May 17, 2011 - Chewing the Fat With Harry S. Dent

Featured Trades: (CHEWING THE FAT WITH HARRY S. DENT)

2) Chewing the Fat With Harry S. Dent. Given the fresh dose of uncertainty besieging the markets these days, I thought I'd touch base with my pal, co-conspiring Eagle Scout, and fellow traveler, Harry S. Dent. Harry runs an independent research boutique, which has accurately predicted many of the major moves in financial markets during the past 25 years.

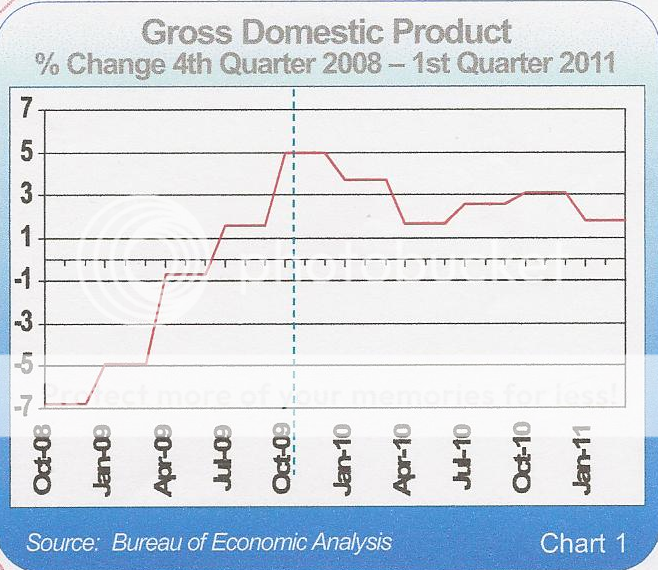

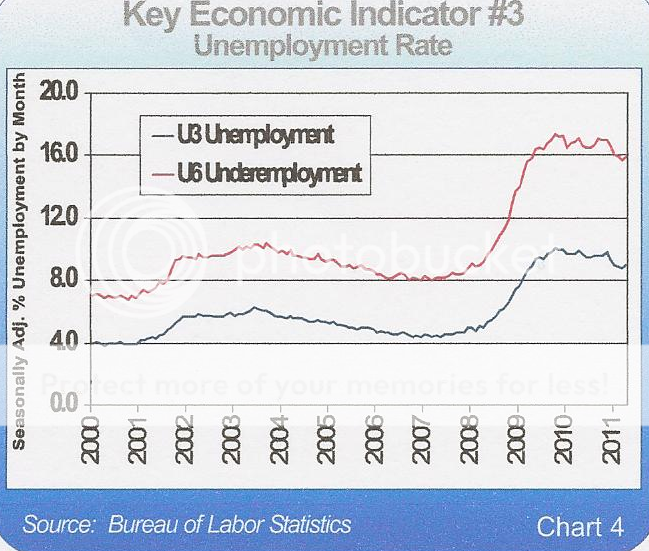

Harry believes that the economy is fizzling because QE2 had a smaller impact than QE1. The Federal Reserve's second monetary stimulus program generated only 2% in additional GDP growth, proof that it is fighting a losing battle. High oil and commodity prices will provide the coup de grace, forcing consumers to retrench further. We won't see this in the data for a couple of months. Once a more serious slowdown appears, Ben Bernanke may entertain a QE3, despite his indications to the contrary.

Residential real estate continues to provide a relentless drag on economic growth, and will worsen. Be happy you aren't trying to sell a house in Florida, where 18% of the homes are already vacant, compared to 16% in Arizona, and 14% in Nevada. Amazingly, some one third of the houses in Naples, Florida are empty.

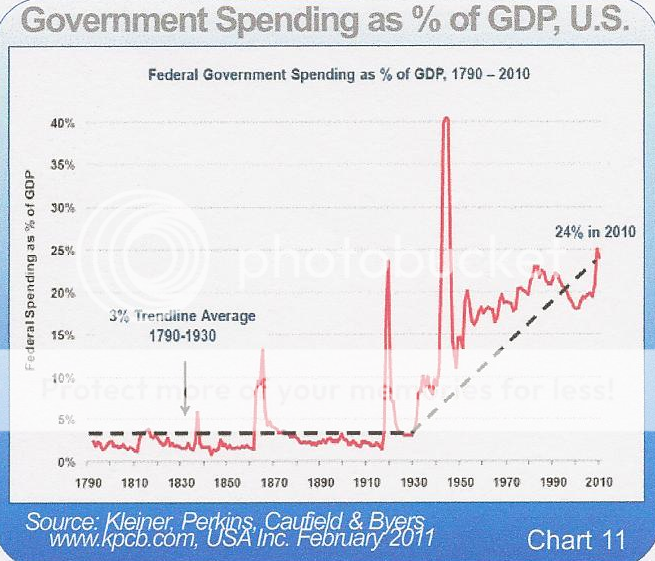

Growth of the national debt continues to be a major headache. Since the Great Depression, public spending has grown steadily, from supporting small town 'Mayberry' to the equivalent of a New York City. While much of the early deficit explosion resulted from WWII and Vietnam, all of the recent growth has come from entitlements, like Medicare and Social Security. Government estimates of $46 trillion in unfunded liabilities are wildly inaccurate, with $70 trillion closer to reality.

Harry's advice to investors is to use any strength in coming months to unload stocks. He would sell all remaining holdings in gold and silver. He also wants to dump oil and other energy plays. And he believes we are about to enter a prolonged period of dollar strength. His favorite vehicle for the greenback is the ETF (UUP), which offers investors a long position against a basket of foreign currencies.

Harry is a native of South Carolina, who like Federal Reserve governor Ben Bernanke, improbably went off to Harvard where he got his MBA. His career then took him to the top notch management consulting firm, Bain & Co. After years of consulting with Fortune 100 companies, he found gaping holes in their understanding of the global economy. That spurred him to take off and create his own research boutique to address these grievous shortfalls in understanding.

To learn more about Harry S. Dent, please go to his website at http://www.meetharrydent.com/

-

-

-