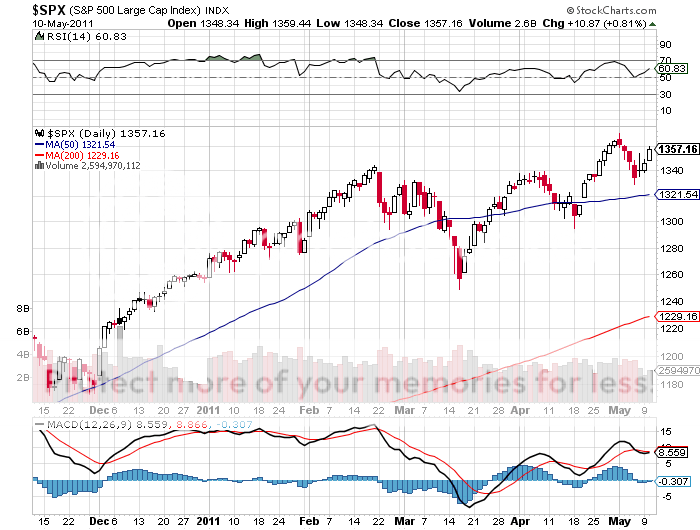

Currently, the S&P 500 remains in a long term, or more than six month uptrend, a medium term uptrend of two to six months, and a short term uptrend of one to eight weeks. Last week's gut wrenching selloff is now threatening the short term uptrend. If it breaks, then the medium and long term trends will be at risk. To see this most clearly, look at the chart below for the PowerShares QQQ Trust (QQQ) for technology shares, which often leads the (SPX). Broken resistance now turns into support at 58.

Now examine the chart for another sector that leads the market, the financials (XLF), which is clearly in a downtrend that shows no sign of stopping. There is now way the (SPX) can make substantial headway from here carrying the deadweight of the financials, which carry a heavy weight in the index.

The bottom line here is that the next step in the formation of this top could be either a double top at in the (SPX) at 1,376, or a marginal new high at 1,400. In either case I expect one or the other to fail. So I have my stops for my current short positions in the (SPX) that I slapped on last week above 1400.

Since I am short through a risk limiting put option accounting for only a small part of my portfolio, I don't mind taking a little pain on the way up. You can never top tick these things, only scale in through increments. At the first sign of weakness, I want to double up my short position to take advantage of a definitive break of the short and medium term trends.

If I am right in my assumption that a slowing economy will lead to a broader and more prolonged 'RISK OFF' trade, then further weakness in stock markets is a sure thing.

-

-

-

Yep, Sold the Top Tick and Bought the Bottom Tic