May 24, 2011 - QE3 Has Already Started

Featured Trades: (QE3 HAS ALREADY STARTED)

2) QE3 Has Already Started. Most analysts have missed the fact that QE3 has already started in earnest. Of course, it would have been easy to miss. Ben Bernanke has not made any grand pronouncements. He hasn't done some public thinking out loud, as he did among friends at Jackson Hole, Wyoming last August. It is not even called 'QE3'. Think of it as a 'stealth QE3'. But make no mistake. A new variety of quantitative easing has already begun in a big way, and is generating its desired effect.

The new QE3 is the 'RISK OFF' trade. QE2 ended up pouring $600 billion into stocks, commodities, oil, gold, and silver. Since April 29, the prospect of slowing economic growth has prompted this hot money to take flight and bail from these assets classes. Think of it as the same $600 billion stampeding into risky markets, doing a 180, and then stampeding right back out against.

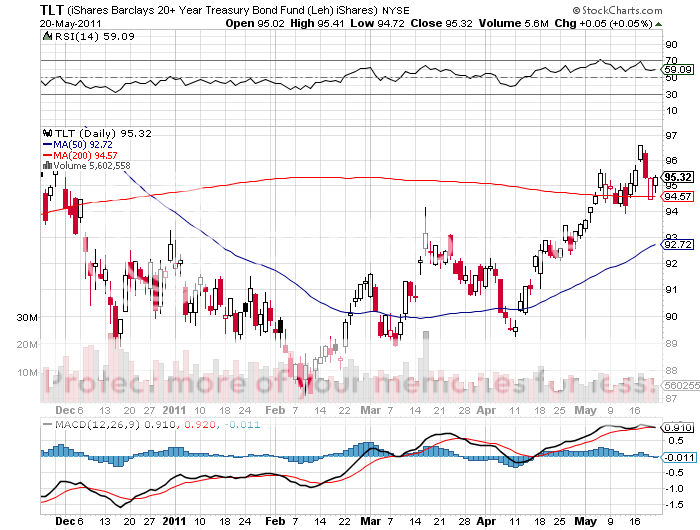

Where is all this money going? Into the Treasury bond market. We have in fact been in new bull market for bonds since February, taking the yield on the ten year Treasury down from 4.10% to 3.10%. If the current 'RISK OFF' trade continues, or even accelerates, we could see ten year yields down to 2.0%-2.5% by the end of the summer.

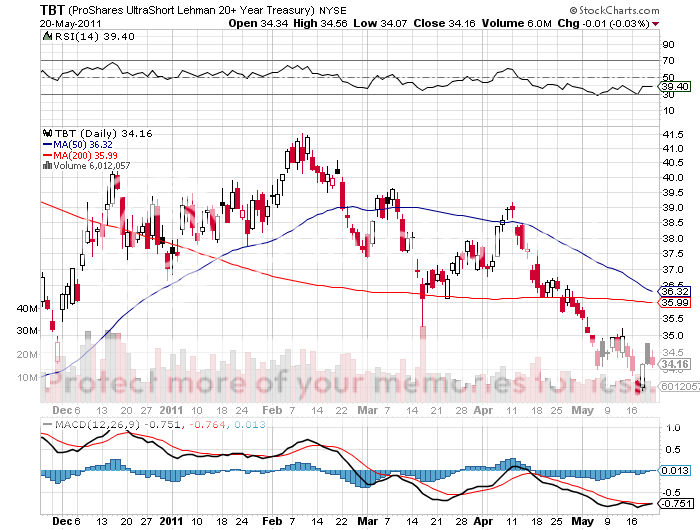

In the ultimate irony, we might even see bonds peak and risk assets bottom on June 30, the day QE2 ends. Given the way that events compress and accelerate these days, I would not be surprised to see things unfold this way. This is why I have been selling short puts on the long bond ETF (TLT), and avoiding bearish bets on bonds, like the plague, such as the (TBT). It is also why I have been piling on shorts in oil and stock at every opportunity.

There is no doubt that this is Ben Bernanke and Treasury Secretary Tim Geithner's plan, and they have voiced as much to Washington confidents in recent weeks. The beauty of this plan is that it has no government fingerprints on it. They are getting private investors to do the heavy lifting for them. That will make them immune from attacks from anti-interventionists, like the Tea Party, and anti-Federal Reservists, like Ron Paul. Bernanke can just sit back and let natural market forces do his handiwork for him.

Clever Ben, clever.

Of course Bernanke cannot employ this strategy forever. Eventually the expiration of Obama's many stimulus programs, the end of the Bush tax cuts, a growing drag by the state and municipal sector, and a worsening structural unemployment problem, will slow economic growth enough to where the Fed will have to take real action. Then they will have to launch a real QE3, or face another Great Recession, something the administration would rather not see in an election year.

Keep in mind that the next Recession will be far worse than the last one. None of the problems of the 2008-2009 debacle, like too big to fail, the real estate collapse, and the burgeoning bad debts on bank balance sheets, have really been solved. The can has merely been kicked forward. The only difference will be that there will be no TARP and no bail outs next time. The chips will fall where they want.

This all means that you better keep running your shorts and make some serious coin from the unfolding 'RISK OFF' trade while you can. Look out below.

-

-

What Do You Have Up Your Sleeve, Ben?