May 18, 2011 -Taking Aim at the Small Caps

Featured Trades: (TAKING AIM AT SMALL CAPS)

2) Taking Aim at the Small Caps. One of the cardinal rules of any hedge fund manager is to buy the cheapest assets in the world, and go short the most expensive assets against them. In a perfect world your longs go up, your shorts go down, and you make a bundle of money.

If we are seeing a slowdown in the US economy, be it temporary or permanent, then US small cap stocks have to be among the most richly priced assets out there. The big cap S&P 500 is currently selling at an historically middling 15 times earnings. That puts small caps selling at a 21 multiple in positively nosebleed territory. Small caps lacking serious assets or reserves are the most dependent on external financing and are the most sensitive to the short term economic cycle. In my book that makes them a short.

However, selling small cap stocks short is easier said than done. Good luck finding stock to borrow for your shorts, which are often illiquid and hard to find, They can be tightly held by a limited number of owners who just so happen to hate short sellers. Try selling their stock and they might even sue you.

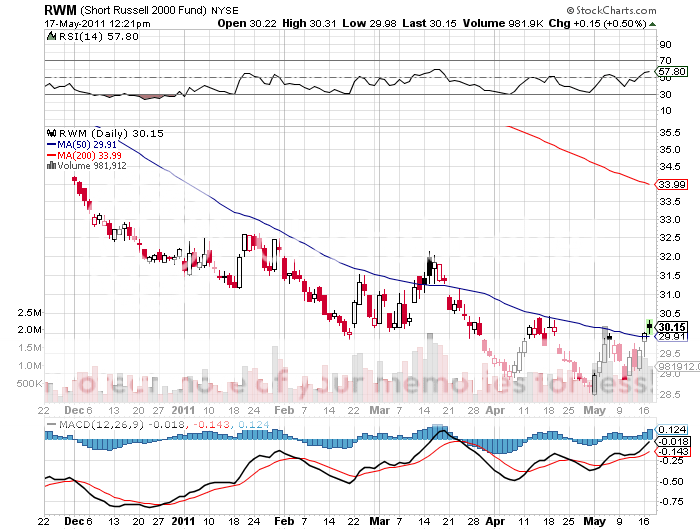

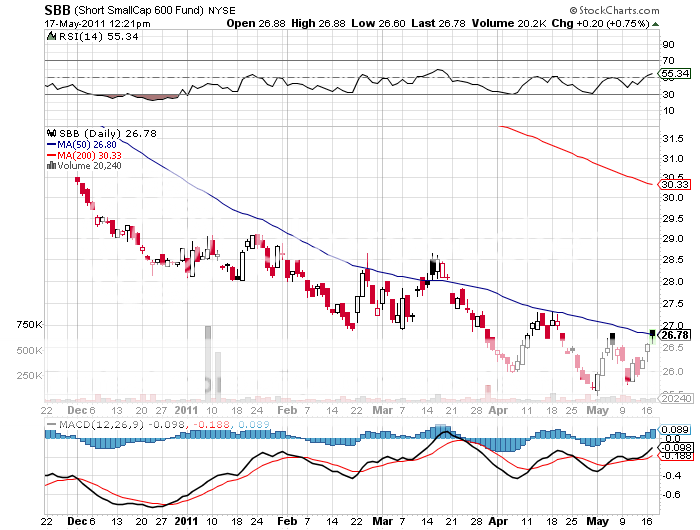

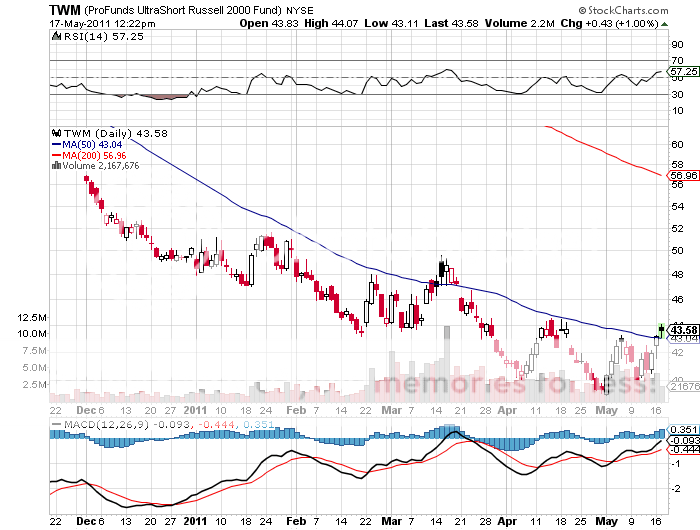

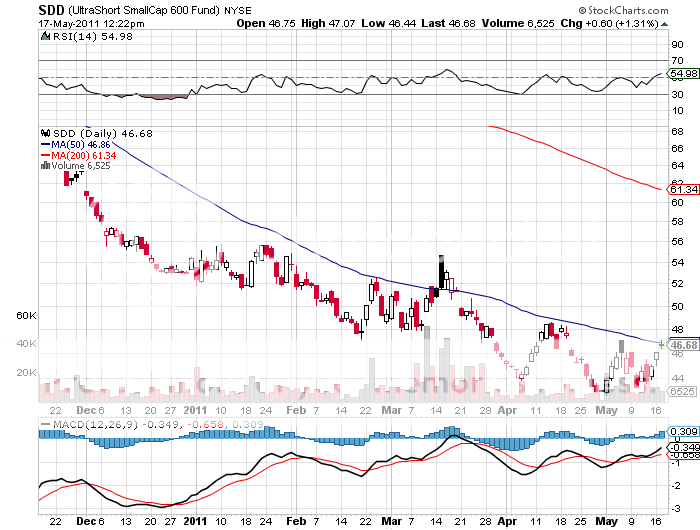

So it is wise to let someone else do the scut work here. ProShares has a range of alternative short bias ETF's here that lets them do the heavy lifting. The (RWM) offers a -1X short on the Russell 2000, while the (TWM) gives you a -2X exposure, a 200% short position against the sector. The (SBB) has a -1X short exposure to the Small Cap 600, while the (SDD) gives you a -2X short exposure.

If you really want an 'E ticket' ride, you can buy options on these funds, although the liquidity is not great and spreads are wide. The October, 2011 (RWM) $29 put, which is 4% out of the money, sells at a middle market of $1.50. This is not something that I would necessarily do today. Rather, hold it in reserve, and when you get a nice sharp counter trend rally, strap some of these babies on at much better prices.

-

-

-

-