May 26, 2023

(WHAT IS A BUY WRITE AND HOW DO I USE IT)

May 26, 2023

Hello everyone,

Would you like your shares to start working for you? I’m talking about a trading strategy, where your shares pay you. And I‘m not just talking about those dividends you receive.

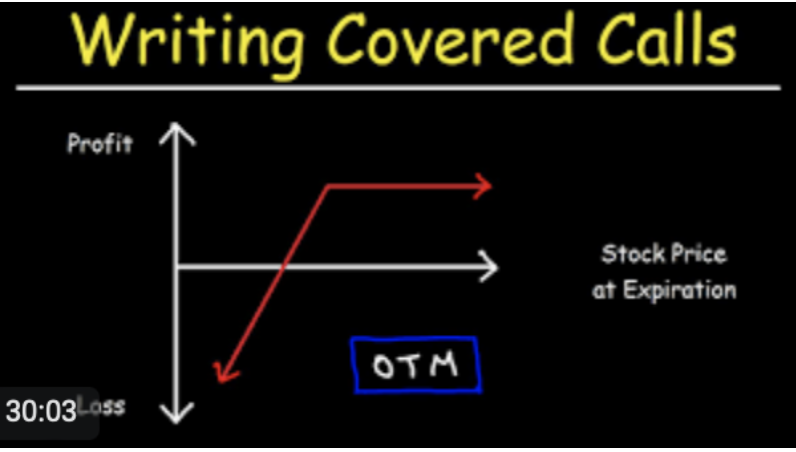

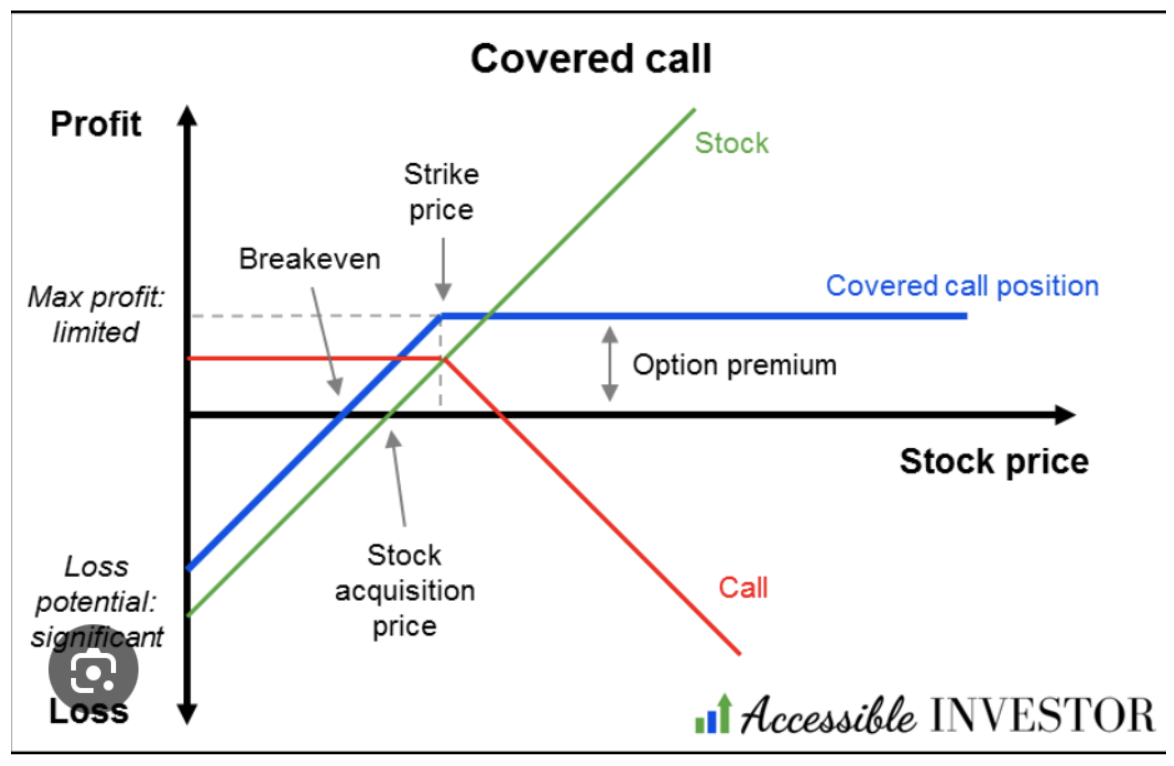

I’m talking about Buy Writes. Also called covered calls. The investors sell options over a stock held in a portfolio to generate cash and therefore guarantee a modest return from them. The option buyer gets the right to “call away” the fund’s shares if they hit or exceed agreed-upon prices.

So, for the beginner, a buy write is combination of positions where you buy a stock and sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis.

“Writing” is another term for selling short in the options world because you are in effect entering into a binding contract. When you sell short an option you are paid the premium the buyer pays, and the cash sits in your brokerage account accruing interest.

If the stock rallies, remains the same price or rises just short of the strike price you sold short, you get to keep the entire premium.

Most buy writes take place in front-month options and the strike prices are 5 or 10% above the current share price. I’ll give you an example of a 2021 Apple position.

Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares.

If Apple shares close under $150 at the August 20 option expiration you get to keep the entire premium. If Apple closes over $150 you automatically become short 100 Apple shares. Then you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account.

Buy writes accomplish several things. Firstly, they reduce risk, pare back the volatility of your portfolio, and bring in extra income. In a nutshell, it will enhance the overall performance of your portfolio.

But how do you know when to pull the trigger on this strategy? If the market is going straight up, you don’t want to touch buy writes with a ten-foot pole as your stock will get called away and you will miss substantial upside.

It’s preferable to skip dividend-paying months, usually March, June, September, and December, to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap.

You don’t want to engage in buy writes in bear markets. Whatever you take in with option premium it will be more than offset by losses on your long stock position.

O.K. let’s say you are a very cautious kind of person. Instead of selling short the $150 strike you call sell the $155 strike for less money. Then your risk of a call away drops too.

You can also go much further out in your expiration date to bring in more money. If you go out to the January expiration you will take in more option premium.

Let’s say you are a particularly aggressive trader. You can double your buy write income by doubling your option short sales at the ratio of 2:1. However, if Apple closes above $150 by expiration day you will be naked short 100 shares of Apple.

It may be that you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple so you will have to buy the shares in the market immediately. Maybe you should leave that to the professionals.

Hang on. There’s another way to do this.

Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. The “vertical” refers to strike prices lined up above each other. The “debit” means you must pay cash for the position instead of getting paid for it.

What about if there was a way to get into the position for free?

You could buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the share rises above the short strike prices, again triggering a margin call.

One strategy you must love is LEAPS (Long Term Equity Anticipation Securities). Go out with your expiration one to two years. Some investors are purely directional in their options. In other words, they buy a straight call, rather than doing a bull call spread. That’s OK. It’s up to you. I’m just giving you options (sorry for the play on words there).

Wishing you all a happy mid-week.

Cheers,

Jacquie