May 16, 2011 - The Corn Conundrum

Featured Trades: (THE CORN CONUNDRUM), (JJG), (DBA), (CORN)

2) The Corn Conundrum. In the days of olde, the prices of agricultural commodities were determined by the birds, the bees, and Mother Nature. No more.

The Mississippi River basin is suffering once in a century floods, thousands of acres of farmland have been destroyed, and those still in operation are far behind schedule in their spring plantings. Private analysts are predicting a substantial fall in yields this year. Drought in Texas means they may lose half their wheat crop. China has flipped from a net exporter of food to a large net importer for the first time in many years. So prices for corn, wheat, and soybeans should be absolutely going through the roof right now. Right?

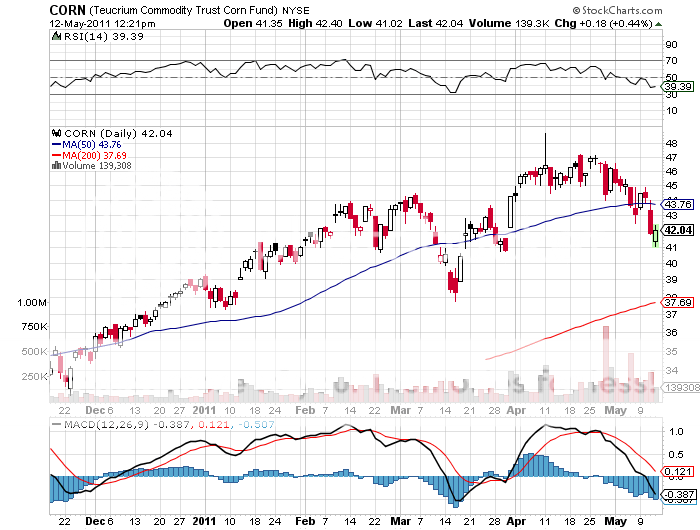

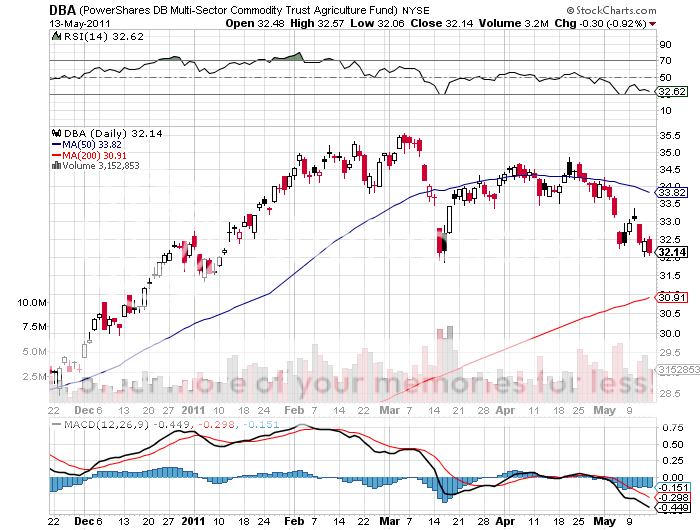

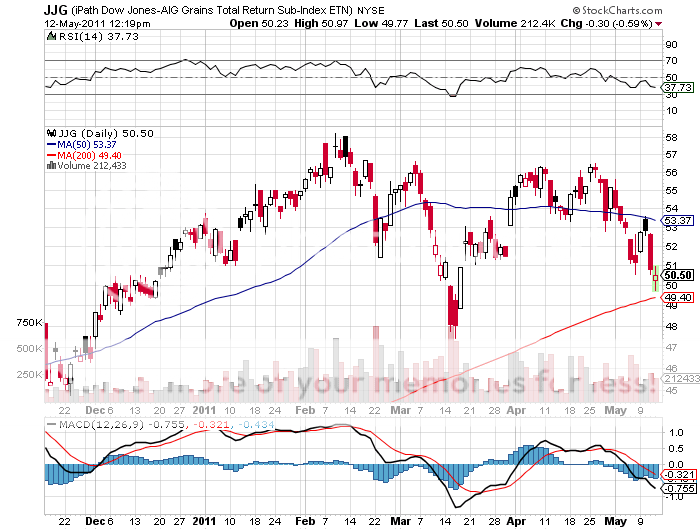

Wrong. Take a look at the charts below for the grain ETF (JJG), the agricultural ETF (DBA), and the fund for corn (CORN), and it is clear that they all peaked at the end of April, right when oil, the euro, gold, silver, stocks, and other commodities began to sell off in earnest. The harsh reality is that food has become just another asset class to be flailed mercilessly by high frequency traders and momentum driven hedge funds. And with the world now in 'RISK OFF' mode that means the ags go down with everything else, big time.

This is only a temporary state of affairs. The basic fact is that the world is still making people faster than the food to feed them. The long term fundamentals for food are in fact getting worse at an ever accelerating rate. Has anyone mentioned? that the world is running out of fresh water with which to irrigate?

So once the hot money has had its way on the downside, they will reverse and pile back in on the long side. Bring an end to the 'RISK OFF' trade, and the ags will be one of the first sectors that you will want to buy.

-

-

-

Still Looking for the 'BUY' Signals for the Ags