May 11, 2011 - From Bad to Worse for the Euro

Featured Trades: (FROM BAD TO WORSE FOR THE EURO), (FXE), (EUO), (UUP)

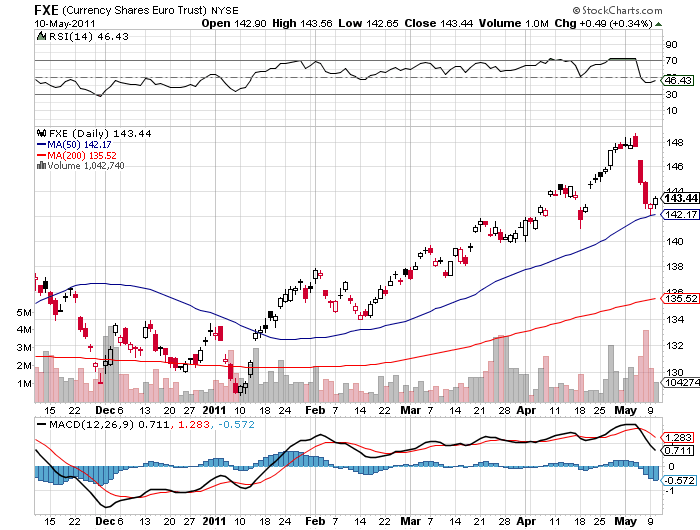

3) From Bad to Worse for the Euro. I am going to take a profit here in my short position in the euro by selling my (FXE) September, 2011 $145 puts. I don't double my capital in two days very often. When I do, I am inclined to grab it by the lapels and shake it until its gold teeth come clattering down on the ground. I don't care about the fundamentals. I don't care about the technicals. A double is the easiest thing in the world to understand. I don't even need a calculator to figure it out.

I managed to pick up these puppies in the greatest of all possible rushes at $3.50. By selling my full 5% weighting at the $7.10 I see on my screen now, I will reap a profit of 103%. For my notional $100,000 portfolio, that brings in a net profit of $5,142, or a 5.14% return, not a bad piece of change for 48 hours' worth of work. For some hedge funds, this is considered a modest year.

Normally I like to keep a position like this for a couple of months, so I don't wear out my fingertips mouse clicking my way through too many short term trades. But the truth is that we have had three months of volatility crammed into two eye popping days. That is normally how long it takes the euro to move eight cents against the dollar. The precipitous decline we saw from $1.49 to $1.42 has in fact been the sharpest fall in the European currency in many years.

By coming out of my short position here, I am also gaining a tactical advantage. If we get a snap back rally, or if Ben Bernanke can somehow keep the party going a little longer, you can sell into another rally in the euro. Initial support at the 50 day moving average can be expected. To mix up a few metaphors (editor please ignore), dry powder here is worth its weight in gold. It also makes sense to roll down the strike as a risk control measure.

If You Miss the Train, Another One Always Comes Along

-