May 13, 2011 - A Review of the Gold Fundamentals

Featured Trades: (A REVIEW OF THE GOLD FUNDAMENTALS), (WORLD GOLD COUNCIL), (GLD), (ABX)

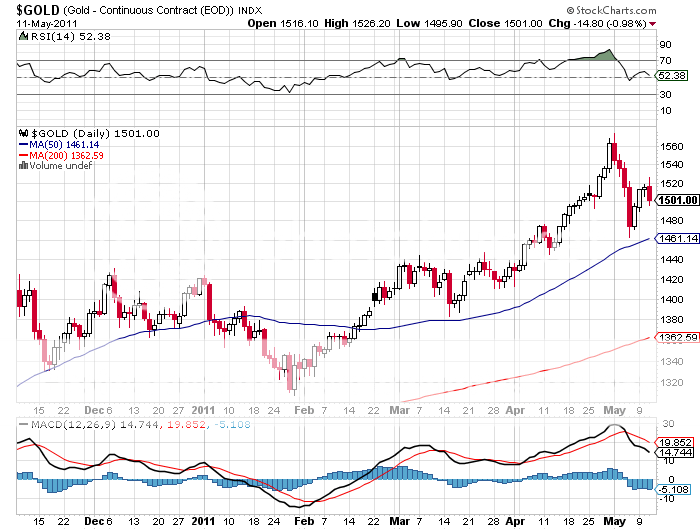

3) A Review of the Gold Fundamentals. With gold crashing through to $1,500 this morning, I thought that I would once against re-examine the fundamentals for the barbarous relic. That is most easily done by reading the Q1 report from the World Gold Council, the final authority on all matters regarding the yellow metal (click here for their link).

Among the many nuggets that I was able to glean was the fact that per capita gold ownership in the US is $1,197 per person. In China, it is $36. Chinese per capita incomes are rising dramatically. What do you think they are going to buy, with a fixed currency encouraging raging domestic inflation? In fact, a rising share of the global trade is moving to the Shanghai Gold Exchange, where imports of the yellow metal are sold to retail buyers.

The US is still on top with gold reserves of $372 billion, followed by Germany ($155 billion), the IMF ($128 billion), Italy ($112 billion), and France ($114 billion). In 2010, central banks turned net buyers of gold for the first time in 21 years, thanks to the end of a decade long liquidation of the European Community's collective holdings, and that trend has continued this year.

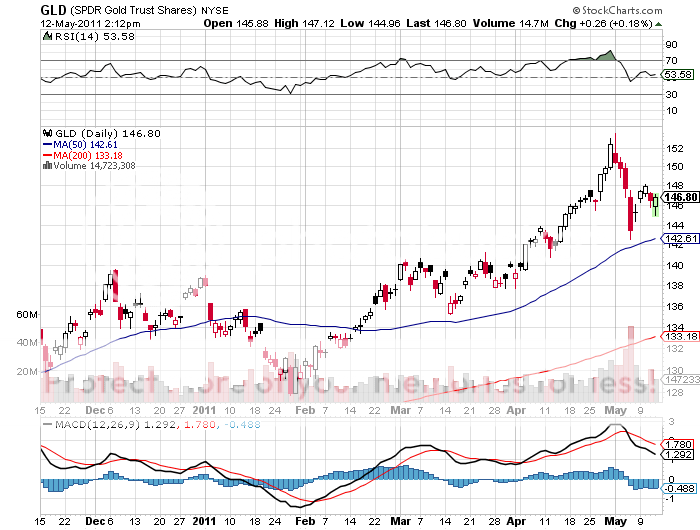

Interestingly, the Gold Spider ETF (GLD) is now the sixth largest holder of gold, followed by China, Switzerland, and Russia. Despite rising prices, (GLD) actually saw a 69.5 metric tonne outflow in holdings in Q1. Perhaps this is smart money, like George Soros' Quantum Fund, getting out at an intermediate term top? I believe that one of our many future financial crises will derive from redemptions hitting (GLD) faster than the market can handle them.

A weak US dollar and exploding American debt levels this year have been big factors in the rising demand for gold. But a little known fact is that gold is actually falling in price when valued in the currencies of several emerging markets, like India, China, and Turkey.

I think that a global 'RISK OFF' trade will hit gold just as hard as the other precious metals and commodities, possibly taking it down as much as 20%-30%. But then the long term fundamentals will reassert themselves, ultimately taking it up to the old inflation adjusted all time high of $2,300. The great thing about gold is that they're not making it anymore.

If you would like to get you gold analysis in musical form with a guitar picking folksong with entertaining graphics, then please click here for a good laugh.

-

-