May 25, 2011 - How's That 'RISK OFF' Trade Working?

Featured Trades: (HOW'S THAT RISK OFF TRADE WORKING?),

(SPX), (SDS), (GLD), (USO), (DUG), (TLT), (TBT), (FCX), (CU)

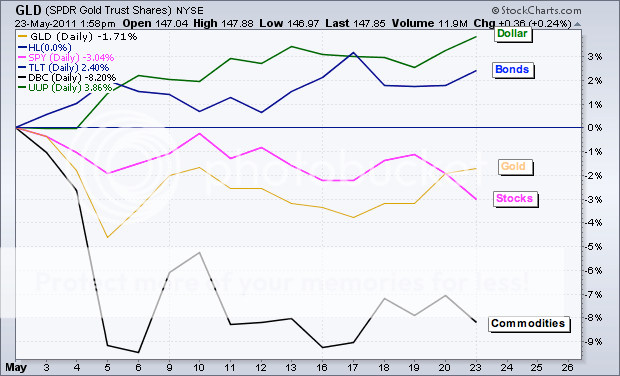

3) How's That 'RISK OFF' Trade Working? Take a look at the chart below since I made my watershed call to put on a 'RISK OFF' portfolio on April 25 (click here for the link). Almost all ass asset classes peaked exactly four days later.

You may recall that the 'RISK OFF' portfolio bets on falling prices for stocks (SPX), (SDS), commodities (CU), (FCX), oil (USO), (DUG), foreign currencies (UUP), (FXE), (EUO), and precious metals (GLD), (SLV). Simultaneously, a flight to safety bid would bring rising prices for the dollar and bonds. The fundamental rational for the portfolio was that all of the money that ran into assets to take advantage of QE2 would run right back out again. Call this my 'Anti-QE2 Portfolio'

I think that the 'RISK OFF' trade will run for not days or weeks, but months. The challenge will be not to get shaken out of the portfolio when the inevitable, technically driven short covering rallies ensue. What would it take to change my mind and return to a 'RISK ON' portfolio? Here is a short list:

*US corporations produce blow out earnings in their September quarterly reports three months off.

*China abandons its inflation fight, cuts interest rates and bank reserve requirements.

*We get a run of weak economic data that prompts Ben Bernanke to launch a real QE3.

*The Japanese governments awakens from its tsunami induced stupor and orders the Bank of Japan to run the printing presses to finance reconstruction. That enables the yen to return as a carry trade and collapse.

All of the above will eventually occur. For precise timing, watch this space. You'll be the first to know.

-

'RISK OFF' Has Months to Run